United States 3D Printing Market Report by Component (Printer, Material, Software, Services), Process (Binder Jetting, Directed Energy Deposition, Material Extrusion, Material Jetting, Powder Bed Fusion, Sheet Lamination, and Others), Technology (Stereolithography, Selective Laser Sintering, Electron Beam Melting, Fused Deposition Modeling, Laminated Object Manufacturing, and Others), Application (Prototyping, Tooling, Functional Part Manufacturing), Vertical (Consumer Products, Industrial, Aerospace and Defense, Automotive, Healthcare, Education and Research, and Others), and Region 2025-2033

United States 3D Printing Market Overview:

The United States 3D printing market size reached USD 5.8 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 41.4 Billion by 2033, exhibiting a growth rate (CAGR) of 21.70% during 2025-2033. The rising demand for 3D printing in numerous sectors, emerging technological advancements, favorable government initiatives, and the widespread adoption of 3D printing in education and research institutions are some of the major factors propelling the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 5.8 Billion |

|

Market Forecast in 2033

|

USD 41.4 Billion |

| Market Growth Rate 2025-2033 | 21.70% |

3D printing, or additive manufacturing, is an advanced technology that allows the creation of three-dimensional objects from digital models. It builds objects layer by layer, adding material as required, which starts with slicing the digital model into thin cross-sectional layers sequentially printed using various materials, such as plastic, metal, resin, or even food substances. A fully formed three-dimensional object is created as each layer is added to the previous one. Additionally, it offers several advantages, including rapid prototyping, customization, reduced material waste, and the ability to create complex geometries not achievable through traditional manufacturing techniques. As a result, it is widely adopted in numerous applications in industries, including manufacturing, aerospace, healthcare, automotive, architecture, and consumer goods.

The market is primarily driven by the rising demand for customized and on-demand production. 3D printing allows the production of highly personalized and tailor-made products, ranging from consumer goods to industrial components. This capability has captured the attention of businesses looking to offer differentiated products and enhance customer satisfaction, thereby driving the adoption of these technologies. Moreover, 3D printing enables rapid prototyping and significantly shortens the product development cycle, reducing the time-to-market and offering a competitive advantage for businesses, representing another major growth-inducing factor. Besides this, the production process allows companies to respond swiftly to market demands, iterate designs efficiently, and introduce new products, accelerating market growth. Along with this, 3D printing is employed to create intricate components, prototypes, and even functional end-use products, propelling market growth. Furthermore, the ability to produce complex geometries, lightweight structures, and parts with enhanced performance characteristics is creating a positive market outlook.

United States 3D Printing Market Trends/Drivers:

The emerging technological advancements

Technological advancements in 3D printing are driving the growth and adoption of this manufacturing technique. In addition, 3D printers offer quick printing speeds that allow rapid prototyping and streamlined production processes, allowing businesses to iterate and bring products to market more quickly which is accelerating the market growth. Moreover, modern 3D printers offer increased printing accuracy and provide higher resolution and precision, resulting in detailed and intricate prints representing another major growth-inducing factor. For instance, it is extensively employed in the healthcare sector to produce intricate medical implants and prosthetics with precise specifications. Additionally, significant developments in the range of materials to use in 3D printing such as metals, ceramics, composites, and even bio-inks for bioprinting applications augment the market growth. Furthermore, advancements in software and design tools optimize 3D models for printing, with Improved software capabilities, such as generative design and simulation tools, enabling designers to optimize designs for strength, weight, and other performance factors, leading to efficient and cost-effective production.

Favorable government initiatives

The implementation of several initiatives by the United States government to foster innovation, research, and development in the field of additive manufacturing is influencing the market growth. Moreover, the increasing support provided by federal agencies such as the national science foundation (NSF) and the Department of Défense (DoD) is representing another major growth-inducing factor. These agencies have allocated funding for research projects focused on advancing 3D printing technologies and exploring their applications in various industries, including aerospace, defense, healthcare, and manufacturing. Additionally, the government has collaborated with academic institutions and research centers to bring together industry experts, researchers, and policymakers to promote knowledge sharing, technology transfer, and the development of best practices which is accelerating the market growth. Besides this, the government is implementing regulations to encourage the product adoption. For instance, initiatives such as the Manufacturing USA program, which includes institutes such as America Makes, aim to accelerate the development and adoption of advanced manufacturing technologies, including 3D printing, through public-private partnerships.

United States 3D Printing Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States 3D printing market report, along with forecasts at the country and regional levels from 2025-2033. Our report has categorized the market based on component, process, technology, application and vertical.

Breakup by Component:

To get more information on this market, Request Sample

- Printer

- Desktop Printer

- Industrial Printer

- Material

- Polymers

- Metal and Alloys

- Ceramic

- Others

- Software

- Services

- 3D Scanning

- Designing

- Prototype Development

- Others

Printers dominate the market

The report has provided a detailed breakup and analysis of the market based on the product type. This includes a printer (desktop printer and industrial printer), material (polymers, metal, alloys, ceramic, and others), software, and services (3D scanning, designing, prototype development, and others). According to the report, printers represented the largest segment.

Printers are the primary component in 3D printing technology, which is essential in the fabrication process, escalating market growth. They are responsible for translating digital designs into physical objects by layering materials to build three-dimensional structures with advancements in printer technology, including improved precision, speed, and material compatibility representing another major growth-inducing factor.

Besides this, the widespread adoption of the printer in numerous industries, including aerospace, automotive, healthcare, and consumer products is providing a positive thrust to the market growth. The versatility of three dimensional (3D) printers and their ability to create complex geometries and customized objects are driving their adoption. Also, other components, such as materials, software, and services, are essential in the market, contributing to the growth and innovation.

Breakup by Process:

- Binder Jetting

- Directed Energy Deposition

- Material Extrusion

- Material Jetting

- Powder Bed Fusion

- Sheet Lamination

- Others

Direct energy disposition holds the largest share of the market

A detailed breakup and analysis of the market based on the process have also been provided in the report. This includes binder jetting, directed energy deposition, material extrusion, material jetting, powder bed fusion, sheet lamination, and others. According to the report, direct energy disposition accounted for the largest market share.

Direct energy disposition refers to a process where materials are melted and deposited layer by layer to create a desired object. This process is gaining traction due to its versatility, allowing the use of various materials, including metals, plastics, and composites. Along with this, they offer several advantages, such as the ability to create complex geometries, high precision, and the increasing potential for customization is propelling the market growth. Also, it is highly suitable for industries such as aerospace, automotive, healthcare, and manufacturing escalating the demand for intricate and customized components.

Furthermore, direct energy disposition enables efficient material usage and reduced waste, contributing to cost savings and sustainability. Additionally, with the ongoing advancements in technology and materials, direct energy disposition is expected to continue dominating the market in the United States, driving innovation and transforming various industries.

Breakup by Technology:

- Stereolithography

- Selective Laser Sintering

- Electron Beam Melting

- Fused Deposition Modeling

- Laminated Object Manufacturing

- Others

Stereolithography holds the largest share of the market

A detailed breakup and analysis of the market based on the technology has also been provided in the report. This includes stereolithography, selective laser sintering, electron beam melting, fused deposition modeling, laminated object manufacturing, and others. According to the report, stereolithography accounted for the largest market share.

Stereolithography (SLA) technology is currently dominating the market. In addition, SLA is a popular additive manufacturing process that uses ultraviolet (UV) lasers to solidify liquid photopolymer resins layer by layer, creating precise and detailed 3D-printed objects. Its high accuracy, smooth surface finish, and ability to produce intricate designs are influencing the market growth. It is also extensively adopted in various industries, including automotive, aerospace, healthcare, and consumer products. Besides this, SLA is capable of producing high-quality prototypes, functional parts, and custom components with excellent dimensional accuracy. The technology enables the creation of complex geometries and fine details, meeting the demands of industries that require intricate and precise designs. Furthermore, the availability of a wide range of UV-curable resins contributes to the market growth, as SLA technology continues to advance and offer improved performance, it is maintaining its stronghold in the market.

Breakup by Application:

- Prototyping

- Tooling

- Functional Part Manufacturing

Prototyping holds the largest share of the market

A detailed breakup and analysis of the market based on the application has also been provided in the report. This includes prototyping, tooling, and functional part manufacturing. According to the report, prototyping accounted for the largest market share.

Prototyping involves the creation of physical models or prototypes to test and evaluate designs before mass production. In addition, 3D printing's ability to quickly produce complex and customized prototypes is propelling market growth. It is the preferred technology in industries such as automotive, aerospace, consumer goods, and healthcare. Besides this, prototyping has the ability to rapidly iterate designs, reduce development time and costs and improve product quality which is influencing market growth. Furthermore, 3D printing allows for the creation of intricate and precise prototypes, enabling engineers and designers to validate their concepts and make necessary modifications augmenting the market growth.

Breakup by Vertical:

- Consumer Products

- Industrial

- Aerospace and Defense

- Automotive

- Healthcare

- Education and Research

- Others

Industrial accounts for the majority of the market share

A detailed breakup and analysis of the market based on the vertical has also been provided in the report. This includes consumer products, industrial, aerospace and defense, automotive, healthcare, education and research, and others. According to the report, industrial accounted for the largest market share.

Industrial verticals, such as aerospace, automotive, healthcare, and manufacturing, are adopting and using this technology for various applications, influencing the market growth. In addition, several industries such as aerospace and automotive utilize 3D printing for rapid prototyping, tooling, and even production of end-use parts, leading to enhanced efficiency, cost savings, and design flexibility representing another major growth-inducing factor.

Besides this, it is revolutionizing medical device manufacturing, patient-specific implants, and anatomical models for surgical planning in the healthcare sector which is accelerating the market growth. Apart from this, the increasing use of 3D printing for customized production, reducing lead times, and enabling complex geometries in the manufacturing industry are propelling the market growth.

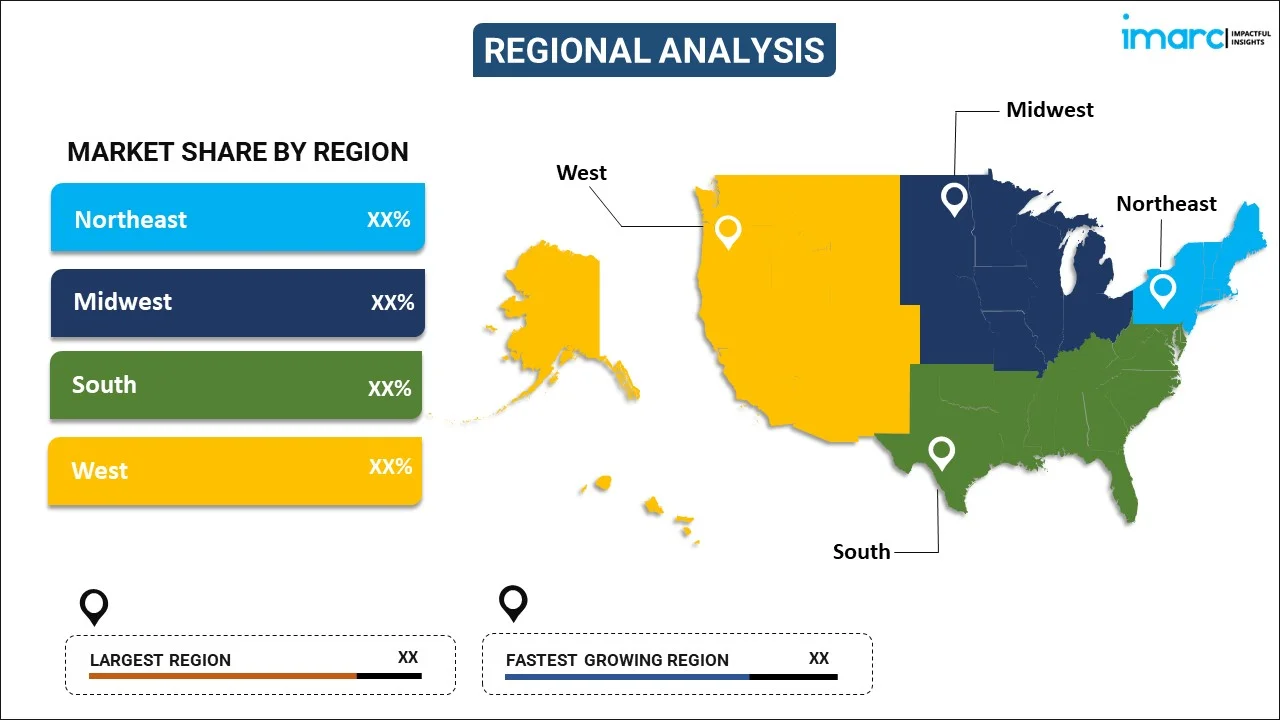

Breakup by Region:

- Northeast

- Midwest

- South

- West

Northeast exhibits a clear dominance in the market

The report has also provided a comprehensive analysis of all the major regional markets, which includes Northeast, Midwest, South, and West. According to the report, Northeast was the largest market for 3D printing in the United States.

The Northeast region of the United States is home to major metropolitan areas such as New York City and Boston, which have a significant concentration of research institutions, universities, and innovative industries. These factors contribute to the development and adoption of printing technologies in sectors such as healthcare, aerospace, and manufacturing.

The Midwest region, often referred to as the manufacturing hub of the United States, has a strong industrial base with states including Michigan, Ohio, and Illinois with manufacturing expertise, making them potential hotspots for the product application in areas such as automotive, aerospace, and consumer goods manufacturing.

The Southern region has seen notable growth in the manufacturing and technology sectors with states such as Texas, Florida, and Georgia adopting 3D printing in various industries, including healthcare, aerospace, and defense propelling the market growth.

The West region, particularly California, is known for its technological innovation and entrepreneurial ecosystem. Silicon Valley, in the San Francisco Bay Area, is a hub for technology companies and startups, including those involved in 3D printing which is essential in the research, development, and commercialization of these technologies across diverse industries.

Competitive Landscape:

Key players in the market are implementing various strategies to strengthen their position and stay competitive. They are strengthening their position and expanding their product portfolios, by engaging in mergers and acquisitions (M&A) activities, and by acquiring innovative startups or companies specializing in specific technologies or applications. Besides this, leading players are investing heavily in research and development (R&D) activities to drive innovation and develop advanced technologies. They focus on enhancing printer capabilities, improving material options, and expanding the range of applications. Along with this, key players are focusing on expanding their geographical presence and establishing sales and distribution networks in emerging markets and regions with high growth potential.

The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- 3D Systems Inc.

- Autodesk Inc.

- Envisiontec Inc.

- Formlabs Inc.

- General Electric Company

- HP Inc.

- Materialise USA LLC

- Optomec Inc.

- Organovo Holdings Inc.

- Sciaky Inc. (Phillips Service Industries Inc.)

- Stratasys Inc. (Stratasys Ltd.)

- The Exone Company and Ultimaker North America

Latest News and Developments:

- In April 2025, Raise3D revealed its RMS220 SLS and DF2+ DLP 3D printers at RAPID+TCT in Detroit. These new systems provide scalable, high-performance functional prototyping and low-volume production solutions with a focus on end-to-end productivity, open material compatibility, and seamless integration with digital inventory services for industrial applications.

- In March 2025, Bambu Lab officially launched the H2D 3D printer with a 350×320×325 mm build area, twin nozzles, laser cutting and engraving, and high-end AMS filament management. H2D is intended for DIY makers and professional users alike and revolutionizes multifunctional desktop 3D printing with cloud and offline operation.

- In May 2025, Chicago Additive unveiled its U.S.-produced AMOS 3D printer, which was developed in partnership with NIWC Pacific and supported by NAVWAR. Developed for defense and field-deployed uses, the rugged FDM system is designed for rapid prototyping, as part of the U.S. military's objective of reinforcing domestic manufacturing and deployable additive capability.

United States 3D Printing Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Components Covered |

|

| Processes Covered | Binder Jetting, Directed Energy Deposition, Material Extrusion, Material Jetting, Powder Bed Fusion, Sheet Lamination, Others. |

| Technologies Covered | Stereolithography, Selective Laser Sintering, Electron Beam Melting, Fused Deposition Modeling, Laminated Object Manufacturing, Others |

| Applications Covered | Prototyping, Tooling, Functional Part Manufacturing |

| Verticals Covered | Consumer Products, Industrial, Aerospace and Defense, Automotive, Healthcare, Education and Research, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Companies Covered | 3D Systems Inc., Autodesk Inc., Envisiontec Inc., Formlabs Inc., General Electric Company, HP Inc., Materialise USA LLC, Optomec Inc., Organovo Holdings Inc., Sciaky Inc. (Phillips Service Industries Inc.), Stratasys Inc. (Stratasys Ltd.), The Exone Company, Ultimaker North America etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States 3D printing market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the United States 3D printing market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States 3D printing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

We expect the United States 3D printing market to exhibit a CAGR of 21.70% during 2025-2033.

The rising adoption of 3D printing for producing prototypes, model creations, physical components, etc., with increased productivity, incurred minimal wastage, and reduced operational costs is primarily driving the United States 3D printing market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across the nation, resulting in the temporary halt in numerous production activities for 3D printing.

Based on the component, the United States 3D printing market can be segmented into printer, material, software, and services. Currently, printer holds the majority of the total market share.

Based on the process, the United States 3D printing market has been divided into binder jetting, directed energy deposition, material extrusion, material jetting, powder bed fusion, sheet lamination, and others. Among these, directed energy deposition currently exhibits a clear dominance in the market.

Based on the technology, the United States 3D printing market can be categorized into stereolithography, selective laser sintering, electron beam melting, fused deposition modeling, laminated object manufacturing, and others. Currently, stereolithography accounts for the majority of the total market share.

Based on the application, the United States 3D printing market has been segregated into prototyping, tooling, and functional part manufacturing, where prototyping currently holds the largest market share.

Based on the vertical, the United States 3D printing market can be bifurcated into consumer products, industrial, aerospace and defense, automotive, healthcare, education and research, and others. Currently, the industrial sector exhibits a clear dominance in the market.

On a regional level, the market has been classified into Northeast, Midwest, South, and West, where Northeast currently dominates the United States 3D printing market.

Some of the major players in the United States 3D printing market include 3D Systems Inc., Autodesk Inc., Envisiontec Inc., Formlabs Inc., General Electric Company, HP Inc., Materialise USA LLC, Optomec Inc., Organovo Holdings Inc., Sciaky Inc. (Phillips Service Industries Inc.), Stratasys Inc. (Stratasys Ltd.), The Exone Company, and Ultimaker North America.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)