United Kingdom Confectionery Market Size, Share, Trends and Forecast by Product Type, Age Group, Price Point, Distribution Channel, and Region, 2026-2034

United Kingdom Confectionery Market Summary:

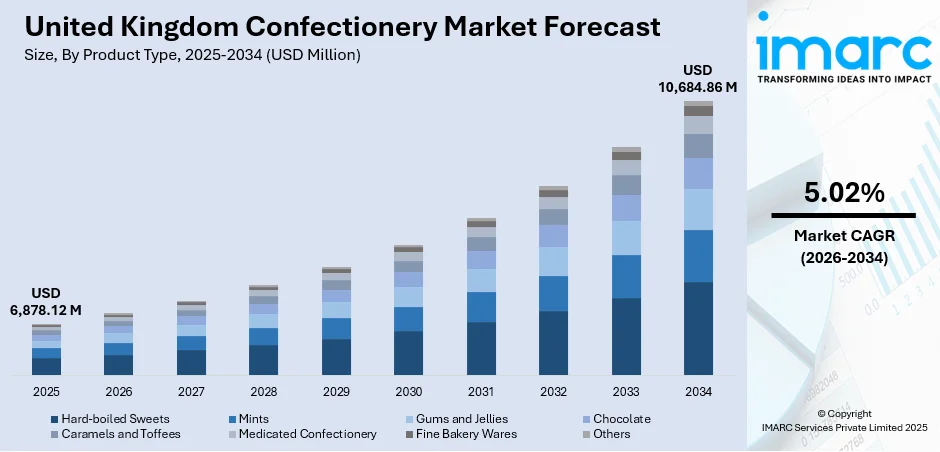

The United Kingdom confectionery market size was valued at USD 6,878.12 Million in 2025 and is projected to reach USD 10,684.86 Million by 2034, growing at a compound annual growth rate of 5.02% from 2026-2034.

The United Kingdom confectionery market is driven by strong consumer demand for indulgent treats, premiumization trends, and growing interest in healthier product formulations. The industry continues adapting to regulatory changes concerning high fat, sugar, and salt products while innovating with reduced-sugar options, sustainable packaging, and ethical sourcing practices to meet evolving consumer preferences.

Key Takeaways and Insights:

-

By Product Type: Chocolate dominated the market with approximately 58% revenue share in 2025, driven by strong consumer preference for indulgent treats, premiumization trends, and innovations in flavours, formats, and health-conscious options including reduced-sugar and plant-based varieties.

-

By Age Group: Adult leads the market with a share of 60% in 2025, owing to consistent consumption patterns, gifting occasions, premium chocolate preferences, and the appeal of confectionery as an affordable luxury during moments of indulgence.

-

By Price Point: Economy represents the largest segment with 50% market share in 2025, supported by cost-of-living pressures influencing purchasing decisions, multi-buy offers, and value-oriented products offered by supermarkets and convenience stores.

-

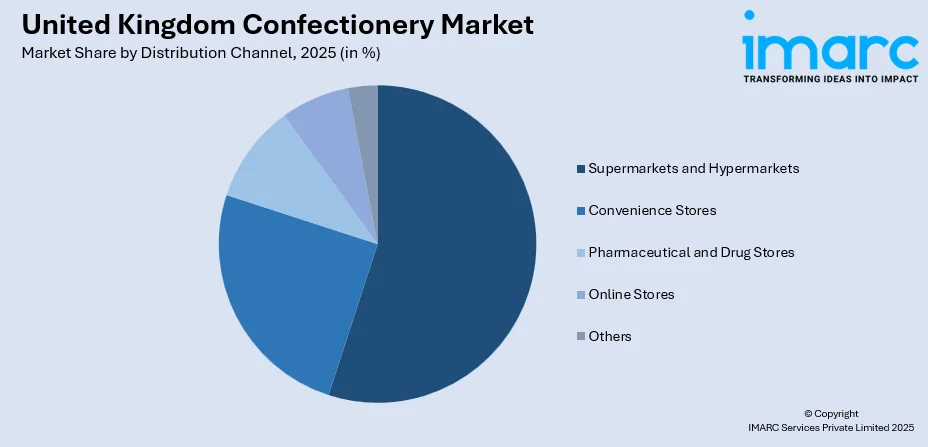

By Distribution Channel: Supermarkets and Hypermarkets account for 55% market share in 2025, benefiting from extensive product ranges, promotional activities, convenient one-stop shopping experiences, and strategic product placement driving impulse purchases.

-

Key Players: The UK confectionery market features established multinational brands alongside artisanal producers, with leading companies focusing on sustainability initiatives, product reformulation, and innovative marketing strategies.

To get more information on this market Request Sample

The United Kingdom confectionery industry demonstrates resilience amid evolving consumer preferences and regulatory challenges. Chocolate confectionery remains the dominant segment, with consumers seeking both indulgent treats and healthier alternatives. For instance, in 2025 Cadbury announced that its core sharingbars sold in the UK and Ireland will be wrapped using 80% certified recycled plastic, an effort to cut plastic waste across around 300 million bars per year. The market is characterized by premiumization trends, with consumers willing to pay more for quality products even during economic pressures. Sustainability and ethical sourcing have become important considerations, driving manufacturers to adopt recycled packaging and responsible cocoa sourcing practices. Seasonal demand patterns, particularly during festive periods, continue driving sales while innovation in reduced-sugar formulations addresses health-conscious consumer segments.

United Kingdom Confectionery Market Trends:

Premiumization and Affordable Luxury Positioning

The UK confectionery market demonstrates strong premiumization trends as consumers increasingly seek quality over quantity when indulging in treats. Premium chocolate is positioned as an affordable luxury, allowing consumers to enjoy indulgent experiences even during periods of economic pressure. According to a recent consumerinsight survey, 61% of UK chocolate users view “premium chocolate as an affordable luxury,” even when under financial strain, underlining how the notion of treatasluxury continues to hold despite economic headwinds. Manufacturers are focusing on unique flavours, premium ingredients, and elevated packaging to differentiate their products and justify higher price points.

Health-Conscious Reformulation and Reduced-Sugar Options

Growing consumer awareness regarding sugar and fat consumption is driving significant product reformulation across the confectionery sector. Manufacturers are developing reduced-sugar products enhanced with vitamins and minerals to appeal to health-conscious consumers. For example, Nestlé has reportedly reduced sugar content in its UK confectionery portfolio by about 10% over the past few years, part of an effort to cut down sugar, salt and saturated fat without sacrificing taste. The industry is responding to regulatory requirements concerning high fat, sugar, and salt products while maintaining the indulgent taste profiles that consumers expect from confectionery products.

Sustainability and Ethical Sourcing Initiatives

Environmental sustainability considerations increasingly influence UK confectionery market dynamics as consumers prioritize products with ethical and environmental credentials. Manufacturers are investing in recycled packaging solutions, sustainable farming practices, and certifications demonstrating responsible sourcing. For instance, a major development at the policy level: in January 2025, the UK government formally launched PackUK as the administrator of the new Extended Producer Responsibility for Packaging (pEPR) scheme. This regulatory step pushes packaging producers, including confectionery firms, to cover the full cost of recycling and wastemanagement for the materials they place on the market, creating strong incentives to shift toward more sustainable and recyclable packaging. The industry is exploring innovations including alternative ingredients and waste reduction technologies to support sustainable production while meeting consumer expectations for environmentally friendly products.

Market Outlook 2026-2034:

The UK confectionery market demonstrates promising growth prospects driven by continued demand for indulgent treats, premiumization trends, and innovations in healthier product formulations. Chocolate confectionery is expected to maintain its dominant position while reduced-sugar and plant-based alternatives capture growing consumer segments. Seasonal demand patterns will continue driving sales during festive periods. The market is adapting to regulatory changes while leveraging sustainability initiatives and ethical sourcing to appeal to environmentally conscious consumers. The market generated a revenue of USD 6,878.12 Million in 2025 and is projected to reach a revenue of USD 10,684.86 Million by 2034, growing at a compound annual growth rate of 5.02% from 2026-2034.

United Kingdom Confectionery Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product Type | Chocolate | 58% |

| Age Group | Adult | 60% |

| Price Point | Economy | 50% |

| Distribution Channel | Supermarkets and Hypermarkets | 55% |

Product Type Insights:

- Hard-boiled Sweets

- Mints

- Gums and Jellies

- Chocolate

- Caramels and Toffees

- Medicated Confectionery

- Fine Bakery Wares

- Others

The chocolate dominates with a market share of 58% of the total United Kingdom confectionery market in 2025.

Chocolate confectionery maintains market leadership driven by strong consumer demand for indulgent treats and the segment's ability to cater to diverse consumption occasions. The category encompasses single-serve bars, sharing packs, boxed chocolates, and seasonal offerings appealing to gifting and self-indulgence preferences. Milk chocolate remains the most popular variety, while dark chocolate gains traction among health-conscious consumers seeking products with perceived health benefits. In 2025, Tony’s Chocolonely unveiled a new 90 g bar format, a smaller, individually portioned alternative to its traditional chunky bars, targeting consumers seeking a premium, ethically sourced treat for solo indulgences. The bars use 100% traceable cocoa, reflecting the brand’s commitment to responsible sourcing.

The segment benefits from continuous innovation in flavours, formats, and health-conscious options including reduced-sugar and plant-based varieties. Premium chocolate positions itself as an affordable luxury, enabling consumers to enjoy indulgent experiences. Manufacturers are responding to consumer preferences for sustainable and ethically sourced products by adopting responsible cocoa sourcing practices and environmentally friendly packaging solutions.

Age Group Insights:

- Children

- Adult

- Geriatric

The adult leads with a share of 60% of the total United Kingdom confectionery market in 2025.

The adult segment maintains dominant market position driven by consistent consumption patterns and the appeal of confectionery as an everyday indulgence and stress relief. For example, a 2024 survey by Mintel found that about 95% of British adults report eating chocolate, with “once a week or more” now the norm for most consumers. Adults represent the primary purchasers across all confectionery categories, including premium chocolate for self-consumption, gifting occasions, and sharing with family and social groups. The segment demonstrates strong demand for both everyday treats and premium offerings positioned as affordable luxuries.

Adult consumers increasingly seek products aligning with health and wellness preferences, driving demand for reduced-sugar formulations and functional confectionery options. The segment responds positively to premiumization trends, with consumers willing to pay more for quality ingredients, unique flavours, and sustainable products. Seasonal purchasing patterns around holidays and celebrations contribute substantially to adult confectionery consumption.

Price Point Insights:

- Economy

- Mid-range

- Luxury

The economy dominates with a market share of 50% of the total United Kingdom confectionery market in 2025.

The economy segment maintains market leadership driven by cost-of-living pressures influencing consumer purchasing decisions across the confectionery category. Value-oriented consumers seek affordable indulgence through multi-buy offers, promotional pricing, and budget-friendly pack sizes offered by major retailers. Supermarket own-label products compete effectively in this segment by offering comparable quality at lower price points than branded alternatives.

The segment benefits from strategic pricing strategies employed by manufacturers and retailers to maintain consumer access to everyday treats. Convenience stores and discount retailers play important roles in economy confectionery distribution. Despite economic pressures, consumers demonstrate willingness to maintain confectionery purchases, viewing them as affordable pleasures during challenging times.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Convenience Stores

- Pharmaceutical and Drug Stores

- Online Stores

- Others

The supermarkets and hypermarkets lead with a share of 55% of the total United Kingdom confectionery market in 2025.

Supermarkets and hypermarkets maintain distribution channel dominance through extensive product ranges, competitive pricing strategies, and convenient one-stop shopping experiences. For example, Ritter Sport expanded its UK retail footprint in 2025 by launching new products in Tesco stores nationwide, including its “Mini Towers” bars, highlighting how supermarkets remain central to reaching shoppers. Major grocery retailers leverage strategic product placement near checkout areas and promotional end-caps to drive impulse purchases. The channel offers comprehensive selections spanning economy to premium confectionery products across all category segments.

The channel benefits from established consumer shopping patterns, loyalty programmes, and promotional activities during seasonal periods. Retailers are expanding own-label confectionery offerings to capture value-conscious consumers while maintaining branded product ranges. Strategic partnerships between manufacturers and retailers support product launches, seasonal campaigns, and promotional activities driving category growth.

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

London represents a major confectionery consumption hub driven by its diverse population, premium chocolate demand, and strong gifting culture. The capital's affluent consumer base supports luxury confectionery brands and flagship retail experiences. International tourism and cosmopolitan demographics create demand for diverse product offerings spanning traditional British sweets to artisanal chocolates.

South East England demonstrates substantial confectionery consumption supported by its affluent demographics and proximity to London's retail influence. The region exhibits strong demand for premium chocolate products and seasonal gifting occasions. Extensive supermarket networks and convenience store presence ensure comprehensive product availability across urban and suburban areas.

North West England's confectionery market benefits from the region's strong traditional confectionery heritage and manufacturing presence. Manchester and Liverpool metropolitan areas drive consumption across diverse demographics. The region demonstrates particular affinity for sugar confectionery products alongside mainstream chocolate offerings through extensive retail networks.

East of England's confectionery consumption reflects the region's growing population and suburban retail development. Family demographics support demand across children's and adult confectionery segments. Supermarket expansion and convenience store networks ensure product accessibility throughout urban centres and smaller communities across the region.

South West England's confectionery market benefits from tourism-driven seasonal demand and regional artisanal confectionery traditions. Coastal resort towns experience elevated consumption during holiday periods. The region's food culture supports local chocolate producers and traditional sweet manufacturers catering to both residents and visitors.

Scotland's confectionery market demonstrates distinct characteristics with strong demand for traditional Scottish confectionery products alongside mainstream offerings. Edinburgh and Glasgow metropolitan areas drive urban consumption patterns. The region's distinctive confectionery heritage supports local manufacturers while international brands maintain strong market presence through major retailers.

West Midlands represents an important confectionery market driven by Birmingham's large urban population and diverse demographics. The region's manufacturing heritage includes significant confectionery production facilities. Extensive retail networks ensure comprehensive product availability while local preferences support both value and premium confectionery segments.

Yorkshire and The Humber's confectionery market benefits from the region's strong confectionery manufacturing heritage and local brand loyalty. Traditional confectionery products maintain popularity alongside contemporary offerings. Leeds, Sheffield, and other urban centres drive consumption while rural areas sustain demand through convenience store and supermarket networks.

East Midlands' confectionery market serves diverse consumer preferences across urban and rural demographics. The region's central location supports distribution and retail accessibility. Nottingham, Leicester, and Derby metropolitan areas drive consumption while supermarket expansion ensures comprehensive product availability throughout the region.

Other UK regions including Wales, Northern Ireland, and North East England contribute to national confectionery consumption through regional retail networks and local preferences. These regions demonstrate demand across mainstream confectionery categories while supporting regional traditional products and local manufacturers serving community preferences.

Market Dynamics:

Growth Drivers:

Why is the United Kingdom Confectionery Market Growing?

Strong Consumer Demand for Indulgent Treats

The UK confectionery market benefits from sustained consumer demand for indulgent treats providing moments of pleasure and comfort. According to reports, Chocolate value sales in the UK rose by 9.3% over the past year, with commentary that “up to 99% of UK households buy it regularly,” underscoring how deeply confectionery is embedded in daily life. Confectionery products serve as affordable luxuries allowing consumers to enjoy small indulgences during daily routines and special occasions. The emotional connection between confectionery and consumer wellbeing supports consistent purchasing patterns across demographic segments. Seasonal occasions including holidays and celebrations drive elevated consumption while everyday treating maintains baseline demand throughout the year.

Premiumization and Innovation in Product Offerings

Premiumization trends drive market growth as consumers increasingly seek quality over quantity when purchasing confectionery products. Premium chocolate positioned as an affordable luxury attracts consumers willing to pay more for superior ingredients, unique flavours, and elevated experiences. Manufacturers continuously innovate through new flavour combinations, format innovations, and limited-edition releases capturing consumer interest. For example, unit sales of premium chocolate in independent stores recently grew by 8%, even during periods when mainstream chocolate sales declined more sharply. The expansion of premium own-label products alongside branded offerings creates opportunities across price segments.

Health-Conscious Reformulation and Reduced-Sugar Products

Growing consumer interest in healthier options drives innovation in reduced-sugar, fortified, and functional confectionery products. In 2025, Swizzels, a wellknown UK sweet maker, confirmed that demand for vegan sweets surged: its vegan countline grew 34.1% in sales, while hangingbags and clipstrips rose 38%, highlighting strong plantbased uptake. Manufacturers are developing products with reduced sugar content enhanced with vitamins and minerals to appeal to health-conscious consumers without sacrificing taste. Plant-based and vegan confectionery options capture growing consumer segments seeking alternatives to traditional products. The convergence of health and indulgence enables brands to expand their consumer base while maintaining category relevance.

Market Restraints:

What Challenges the United Kingdom Confectionery Market is Facing?

Regulatory Restrictions on High Fat, Sugar, and Salt Products

UK confectionery manufacturers face regulatory challenges concerning high fat, sugar, and salt products affecting marketing, placement, and promotional activities. Advertising restrictions and placement limitations in retail environments impact product visibility and impulse purchasing opportunities. Manufacturers must balance regulatory compliance with maintaining product appeal and consumer satisfaction.

Rising Input Costs and Ingredient Price Volatility

Confectionery manufacturers face challenges from volatile cocoa and sugar prices impacting production costs and profit margins. Global supply chain disruptions and agricultural yield variations create uncertainty in ingredient sourcing. Manufacturers must balance cost pressures with consumer price sensitivity while maintaining product quality standards.

Health Consciousness and Sugar Reduction Pressures

Growing health consciousness among consumers creates challenges for traditional confectionery products associated with high sugar content. The industry must invest in reformulation and innovation to develop healthier alternatives meeting evolving consumer expectations. Competition from alternative snacking options including protein bars and fruit-based products presents ongoing competitive pressure.

Competitive Landscape:

The UK confectionery market exhibits a competitive landscape featuring established multinational corporations alongside regional and artisanal producers. Major international brands dominate chocolate and sugar confectionery segments through strong brand recognition, extensive distribution networks, and sustained marketing investment. The market demonstrates increasing competition from premium own-label products replicating branded attributes at lower price points. Manufacturers differentiate through innovation, sustainability initiatives, and ethical sourcing commitments. Strategic partnerships between brands and retailers support seasonal campaigns and promotional activities while product reformulation addresses health-conscious consumer segments.

Recent Developments:

-

In 2025, Whitakers Chocolates inaugurated a new nutprocessing facility at its Snaygill site in Skipton, North Yorkshire, enabling inhouse nut control. The move coincides with the launch of Milk Chocolate Brazil Nuts, highlighting a trend toward premium, nutfocused confectionery and vertical integration in chocolate production.

United Kingdom Confectionery Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Hard-boiled Sweets, Mints, Gums and Jellies, Chocolate, Caramels and Toffees, Medicated Confectionery, Fine Bakery Wares, Others |

| Age Groups Covered | Children, Adult, Geriatric |

| Price Points Covered | Economy, Mid-range, Luxury |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Pharmaceutical and Drug Stores, Online Stores, Others |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The United Kingdom confectionery market size was valued at USD 6,878.12 Million in 2025.

The United Kingdom confectionery market is expected to grow at a compound annual growth rate of 5.02% from 2026-2034 to reach USD 10,684.86 Million by 2034.

Chocolate dominated the market with a 58% share, driven by strong consumer demand for indulgent treats, premiumization trends, and innovations in flavours, formats, and health-conscious options.

Key factors driving the United Kingdom confectionery market include strong consumer demand for indulgent treats, premiumization and product innovation, health-conscious reformulation, seasonal consumption patterns, and the positioning of confectionery as an affordable luxury.

Major challenges include regulatory restrictions on high fat, sugar, and salt products, rising input costs and ingredient price volatility, health consciousness pressures, competition from alternative snacking options, and the need for sustainable sourcing practices.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)