United States Alzheimer’s Drugs Market Size, Share, Trends and Forecast by Drug Class, Distribution Channel, and Region, 2026-2034

United States Alzheimer’s Drugs Market Size and Share:

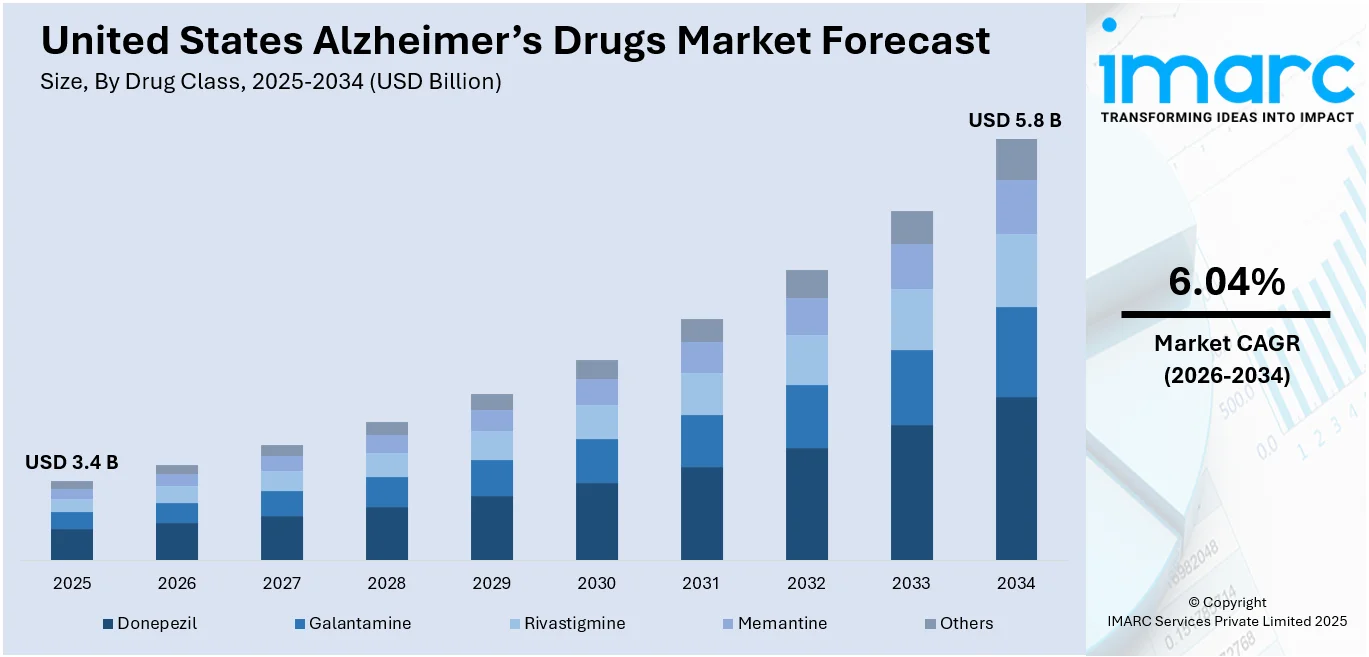

The United States Alzheimer’s drugs market size was valued at USD 3.4 Billion in 2025. Looking forward, the market is expected to reach USD 5.8 Billion by 2034, exhibiting a CAGR of 6.04% during 2026-2034. Northeast currently dominates the market, holding a significant market share of over 32.2% in 2025. The market is experiencing growth due to significant progress in neuroscience and an enhanced comprehension of the fundamental mechanisms of the disease, resulting in the identification of potential therapeutic agents. Increased disease occurrence, along with increased public awareness stimulates early diagnosis and treatment. Steep federal funding by agencies such as the National Institutes of Health (NIH) drives large R&D programs, culminating in breakthrough drug therapies. Advanced healthcare facilities and insurance coverage also enable easy access for patients, further boosting the United States Alzheimer’s drugs market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 3.4 Billion |

| Market Forecast in 2034 | USD 5.8 Billion |

| Market Growth Rate 2026-2034 | 6.04% |

United States Alzheimer’s Drugs Market Analysis:

- Major Drivers: The market is fueled by rising awareness of Alzheimer's, the aging population, and the advance of neuroscience. Breakthroughs in disease-modifying therapies and supportive regulatory conditions promote investment and research. Public health policies and partnerships among pharmaceutical companies and research organizations further speed up the development and availability of new treatments.

- Key Market Trends: A move towards disease-modifying treatments is reshaping treatment strategies. Emerging drug delivery technologies, such as oral and injectable form, improve patient compliance. The union of artificial intelligence and precision medicine is speeding up drug discovery thereby contributing to the United States Alzheimer's drugs market demand. Collaborations, innovative clinical trials, and digital monitoring systems are redesigning more tailored and efficient Alzheimer's treatment.

- Market Opportunities: New market opportunities exist with emerging therapies addressing neurodegeneration, inflammation, and genetic factors. Progress in patient-friendly drug delivery and monitoring equipment enhances care. Enhanced public-private sector collaboration drives innovation, and continued research on early detection and prevention opportunities provides opportunities for next-generation interventions and expansion into wider markets.

- Market Challenges: According to the United States Alzheimer's drugs market analysis, the expensive development costs and long clinical trials prolong progress. Healthcare system limitations and reimbursement policies restrict market access. The complexity of the disease, along with the requirement for sophisticated diagnostics and effective patient management strategies, is an obstruction. Uncertain long-term effectiveness of new treatments and regulatory barriers add to the complexity of adoption.

To get more information on this market Request Sample

United States Alzheimer's pharmaceuticals market is fueled by the fast-growing aging population, with a substantial percentage reaching the age category most susceptible to Alzheimer's disease. This population trend puts more pressure on the need for effective medications and compels healthcare systems to treat neurodegenerative disorders as a high priority. The US also enjoys a strong healthcare infrastructure and well-supported research environment, backed by institutions such as the National Institutes of Health (NIH) and prestigious academic medical institutions like Johns Hopkins and the Mayo Clinic. These institutions drive innovation through basic and translational research that gives rise to the identification of new therapeutic targets. Additionally, the American regulatory landscape—headed by the Food and Drug Administration (FDA)—provides expedited approval avenues for breakthrough medicines, stimulating the drug industry to invest significantly in research for Alzheimer's. Public visibility, stimulated by advocacy groups and an active media culture, also boosts patient recruitment in clinical trials, propelling the tempo of pharmaceutical development in the nation.

Another key driver according to the United States Alzheimer's drugs market forecast, is the country's dominance in biopharmaceutical research and venture capital investment. The US is home to some of the world's top pharmaceutical and biotech firms that are actively involved in producing disease-modifying therapies and cognitive symptom management medications for Alzheimer's. The nation's hotspots of innovation—Boston, San Francisco, and the Research Triangle of North Carolina, for example—have become incubators of startups targeting neurodegenerative diseases, frequently in close association with universities, government research centers, and venture capitalists. This setting allows quick translation of discoveries made in the lab into the clinic. In addition, the active role of the US government in Alzheimer's research funding, especially through public-private collaborations such as the Accelerating Medicines Partnership (AMP), provides continued momentum to drug discovery programs. The insurance environment, such as Medicare coverage of diagnostics and promising therapies, also encourages commercial investment by promoting market access and affordability to patients. This intersection of financial, scientific, and regulatory support positions the US as a potent driving force for Alzheimer's drug development.

United States Alzheimer’s Drugs Market Trends:

Changes in Neuroscience and Knowledge of Disease Mechanisms

Improvements in neuroscience and a deeper comprehension of the disease's fundamental processes are transforming the United States Alzheimer's drugs market outlook. Historically, drug development has been centered on amyloid plaque and tau protein deposition, but scientists today understand Alzheimer's as a multifaceted disease with neuroinflammation, vascular injury, and genetics at play. For example, the University of Miami announced in October 2024 that it will contribute USD 30 million to advance neuroscience and aging research. With the help of this grant, a computational biology program will be established, encouraging departmental cooperation to enhance patient care and promote basic science. American universities and biotechnology companies are leading the way in this research, with innovative work occurring at institutions like the Mayo Clinic and Massachusetts General Hospital. The convergence of biomarkers, precision diagnostics, and neuroimaging tools is enabling earlier and more precise diagnosis, paving the way for targeted treatments. Consequently, the pharmaceutical industry is broadening its focus to encompass therapies for synaptic dysfunction, oxidative stress, and immune system modulation. This multi-faceted strategy, founded on cutting-edge neuroscience, is building a more solid and diversified pipeline of drugs that may lead to more potent disease-modifying therapies in the near term.

Rising Prevalence Fueling Urgency and Investment

The increasing prevalence of Alzheimer's disease is one of the most significant United States Alzheimer's drugs market trends. The number of persons with Alzheimer's and similar dementias is sharply increasing as the population ages, particularly as the baby boomer generation enters old age. 74% of people with Alzheimer's are 75 years of age or older, and 7.2 million Americans 65 and over are estimated to have the disease, according to the Alzheimer's Association. One in nine persons aged 65 and over, or 11% of the population, suffer from Alzheimer's. This growing burden imposes a serious burden on caregivers, health care systems, and long-term care services. In turn, the market is feeling increased pressure from public and private markets to move faster on research and get effective treatments to market. The United States health care system, with its broad insurance networks and federal funding institutions like Medicare and the National Institutes of Health (NIH), sits at the hub of facilitating innovation and access. Furthermore, advocacy organizations like the Alzheimer's Association have helped to raise money and support, which has improved the climate for clinical trials and medication development.

Appearance of New Therapeutics and Larger Implications

The United States is also experiencing the appearance of new treatments that are adding to the larger arena of neurodegenerative disorder therapeutics. Some recent approvals and development in the pipeline include beta-amyloid-targeting monoclonal antibodies, anti-tau therapies, and even gene-based approaches. These advances are impacting Alzheimer's treatment while also providing a model for therapies of other neurodegenerative conditions such as Parkinson's and ALS. Recently, in order to further develop its CSF1R inhibitor, MOD 001, for the treatment of ALS and frontotemporal dementia (FTD), Modulo Bio obtained a USD 4.8 million investment from the Alzheimer's Drug Discovery Foundation (ADDF) in March 2025. Investigational New Drug enabling research are supported by the financing. Notably, these new medicines are being discovered in an environment where these pathways for accelerated approval and value-based pricing are available—uniquely characteristic of the US reimbursement and regulatory landscape. The combination of digital health technologies, such as AI-driven cognitive evaluations and telemedicine monitoring devices, further augments the treatment landscape by allowing for more targeted treatment. With new classes of drugs entering the market and changing clinical practices, the US Alzheimer's drug market is squarely aligned at the intersection of neurology, biotechnology, and precision medicine, fueling long-term change in the treatment of neurodegenerative diseases, along with United States alzheimer’s drugs market growth.

United States Alzheimer’s Drugs Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States Alzheimer’s drugs market, along with forecasts at the regional, and country levels from 2026-2034. The market has been categorized based on drug class and distribution channel.

Analysis by Drug Class:

- Donepezil

- Galantamine

- Rivastigmine

- Memantine

- Others

Donepezil stands as the largest component in 2025, holding around 67.9% of the market. One of the best drugs for Alzheimer's disease in the United States is donepezil, a cholinesterase inhibitor marketed under the name Aricept. By increasing acetylcholine levels in the brain, this class of medications aids patients with mild to moderate Alzheimer's disease. Given how widely used and accepted it is by both patients and healthcare professionals, donepezil has a sizable market share. The medication's established status as a mainstay in Alzheimer's treatment has been cemented by its prolonged availability on the market and effectiveness in managing symptoms. Additionally, Donepezil's continued dominance in the market can be attributed to the accessibility of generic versions.

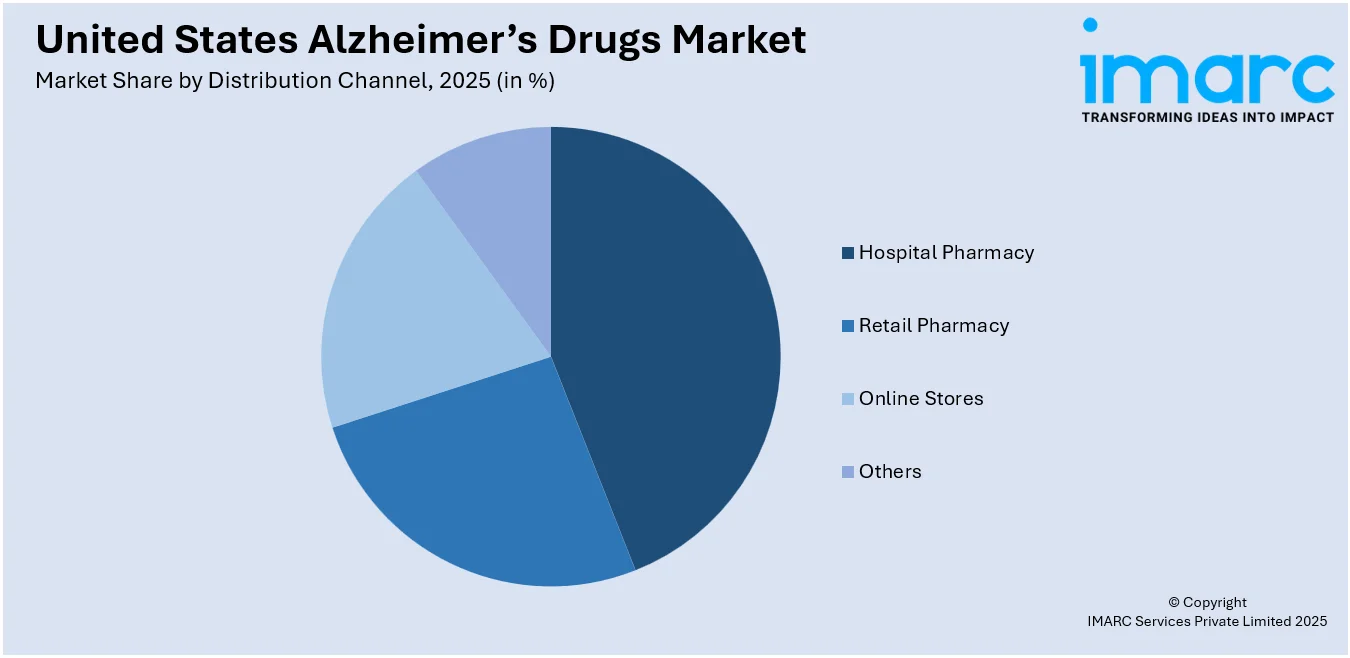

Analysis by Distribution Channel:

Access the comprehensive market breakdown Request Sample

- Hospital Pharmacy

- Retail Pharmacy

- Online Stores

- Others

Hospital pharmacy leads the market with around 45.8% of market share in 2025. Hospital pharmacies are a central point in the United States market for Alzheimer's drugs, being the most important distribution channel for these drugs. Due to the complexity of Alzheimer's disease, patients usually need advanced care involving thorough diagnostics, individualized treatment regimens, and constant monitoring, which is usually available in hospitals. This interdisciplinary strategy guarantees that patients are administered timely and correct drugs like cholinesterase inhibitors and NMDA receptor antagonists under the guidance of healthcare professionals. Additionally, hospital pharmacies are well furnished with the required infrastructure to manage the administration of complex therapies, for example, monoclonal antibodies, which may involve specialized storage and handling protocols. The centralization of hospital pharmacies enables improved coordination between multidisciplinary care teams, enabling improved drug management and patient outcomes.

Regional Analysis:

- Northeast

- Midwest

- South

- West

In 2025, Northeast accounted for the largest market share of over 32.2%. The Northeast of the United States is a top segment within the Alzheimer's drug market, fueled by a number of factors. The region boasts a high percentage of the US population 65 and above, a cohort most vulnerable to Alzheimer's disease. Those states like New York, Massachusetts, and Pennsylvania have well-organized healthcare infrastructures in place, consisting of well-known medical facilities and research organizations, for early diagnosis and treatment. The presence of large pharmaceutical companies and biotech industries in the Northeast region also hastens the invention and delivery of Alzheimer's drugs. Also, the region has strong healthcare policies and insurance coverage, providing wider access to treatment. Public education initiatives and the backing of advocacy groups further play a role in the higher demand for Alzheimer's medication in this area. Together, these combine to make the Northeast a focal point in the US market for Alzheimer's drugs.

Competitive Landscape:

Several major players in the United States Alzheimer's pharmaceutical market are taking a variety of strategic initiatives to spur innovation, increase treatment alternatives, and accommodate the accelerating demand for effective treatments. Large pharmaceutical firms like Biogen, Eli Lilly, and Eisai are at the forefront by making aggressive investments in research and development, particularly in disease-modifying treatments that can alter how Alzheimer's develops instead of just managing the symptoms. These companies are aggressively working with academic institutions and government agencies to speed clinical trials and achieve quicker regulatory approvals through routes such as the FDA's Accelerated Approval Program. Further, many companies are going for precision medicine by applying biomarkers and advanced imaging methods to identify appropriate patients for focus treatments. Strategic alliances and co-development agreements are also prevalent, facilitating the pooling of expertise and the sharing of risk involved in expensive drug development. Apart from therapeutic development, major companies are investing in patient awareness campaigns, healthcare provider education, and patient and caregiver support programs with an aim to enhance diagnosis rates and treatment compliance. Some companies are also increasing access by way of value-based price models and insurance partnerships. Together, these efforts demonstrate an all-encompassing strategy for tackling both the clinical and logistical hurdles of treating Alzheimer's disease in the American marketplace.

The report provides a comprehensive analysis of the competitive landscape in the United States Alzheimer’s drugs market with detailed profiles of all major companies, including:

Latest News and Developments:

- May 2025: Sanofi acquired Vigil Neuroscience for USD 470 Million, securing control of its experimental Alzheimer’s drug, VG-3927. This acquisition, at a 250% premium, aims to accelerate the drug's development. Sanofi also plans to leverage TREM2-targeting strategies to address neurodegenerative diseases.

- May 2025: Algernon Pharmaceuticals announced plans to launch a US imaging center chain for Alzheimer’s disease, focusing on diagnostic and treatment services, including PET scans. The company is acquiring NoBrainer Imaging Centers and aims to open clinics in Florida, Los Angeles, and five other US cities by 2026.

- March 2025: In the last ten years, Alpha Cognition introduced ZUNVEYL, the first oral medication for mild to moderate Alzheimer's disease to receive FDA approval. With monthly infusions, ZUNVEYL, a cholinesterase inhibitor, provides patients and caregivers with an alternate therapy option that enhances cognitive function by focusing on amyloid plaques.

- January 2025: The FDA approved LEQEMBI® (lecanemab-irmb) for once every four weeks maintenance dosing in early Alzheimer's disease. This approval allows easier long-term treatment, helping slow disease progression and prolong therapy benefits. LEQEMBI reduces cognitive decline and is available in multiple countries, including the US, Japan, and the EU.

- October 2024: AbbVie announced its acquisition of Aliada Therapeutics for USD 1.4 Billion. The deal strengthens AbbVie's focus on Alzheimer's treatment, particularly with Aliada's ALIA-1758, an anti-amyloid antibody using innovative blood-brain barrier-crossing technology. The acquisition aims to enhance CNS drug delivery capabilities.

United States Alzheimer’s Drugs Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Drug Classes Covered | Donepezil, Galantamine, Rivastigmine, Memantine, Others |

| Distribution Channels Covered | Hospital Pharmacy, Retail Pharmacy, Online Stores, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States alzheimer’s drugs market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the United States alzheimer’s drugs market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States alzheimer’s drugs industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The United States Alzheimer’s drugs market was valued at USD 3.4 Billion in 2025.

The United States Alzheimer’s drugs market is projected to exhibit a CAGR of 6.04% during 2026-2034, reaching a value of USD 5.8 Billion by 2034.

The United States Alzheimer’s drugs market is driven by an aging population, increasing disease prevalence, and strong federal funding for research. Supportive regulatory frameworks, advanced healthcare infrastructure, and growing awareness campaigns also contribute, encouraging pharmaceutical innovation and accelerating the development and adoption of new therapeutic options across the country.

Northeast currently dominates the United States Alzheimer’s drugs market, driven by its high aging population, advanced healthcare infrastructure, and concentration of top-tier research institutions. Strong public health initiatives, robust insurance coverage, and early adoption of innovative treatments further support market growth and accessibility in this medically progressive region.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)