Ultra High Molecular Weight Polyethylene Market Size, Share, Trends and Forecast by Product, Application, and Region, 2026-2034

Ultra High Molecular Weight Polyethylene Market Size and Share:

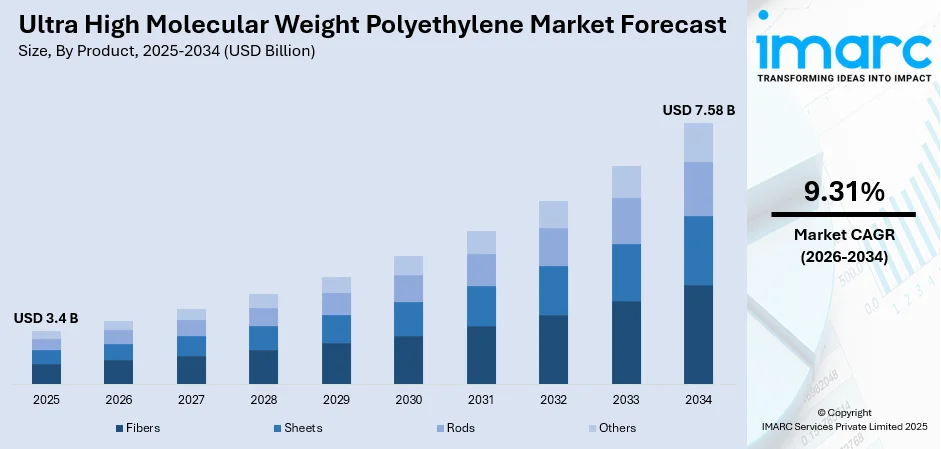

The global ultra high molecular weight polyethylene market size was valued at USD 3.4 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 7.58 Billion by 2034, exhibiting a CAGR of 9.31% from 2026-2034. Asia Pacific currently dominates the market, holding a market share of 42%. The market is increasingly popular in protection, industrial, and medical applications for abrasion resistance, impact strength, and low friction. Lightweighting and durability enhance its use in fibers, liners, and sheets, driving demand growth. Improved processing and wider supply availability support further adoption. A cross-industry focus on longer service life and lower maintenance underpins market expansion, while sustainability and recyclability influence procurement and specifications. This balance dictates steady, diversified demand across global industries, reinforcing the growth of the ultra high molecular weight polyethylene market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 3.4 Billion |

| Market Forecast in 2034 | USD 7.58 Billion |

| Market Growth Rate (2026-2034) | 9.31% |

Increases in demand for rugged, light material across various end-use industries are a major global driver of ultra high molecular weight polyethylene. Specifiers and designers prefer materials that prolong product life and lower weight, facilitating changes in transportation, sports equipment, industrial liners, and medical devices. In July 2025, Repsol S.A. announced plans to commission a 15,000 t/yr ultra high molecular weight polyethylene plant at its Puertollano complex in Spain by 2026, strengthening supply for industrial and performance-grade applications. Advances in melt processing, consolidation methods, and fiber spinning enhance viable applications and reduce adoption barriers. At the same time, material properties such as outstanding abrasion resistance, excellent impact tolerance, and low coefficient of friction meet changing performance requirements for long-life parts and protection systems. As value chains favor lifecycle performance and maintenance minimization, procurement decisions increasingly identify materials with low replacement frequency and total cost of ownership, substantiating steady adoption worldwide and across applications.

To get more information on this market, Request Sample

In the US, growth is driven by infrastructure rehabilitation, occupational safety improvements, and industrial specialty needs, where engineered materials are selected to provide long-term performance and reliability. Public and private sector programs focus on materials that minimize downtime and maintenance cycles for conveyors, chute liners, and protective fabrics, providing stable procurement streams. In fiber applications, ballistic and personal protection segments favor materials that are low in weight but high in energy absorption. With well-established manufacturing capabilities and supply chains, the US market facilitates dense adoption representing a dominant 78% share in some subsegments, where specification-based purchasing and industry standards drive conversion from conventional polymers to ultra high molecular weight polyethylene.

Ultra High Molecular Weight Polyethylene Market Trends:

Performance-Driven Application Expansion

In September 2024, Braskem received a conditional commitment of up to US $50 million in federal funding under the U.S. Department of Energy’s infrastructure act to expand its ultra high molecular weight polyethylene (UHMWPE) resin capacity in Texas, targeting lithium-ion battery separator film applications. Manufacturers and designers are pushing the application of the market into more valuable, performance-intolerant applications. It is a trend from commodity substitution to specification-driven uptake: engineers place emphasis on abrasion resistance, fatigue life, and low friction when choosing materials for conveyor liners, wear strips, and heavy-duty chute systems. In textiles, advances in fiber spinning and consolidation technology allow for lighter protective fabrics that comply with more demanding ergonomic and ballistic specifications. The outcome is an expanding range of end applications in which UHMWPE displaces heavier or less impact-resistant alternatives, allowing product designers to trade lifecycle cost against performance. Collaboration between end-users and material scientists further optimizes grade choice and processing, reflecting the ongoing evolution and innovation within ultra high molecular weight polyethylene market trends.

Processing And Supply Chain Refinement

Improvements in compounding, consolidating, and sheet extrusion technologies are enabling standardization of quality and minimizing ultra high molecular weight polyethylene component production variation. These advances in processing facilitate easier production of consistent sheets, fibers, and molded parts at volume, enhancing lead times and part-to-part consistency. Larger distribution networks and enhanced logistics for dense, high-value grades have lowered adoption friction for downstream converters. This trend induces specification engineers to take UHMWPE into consideration where before supply unpredictability would have been the limiting factor. When process reliability rises, downstream converters invest in design updates which take advantage of the low friction and wear resistance of the material to speed up conversion across industries.

Sustainability And Circularity Influencing Procurement

In June 2025, Mitsui Chemicals announced the development of a recyclable ultra high molecular weight polyethylene (UHMWPE) grade designed for easier recovery and reprocessing in industrial and medical applications, reinforcing the material’s environmental value proposition. Environmental factors are increasingly affecting material choice, and stakeholders are investigating recycling options, end-of-life disposal, and the long service life of the material as sustainability advantages. Procurement professionals consider total lifecycle effects: longer product life lowers replacement rate and landfill contributions, while recycling or reclamation programs are developing to tap value from post-industrial and post-consumer flows. This trend encourages manufacturers to document embodied impacts, engage in take-back programs, and adopt grades that can be more readily reprocessed. The sustainability narrative strengthens UHMWPE’s appeal in sectors seeking to reduce maintenance-related waste and demonstrate responsible sourcing, nudging specifications toward materials that combine performance with lower lifecycle burden.

Ultra High Molecular Weight Polyethylene Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global ultra high molecular weight polyethylene market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on product and application.

Analysis by Product:

- Fibers

- Sheets

- Rods

- Others

Sheets are a popular form for ultra high molecular weight polyethylene, prized for their versatility in wear lining, machine guards, and structural overlays. They currently exhibit a share of 46%. Sheets' flat, uniform geometry allows easy machining into intricate parts, easy lamination with other substrates, and reproducible wear characteristics over sliding surfaces. Their low friction coefficient and resistance to abrasion make them the choice for material-handling equipment liners where downtime is minimized and replacement frequency is reduced. Fabricators like sheet stock due to consistent dimensional stability and ease of installation, while design groups leverage sheets to attain weight savings and longer service life, reflecting the overall momentum of ultra high molecular weight polyethylene market growth.

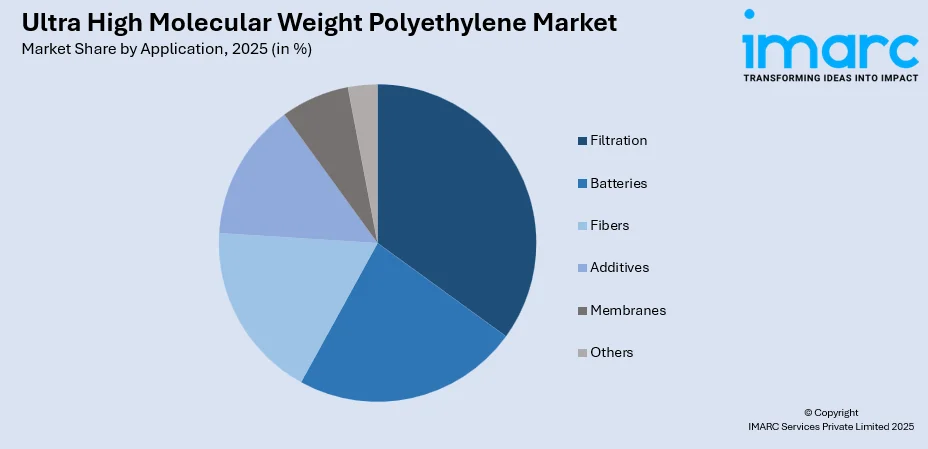

Analysis by Application:

To get detailed segment analysis of this market, Request Sample

- Filtration

- Batteries

- Fibers

- Additives

- Membranes

- Others

Ultra high molecular weight polyethylene fibers hold a share of 32% and are valued for having a high tensile strength coupled with low weight, and these find suitable applications in high-performance textiles and protection. Utilization in ballistic textiles, cut-resistant gloves, and high-strength cords takes advantage of superior energy absorption and impact transfer properties. Fiber production methods that preserve molecular orientation and integrity are key to performance, and these fibers enable product designers to make lighter, more wearable protection systems without decreasing safety. Increasing demand for ergonomic, lightweight personal protective equipment and advanced composites fosters consistent demand for UHMWPE fibers, underpinning their strong application.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific dominates the ultra-high molecular weight polyethylene (UHMWPE) market, holding a 42% share due to strong growth across automotive, healthcare, and industrial sectors. The region benefits from rising demand for lightweight and durable materials used in vehicle components, medical implants, and industrial equipment. China, Japan, and India are key contributors, driven by expanding manufacturing bases and technological advancements in polymer processing. Ultra high molecular weight polyethylene market outlook indicates that Asia Pacific will maintain its leadership, supported by infrastructure development, growing investments in automation, and increasing adoption of UHMWPE in marine and energy applications. Additionally, government initiatives promoting industrial efficiency and cost-effective production have further strengthened the region’s competitive edge, ensuring continued growth and innovation in the UHMWPE market over the coming years.

Key Regional Takeaways:

United States Ultra High Molecular Weight Polyethylene Market Analysis

In the United States, market trends focus on specification-led purchasing, with material choice being steered by lifecycle performance and standards compliance. Applications like industrial processing, infrastructure maintenance, and personal protection value long service life and low maintenance cycles, which make UHMWPE adoption desirable. Local converters and textile producers increasingly design to the low weight and high abrasion resistance of the polymer to meet performance targets in protective equipment, chute liners, and replacement components. Strong distribution channels and engineering capabilities facilitate fast prototyping and uptake, allowing designers to test UHMWPE in key applications and roll out successful implementations throughout facilities and industries.

North America Ultra High Molecular Weight Polyethylene Market Analysis

Throughout North America, including the United States, purchasing decisions strike a balance between performance and cost of ownership. Material handling, logistics, and protective equipment end users prefer materials that minimize downtime and maintenance intervals. Regional support infrastructure such as test laboratories, fabricators, and design consultancies enables specification and integration, easing adoption routes. Demand clusters where retrofit applications and new equipment offer opportunities for designers to demonstrate transparent lifecycle gains. The regional focus on standards and occupational safety enables technical benefits to be translated into procurement successes for UHMWPE-based solutions.

Asia Pacific Ultra High Molecular Weight Polyethylene Market Analysis

Asia Pacific's market is defined by swiftly growing end-use applications and considerable manufacturing capacity consuming UHMWPE in the form of sheets, fibers, and molded items. Demand for wear resistance and lightweight solutions is fueled by the growth of the region's textiles, heavy industry, and infrastructure. Grades are converted locally by processors and converters to satisfy varied climatic as well as operating requirements, enabling wide application coverage. As local supply chains become more established and processing becomes stronger, UHMWPE becomes a viable engineering option for an increasingly large group of purchasers, supporting the region's firm market share.

Europe Ultra High Molecular Weight Polyethylene Market Analysis

European markets prioritize regulatory compliance, certification, and sustainability credentials. UHMWPE adoption is prioritized in industries where durability and lower lifecycle footprint match regional policy agendas. Niche uses in advanced textiles and industrial liners are supported by close engagement among specifiers and material suppliers to provide performance and environmental reporting assurance. The emphasis in the region on traceability and lifecycle metrics helps suppliers and converters report long-term advantages and recyclability, enabling consistent adoption in engineered applications.

Latin America Ultra High Molecular Weight Polyethylene Market Analysis

In Latin America, adoption of UHMWPE is led by retrofits in mining, agriculture, and material handling applications where abrasion resistance and extended life lower operating expenses. Local converters adapt product offerings to fulfill cost-conscious markets with evidence of the material's endurance benefits over conventional options. Infrastructure development and expanding industrial operations provide islands of demand, with procurement tending toward materials that lengthen replacement cycles and lower maintenance hassles for remote or hostile operating conditions.

Middle East and Africa Ultra High Molecular Weight Polyethylene Market Analysis

Middle East and Africa markets appreciate high-performance polymers for uses subjected to abrasive materials and extreme conditions of operation. Wear resistance combined with durability makes UHMWPE a preferred choice for liners, balancing equipment, and protection solutions. Patterns of adoption are reflective of dense industrial applications and targeted industry-driven demand instead of mass consumer adoption. Where operational reliability over the long term is critical, UHMWPE is specified to reduce lifecycle maintenance requirements and extend service intervals.

Competitive Landscape:

The competitive landscape is focused on material differentiation by grade ranges, processing support, distribution reach, and specification services that influence the ultra high molecular weight polyethylene market forecast. Suppliers focus on consistent quality, form availability such as sheets, rods, and fibers, and technical support in securing specification-driven contracts. Converters and fabricators providing value-added services including precision machining, lamination, and custom fiber spinning seize downstream market opportunities. Distribution networks providing reliable lead times and localized stock positions minimize end-user adoption friction. Joint work with engineering groups to confirm lifecycle advantages and incorporate UHMWPE in current product designs deepens market positions. With procurement criteria increasingly focusing on total cost of ownership and sustainability, participants with documented lifecycle benefits and end-of-life treatment options are best positioned to capture incremental demand.

The report provides a comprehensive analysis of the competitive landscape in the ultra high molecular weight polyethylene market with detailed profiles of all major companies, including:

- Asahi Kasei Corporation

- Braskem

- Celanese Corporation

- China Petrochemical Corporation

- Crown Plastics Inc.

- Dotmar Engineering Plastics

- Garland Manufacturing Company

- Koninklijke DSM N.V.

- LyondellBasell Industries Holdings B.V.

- Mitsubishi Chemical Advanced Materials Group

- Mitsui Chemicals, Inc.

- Nitto Denko Corporation

- TSE Industries Inc.

Latest News and Developments:

- July 2025: Avient Corporation, through its Dyneema® brand, launched a next-generation composite fabric made from ultra-high-molecular-weight polyethylene (UHMWPE). The innovation features a dual-layer design with a Dyneema® composite core and a 100% Dyneema® woven abrasion-resistant face fabric, offering significantly enhanced durability, tear strength, and reduced weight for high-performance applications.

- June 2025: Fibre Extrusion Technology Ltd. (FET) unveiled a sustainable innovation for producing ultra-high-molecular-weight polyethylene (UHMWPE) fibres targeting the biomedical market. The company introduced a new batch solvent-extraction system using supercritical CO₂ instead of conventional solvents like hexane or DCM, significantly reducing environmental impact while enhancing fibre quality and production efficiency.

Ultra High Molecular Weight Polyethylene Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Fibers, Sheets, Rods, Others |

| Applications Covered | Filtration, Batteries, Fibers, Additives, Membranes, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Asahi Kasei Corporation, Braskem, Celanese Corporation, China Petrochemical Corporation, Crown Plastics Inc., Dotmar Engineering Plastics, Garland Manufacturing Company, Koninklijke DSM N.V., Lyondellbasell Industries Holdings B.V., Mitsubishi Chemical Advanced Materials Group, Mitsui Chemicals, Inc., Nitto Denko Corporation, TSE Industries Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the ultra high molecular weight polyethylene market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global ultra high molecular weight polyethylene market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the ultra high molecular weight polyethylene industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The ultra high molecular weight polyethylene market was valued at USD 3.4 Billion in 2025.

The ultra high molecular weight polyethylene market is projected to exhibit a CAGR of 9.31% during 2026-2034, reaching a value of USD 7.58 Billion by 2034.

High performance of the material, including abrasion resistance, impact strength, and low friction, pushes adoption in protection, industrial, and medical applications. The need for lightweight, long-lasting components minimizes replacement rate and overall cost of ownership. Advances in processing and greater supply availability make formats more varied such as sheets, fibers, and molded components. Sustainability and maintenance avoidance also impact purchasing in favor of UHMWPE.

The Asia Pacific region is leading the market currently with 42% owing to the high manufacturing capacity, widespread end-use application, and escalating specification-driven purchasing across protection, textile, and industrial sectors. Regional processing abilities and increasing converter networks enable extensive use of fibers, sheets, and molded parts, which maintains Asia Pacific's strong market share currently.

Some of the major players in the ultra high molecular weight polyethylene market include Asahi Kasei Corporation, Braskem, Celanese Corporation, China Petrochemical Corporation, Crown Plastics Inc., Dotmar Engineering Plastics, Garland Manufacturing Company, Koninklijke DSM N.V., Lyondellbasell Industries Holdings B.V., Mitsubishi Chemical Advanced Materials Group, Mitsui Chemicals, Inc., Nitto Denko Corporation, TSE Industries Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)