UK Used Cooking Oil Market Size, Share, Trends and Forecast by Source, Application, and Region, 2026-2034

UK Used Cooking Oil Market Summary:

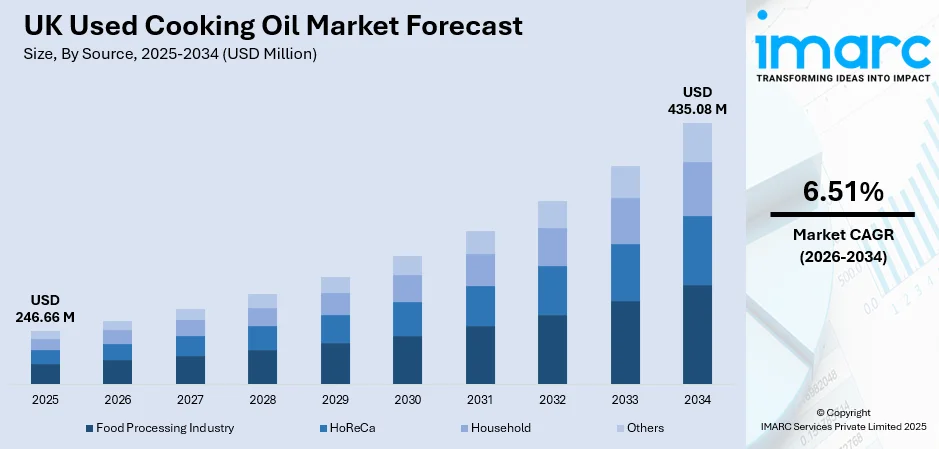

The UK used cooking oil market size was valued at USD 246.66 Million in 2025 and is projected to reach USD 435.08 Million by 2034, growing at a compound annual growth rate of 6.51% from 2026-2034.

The UK used cooking oil market is experiencing robust expansion driven by the nation's commitment to renewable energy and sustainable waste management. The convergence of regulatory support through the Renewable Transport Fuel Obligation, growing biodiesel production infrastructure, and heightened environmental awareness among foodservice operators is fundamentally reshaping collection networks and processing capabilities. Increasing investments in circular economy initiatives and advanced biofuel technologies are creating substantial opportunities across the value chain.

Key Takeaways and Insights:

- By Source: HoReCa holds a share of 65% in 2025, driven by dense urban foodservice presence, regulatory disposal requirements, and well-established commercial collection networks.

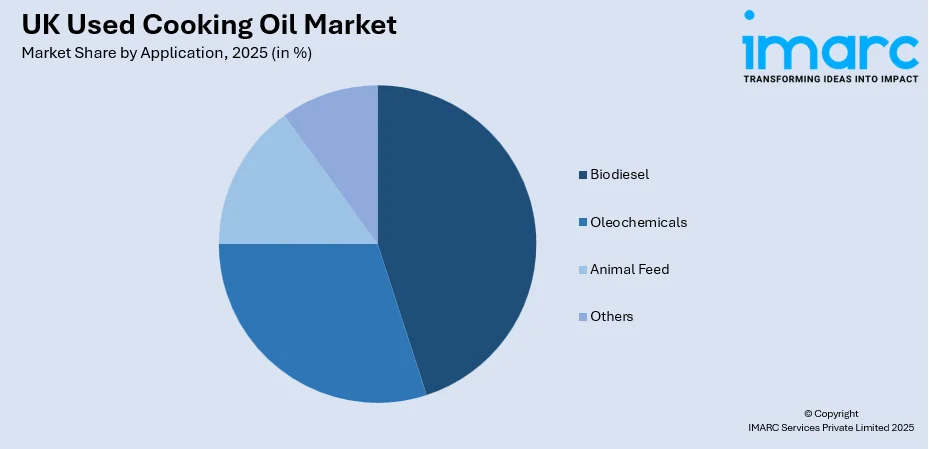

- By Application: Biodiesel captured 49% share in 2025, driven by RTFO mandates, double-credit incentives, and rising demand for low-carbon fuel alternatives.

- Key Players: The market shows moderate–high competition, with major collectors and biodiesel producers competing alongside emerging circular-economy firms across all segments.

To get more information on this market, Request Sample

The UK used cooking oil market represents one of the most dynamic segments within the broader renewable fuels and circular economy landscape. The market transformation is driven by the nation's ambitious decarbonisation targets and supportive policy frameworks that incentivise waste-to-energy conversion. Growing environmental consciousness among consumers and businesses, combined with stringent waste management regulations, is accelerating proper disposal and recycling practices. In 2024, Olleco announced that it had expanded its national UCO collection network to serve over 50,000 foodservice businesses across the UK, strengthening the supply chain for waste-derived biofuels. The expansion of collection networks across urban and semi-urban areas, technological advancements in refining processes, and rising demand from biodiesel manufacturers are collectively strengthening market fundamentals while creating new revenue streams for foodservice operators and waste management companies.

UK Used Cooking Oil Market Trends:

Accelerating Circular Economy Integration

The UK is witnessing a fundamental shift toward circular economy principles in waste oil management. Closed-loop systems where restaurants receive fresh cooking oil and their waste is collected, processed, and converted back into biofuel are gaining traction. For instance, in 2025 Quatra — a leading used cooking oil (UCO) collector and recycler — publicly signed a long-term agreement with TotalEnergies to supply 60,000 tonnes per year of UCO to support its biorefineries, underlining the increasing role of UCO as a strategic feedstock rather than waste. This transformation is positioning used cooking oil as a valuable resource rather than a disposal liability, driving investment in collection infrastructure and processing capabilities across the nation.

Expansion of Sustainable Aviation Fuel Applications

Used cooking oil is increasingly being processed into sustainable aviation fuel to support the UK's aviation decarbonisation goals. With mandates requiring increasing SAF blends in jet fuel, the demand for UCO as a feedstock is expanding beyond traditional biodiesel applications. In 2024, Phillips 66 Humber Refinery announced expanded production of SAF made from waste oils, including UCO, supplying airlines such as British Airways under new offtake agreements. This diversification is creating new market opportunities and driving investment in advanced processing technologies across the UK used cooking oil market growth trajectory.

Digital Transformation in Collection Networks

Collection companies are deploying smart logistics, automated scheduling systems, and digital tracking platforms to optimise used cooking oil collection efficiency. These technological advancements are reducing operational costs, improving route planning, and enhancing traceability throughout the supply chain. The digitalisation trend is particularly prominent among larger collectors serving national restaurant chains and hotel groups.

Market Outlook 2026-2034:

The UK used cooking oil market demonstrates strong growth potential throughout the forecast period, underpinned by supportive regulatory frameworks and expanding renewable energy demand. Increasing domestic collection capabilities, rising biodiesel production capacity, and growing sustainable aviation fuel requirements are expected to drive higher revenue streams and foster a more competitive, mature market ecosystem across the UK. The market generated a revenue of USD 246.66 Million in 2025 and is projected to reach a revenue of USD 435.08 Million by 2034, growing at a compound annual growth rate of 6.51% from 2026-2034.

UK Used Cooking Oil Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Source |

HoReCa |

65% |

|

Application |

Biodiesel |

49% |

Source Insights:

- Food Processing Industry

- HoReCa

- Household

- Others

The HoReCa dominates with a market share of 65% of the total UK used cooking oil market in 2025.

Hotels, restaurants, and catering establishments represent the primary source of used cooking oil in the UK, generating substantial volumes through daily frying and cooking operations. The concentration of foodservice establishments in urban centres provides reliable and commercially viable collection opportunities. For instance, in 2025 WasteCare Ltd — a major UCO-collection and recycling operator — reported a sharp increase in waste cooking-oil volumes from hospitality kitchens (restaurants, takeaways, hotels), citing that rising demand for fried and convenience foods across the UK has pushed oil-waste generation to “an all-time high. Licensed waste oil collectors maintain established relationships with major restaurant chains, independent eateries, and hotel groups, ensuring consistent supply for biodiesel production facilities across the nation.

Regulatory compliance requirements under the Environmental Protection Act and Waste (England and Wales) Regulations mandate proper disposal of commercial cooking oil, driving HoReCa operators to partner with licensed collectors. Many foodservice businesses now view waste oil collection as both an environmental responsibility and a potential revenue stream, with collectors offering payment for high-quality oil. This commercial incentive structure strengthens collection networks and ensures steady feedstock supply for the UK's biodiesel industry.

Application Insights:

Access the Comprehensive Market Breakdown, Request Sample

- Biodiesel

- Oleochemicals

- Animal Feed

- Others

The biodiesel leads with a share of 49% of the total UK used cooking oil market in 2025.

Biodiesel production remains the primary application for used cooking oil in the UK, supported by the Renewable Transport Fuel Obligation, which encourages renewable fuel blending in transport fuels. UCO-derived biodiesel offers notable greenhouse-gas emission reductions compared to conventional diesel, making it a preferred option for fuel suppliers aiming to meet regulatory requirements. In 2024, Argent Energy announced an expansion of its biodiesel production capacity in the UK, specifically increasing its intake of waste-derived feedstocks such as used cooking oil to meet rising demand driven by RTFO obligations. The double-credit incentive for waste-derived fuels under the RTFO further boosts the economic appeal of UCO-based biodiesel.

UK biodiesel producers continue to invest in processing infrastructure capable of managing variable-quality UCO feedstock. Advanced refining technologies enable the efficient conversion of waste cooking oil into high-quality biodiesel that meets EN14214 standards. The segment benefits from well-established distribution networks that supply biodiesel blends to transport fleets and fuel retailers nationwide, reinforcing the UK's broader decarbonisation agenda.

Region Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

London represents the largest regional market for used cooking oil collection due to its exceptional concentration of foodservice establishments, diverse culinary landscape, and substantial hospitality sector serving millions of residents and visitors.

South East England benefits from proximity to London's distribution networks and hosts significant food manufacturing operations, creating reliable UCO supply streams for regional biodiesel producers and collection companies.

North West England is experiencing market growth driven by expanding collection infrastructure in Manchester and Liverpool metropolitan areas, with new processing facilities enhancing regional UCO recycling capacity.

East of England contributes to the UK market through established agricultural processing operations and growing foodservice sectors in cities like Cambridge and Norwich, supporting steady UCO generation volumes.

South West England's tourism-driven hospitality sector generates substantial seasonal UCO volumes, with collection networks serving coastal resorts and popular visitor destinations across the region.

Scotland is advancing UCO collection and biodiesel adoption through pilot programmes and supportive regional policies, with Edinburgh and Glasgow serving as primary collection centres for the Scottish market.

West Midlands hosts significant biofuel processing capacity including new production facilities, positioning the region as an emerging hub for UCO conversion to renewable fuels serving national markets.

Yorkshire and The Humber benefits from established biodiesel production infrastructure and growing collection networks serving the region's foodservice industry across Leeds, Sheffield, and Hull metropolitan areas.

East Midlands contributes to market growth through food manufacturing operations and expanding restaurant sectors in Nottingham and Leicester, with collection services connecting to regional processing facilities.

Other regions including Wales and Northern Ireland are developing UCO collection infrastructure, with growing awareness of recycling opportunities and emerging partnerships between foodservice operators and licensed collectors.

Market Dynamics:

Growth Drivers:

Why is the UK Used Cooking Oil Market Growing?

Supportive Regulatory Framework and Renewable Fuel Mandates

The UK's Renewable Transport Fuel Obligation serves as a primary catalyst for market expansion by mandating that fuel suppliers incorporate sustainable renewable fuels into their offerings. The scheme's double-credit mechanism for waste-derived feedstocks provides substantial economic incentives for UCO-based biodiesel production, making it more commercially attractive than conventional alternatives. In 2024, waste feedstocks, including used cooking oil, accounted for 77% of all renewable fuel supplied under the RTFO, highlighting the growing importance of UCO in the UK renewable fuel sector. These regulatory requirements create guaranteed demand for used cooking oil while encouraging investment in collection and processing infrastructure. The RTFO targets are set to increase progressively, ensuring sustained growth in UCO demand throughout the forecast period. Additionally, the introduction of Sustainable Aviation Fuel mandates opens new market opportunities for UCO conversion into aviation biofuels, further diversifying end-use applications and strengthening market fundamentals.

Expanding Foodservice Industry and Collection Infrastructure

The UK's thriving foodservice sector generates substantial volumes of used cooking oil through restaurants, takeaways, pubs, hotels, and catering operations. As consumer demand for convenience dining and diverse culinary experiences continues to grow, the number of foodservice establishments and their cooking oil consumption increases correspondingly. This expansion provides reliable and concentrated sources of UCO for collection companies to serve. Licensed collectors have established efficient nationwide networks with regular pickup schedules, making waste oil disposal convenient for food businesses while ensuring consistent feedstock supply for biodiesel producers. Many collectors now offer payment for high-quality oil, transforming waste management from a cost centre into a potential revenue stream for foodservice operators and incentivising proper disposal practices.

Environmental Consciousness and Corporate Sustainability Goals

Growing environmental awareness among businesses and consumers is accelerating adoption of sustainable waste management practices including UCO recycling. Many restaurant chains and hospitality groups have incorporated waste oil recycling into their environmental, social, and governance strategies, recognising its contribution to carbon reduction targets. According to aources, Olleco reports that biodiesel produced from used cooking oil (UCO) can cut greenhouse gas emissions by around 88–89 % compared with fossil diesel. The conversion of UCO into biodiesel can reduce greenhouse gas emissions by eighty to ninety percent compared to conventional fossil diesel, making it an effective decarbonisation tool. Businesses increasingly view responsible UCO disposal as both an environmental obligation and a brand differentiator, attracting environmentally conscious customers. This heightened sustainability focus is driving voluntary participation in recycling programmes beyond regulatory requirements, expanding the overall pool of available feedstock for the biofuels industry.

Market Restraints:

What Challenges the UK Used Cooking Oil Market is Facing?

Import Dependency and Supply Chain Vulnerabilities

Domestic UCO collection cannot meet the UK's biodiesel production requirements, necessitating significant imports from international sources. This dependency exposes the market to global supply fluctuations, price volatility, and geopolitical uncertainties. Shipping costs, currency exchange rates, and trade policy changes can impact feedstock availability and economics, creating planning challenges for biodiesel producers reliant on consistent supply.

Quality Verification and Fraud Concerns

Ensuring the authenticity of waste-derived feedstocks presents ongoing challenges for the industry. The higher value of certified UCO compared to virgin oils creates incentives for fraudulent mislabelling, potentially undermining environmental benefits and market integrity. Verification systems rely heavily on documentation audits rather than physical testing, leaving gaps that can be exploited by unscrupulous suppliers.

Competition from Alternative Renewable Fuels and Feedstocks

The UCO market faces competition from alternative renewable fuel technologies and feedstocks vying for policy support and investment. Hydrogen, electric vehicles, and other biofuel feedstocks compete for regulatory incentives and market share. Changing policy priorities or technological breakthroughs in competing sectors could potentially redirect investment away from UCO-based biofuels.

Competitive Landscape:

The UK used cooking oil market exhibits moderate to high competitive intensity characterised by the presence of established waste oil collectors, biodiesel producers, and emerging circular economy enterprises. Market dynamics reflect diverse business models ranging from national collection networks serving major hospitality chains to regional operators focused on local foodservice establishments. The competitive landscape is increasingly shaped by vertical integration strategies, with companies seeking to control both collection and processing capabilities. Sustainability certifications, collection efficiency, and processing technology differentiation are becoming key competitive factors. Strategic partnerships between collectors, biodiesel producers, and end-users are fostering supply chain integration while new market entrants are introducing digital platforms and innovative service models to capture market share.

Recent Developments:

- In February 2025, Olleco launched a new processing plant for used cooking oil in Liverpool, UK. The facility processes collected UCO and transports it via pipeline to the company's biodiesel plant. The biodiesel produced achieves an 89% carbon reduction compared to fossil diesel, serving transport fleets and fuel forecourts across the nation.

- In May 2025, Lifecycle Oils opened a new biofuel processing facility in Wednesbury, West Midlands. The modern plant produces LF100 biofuel using multi-stage filtration and extended settling processes, demonstrating circular economy principles by operating entirely on its own UCO-derived fuel.

- In November 2025, the UK expanded its list of acceptable waste feedstocks under the Renewable Transport Fuel Obligation, including new categories eligible for double-counting incentives. This regulatory development further diversifies the supply chain and strengthens market fundamentals for UCO-based biofuels.

UK Used Cooking Oil Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sources Covered | Food Processing Industry, HoReCa, Household, Others |

| Applications Covered | Biodiesel, Oleochemicals, Animal Feed, Others |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The UK used cooking oil market size was valued at USD 246.66 Million in 2025.

The UK used cooking oil market is expected to grow at a compound annual growth rate of 6.51% from 2026-2034 to reach USD 435.08 Million by 2034.

The HoReCa segment remains the main source of the UK’s used cooking oil with 65% share, driven by high daily oil usage, strong collector partnerships, rising foodservice activity, and regulatory requirements that encourage proper disposal and consistent supply.

Key factors driving the UK used cooking oil market include supportive regulatory frameworks through the Renewable Transport Fuel Obligation, expanding foodservice industry generating reliable UCO supply, growing biodiesel production infrastructure, increasing environmental awareness, and rising demand for sustainable aviation fuel.

Major challenges include import dependency for meeting domestic biodiesel production requirements, supply chain vulnerabilities from global market fluctuations, quality verification and fraud concerns with imported feedstocks, competition from alternative renewable fuels, and household collection infrastructure gaps limiting domestic supply potential.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)