United States Aerostat Systems Market Size, Share, Trends and Forecast by Report by Payload, Sub-System, Product Type, Propulsion System, Class, and Region, 2025-2033

United States Aerostat Systems Market Overview:

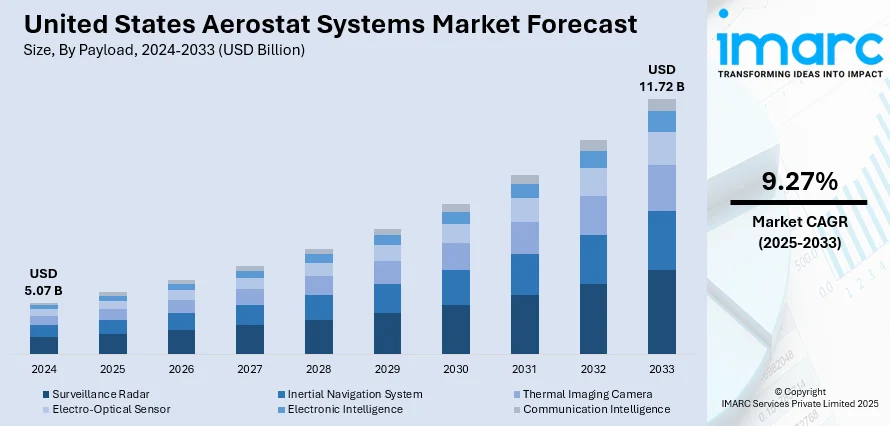

The United States aerostat systems market size was valued at USD 5.07 Billion in 2024. The market is projected to reach USD 11.72 Billion by 2033, exhibiting a CAGR of 9.27% during 2025-2033. Midwest currently dominates the market in 2024. The market is fueled by the increasing demand for persistent surveillance solutions across defense, border security, and critical infrastructure monitoring applications. Besides, advancements in aerostat technology, such as enhanced payload integration, improved endurance, and real-time data transmission, support the market expansion. Apart from that, cost-effectiveness compared to other aerial platforms and growing investments in modernizing surveillance systems further augment the United States aerostat systems market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 5.07 Billion |

| Market Forecast in 2033 | USD 11.72 Billion |

| Market Growth Rate 2025-2033 | 9.27% |

The market is majorly influenced by the heightened national security concerns and the need for persistent surveillance, which has led to greater adoption of aerostats for border monitoring, early threat detection, and intelligence gathering. Moreover, the growing emphasis on cost-effective intelligence, surveillance, and reconnaissance (ISR) platforms has made aerostats an attractive alternative to satellites and drones, particularly in long-duration missions. For instance, in April 2025, the U.S. Army entered a USD 4.2 Billion, 10‑year Multiple Award Task Order Contract (MATOC) to procure Persistent Surveillance Systems–Tethered (PSS‑T) high‑altitude aerostat platforms to enhance its ISR capabilities. Ten companies were selected to compete for task orders under the Army's Program Executive Office for Intelligence, Electronic Warfare & Sensors (PEO IEW&S). These tethered airships, operating at altitudes up to 15,000 ft, will carry advanced sensor payloads to provide persistent, cost‑effective 360‑degree monitoring over wide areas. Apart from this, one of the growing United States aerostat systems market trends is the emergence of AI-enabled data analytics and automation in aerostat ground control systems enhances their reliability and responsiveness, which is further accelerating their integration into national surveillance and communication networks.

To get more information on this market, Request Sample

In addition to this, the integration of advanced sensors, including EO/IR, radar, and communication modules, is expanding the functionality of aerostats in complex mission environments. Also, the expansion of 5G and emergency telecommunication infrastructure is creating new use cases for aerostats in remote communication support. Industry reports project that by 2030, 5G will account for 90% of all network connections in North America, including the United States and Canada, contributing around USD 210 Billion to the region's economy. Furthermore, increased spending on defense modernization and homeland security has driven federal and state-level investments in aerostat deployments. Besides military applications, the growing demand for environmental monitoring, disaster response, and infrastructure inspection is diversifying the market base. The ability of aerostats to operate continuously at high altitudes with minimal fuel consumption makes them highly suitable for long-term observation tasks.

United States Aerostat Systems Market Trends:

Increasing Investments in the Defense Budget and Military Infrastructure

The market is witnessing significant growth due to consistent federal investment in defense modernization and military infrastructure. According to an industry report, the Biden-Harris Administration has submitted a Fiscal Year (FY) 2025 budget request of USD 849.8 Billion for the Department of Defense (DoD), underscoring a strong commitment to national security and technological advancement. In addition to this, Bravura Information Technology Systems, Inc. recently signed a contract worth USD 305.7 Million with the US Army to support the maintenance and sustainment costs of Persistent Surveillance Systems-Tethered Aerostat (PSS-T). Aerostat systems, valued for their cost-effective and persistent surveillance capabilities, are being increasingly deployed for border security, battlefield monitoring, and intelligence-gathering missions. The Department of Defense (DoD) has allocated rising budgets toward upgrading ISR (Intelligence, Surveillance, and Reconnaissance) platforms, in which tethered aerostats play a crucial role. These systems are especially favored for their long-endurance flight capabilities and relatively low operating costs compared to unmanned aerial vehicles or satellites. Furthermore, strategic initiatives to strengthen homeland security and counter emerging aerial threats have propelled demand for advanced surveillance solutions, such as radar-equipped aerostats. This growing emphasis on enhancing situational awareness, coupled with long-term procurement planning, supports the United States aerostat systems market growth.

Improved Telecommunication Network Quality and Remote Monitoring Applications

Enhanced telecommunication infrastructure in the United States is facilitating wider adoption of aerostat systems for commercial and public safety applications. As broadband and 5G networks continue to expand, there is a parallel rise in the need for elevated platforms to support line-of-sight communications in remote and underserved areas. Aerostats, with their high-altitude tethering and extended coverage radius, are being utilized as temporary communication relays during natural disasters, major public events, or infrastructure breakdowns. This trend is especially pronounced in regions prone to wildfires, hurricanes, or floods, where conventional towers may be compromised. Furthermore, leading manufacturers are collaborating with telecommunication service providers to improve the telecommunication network quality, which is positively impacting the United States aerostat systems market outlook. As per industry reports, the U.S. government has adopted a USD 9 Billion 5G Fund budget, with USD 8 Billion allocated for Phase I, including USD 680 Million reserved for Tribal lands, and at least USD 1 Billion for Phase II, to expand next-generation wireless connectivity across the nation. Apart from this, Altaeros launched the world’s first aerial cell tower, SuperTower ST200, to enhance 4G LTE networks in the region. As digital connectivity becomes more mission-critical across sectors, the role of aerostats in bridging communication gaps and enabling remote surveillance is gaining strategic and commercial importance.

United States Aerostat Systems Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States aerostat systems market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on payload, sub-system, product type, propulsion system, and class.

Analysis by Payload:

- Surveillance Radar

- Inertial Navigation System

- Thermal Imaging Camera

- Electro-Optical Sensor

- Electronic Intelligence

- Communication Intelligence

Surveillance radar leads the market in 2024. The segment provides improved situational awareness and persistent watch capabilities over huge geographic expanses. It is especially significant in defense and homeland security missions, where timely detection of threats, border surveillance, and aerial reconnaissance are essential. Installed on tethered aerostats, surveillance radars allow for long-duration, wide-area coverage with relatively low operating expense compared to satellites or manned aircraft. Real-time tracking of ground and airborne targets is made possible by these radars with continuous ISR capability even in remote or hostile areas. The incorporation of next-generation radar technologies—like synthetic aperture radar (SAR) and ground moving target indication (GMTI)—has radically enhanced detection precision, target identification, and weather-durable performance. As the national security priorities change and the need for cost-effective ISR systems increases, the position of surveillance radar as a payload in aerostat systems remains strategically significant in the U.S. market.

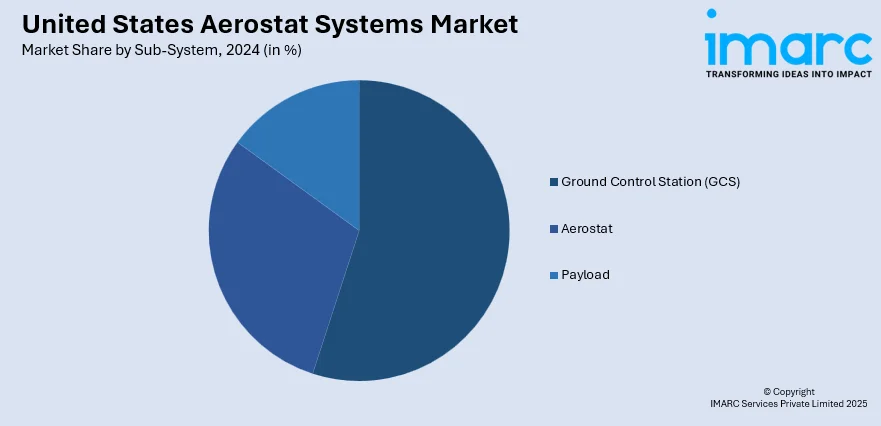

Analysis by Sub-System:

- Aerostat

- Ground Control Station (GCS)

- Payload

Ground control station (GCS) leads the market in 2024. The segment serves as the command center for operations and data management. It provides real-time control, monitoring, and communication with the aerostat platform to ensure smooth coordination between payloads on board and ground operators. The GCS controls flight parameters, tether control, payload operation, and data processing, and thus performs a critical function in mission execution. With sophisticated software and communication interfaces, contemporary GCS units enable high-definition data transmission and integration within command-and-control networks. In defense and homeland security, the dependability and responsiveness of the GCS directly influence surveillance, reconnaissance, and communications missions. With increasing sophistication in aerostat deployments, the need for advanced, modular, and mobile GCS solutions also increases, further establishing its importance in the overall aerostat systems architecture across the U.S. marketplace.

Analysis by Product Type:

- Balloon

- Airship

- Hybrid

Airship leads the market in 2024. The segment offers a combination of endurance, mobility, and payload capacity not typically available in tethered systems. Unlike traditional aerostats, airships are free-flying and steerable, allowing them to cover larger areas and adapt to mission-specific requirements without reliance on fixed ground positions. This mobility makes them particularly suitable for applications such as wide-area surveillance, maritime monitoring, disaster response, and communication support in remote or temporary locations. Airships can carry heavier and more diverse payloads, including advanced radar, communication modules, and electro-optic systems, enabling extended mission durations with high operational flexibility. Their ability to remain airborne for days or even weeks provides a cost-effective alternative to manned aircraft or satellites for certain surveillance tasks. As the demand grows for persistent, adaptable aerial platforms, airships continue to gain relevance in both defense and civilian sectors of the market.

Analysis by Propulsion System:

- Powered Aerostats

- Unpowered Aerostats

Powered aerostats lead the market in 2024. Powered aerostats, equipped with integrated propulsion systems, play a crucial role in expanding the operational scope of aerostat systems. Unlike traditional tethered variants, powered aerostats offer enhanced flexibility and the ability to adjust position or altitude autonomously, which is vital for dynamic surveillance, border patrolling, and wide-area communication missions. Their propulsion systems enable them to remain airborne over longer durations and respond to shifting mission demands without relying solely on ground-based controls. This mobility increases mission flexibility, allowing for repositioning in response to real-time threats or environmental conditions. Powered aerostats are especially valuable in scenarios where fixed-site tethering is impractical, such as in disaster zones, coastal monitoring, or mobile military operations. As the U.S. defense and homeland security sectors seek more responsive and adaptive aerial platforms, powered aerostats are emerging as a critical solution, combining the endurance of lighter-than-air systems with the agility of self-propelled aerial assets.

Analysis by Class:

- Compact-Sized Aerostats

- Mid-Sized Aerostats

- Large-Sized Aerostats

Compact-sized aerostats lead the market in 2024. The segment is known for its operational flexibility, quick deployment ability, and affordability. Such short-class systems are suited to short-range surveillance, tactical communications, and emergency response missions where large-scale infrastructure is either impracticable or unnecessary. Compact-sized aerostat’s small size permits rapid deployment and mobility, making them well-suited for temporary or mobile operations performed by military forces, border patrol agencies, and disaster relief organizations. Compact aerostats, though smaller in size, can support vital payloads like electro-optic sensors, communication relays, and radar systems, offering useful real-time intelligence in focused mission environments. In addition, they have a low logistics profile and relatively lower purchase and maintenance expenses, which makes them available to a larger audience of users, including state and local authorities. As the demand for agile and scalable surveillance grows, small-sized aerostats are becoming more prominent as an effective and versatile solution in the market.

Regional Analysis:

- Northeast

- Midwest

- South

- West

In 2024, Midwest dominates the market. The market in the region is expanding rapidly due to its vast open landscapes, minimal urban obstructions, and strategic demand for wide-area monitoring. This region benefits from aerostat deployments primarily for applications such as border and infrastructure surveillance, agricultural monitoring, and disaster management. The relatively flat terrain and large rural areas enhance the operational efficiency of aerostats, allowing for uninterrupted line-of-sight communications and extended aerial coverage. Additionally, state and local agencies in the Midwest are increasingly utilizing compact and mobile aerostat systems for real-time data collection and public safety efforts. The region also supports defense-related activities, including training exercises and airspace monitoring, which create a steady demand for persistent aerial platforms. As interest grows in cost-effective, rapidly deployable surveillance solutions, the Midwest is becoming a key contributor to the overall expansion and diversification of the aerostat systems market in the United States.

Competitive Landscape:

The competitive landscape of the market is characterized by steady innovations and strategic positioning among a limited number of defense-focused manufacturers. The market is driven primarily by defense and homeland security applications, including border surveillance, persistent threat detection, and communication support in inaccessible areas. Moreover, high entry barriers, due to stringent regulatory approvals, technical complexity, and the need for advanced integration capabilities, limit the influx of new players. Also, companies differentiate themselves through innovation in payload capacity, endurance, and cost-effective operations. Additionally, demand for hybrid and autonomous systems is encouraging investments in research and development. Procurement cycles are influenced by government defense budgets and long-term military modernization programs, contributing to predictable but competitive bidding environments. Besides this, customization and reliability are key decision factors in procurement contracts. According to the United States aerostat systems market forecast, the market is expected to witness moderate growth over the coming years, driven by rising demand for persistent surveillance and technological advancements in tethered aerial platforms.

The report provides a comprehensive analysis of the competitive landscape in the United States aerostat market with detailed profiles of all major companies.

Latest News and Developments:

- March 2025: The U.S. Army awarded a USD 4.19 Billion, 10-year contract to 10 companies for the production and supply of lighter-than-air systems, tethered platforms, and elevated sensors to support intelligence, surveillance, and reconnaissance (ISR) missions.

- May 2025: RTX shipped its first Gallium Nitride-enabled AN/TPY-2 radar to the U.S. Missile Defence Agency. Featuring CX6 computing, the radar improved precision targeting and electronic attack protection, reinforcing national missile defence capabilities with enhanced detection and tracking of ballistic threats in contested electronic environments.

- April 2025: Lockheed Martin delivered the first TPY-4 radar to the U.S. Air Force after early phase testing under the 3DELRR program. The radar, designed with full digital architecture, offered long-range detection, resilience in jamming, and high mobility, supporting advanced threat response and expeditionary air surveillance missions.

United States Aerostat Systems Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Payloads Covered | Surveillance Radar, Inertial Navigation System, Thermal Imaging Camera, Electro-Optical Sensor, Electronic Intelligence, Communication Intelligence. |

| Sub-Systems Covered | Aerostat, Ground Control Station (GCS), Payload |

| Product Types Covered | Balloon, Airship, Hybrid |

| Propulsion Systems Covered | Powered Aerostats, Unpowered Aerostats |

| Classes Covered | Compact-Sized Aerostats, Mid-Sized Aerostats, Large-Sized Aerostats |

| Regions Covered | Germany, France, United Kingdom, Italy, Spain, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States aerostat systems market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the United States aerostat systems market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the aerostat systems industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The aerostat systems in United States as valued at USD 5.07 Billion in 2024.

The United States aerostat systems market is projected to exhibit a CAGR of 9.27% during 2025-2033, reaching a value of USD 11.72 Billion by 2033.

The market is driven by increasing demand for surveillance, security, and reconnaissance applications, particularly in defense and border monitoring. Advancements in aerostat technology, the need for cost-effective alternatives to satellites, and the growing use of aerostats in communication and environmental monitoring also contribute to market growth.

Airship dominates the product type segment in the market in 2024 due to due to its versatility, cost-effectiveness, and capability to carry heavy payloads over extended periods. It offers significant advantages in surveillance, communication, and data collection, making it the preferred choice for military, security, and environmental monitoring applications.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)