UK Toys Market Size, Share, Trends and Forecast by Product Type, Age Group, Sales Channel, and Region, 2025-2033

UK Toys Market Overview:

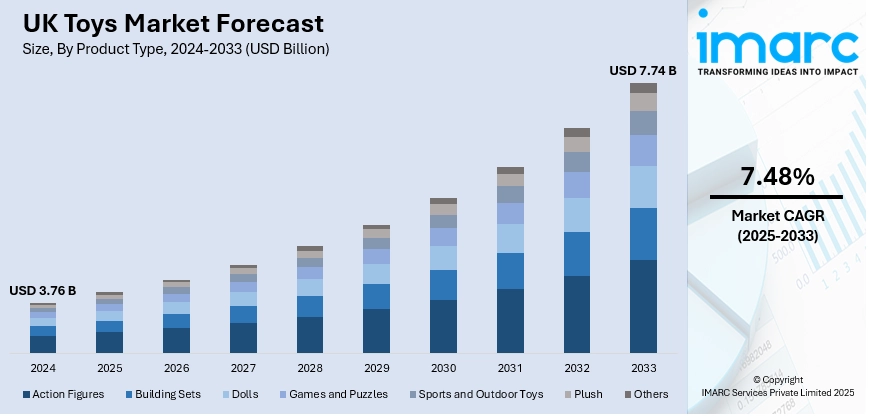

The UK toys market size reached USD 3.76 Billion in 2024. Looking forward, the market is expected to reach USD 7.74 Billion by 2033, exhibiting a growth rate (CAGR) of 7.48% during 2025-2033. The market is driven by innovation in licensed products, rising demand for educational and sustainable toys, and strong seasonal sales during holidays. E-commerce growth and shifting consumer preferences toward tech-integrated and eco-friendly playthings are also influencing the market landscape. These evolving trends continue to shape competition and impact the overall UK toys market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.76 Billion |

| Market Forecast in 2033 | USD 7.74 Billion |

| Market Growth Rate 2025-2033 | 7.48% |

UK Toys Market Trends:

Expansion of Omnichannel Retail and Shop-in-Shop Models

The evolution of retail strategies in the UK toys market has significantly contributed to its growth. The rise of omnichannel shopping, combining in-store, online, and mobile platforms, offers consumers greater flexibility and convenience. Retailers like The Entertainer and WHSmith are partnering with supermarkets and introducing shop-in-shop formats, making toys more accessible in everyday shopping environments. These models extend product reach and visibility, even in locations not traditionally associated with toy sales. Additionally, robust e-commerce platforms enable brands to serve a broader customer base and offer personalized experiences. Seasonal promotions, home delivery, and click-and-collect services further enhance appeal. As shopping habits continue to evolve, innovative distribution strategies are playing a central role in boosting sales and expanding the overall UK toys market growth. For instance, in January 2025, Plum Play unveiled a new distribution agreement with Nikko Toys, naming the company as the official distributor for the UK and Ireland. This partnership signals a notable extension of Plum Play’s product lineup, which will now feature Nikko Toys’ well-known collection of radio-controlled vehicles starting in 2025 and continuing.

To get more information on this market, Request Sample

Popularity of Licensed and Franchise-Based Products

Licensed toys based on popular entertainment franchises like Marvel, Disney, Pokémon, and Harry Potter continue to captivate children and collectors across the UK. These toys benefit from strong brand recognition, boosted by media coverage, movies, and TV series that create emotional connections with consumers. Manufacturers time product releases alongside major film premieres and holiday seasons to maximize sales. Retailers also rely on licensed products to drive traffic and increase basket sizes. The appeal of familiar characters and themes gives these toys an edge in a competitive market, encouraging repeat purchases and brand loyalty. This trend fuels consistent demand and influences product development, making licensed merchandise a cornerstone of growth in the UK toys market. For instance, in August 2024, Moose Toys revealed a new exclusive agreement with Click Distribution (UK), appointing the company to oversee its distribution operations within the UK. This strategic move represents a major development in their ongoing partnership, which has been in place since 2019 and continues to strengthen their collaborative efforts in the region.

UK Toys Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, age group, and sales channel.

Product Type Insights:

- Action Figures

- Building Sets

- Dolls

- Games and Puzzles

- Sports and Outdoor Toys

- Plush

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes action figures, building sets, dolls, games and puzzles, sports and outdoor toys, plush, and others.

Age Group Insights:

- Up to 5 Years

- 5 to 10 Years

- Above 10 Years

A detailed breakup and analysis of the market based on the age group have also been provided in the report. This includes up to 5 years, 5 to 10 years, and above 10 years.

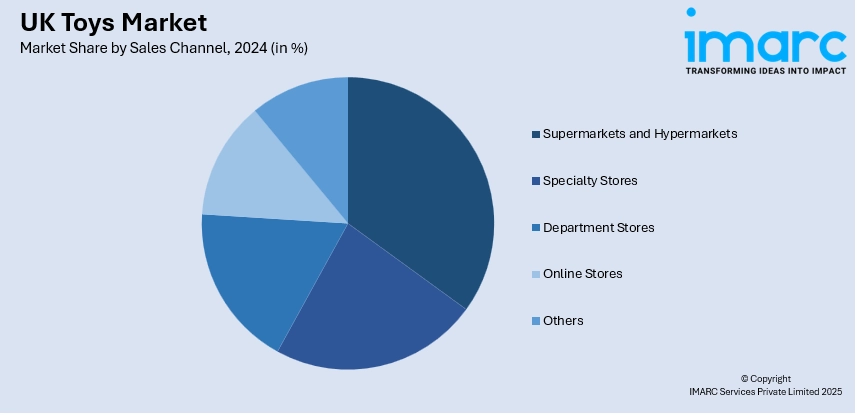

Sales Channel Insights:

- Supermarkets and Hypermarkets

- Specialty Stores

- Department Stores

- Online Stores

- Others

A detailed breakup and analysis of the market based on the sales channel have also been provided in the report. This includes supermarkets and hypermarkets, specialty stores, department stores, online stores, and others.

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UK Toys Market News:

- In April 2025, The Entertainer revealed plans to roll out a range of its leading toy products across more than 2,000 Tesco Express outlets, further strengthening its ongoing collaboration with the UK’s largest supermarket chain. This move highlights the success of their partnership and aims to enhance accessibility to popular toys for consumers through Tesco’s widespread retail network.

- In April 2024, WHP Global, the parent company of Toys “R” Us, signed a major long-term licensing deal with WHSmith, granting the retailer exclusive rights to operate Toys “R” Us shop-in-shops across the UK. As part of the agreement, WHSmith will introduce these dedicated toy sections within its High Street locations, with 30 new outlets set to launch this summer.

UK Toys Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Action Figures, Building Sets, Dolls, Games and Puzzles, Sports and Outdoor Toys, Plush, Others |

| Age Groups Covered | Up to 5 Years, 5 to 10 Years, Above 10 Years |

| Sales Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Department Stores, Online Stores, Others |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UK toys market performed so far and how will it perform in the coming years?

- What is the breakup of the UK toys market on the basis of product type?

- What is the breakup of the UK toys market on the basis of age group?

- What is the breakup of the UK toys market on the basis of sales channel?

- What is the breakup of the UK toys market on the basis of region?

- What are the various stages in the value chain of the UK toys market?

- What are the key driving factors and challenges in the UK toys market?

- What is the structure of the UK toys market and who are the key players?

- What is the degree of competition in the UK toys market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UK toys market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UK toys market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UK toys industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)