Ultra-Secure Smartphone Market Size, Share, Trends and Forecast by Operating System, End User and Region, 2025-2033

Ultra-Secure Smartphone Market Size and Share:

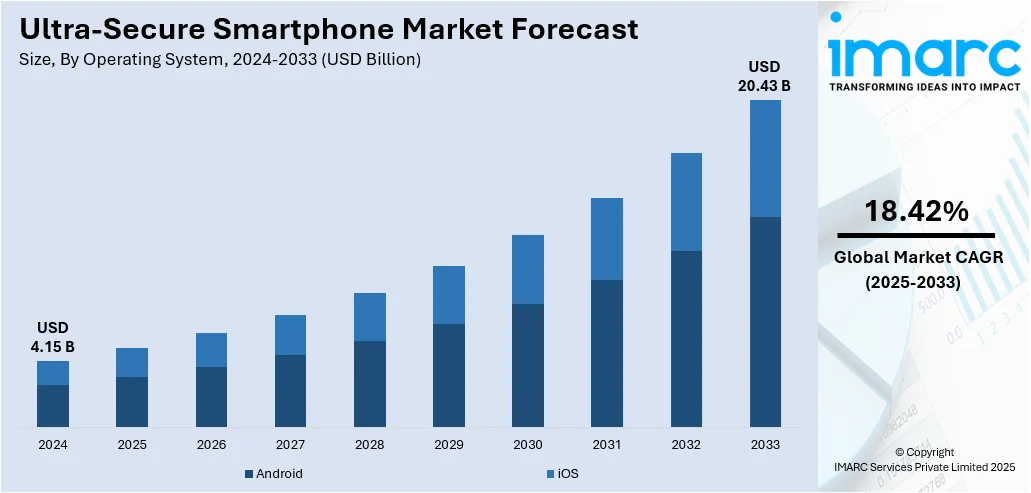

The global ultra-secure smartphone market size was valued at USD 4.15 Billion in 2024. The market is projected to reach USD 20.43 Billion by 2033, exhibiting a CAGR of 18.42% from 2025-2033. North America currently dominates the market, holding a market share of 40.0% in 2024. At present, as individuals, businesses, and government agencies are facing increasing threats like hacking, data theft, and surveillance, the need for ultra-secure smartphones is rising. Besides this, ongoing collaborations between governing agencies and key players are contributing to the expansion of the ultra-secure smartphone market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 4.15 Billion |

|

Market Forecast in 2033

|

USD 20.43 Billion |

| Market Growth Rate 2025-2033 | 18.42% |

At present, the market is growing due to rising concerns about cyber threats, data breaches, and digital privacy. Governments, defense agencies, and businesses are demanding safe communication tools to protect sensitive information. Ultra-secure smartphones offer features like encrypted messaging and advanced biometric authentication, which attract users who handle confidential data. The increase in remote work and mobile-based transactions is also creating the need for more secure devices. Industries like finance, healthcare, and legal services prefer ultra-secure smartphones to meet regulatory and compliance standards. Individuals have also become more aware about privacy risks and seek protection from surveillance and hacking. Tech companies are responding by investing in military-grade security features and limiting third-party access.

To get more information on this market, Request Sample

The United States has emerged as a major region in the ultra-secure smartphone market owing to many factors. Increasing concerns about data privacy and surveillance are fueling the ultra-secure smartphone market growth. Government agencies, military units, and corporate organizations require highly secure devices to protect sensitive communication and confidential information. The rise in remote work, digital banking, and online data exchange is further creating the need for secure mobile platforms. As per industry reports, in 2024, in the United States, around 73% of adults utilized online banking services regularly. Sectors like defense, finance, and healthcare rely on ultra-secure smartphones to meet strict regulatory and compliance standards. The growing incidents of data breaches and hacking attempts are motivating both individuals and enterprises to employ enhanced mobile protection. With high digital adoption and strong emphasis on national security, the demand for ultra-secure smartphones remains strong and continues to expand.

Ultra-Secure Smartphone Market Trends:

Growing security risks

Rising security risks are impelling the market growth. As cyberattacks have become more frequent and sophisticated, the need for highly secure communication tools is high. An increase in the cost of a data breach is encouraging organizations to invest in devices that prevent unauthorized access and protect sensitive information. It was noted that the worldwide average expense of a data breach in 2024 increased by 10% from 2023, indicating the highest total ever documented. Ultra-secure smartphones offer advanced features, such as encrypted messaging, secure operating systems, and biometric authentication to reduce vulnerability. Sectors like defense, finance, and healthcare rely on these devices to safeguard classified and personal data. Users are also seeking protection from malware, phishing, and tracking. With digital communication becoming central to everyday life, secure mobile platforms are becoming a priority. The fear of reputational damage and financial losses is offering a favorable ultra-secure smartphone market outlook.

Increasing reliance on smartphones for professional tasks

The growing reliance on smartphones for professional tasks is positively influencing the market. A survey conducted by National Business Communications found that in 2024, 70% of office workers utilized their smartphones for work, highlighting the increasing dependence on mobile devices for professional activities. Professionals across industries rely on smartphones for real-time communication, financial transactions, and data sharing, making security a top priority. With increasing mobile-based workflows, the risk of data breaches, cyberattacks, and unauthorized access is rising. To counter these threats, organizations and individuals are seeking ultra-secure smartphones that offer strong encryption, secure apps, and advanced authentication. These devices help protect confidential business data and ensure compliance with data protection policies. Companies are also encouraging employees to use secure mobile devices, especially under remote work and bring-your-own-device setups.

Collaborations between governing bodies and key players

The ongoing partnerships between governing bodies and major players are among the major ultra-secure smartphone market trends. Regulatory bodies in various nations are teaming up with industry stakeholders to develop ultra-secure smartphones that can exchange confidential documents among government officials and military staff. The revelation of a security breach impacting more than 225,000 UK military staff, as of May 2024, underscored the worldwide security threats associated with external contractors in the defense industry. The assailant obtained personal data of current, reserve, and past UK military personnel via a third-party payroll service. Government agencies are focusing on data protection and national security, which is leading them to work closely with smartphone manufacturers and cybersecurity firms. These partnerships help develop devices that meet strict security protocols and regulatory requirements. Key players are gaining support through funding, certifications, and access to classified threat intelligence, enabling them to build more robust solutions. Such collaborations are also creating trust among enterprise and defense customers who prioritize secure communication.

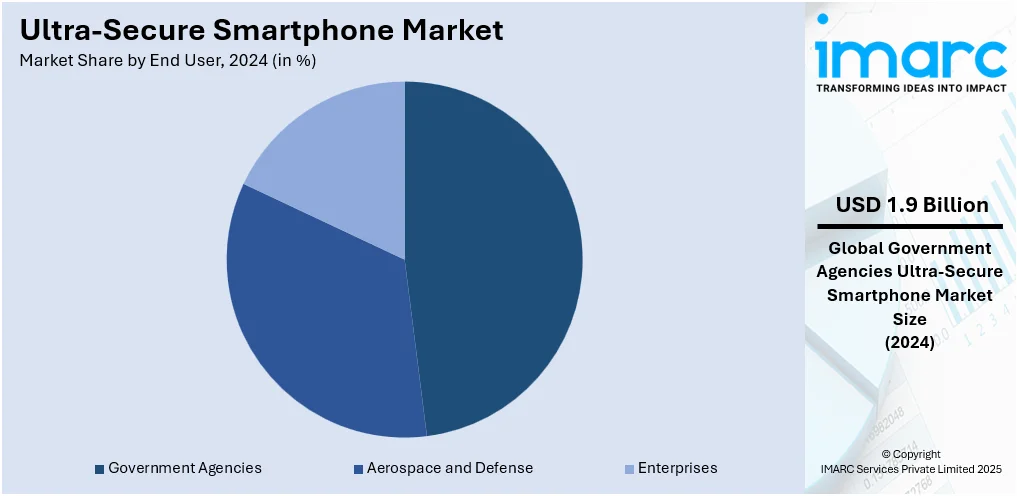

Ultra-Secure Smartphone Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global ultra-secure smartphone market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on operating system and end user.

Analysis by Operating System:

- Android

- iOS

Android held 68.6% of the market share in 2024. It is gaining popularity because of its open-source nature and high flexibility for customization. Manufacturers and developers prefer Android as it allows them to build secure platforms tailored to specific security needs. With Android, companies can modify the source code, add encryption layers, and disable unnecessary features to reduce vulnerabilities. This makes it suitable for creating ultra-secure smartphones for government, defense, and enterprise use. Android also supports a wide range of hardware, making it easier for device makers to develop secure solutions across different price ranges. Many security-focused brands choose Android to design phones with enhanced privacy features, secure boot processes, and isolated communication apps. Its large user base and continuous software updates from Google aid in maintaining compatibility while allowing room for custom security patches. According to the ultra-secure smartphone market forecast, the adaptability, wide acceptance, and strong developer support will continue to make Android the preferred operating system in the industry.

Analysis by End User:

- Government Agencies

- Aerospace and Defense

- Enterprises

Government agencies account for 46.6% of the market share. They require the highest level of data protection and secure communication. These agencies handle classified information, national security data, and sensitive operations that cannot be compromised. To prevent cyber threats, hacking, espionage, and unauthorized access, government departments are investing heavily in ultra-secure smartphones that offer encrypted communication, safe operating systems, and restricted app access. Law enforcement, intelligence, and defense sectors rely on these devices to ensure confidential communication and protected data exchange. The need for secure remote access, especially with increasing digital operations and fieldwork, is further driving adoption among government users. These agencies also follow strict data protection regulations, making ultra-secure smartphones essential tools for compliance. Additionally, government agencies often collaborate with tech firms to develop customized security solutions suited for mission-critical tasks.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America, accounting for a share of 40.0%, enjoys the leading position in the market. The region is noted for its strong focus on cybersecurity, high adoption of advanced technologies, and significant government and defense spending. As per industry reports, the United States cybersecurity market size reached USD 84.9 Billion in 2024. The region is home to several key players and security-focused tech companies that actively develop and supply secure mobile devices. US government agencies, including military, intelligence, and law enforcement, are demanding ultra-secure smartphones to protect sensitive information and ensure safe communication. Rising number of cyber threats, data breaches, and surveillance concerns are further creating the need for privacy-focused solutions. North American enterprises, especially in finance, healthcare, and legal sectors, also require secure devices to comply with strict data protection regulations. The region’s high awareness about digital privacy and strong investments in security infrastructure are promoting steady adoption. Additionally, the presence of a tech-savvy population and a well-established network of cybersecurity solutions is fueling the market growth.

Key Regional Takeaways:

United States Ultra-Secure Smartphone Market Analysis

The United States holds 87.80% of the market share in North America. The market in the United States is witnessing substantial growth, primarily fueled by increasing data privacy regulations across various industries. Increasing adoption of secure mobile devices by defense, legal, and financial sectors to prevent cyber-espionage and internal data breaches is significantly contributing to the high demand. Additionally, the rise in remote and hybrid work culture has elevated the need for high-level encryption and tamper-resistant devices to safeguard enterprise communication. According to an industry report, in 2024, 29% of workdays in the US continued to be conducted remotely, highlighting the requirement for secure mobile endpoints to safeguard sensitive business data among distributed teams. The integration of biometric authentication and advanced mobile security frameworks is further enhancing device appeal among professional users. Moreover, the demand for secure platforms to manage classified information and protect against social engineering attacks is rising. Increased government investments in secure communication technologies and the growing awareness about end-to-end encryption among C-level executives and tech-savvy users are also accelerating adoption. Furthermore, organizations are implementing mobile device management (MDM) solutions, which favor the employment of ultra-secure smartphones to ensure compliance with internal data protection policies.

Europe Ultra-Secure Smartphone Market Analysis

In Europe, the market is expanding due to the growing concerns about cross-border data privacy and digital sovereignty. The region's emphasis on safeguarding sensitive information transmitted through mobile channels, particularly among diplomats, corporate executives, and critical service operators, is catalyzing the demand. According to reports, cybersecurity budgets are on the rise across the region, with an average projected growth rate of 31% by March 2026, supporting the procurement and integration of advanced secure mobile technologies. Moreover, the enforcement of stringent compliance frameworks, such as those aligned with the General Data Protection Regulation (GDPR), is motivating enterprises to adopt more secure mobile technologies. The rapid digitalization of public services and secure citizen engagement platforms is increasing reliance on ultra-secure smartphones for authentication and communication. Cyberattacks in the energy and finance sectors are enabling the employment of secure mobile communication tools. Government agencies and private organizations are promoting the use of encryption for remote negotiations and intellectual property protection.

Asia-Pacific Ultra-Secure Smartphone Market Analysis

The Asia-Pacific ultra-secure smartphone market is gaining momentum due to the rising demand for secure communication in high-risk operational environments. The expanding digital defense infrastructure and increasing deployment of secure mobile networks in strategic sectors are promoting the use of ultra-secure devices. According to the Data Security Council of India (DSCI), in 2024, 8.44 Million endpoints exposed 369.01 Million unique malware detections, emphasizing the increased risk environment and the necessity for enhanced mobile protections in the area. The surge in cyber surveillance activities has heightened awareness among professionals about mobile data protection, especially in urban centers. Moreover, the rise in venture capital investment in cybersecurity startups and secure communication platforms is supporting the development and demand for ultra-secure smartphones. Blockchain-backed mobile security protocols are gaining popularity due to increased business travelers and cross-border executives, making ultra-secure smartphones crucial for maintaining operational integrity and data confidentiality across various sectors.

Latin America Ultra-Secure Smartphone Market Analysis

In Latin America, the market is driven by increasing digital transformation efforts in public administration and corporate governance. With the growing reliance on mobile-based transactions and cloud storage, there is a high demand for secure communication channels that protect sensitive personal and institutional data. As per the Brazilian NR, by 2026, it is anticipated that 25% of industrial businesses in Brazil will undergo digital transformation, rising to 50% by 2033, signaling a significant shift towards secure digital ecosystems that will necessitate reliable mobile security infrastructure. A heightened focus on securing executive communication within private firms and public agencies is also contributing to the market growth. Increasing demand for secure devices in the digital age, driven by the growth of mobile banking platforms, fintech ecosystems, and legal compliance, is transforming industries.

Middle East and Africa Ultra-Secure Smartphone Market Analysis

In the Middle East and Africa region, the market is experiencing rising demand for ultra-secure smartphones due to the increasing implementation of advanced digital identity systems. According to reports, in 2024, Saudi Arabia reached a 96% maturity level in digital government services, showcasing impressive metrics like 99% service availability, 93% user satisfaction, and 99% public participation, fostering a supportive atmosphere for secure communication technologies. The growing deployment of safe communication technologies within national infrastructure projects and executive-level operations is encouraging the adoption of temper-proof mobile devices. Ultra-secure smartphones are gaining popularity in the oil and gas sectors, border control, and smart city initiatives, driving market expansion and catalyzing the demand for encrypted communication tools.

Competitive Landscape:

Key players are investing in advanced technologies and developing highly secure devices tailored to government, enterprise, and privacy-focused users. These companies are focusing on integrating strong encryption, secure operating systems, and advanced authentication features to protect user data from cyber threats and surveillance. They are also collaborating with cybersecurity firms and regulatory bodies to ensure compliance with strict security standards. Key players are actively launching new models with improved performance and updated security features to meet evolving customer needs. Through strategic marketing, they are generating awareness about the importance of mobile security among individuals and organizations. Their global distribution networks and partnerships with government and defense sectors are helping expand market reach. By continuously innovating and adapting to rising cybersecurity challenges, these key players are significantly shaping market trends and catalyzing the demand for ultra-secure smartphones. For instance, in November 2024, WISeKey International Holding Ltd. revealed the imminent launch of SEALPhone, an advanced Web3 smartphone intended for secure cryptocurrency usage, military-grade digital security, and safe Internet of Things (IoT) connectivity. Scheduled for release in Q2 2025, the SEALPhone expanded on the achievements of WISePhone, which was first introduced in 2017 as one of the initial blockchain-supported secure phones.

The report provides a comprehensive analysis of the competitive landscape in the ultra-secure smartphone market with detailed profiles of all major companies, including:

- Atos SE

- Bittium

- BlackBerry Limited

- Cog Systems

- Gryphon Secure

- Samsung Electronics Co. Ltd.

- Silent Circle

- Sirin Labs

- The Boeing Company

Latest News and Developments:

- February 2025: EDGE Group's KATIM collaborated with e& UAE to enhance ultra-secure communication technologies. They consented to develop the KATIM X3M ultra-secure smartphone, incorporate KATIM Gateways, and launch the encrypted KATIM Secure App X4, improving data integrity and encryption for government and enterprise users.

- June 2025: Bittium was set to introduce new software designed to facilitate secure mobile communication on all leading operating platforms, including iOS, Android, and Microsoft Windows. The software collection, which included Bittium's SafeMove mobile VPN and Secure Call, was intended to encrypt network communications, messaging, and enable end-to-end encrypted audio and video calls.

Ultra-Secure Smartphone Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Operating Systems Covered | Android, iOS |

| End Users Covered | Government Agencies, Aerospace and Defense, Enterprises |

| Region Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Atos SE, Bittium, BlackBerry Limited, Cog Systems, Gryphon Secure, Samsung Electronics Co. Ltd., Silent Circle, Sirin Labs and The Boeing Company. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the ultra-secure smartphone market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global ultra-secure smartphone market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the ultra-secure smartphone industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The ultra-secure smartphone market was valued at USD 4.15 Billion in 2024.

The ultra-secure smartphone market is projected to exhibit a CAGR of 18.42% during 2025-2033, reaching a value of USD 20.43 Billion by 2033.

As cyber threats are becoming more sophisticated, individuals, businesses, and government agencies are seeking devices that offer strong protection for sensitive communication and data. The demand is increasing, particularly among professionals handling confidential information, such as executives, defense personnel, and journalists. The rise of remote work and mobile transactions is further creating the need for secure mobile platforms.

North America currently dominates the ultra-secure smartphone market, accounting for a share of 40.0% in 2024, driven by strong cybersecurity focus, high government demand, and presence of key tech players. Rising cyber threats and strict data protection laws are further boosting the adoption of secure devices across the public and private sectors.

Some of the major players in the ultra-secure smartphone market include Atos SE, Bittium, BlackBerry Limited, Cog Systems, Gryphon Secure, Samsung Electronics Co. Ltd., Silent Circle, Sirin Labs, The Boeing Company, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)