United States 3D Printing Materials Market Size, Share, Trends and Forecast by Type, Form, End User, and Region, 2025-2033

United States 3D Printing Materials Market Overview:

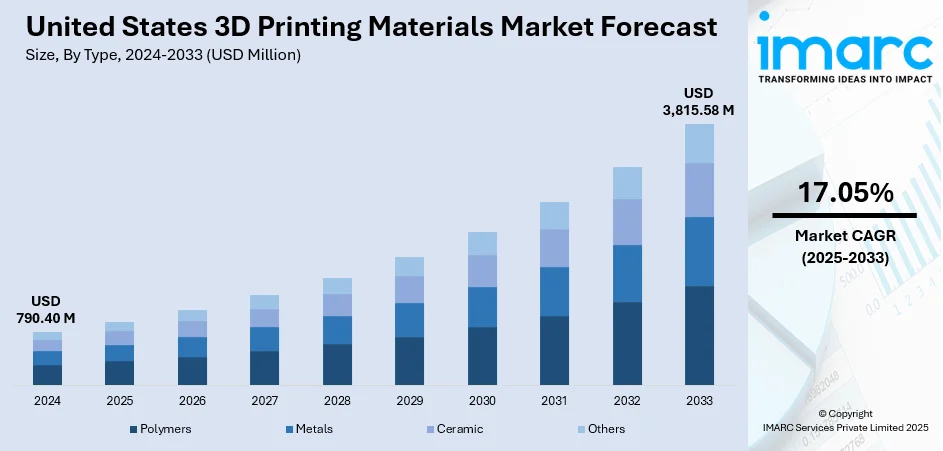

The United States 3D printing materials market size was valued at USD 790.40 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 3,815.58 Million by 2033, exhibiting a CAGR of 17.05% from 2025-2033. At present, the growing emphasis on sustainability is encouraging the use of green, recyclable, and bio-based materials. Government initiatives and environmental regulations are also promoting eco-friendly material development. Besides this, rising clinical acceptance and regulatory approvals are contributing to the expansion of the United States 3D printing materials market share

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 790.40 Million |

| Market Forecast in 2033 | USD 3,815.58 Million |

| Market Growth Rate (2025-2033) | 17.05% |

At present, the market is growing steadily due to the rising adoption of 3D printing across various industries, such as aerospace, automotive, healthcare, and consumer goods. In aerospace and automotive, companies are using 3D printing to create lightweight, durable, and complex parts that help improve fuel efficiency and performance. The healthcare sector is experiencing strong demand for customized solutions like prosthetics, dental implants, surgical tools, and anatomical models. As more hospitals and labs are employing 3D printing, the need for high-quality materials is increasing. The continuous development of advanced materials, including composites, bio-compatible plastics, and metals, is making 3D printing more versatile and appealing.

To get more information on this market, Request Sample

In line with this, the market is benefiting from the growing focus on sustainability, encouraging the utilization of recyclable and eco-friendly materials. Educational institutions and research centers are also investing in 3D printing for hands-on learning and innovation, further catalyzing material demand. Additionally, as more companies are integrating 3D printing into their production lines, there is greater requirement for consistent, high-performance materials that meet industry standards. The rise of local production and customization trends is also supporting the 3D printing materials market growth, especially in consumer products and electronics. Increasing artificial intelligence (AI) adoption is enabling smarter material development, automating design processes, improving print accuracy, and reducing trial-and-error. As per the IMARC Group, the United States AI market is set to attain USD 1,09,514.9 Million by 2033, exhibiting a growth rate (CAGR) of 12.16% during 2025-2033.

United States 3D Printing Materials Market Trends:

Increasing clinical acceptance

Rising clinical acceptance is positively influencing the market in the United States. Hospitals, clinics, and medical device manufacturers are using 3D printing to create customized implants, surgical guides, and prosthetics that enhance patient care. Rising confidence among healthcare professionals stems from improved material safety, precision, and performance. Regulatory support from agencies like the Food and Drug Administration (FDA) ensures a safe pathway for new materials and applications, accelerating their utilization. As per industry reports, in 2024, the US FDA cleared more than 100 3D printed medical devices, showing the enhanced trust and proven reliability of these technologies in clinical settings. This approval is encouraging further investments in research and development (R&D) activities of medical-grade materials. As healthcare providers continue to witness the benefits of patient-specific treatments and faster production times, the demand for high-quality, bio-compatible 3D printing materials is rising.

Rising emphasis on sustainability

The growing emphasis on sustainability is among the major United States 3D printing materials market trends. Industries are focusing on minimizing waste, lowering carbon emissions, and adopting cleaner production methods. This eco-friendly change is corresponding with local efforts for sustainable methods. An analysis of Kimya’s recycled PETG 3D filament revealed a notable decrease in carbon footprint. The research showed a 35% reduction in CO2 emissions when opting for the recycled filament, as of June 2025. 3D printing supports this shift by using only the exact amount of material needed, minimizing leftovers compared to traditional manufacturing. Manufacturers develop biodegradable polymers and recyclable materials that meet both performance and environmental standards. This transition to sustainability also aligns with user preferences and corporate goals for greener practices. Companies are utilizing closed-loop systems where unused material can be re-employed, further cutting waste. Government initiatives and environmental regulations are also promoting sustainable material development. As businesses are aiming to meet environmental targets while maintaining efficiency and innovation, the demand for sustainable 3D printing materials continues to rise.

Growing demand for precise, material-specific printing solutions

Strong demand for precise, material-specific printing solutions is offering a favorable United States 3D printing materials market growth. In the healthcare sector, there is a growing need for materials that replicate real tissue, bone, and organ structures. According to industrial reports, in 2024, 94% of US surgeons who used 3D-printed anatomical models found them highly valuable for presurgical planning, highlighting the importance of accuracy and material suitability. In aerospace, precise materials enable the production of high-strength parts that improve fuel efficiency and performance. In the automotive industry, customized materials support the creation of complex, durable components utilized in both prototyping and final manufacturing. This rising demand is leading to the continuous development of advanced polymers, composites, and metal powders designed for specific end uses.

United States 3D Printing Materials Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States 3D printing materials market, along with forecast at the country and regional levels from 2025-2033. The market has been categorized based on type, form, and end user.

Analysis by Type:

- Polymers

- Acrylonitrile Butadiene Styrene (ABS)

- Polylactic Acid (PLA)

- Photopolymers

- Nylon

- Others

- Metals

- Steel

- Titanium

- Aluminum

- Others

- Ceramic

- Silica Sand

- Glass

- Gypsum

- Others

- Others

Polymers (acrylonitrile butadiene styrene (ABS), polylactic acid (PLA), photopolymers, nylon, and others) held 38.8% of the market share in 2024. They are highly versatile, cost-effective, and widely used across multiple industries. These materials are easy to process, lightweight, and suitable for both prototyping and end-use parts. Various types of polymers offer different properties like flexibility and strength, making them suitable for utilization in automotive, healthcare, consumer products, and education. Polymers are compatible with a range of 3D printing technologies, especially fused deposition modeling (FDM), which is one of the most economical printing methods. The availability of polymer filaments and resins in different grades and colors also supports customization and design flexibility. Moreover, advancements in biodegradable and bio-based polymers are promoting sustainability, which is catalyzing their demand. As per the United States 3D printing materials market forecast, with the growing interest in low-cost, user-friendly printing solutions, polymers will continue to dominate the industry.

Analysis by Form:

- Powder

- Filament

- Liquid

Powder represented the largest segment share. It is essential for advanced printing technologies like selective laser sintering (SLS) and direct metal laser sintering (DMLS), which are widely employed in aerospace, automotive, and healthcare industries. Powder form allows high precision, complex geometries, and strong mechanical properties, rendering it suitable for manufacturing both prototypes and end-use parts. Metal powders, such as titanium and aluminum, are especially preferred for high-performance applications that demand strength and durability. Polymer powders like nylon are also popular for functional and flexible components. The reusability of unused powder in many processes reduces material waste and enhances cost-efficiency. As industries continue to adopt additive manufacturing for critical and complex parts, the demand for high-quality powder materials is increasing. Powder also allows uniform layer distribution and efficient sintering, resulting in superior surface finish and structural integrity.

Analysis by End User:

- Consumer Products

- Aerospace and Defense

- Automotive

- Healthcare

- Education and Research

- Others

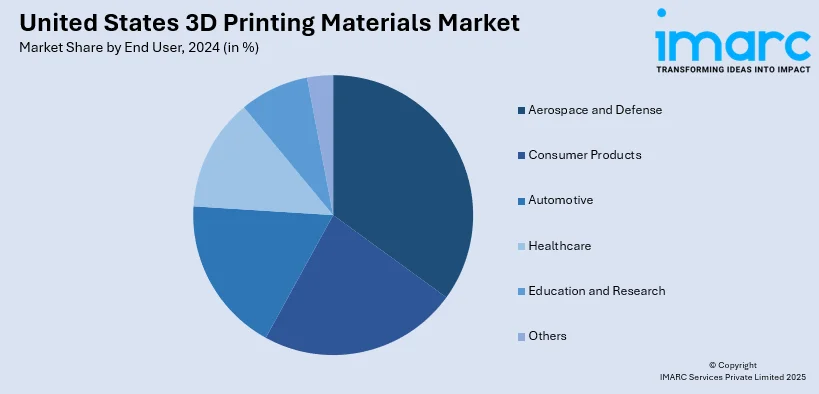

Aerospace and defense hold 28.9% of the market share. These sectors are demanding lightweight, durable, and complex components that traditional manufacturing struggles to produce efficiently. 3D printing allows rapid prototyping, design flexibility, and part consolidation, which helps reduce weight and improve performance in aircraft, spacecraft, and defense systems. These industries are employing high-performance materials like metal powders, composites, and advanced polymers that can withstand extreme conditions and meet strict safety standards. Additive manufacturing also enables on-demand production and customization, reducing lead times and inventory costs. Defense applications benefit from the ability to manufacture spare parts quickly in remote or mission-critical environments. Continuous spending on research and innovations within the aerospace and defense sectors is promoting the adoption of cutting-edge 3D printing technologies. With strong government support and high industry standards, these sectors continue to drive the demand for advanced 3D printing materials.

Regional Analysis:

- Northeast

- Midwest

- South

- West

Northeast is enjoying the leading position in the market. The region is noted for its strong industrial base, advanced research institutions, and high concentration of technology companies. The region is home to several leading universities and research centers that actively develop and test new 3D printing materials, driving innovations and commercialization. Many startups and established tech firms in the Northeast region, including cities like Boston, New York City, and Philadelphia, focus on additive manufacturing, creating a dynamic ecosystem that supports the growth of the market. The presence of major aerospace and defense companies, along with the expansion of hospitals, is also catalyzing the demand for specialized 3D printing materials in the region. In April 2025, Northwell Health transformed Lenox Health Greenwich Village into Northwell Greenwich Village Hospital (NGVH), a facility aimed at addressing the changing health care needs of the West Village area in New York. The updated hospital would provide emergency cardiac treatments and elective surgeries via a cutting-edge cath lab, delivering advanced, life-saving care directly to the community. Such establishments are driving the demand for 3D printing materials as they support disease treatment by enabling the development of prosthetics, drug delivery systems, and anatomical models. Access to skilled professionals and a well-developed supply chain are further strengthening the region’s leadership.

Competitive Landscape:

Key players are wagering on R&D activities to come up with modern, reliable materials. They are introducing a wide range of innovative materials, such as metal powders, composites, and bio-compatible polymers, to meet the requirements of different industries. These companies are also partnering with manufacturers, healthcare providers, and research institutions to expand the utilization of 3D printing technologies. They are setting quality standards, ensuring reliable material supply, and offering technical support to users. By lowering prices and increasing availability, key players help make 3D printing more accessible to small businesses and individuals. Their marketing strategies and educational efforts are also generating awareness and building trust in 3D printing. Overall, their efforts are significantly fueling the employment of 3D printing materials across the country. For instance, in January 2025, RIC Technology unveiled RIC-PRIMUS, a robotic 3D construction printer capable of printing three-story structures. Demonstrated at World of Concrete 2025, it offered expanded material compatibility, real-time quality control, and reduced labor needs. The robot was printed with concrete and mortar, enhancing commercial construction efficiency and structural precision at scale.

The report provides a comprehensive analysis of the competitive landscape in the United States 3D printing materials market with detailed profiles of all major companies.

Latest News and Developments:

- June 2025: UltiMaker launched the S6 3D printer with 4x faster print speeds using the new Cheetah motion planner. Designed for professionals, the S6 supported over 300 materials and offered dual extrusion, flexible build plates, and enhanced productivity. It was built under ISO standards and came with a two-year warranty.

- April 2025: Raise3D introduced the RMS220 SLS system and DF2+ DLP printer at Rapid TCT 2025. The RMS220 supported industrial-scale batch production with PA12, PA11, and TPU materials, while the DF2+ offered faster resin printing and compatibility with over 30 advanced resins. Both systems emphasized cost-efficiency and high material performance.

- April 2025: Haddy opened the world’s largest 3D printing facility in St. Petersburg, FL, powered by AI and robotics. The plant enabled high-speed, scalable, and sustainable production using recyclable materials. Initially focused on furniture, Haddy expanded into defense and infrastructure, redefining local, on-demand manufacturing with significantly higher material throughput.

United States 3D Printing Materials Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Forms Covered | Powder, Filament, Liquid |

| End Users Covered | Consumer Products, Aerospace and Defense, Automotive, Healthcare, Education and Research, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States 3D printing materials market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the United States 3D printing materials market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States 3D printing materials industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The United States 3D printing materials market was valued at USD 790.40 Million in 2024.

The United States 3D printing materials market is projected to exhibit a CAGR of 17.05% during 2025-2033, reaching a value of USD 3,815.58 Million by 2033.

Companies in the technology and aerospace sectors are turning to 3D printing for faster prototyping, cost-efficient production, and the ability to create complex and lightweight designs. In the medical field, rising demand for customized implants, prosthetics, and dental devices is promoting the utilization of specialized 3D printing materials. Technological advancements are expanding the variety of usable materials, including high-performance polymers, composites, and metals.

Polymers account for the largest share in the United States 3D printing materials market, due to their versatility, low cost, ease of use, and compatibility with common printing technologies, rendering them suitable for utilization in prototyping, consumer products, healthcare, and education sectors.

Northeast accounts for the largest share in the United States 3D printing materials market, driven by the strong presence of research institutions, advanced industries, skilled workforce, and supportive government initiatives, which aid in fostering innovations, demand, and production of high-quality 3D printing materials.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)