United Kingdom Gaming Market Report by Device Type (Consoles, Mobiles and Tablets, Computers), Platform (Online, Offline), Revenue Type (In-Game Purchase, Game Purchase, Advertising), Type (Adventure/Role Playing Games, Puzzles, Social Games, Strategy, Simulation, and Others), Age Group (Adult, Children), and Region 2025-2033

United Kingdom Gaming Market Overview:

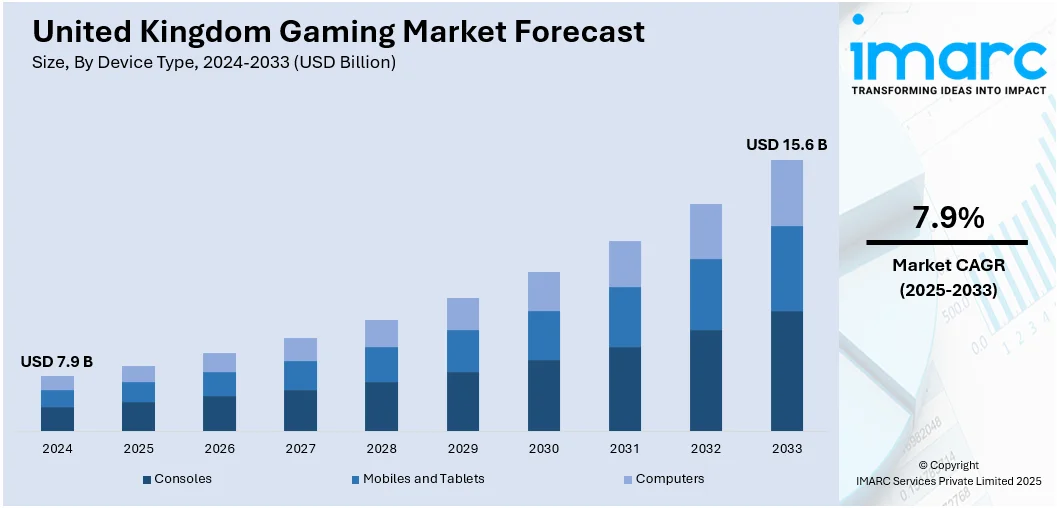

The UK gaming market size reached USD 7.9 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 15.6 Billion by 2033, exhibiting a growth rate (CAGR) of 7.9% during 2025-2033. The increasing internet penetration, the rising popularity of mobile gaming, significant advancements in gaming technology, the robust esports scene, the growing base of casual gamers, and strong consumer spending on entertainment are some of the major factors propelling the growth of the market. The UK gaming market ranks as the biggest in Europe and holds the sixth position worldwide in terms of revenue.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 7.9 Billion |

| Market Forecast in 2033 | USD 15.6 Billion |

| Market Growth Rate (2025-2033) | 7.9% |

United Kingdom Gaming Market Trends:

Significant Technological Advancements

Innovations in gaming technology, such as virtual reality (VR), augmented reality (AR), and high-performance gaming consoles, enhance the gaming experience, attracting more players and increasing engagement. For instance, in February 2023, Sony PlayStation launched the new PS VR 2, Sony’s latest VR headset. It is designed to work with the PlayStation 5, Sony’s next-gen console that’s been plagued with manufacturing delays due to chronic semiconductor shortages. Similarly, in August 2023, Sandbox VR officially opened its largest venue globally and first ever UK site outside of London at Hammerson’s Bullring & Grand Central in Birmingham city center. The opening of Sandbox VR reflects Hammerson’s strategy to reinvigorate its assets through new brands, market firsts, and experiential concepts to attract new visitors and diversify revenue streams. The selection of Bullring & Grand Central demonstrates the appeal and quality of Hammerson’s city center estates to high-profile brands. The new venue houses seven exclusively designed interactive worlds, including the newly launched epic fantasy game, “Seekers of the Shard: Dragonfire” and a captivating replica of the Netflix phenomenon “Squid Game”, launched in early Autumn 2023. These developments highlight the continued expansion of the UK gaming market, with immersive technology also fueling growth in the broader online gaming market.

To get more information on this market, Request Sample

Growing Mobile Gaming

The widespread adoption of smartphones and mobile devices is significantly expanding the gaming audience, with mobile games becoming increasingly popular due to their accessibility and convenience. According to industry reports, in 2023, 87% of UK adults own a smartphone. 96% of 16- to 24-year-olds own a smartphone, but just 69% of over-65s own a smartphone. Brits spend an average of 4 hours and 14 minutes a day on their smartphones. There are 66.11 million internet users in the UK, around 98% of the population. 7% of UK households do not have access to the internet at home in 2023. A quarter (25%) of those aged 65 and over don’t have access to the internet at home. There are estimated to be 60.2 million mobile internet users in 2023. Almost 1 in 5 internet users (18%) only go online via a smartphone. 8 in 10 people (81%) say their smartphone keeps them up at night. Such statistics empirically exemplify the increasing penetration of smartphones and mobile devices into the daily lives of individuals, particularly the young demographic, which, in turn, is contributing to the growth of the UK mobile games market. This rise also complements niche segments, with demand in areas like the retro gaming market UK 2025 showing how nostalgia-driven content can thrive alongside cutting-edge mobile titles.

Growing Recognition of Competitive Gaming

Esports is becoming a mainstream part of the UK esports market, attracting both casual audiences and serious investors. The surge in popularity has been fueled by professional tournaments, university-level leagues, and grassroots competitions that create a strong player pipeline. Sponsorship deals with major brands and partnerships with football clubs are adding credibility and expanding reach beyond traditional gaming communities. The rise of streaming platforms like Twitch and YouTube Gaming has further amplified visibility, allowing players to build global followings from local events. With younger demographics engaging heavily and advertisers taking notice, esports is now seen as a viable entertainment and career path, reshaping how competitive gaming fits within the UK’s broader entertainment industry.

United Kingdom Gaming Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional and country level for 2025-2033. Our report has categorized the market based on device type, platform, revenue type, type, and age group.

Device Type Insights:

- Consoles

- Mobiles and Tablets

- Computers

The report has provided a detailed breakup and analysis of the market based on the device type. This includes consoles, mobiles and tablets, and computers.

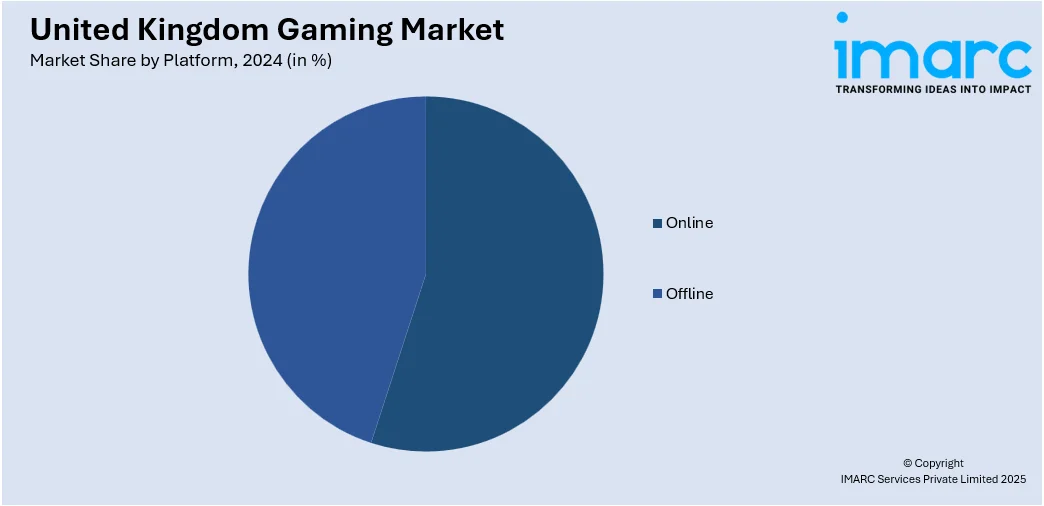

Platform Insights:

- Online

- Offline

A detailed breakup and analysis of the market based on the platform have also been provided in the report. This includes online and offline.

Revenue Type Insights:

- In-Game Purchase

- Game Purchase

- Advertising

A detailed breakup and analysis of the market based on the revenue type have also been provided in the report. This includes in-game purchase, game purchase, and advertising.

Type Insights:

- Adventure/Role Playing Games

- Puzzles

- Social Games

- Strategy

- Simulation

- Others

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes adventure/role playing games, puzzles, social games, strategy, simulation, and others.

Age Group Insights:

- Adult

- Children

A detailed breakup and analysis of the market based on the age group have also been provided in the report. This includes adult and children.

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

United Kingdom Gaming Market News:

- In July 2025, British Esports secured funding to build the UK’s first dedicated Gaming and Esports Arena in Sunderland, opening in early 2026. The 15,000 sq. ft. venue would feature a 200-seat theatre, giant LED screen, broadcast studios, and training facilities. Positioned alongside the National Esports Performance Campus, it aims to host elite competitions, live audiences, and serve as a training hub for events like the Esports World Cup and Olympic Esports Games.

- In April 2025, NetBet UK expanded its online casino portfolio by partnering with Blueprint Gaming, making a range of the provider’s popular titles available to UK players. This move continues NetBet’s strategy of growing its library through collaborations with leading developers. The partnership strengthens NetBet’s position in offering one of the most diverse and engaging casino experiences in the market, reinforcing its commitment to delivering high-quality gaming content.

- In May 2024, Ukie, the leading video games industry body, announced the launch of the ‘Ask About Games’ parent hub, an invaluable resource designed to support parents, caregivers, and families in navigating the world of video games. As technology continues to evolve, so does the landscape of parenting, with video game ownership now a staple in 70% of UK households. This new hub aims to equip parents with the necessary tools and knowledge to engage in meaningful discussions about fostering healthy digital habits for their children.

- In July 2024, Metric Gaming, an emerging player in premium sportsbook supply, announced a partnership with Betzone to launch the brand’s new UK sportsbook venture. This collaboration follows the successful debut of Metric’s much-hyped sportsbook platform in the Netherlands this past May. The deal marks Metric’s entry into another tightly regulated and strategically crucial market, given the B2B provider’s “whiter-than-white” regulatory strategy.

United Kingdom Gaming Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Device Types Covered | Consoles, Mobiles and Tablets, Computers |

| Platforms Covered | Online, Offline |

| Revenue Types Covered | In-Game Purchase, Game Purchase, Advertising |

| Types Covered | Adventure/Role Playing Games, Puzzles, Social Games, Strategy, Simulation, Others |

| Age Group Covered | Adult, Children |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United Kingdom gaming market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the United Kingdom gaming market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United Kingdom gaming industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The gaming market in the United Kingdom reached USD 7.9 Billion in 2024.

The United Kingdom gaming market is projected to exhibit a CAGR of 7.9% during 2025-2033, reaching USD 15.6 Billion by 2033.

The UK gaming market is driven by mobile gaming adoption, strong console demand, rising esports popularity, and VR/AR innovations. Digital distribution platforms expand reach, while cloud gaming boosts accessibility. Favorable demographics, high disposable incomes, and strong developer presence further fuel growth, supported by government incentives and international collaborations.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)