United States Acetic Acid Market Size, Share, Trends and Forecast by Application, End Use, and Region, 2026-2034

United States Acetic Acid Market Size and Share:

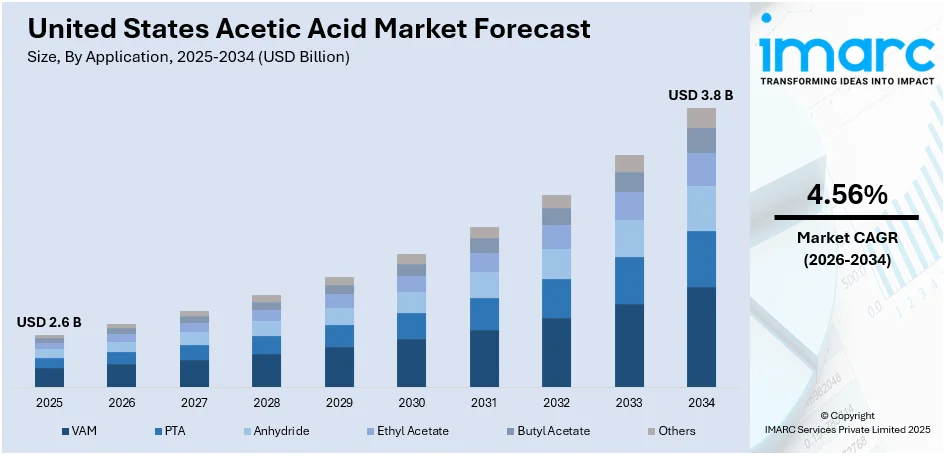

The United States acetic acid market size was valued at USD 2.6 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 3.8 Billion by 2034, exhibiting a CAGR of 4.56% during 2026-2034. South currently dominates the market in 2025. The market is expanding due to rising demand across food, textiles, and chemicals, along with a shift towards sustainable production methods. These factors are contributing to the continued growth of the industry, supporting the overall United States acetic acid market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 2.6 Billion |

| Market Forecast in 2034 | USD 3.8 Billion |

| Market Growth Rate (2026-2034) | 4.56% |

United States Acetic Acid Market Analysis:

- Major Drivers: Increased demand for vinyl acetate monomer (VAM) in the construction and automotive sectors propels market consumption. Increasing food preservation requirements and environmentally friendly packaging demands further propel market growth. Increased pharmaceutical manufacturing and textile production also contribute to sustained growth in various industrial applications.

- Key Market Trends: The market is exhibiting robust growth through widening application in plastics, pharmaceuticals, and renewable chemistry. Bio-based processes are becoming increasingly popular as companies embrace sustainable manufacturing. Strategic collaboration and capacity increases indicate strong future demand in various end-use markets.

- Market Challenges: The environmental regulations place more stringent emission requirements on United States acetic acid manufacturing plants, raising compliance costs. Unstable raw material prices and supply chain vagaries introduce operating uncertainties. Market competition from substitute chemicals and changing consumer tastes are other market challenges that demand strategic adjustment.

- Market Opportunities: Increasing demand for environmentally friendly United States acetic acid production offers huge expansion potential. New applications in renewable energy and advanced materials provide new profit opportunities. Production efficiency and waste minimization technological breakthroughs provide competitive leverage for visionary producers.

The market expansion is, however, dominated by its growing use in several industries including food and beverages, textiles, and chemicals. Acetic acid is a vital ingredient in the preservation of food and as a major ingredient in the manufacture of vinegar, which is a widely used preservative and flavoring agent. Its use in the production of synthetic fibers like polyester has also fueled demand in the textile industry. Increased consumer demand for processed and packaged foods further fuels the acetic acid demand for food processing and preservation. Additionally, use in chemical manufacturing, especially the production of acetate esters for use in coatings, adhesives, and plastics, aids the consistent growth of the market. Increasing focus on sustainability is inspiring businesses to innovate and seek new ways of reducing their environmental footprint.

To get more information on this market Request Sample

Apart from this, more stringent emissions standards are compelling the implementation of energy-efficient production processes in acetic acid production. With environmental issues gaining more recognition, the US market will increasingly look towards environmentally friendly solutions, opening up avenues for the design of cleaner production technologies. This environmental concern-driven trend not only influences market forces but also has an impact on purchasing behavior among consumers, which in turn reflects on market demand.

United States Acetic Acid Market Trends:

Growth in VAM Demand and Applications

The acetic acid market in the United States is witnessing substantial growth, driven by multiple factors that highlight its importance across various sectors. A key driver is the rising demand for vinyl acetate monomer (VAM), particularly in the construction and automotive industries. The global VAM market was valued at USD 8.9 billion in 2023 and is projected to reach USD 13.4 billion by 2032, growing at a CAGR of 4.70%. This trend, along with the expanding textile industry, where acetic acid is essential in producing synthetic fibers like polyester, has further boosted the market. According to estimates, the U.S. textile market is expected to grow from USD 188.3 billion in 2024 to USD 277.4 billion by 2033, with a CAGR of 4.1%. Additionally, the pharmaceutical sector's use of acetic acid as a critical ingredient in drug production adds to its market demand. Acetic acid's versatility in the food and beverage industry, serving as a preservative and flavor enhancer, further supports market growth. Strategic partnerships and acquisitions are also playing a role in this expansion. For instance, INEOS acquired Eastman’s Texas City site to enhance production capabilities. The growing adoption of eco-friendly practices and the rising demand for bio-based acetic acid are expected to continue driving the market in the forecast period.

Expansion of Acetic Acid Applications

The United States acetic acid market growth is largely driven by the expanding range of applications in various industries. One significant contributor is its widespread use in the food and beverage industry, where acetic acid plays a key role in food preservation, vinegar production, and flavor enhancement. For instance, the food sector relies heavily on acetic acid for pickling vegetables and in sauces such as ketchup. In the chemical sector, acetic acid is an essential component for producing acetate esters, used in solvents, coatings, and plastics. As an example, acetic acid is a key raw material in the production of acetic anhydride, used in making pharmaceuticals and dyes. Moreover, the rising demand for sustainable and eco-friendly materials is encouraging manufacturers to explore renewable feedstocks, further expanding the scope of acetic acid applications. The textile industry also contributes to the growth of the acetic acid market, particularly with its use in the production of synthetic fibers such as polyester. Companies like Eastman Chemical have utilized acetic acid in their polyester production processes. As the global demand for textiles and fashion continues to rise, acetic acid remains crucial in manufacturing processes. With ongoing advancements in production technologies, particularly in bio-based production methods, acetic acid’s role in both traditional and emerging applications ensures its increasing presence in the United States market, fueling continued demand and growth.

Shift Towards Green Production Methods

The United States acetic acid market trends are witnessing a strong shift toward environmentally sustainable production practices. Manufacturers are increasingly adopting bio-based methods for producing acetic acid, using renewable resources such as bioethanol rather than conventional petroleum-based feedstocks. A prime example of this trend is the partnership between companies like LyondellBasell and BP, which have focused on producing bio-based acetic acid from renewable sources. This trend is driven by growing environmental concerns and the pressure to meet stricter government regulations on emissions and carbon footprints. As consumers and industries demand more eco-friendly products, companies like Celanese are investing in technologies that reduce the environmental impact of acetic acid production. These green production methods not only help in minimizing waste and energy consumption but also align with the broader industry movement toward sustainable manufacturing. The adoption of energy-efficient processes and waste-reducing innovations, such as carbon capture technologies, is expected to be a key driver in the acetic acid market, making it more competitive and appealing to eco-conscious consumers. With the continued emphasis on environmental responsibility, it is clear that green production will remain a major factor in shaping the future of the United States Acetic Acid market.

United States Acetic Acid Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States acetic acid market, along with forecasts at the regional and country levels from 2026-2034. The market has been categorized based on application and end use.

Analysis by Application:

- VAM

- PTA

- Anhydride

- Ethyl Acetate

- Butyl Acetate

- Others

As per the US acetic acid market outlook, in 2025, the VAM segment led the market, accounted for the 36.6%. This growth is driven by the rising demand for VAM in the production of various applications, such as paints, adhesives, and coatings. VAM is a critical raw material used in producing polyvinyl acetate, a key component for construction and automotive industries, where strong adhesives and coatings are essential. As construction and infrastructure development accelerate, the need for VAM has surged. Additionally, the automotive industry's growing demand for high-performance adhesives further boosts the market. The versatility of VAM in multiple industries ensures sustained growth in this segment, solidifying its position in the acetic acid market.

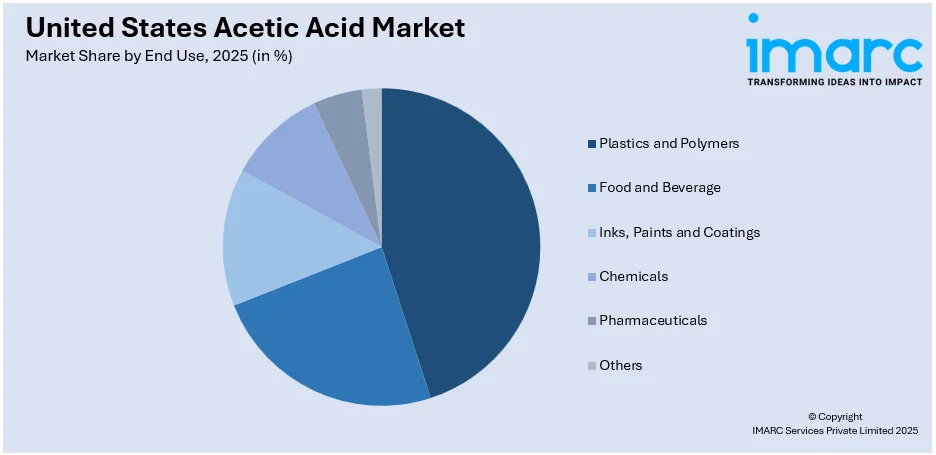

Analysis by End Use:

Access the comprehensive market breakdown Request Sample

- Plastics and Polymers

- Food and Beverage

- Inks, Paints and Coatings

- Chemicals

- Pharmaceuticals

- Others

In 2025 the plastics and polymers led the market, accounted for the for the market share of 42.8%. The demand for acetic acid in plastics production, particularly for producing PET (polyethylene terephthalate) used in packaging, textiles, and containers, has risen significantly. With growing consumer demand for packaged goods and eco-friendly materials, acetic acid’s role in manufacturing durable and recyclable plastics has been crucial. Additionally, acetic acid is used in the production of various polymers such as acetates, which are in high demand for applications like coatings, films, and fibers. The continued expansion of the packaging, automotive, and textile industries directly influences the growth of the plastics and polymers segment, driving acetic acid consumption.

Regional Analysis:

- Northeast

- Midwest

- South

- West

Based on the US acetic acid market forecast, in 2025 the South led the market, accounted for the for the market share of 35.0%. The demand for acetic acid in plastics production, particularly for producing PET (polyethylene terephthalate) used in packaging, textiles, and containers, has risen significantly. With growing consumer demand for packaged goods and eco-friendly materials, acetic acid’s role in manufacturing durable and recyclable plastics has been crucial. Additionally, acetic acid is used in the production of various polymers such as acetates, which are in high demand for applications like coatings, films, and fibers. The continued expansion of the packaging, automotive, and textile industries directly influences the growth of the plastics and polymers segment, driving acetic acid consumption.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

United States Acetic Acid Market News:

- June 2025: Virginia-based New Iridium successfully secured USD 2.65 Million in seed financing. The funding will be used to advance the development of an industrial pilot facility that is capable of processing 50 metric tons annually. This plant will validate the scalability of the technique for producing bio-based acetic acid and ethyl acetate.

- May 2025: Again officially commenced the construction of its new acetic acid manufacturing plant in Texas City with a groundbreaking ceremony. This venture, which is backed by Helm and Diamond Infrastructure Solutions, intends to improve industrial resilience and regional supply networks while providing low-emission chemical solutions.

- March 2024: Texas-based Celanese began a new 1.3 Million Ton Clear Lake acetic acid expansion, which is considered the least expensive and carbon-intensive acetic acid plant globally. This significant achievement expands on the recent ISCC-certified carbon capture and utilization (CCU) project, which captured 180 kt of CO2 industrial emissions while increasing the capacity of the Fairway Methanol joint venture with Mitsui & Co., Ltd. by 130 kt.

- February 2024: Celanese Corporation confirmed that it has been authorized as a vendor for Utilization Procurement Grants (UPGrants) by the Office of Fossil Energy and Carbon Management of the U.S. Department of Energy. Celanese is now the sole manufacturer providing low-carbon acetic acid under the ECO-CC brand, allowing the business to assist municipalities in fulfilling the rising demand for circular and sustainable solutions.

United States Acetic Acid Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | VAM, PTA, Anhydride, Ethyl Acetate, Butyl Acetate, Others |

| End Uses Covered | Plastics and Polymers, Food and Beverage, Inks, Paints and Coatings, Chemicals, Pharmaceuticals, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States acetic acid market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the United States acetic acid market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States acetic acid industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The acetic acid market in US was valued at USD 2.6 Billion in 2025.

The US acetic acid market is projected to exhibit a CAGR of 4.56% during 2026-2034, reaching a value of USD 3.8 Billion by 2034.

The US acetic acid market is driven by rising demand across industries such as construction, automotive, textiles, and pharmaceuticals. Increased use of vinyl acetate monomer (VAM), growing textile production, and the shift towards bio-based acetic acid are key market drivers.

In 2025, the South dominated the US acetic acid market driven by the presence of key manufacturing hubs, particularly in the chemical and automotive sectors. The region’s access to affordable feedstocks and strong production facilities further contributed to its market leadership.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)