United States Agricultural Irrigation Machinery Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033

United States Agricultural Irrigation Machinery Market Size and Share:

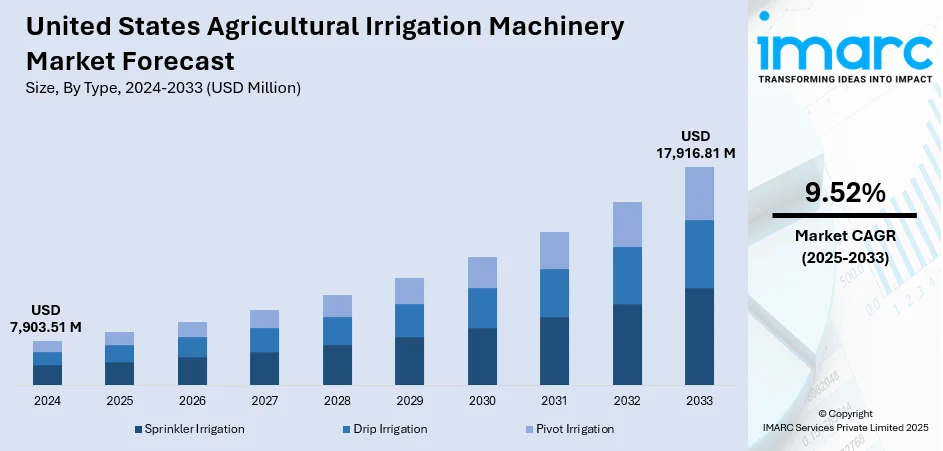

The United States agricultural irrigation machinery market size was valued at USD 7,903.51 Million in 2024. Looking forward, the market is projected to reach USD 17,916.81 Million by 2033, exhibiting a CAGR of 9.52% from 2025-2033. The market is growing steadily driven by rising demand for efficient water management solutions, increasing adoption of mechanized farming, and the need to improve crop yields amid climate variability. Technological advancements, such as smart irrigation systems and automated sprinklers, are further supporting adoption. Expanding investments in sustainable agriculture are also contributing positively to the overall United States agricultural irrigation machinery market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 7,903.51 Million |

|

Market Forecast in 2033

|

USD 17,916.81 Million |

| Market Growth Rate 2025-2033 | 9.52% |

The agricultural irrigation machinery market in the United States is mainly fueled by the increasing demand for water efficiency in farming and the goal of enhancing crop yields. The growing concerns about water scarcity are prompting farmers to implement modern irrigation techniques, including drip, pivot, and sprinkler systems. For instance, in November 2024, Cisgenics launched its innovative irrigation system, CisgenX, at the Irrigation Show in Long Beach, California. Utilizing IoT sensors and machine learning, CisgenX optimizes water management, reducing usage by 40-70%. This groundbreaking solution addresses the growing water crisis and supports sustainability across various industries. Moreover, the advancement toward precision agriculture backed by digital monitoring tools and automated equipment is helping to optimize resource use. These elements are driving adoption in both large-scale farms and smaller agricultural operations.

To get more information on this market, Request Sample

Government programs that promote sustainable farming, along with subsidies and financial support for modern irrigation technologies, are contributing to market expansion. Farmers are increasingly investing in advanced systems to lessen their reliance on labor and ensure consistent water distribution across different crops. Variability in climate and unpredictable rainfall patterns are accelerating the United States agricultural irrigation machinery market demand. For instance, in May 2025, Google and Arable expanded their partnership to enhance irrigation efficiency on 20,000 acres in North and South Carolina. The initiative aims to save over 500 million gallons of water annually while providing farmers with training and tools to improve profitability and reduce environmental impact, supporting Google’s water replenishment goals. The rising use of smart technologies, along with increased private investment in agricultural mechanization, continues to fuel innovation and support the market's long-term development.

United States Agricultural Irrigation Machinery Market Trends:

Increasing Demand for Efficient Water Management

The United States agricultural irrigation machinery market is driven by the growing need for efficient water management solutions. As per National Geographic, around 165 million Americans use groundwater for drinking, farmers use it for irrigation and 37% of our total water usage is for agriculture and industrial manufacturing. With water scarcity becoming a critical issue in several states, particularly in the western and southwestern regions, farmers are increasingly adopting advanced irrigation technologies to optimize water usage. These systems, including drip irrigation and center pivot irrigation, help reduce water wastage and improve crop yield by ensuring precise water delivery to the plants. The emphasis on sustainable agricultural practices and the necessity to conserve water resources are pushing the demand for modern irrigation machinery. Additionally, government initiatives and subsidies aimed at promoting water-efficient practices in agriculture are encouraging farmers to invest in these technologies, further propelling the United States agricultural irrigation machinery market growth.

Rising Awareness Regarding Climate Change

The other crucial driver in the market is growing awareness about climate change and its agricultural consequences. Unpredictable weather conditions, oscillating between extended droughts and erratic rainfall, have raised the urge for reliable irrigation systems that would function actively against unstable climatic shifts. Resilient irrigation systems are increasingly being viewed as a central investment whereby farmers can ensure the survival of crops under climate-induced stress. Besides, the emphasis currently on sustainable agriculture and conservation of the environment encourages the adoption of irrigation technologies that are water efficient. According to Mckinsey and Company, in a survey conducted on 500 US farmers, 90% of farmers are aware about the recommended sustainable agricultural practices, overall implementation remains low. While more than 68% of farmers polled use reduced- or no-till strategies, just approximately half use variable-rate fertilizer application, and 35% use controlled-irrigation approaches. With the agricultural industry increasingly prioritizing climate change mitigation and water resource protection, the need for advanced irrigation equipment that can improve water efficiency and boost crop adaptability is anticipated to rise, further stimulating market growth.

United States Agricultural Irrigation Machinery Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States agricultural irrigation machinery market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on type and application.

Analysis by Type:

- Sprinkler Irrigation

- Pumping Unit

- Tubing

- Couplers

- Spray/Sprinklers Heads

- Fittings and Accessories

- Drip Irrigation

- Valves

- Backflow Preventers

- Pressure Regulators

- Filters

- Emitters

- Tubing

- Others

- Pivot Irrigation

Sprinkler irrigation systems are widely adopted in the United States due to their versatility and ability to cover large areas efficiently. Key components include pumping units, tubing, couplers, sprinkler heads, fittings, and accessories, all working together to ensure even water distribution across fields. These systems are particularly beneficial for crops sensitive to uneven watering. Their adaptability to various soil types and farm sizes makes them a popular choice, driving consistent demand and strengthening the United States agricultural irrigation machinery market outlook.

Drip irrigation is gaining traction in the US as farmers prioritize water conservation and targeted irrigation. The system consists of valves, backflow preventers, pressure regulators, filters, emitters, tubing, and other accessories designed to deliver precise water amounts directly to crop roots. This reduces water wastage while improving nutrient absorption, making it highly effective for fruits, vegetables, and high-value crops. The growing emphasis on sustainable farming practices and efficient resource utilization is fueling adoption of drip irrigation technologies across diverse agricultural regions.

Pivot irrigation systems are increasingly popular in large-scale farms across the United States for their efficiency in irrigating extensive fields. These mechanized systems rotate around a central point, ensuring uniform water coverage with minimal labor. They are particularly effective for cereal crops, grains, and forage, where large land areas require consistent watering. Pivot systems also integrate well with smart technologies, allowing for automated adjustments. Their scalability, reliability, and ability to optimize water distribution make them a vital segment in modern US agricultural irrigation machinery.

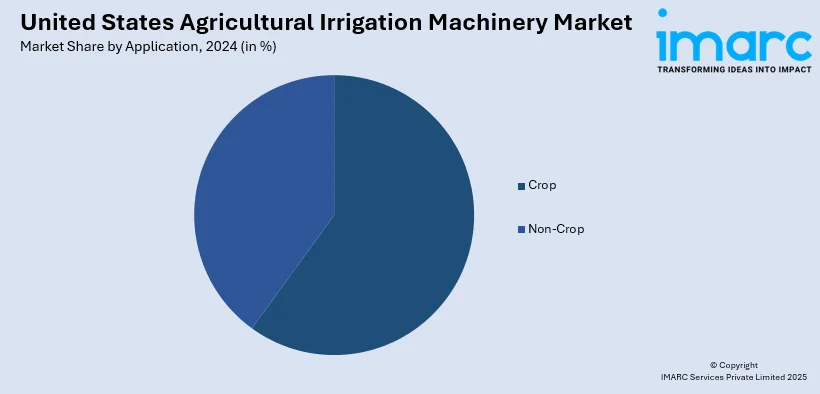

Analysis by Application:

- Crop

- Field Crops

- Vegetables

- Fruits

- Non-Crop

The crop segment includes field crops, vegetables, and fruits, each requiring tailored irrigation solutions. Field crops such as corn, wheat, and soybeans rely heavily on large-scale systems like pivot and sprinkler irrigation for wide coverage and efficiency. Vegetables demand precision irrigation, where drip systems play a key role in reducing wastage and improving nutrient absorption. Fruits, including orchards and vineyards, require controlled watering to ensure consistent yields and quality. Together, these segments form the backbone of irrigation machinery demand in agriculture.

The non-crop segment covers applications outside traditional farming, such as landscaping, turf management, nurseries, and greenhouse operations. Irrigation systems in this category are used for parks, residential lawns, golf courses, and urban greenery projects. Sprinkler systems are common due to their broad coverage, while drip systems are preferred for controlled environments like greenhouses. Growing urbanization and the need for sustainable water management highlight a key United States agricultural irrigation machinery market trend, where non-agricultural uses are steadily expanding alongside traditional farming.

Regional Analysis:

- Northeast

- Midwest

- South

- West

The Northeast region of the United States has limited agricultural land compared to other areas but demonstrates strong demand for specialized irrigation systems. Farmers in this region often focus on high-value crops such as fruits, vegetables, and greenhouse produce, which require precision irrigation. Drip and sprinkler systems are commonly used to optimize water usage in smaller plots. With growing urban agriculture and greenhouse operations, the Northeast continues to be a niche yet significant contributor to the agricultural irrigation machinery market.

The Midwest, often referred to as America’s agricultural heartland, dominates irrigation machinery demand due to its vast cultivation of corn, soybeans, and wheat. Large-scale pivot and sprinkler systems are widely used to cover expansive fields efficiently. Farmers increasingly adopt advanced machinery to mitigate risks from unpredictable rainfall and droughts. The region’s reliance on mechanized irrigation to sustain high crop yields makes it one of the largest contributors to overall market growth, ensuring a consistent and strong presence in irrigation adoption.

The South has diverse agricultural practices, ranging from cotton and rice to fruits and vegetables, creating demand for multiple irrigation solutions. Drip irrigation is gaining popularity for water-intensive crops, while sprinkler systems are common in large fields. The region’s hot climate and frequent dry spells increase reliance on efficient irrigation machinery. Additionally, government support for modernizing farming practices is encouraging the adoption of advanced systems. The South’s agricultural diversity and climatic challenges make it a key driver of irrigation equipment demand.

The West region faces significant challenges from water scarcity, making efficient irrigation solutions critical for sustaining agriculture. High-value crops such as grapes, nuts, and vegetables dominate farming in states like California, requiring advanced drip and micro-irrigation systems. Farmers are also adopting smart and automated irrigation machinery to optimize limited water resources. Regulatory pressures and sustainability initiatives further drive innovation in this region. As a result, the West stands out as a leader in advanced irrigation technologies and water-efficient farming practices.

Competitive Landscape:

The competitive landscape of the United States agricultural irrigation machinery market is characterized by strong innovation, technological advancements, and increasing focus on sustainability. Companies are investing in precision irrigation systems, automation, and smart monitoring solutions to address challenges of water scarcity and rising demand for crop productivity. Manufacturers emphasize offering customizable and cost-efficient solutions to cater to diverse farming scales, from large field crops to specialty fruits and vegetables. Competition is also shaped by government sustainability policies and farmers’ growing preference for efficient, long-lasting machinery. Strategic collaborations, product diversification, and R&D investments remain critical in gaining market presence. This trend is expected to intensify, according to United States agricultural irrigation machinery market forecast, as farmers adopt advanced irrigation technologies.

The report provides a comprehensive analysis of the competitive landscape in the United States agricultural irrigation machinery market with detailed profiles of all major companies.

Latest News and Developments:

- August 2025: Lumo Inc. launched Pump Automation, an advanced integration with its smart valve platform. The solution, designed to enhance safety, reliability, and pump-to-plant performance, leverages block-level irrigation data to streamline irrigation management, minimize manual intervention, and ensure consistent water delivery across crops, reinforcing Lumo’s commitment to innovation and efficiency in specialty agriculture.

- September 2025: Reinke Manufacturing announced the U.S. and Canada availability of its E3™ precision series of center pivot systems, marking a significant advancement in irrigation technology. The patented system introduces industry-first innovations such as ReinLock™ truss technology, uniform coupler spacing, and a distinctive blue end sign, all aimed at setting new standards for water application uniformity, efficiency, and performance.

- August 2025: Edina-based lawn technology company Irrigreen introduced the Sprinkler 3, an AI-powered sprinkler head that can be controlled via mobile phone. The company’s decision to manufacture locally has already yielded benefits, enabling faster product development and supporting a successful funding round.

United States Agricultural Irrigation Machinery Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Applications Covered |

|

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States agricultural irrigation machinery market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the United States agricultural irrigation machinery market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States agricultural irrigation machinery industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The agricultural irrigation machinery market in the United States was valued at USD 7,903.51 Million in 2024.

The United States agricultural irrigation machinery market is projected to exhibit a CAGR of 9.52% during 2025-2033, reaching a value of USD 17,916.81 Million by 2033.

Key factors driving the United States agricultural irrigation machinery market include increasing demand for efficient water management in agriculture, adoption of advanced irrigation technologies, increased emphasis on environmentally friendly farming methods and governmental programs encouraging precision agriculture. Climate variability and the need to enhance crop yield efficiency are also fueling the market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)