United States Animal Genetics Market Size, Share, Trends and Forecast by Live Animal, Genetic Materials, Services, End User, and Region, 2025-2033

United States Animal Genetics Market Size and Share:

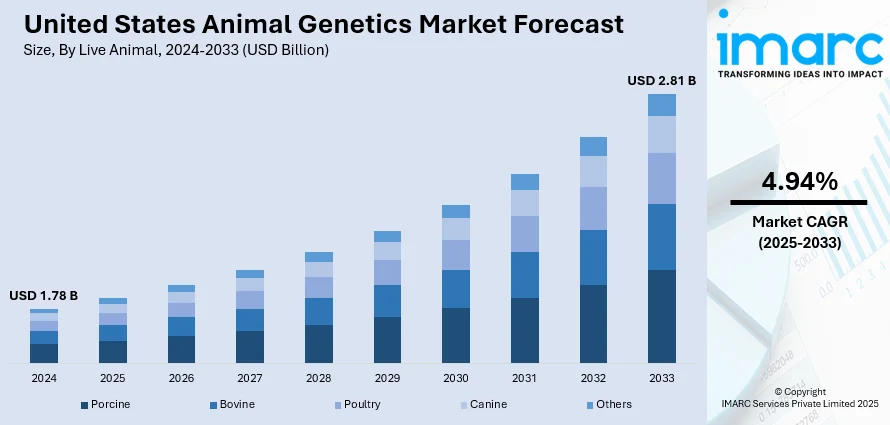

The United States animal genetics market size reached USD 1.78 Billion in 2024. The market is projected to reach USD 2.81 Billion by 2033, exhibiting a growth rate (CAGR) of 4.94% during 2025-2033. The market is driven by advancements in genetic technologies, enabling enhanced disease resistance and productivity in livestock, while meeting rising protein demand. Growing consumer preference for sustainable meat and dairy products incentivizes farmers to adopt high-yield genetics, supported by government funding for biosecurity and agricultural innovation. Additionally, disease risks and export competitiveness are accelerating investments in resilient animal genetics, further augmenting the United States animal genetics market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 1.78 Billion |

|

Market Forecast in 2033

|

USD 2.81 Billion |

| Market Growth Rate 2025-2033 | 4.94% |

The market is driven by advancements in genetic technologies and increasing demand for high-quality livestock. Precision breeding tools, such as CRISPR and genomic selection, enable producers to enhance traits such as disease resistance, feed efficiency, and productivity, meeting the needs of a growing population. Additionally, rising consumer preference for sustainably sourced meat and dairy products pushes farmers to adopt superior genetics for improved yield and reduced environmental impact. Government support through funding for agricultural research and biosecurity measures further accelerates innovation, ensuring the industry remains competitive in a global market as per the United States animal genetics market outlook. During fiscal year 2024, agricultural research and biosecurity programs supported by the U.S. Government saw huge growth, with over USD 3.03 Billion invested in 135 climate-smart commodity projects that span 5 million acres. Furthermore, USD 90 Million went to 53 conservation innovation grants that are intended to develop new ag-tech and sustainable methods. The USDA further advanced national biosecurity by testing more than 52,000 wild birds for avian influenza and growing the Swine Health Improvement Program to cover 67% of U.S. swine inventory. For U.S. animal genetics industry stakeholders, these federally funded programs mean better disease control, increased biosecurity infrastructure, and new genomics-based market opportunities for livestock innovation.

To get more information on this market, Request Sample

In addition, the expanding livestock and poultry industries are also propelling the United States animal genetics market growth, fueled by rising protein consumption and export demand. The U.S. is a major exporter of beef, pork, and poultry, necessitating genetically superior animals to maintain market dominance. The U.S. per capita meat consumption is expected to rise modestly at a pace of 0.3% annually and reach 226.2 pounds in 2025. The increase is driven mainly by the increasing demand for poultry, and red meat consumption remains flat. The value and flexibility of poultry, coupled with advances in genetics and efficiencies of production, continue to counteract the effects of food pattern changes and economic pressures, including supply chain disruptions due to the COVID-19 pandemic and inflationary trends anticipated in 2024. For the animal genetics industry in the United States, the trend signals a sustained focus on innovation in broiler breeding to meet shifting consumer desires and improve the resilience of protein supply. Disease outbreaks, such as avian flu and swine fever, have accelerated the need for resilient genetics, prompting investments in biotech solutions. Furthermore, the pet industry’s growth has influenced demand for specialized breeding in companion animals, including dogs and horses. These factors, combined with increasing private-sector investments in animal genetics startups, create a robust growth trajectory for the market.

United States Animal Genetics Market Trends:

Growing Consumer Demand for High-Quality Animal Products

The escalating demand for meat, dairy, and eggs in the United States continues to drive innovation in animal genetics. In 2022, Americans consumed a staggering 120.26 kilograms of meat per capita. This includes 53.03 kg of poultry, 37.65 kg of beef, and 29.58 kg of pork per person. Such high consumption levels put pressure on producers to ensure consistent quality, efficiency, and sustainability. Consumers are also becoming more health-conscious, seeking animal products that are not only abundant but safer and nutritionally superior. To meet these expectations, genetic selection has become a strategic tool for breeding animals that offer improved feed efficiency, leaner meat, and enhanced milk yield. The result is a more productive livestock sector that aligns with changing dietary trends. This shift in consumer behavior is significantly accelerating demand for genetically enhanced livestock, particularly those tailored for superior performance under varied farming conditions, thus contributing to the United States animal genetics market trends.

Technological Advancements in Genetic Research and Disease Resistance

Precision breeding and genomic technologies are transforming the U.S. animal genetics market. Notably, in April 2025, a global research team led by Professor Huaijun Zhou at the University of California, Davis, produced the first comprehensive map of chicken gene regulation. This milestone opens new avenues for developing disease-resilient poultry, including resistance to avian influenza. Genetic advancements now enable the selection of traits that enhance immunity, reduce susceptibility to infection, and lower reliance on antibiotics. This is crucial as both regulatory scrutiny and public awareness around antibiotic use intensify. Moreover, the genetic engineering of livestock to resist illnesses enhances animal welfare and lowers production losses. These innovations make it possible to rear animals that maintain high performance without compromising health, further driving the market forward. As technology continues to improve the predictability and speed of genetic gains, it is solidifying genetics as a cornerstone of modern livestock management.

Environmental Sustainability and Global Standards Pressuring Genetic Improvements

Sustainability concerns are heavily shaping the future of animal agriculture in the U.S., with environmental footprints becoming a critical focus area. According to the United States Environmental Protection Agency (EPA), animal agriculture was responsible for emitting 274.296 million metric tons of CO₂ equivalents in 2022, which constituted 43.3% of total greenhouse gas emissions from the agricultural sector. As a result, there’s a growing demand for livestock that produce less methane, require lower feed intake, and have a minimized ecological impact. Genetic advancements are key to meeting these goals, making it possible to selectively breed animals for improved environmental efficiency. Simultaneously, the globalization of meat and dairy trade imposes strict quality and safety standards. U.S. producers are turning to genetic solutions to ensure compliance with these benchmarks, ensuring their livestock remains competitive in global markets. As per United States animal genetics market forecast, this convergence of ecological accountability and international trade imperatives is compelling rapid genetic innovation in animal agriculture.

United States Animal Genetics Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States animal genetics market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on live animal, genetic materials, services, and end user.

Analysis by Live Animal:

- Porcine

- Bovine

- Poultry

- Canine

- Others

Poultry stands as the largest component in 2024, holding around 39.5% of the market, driven by its high production efficiency and widespread consumption as a cost-effective protein source. The sector gains advantages from swift breeding cycles, which facilitate quicker genetic enhancements in characteristics like growth rate, feed conversion efficiency, and disease resistance, essential for satisfying both domestic and international demand. Broiler chickens, in particular, account for a significant share, with advanced genetic selection enabling producers to achieve market-ready weights in just six weeks. Additionally, the increasing prevalence of avian influenza has heightened focus on biosecurity and resilient genetics, spurring innovation in vaccine development and gene-editing technologies. The poultry sector also leads in vertical integration, with major genetics companies supplying tailored breeds to large-scale producers, ensuring consistency in meat quality and production efficiency. As consumer preferences shift toward leaner, antibiotic-free poultry, genetic selection for healthier, more sustainable flocks will further solidify the segment’s market dominance.

Analysis by Genetic Materials:

- Embryo

- Semen

Semen leads the market with around 60.6% of market share in 2024, primarily due to its cost-effectiveness, scalability, and widespread adoption in artificial insemination (AI) programs across livestock industries. Bovine semen, in particular, holds a significant share, driven by dairy and beef producers seeking elite genetics to enhance milk yield, growth rates, and disease resistance. The efficiency of frozen semen storage and global distribution enables breeders to access superior genetics without the logistical challenges of live animal transport. Advances in sex-sorted and genomic-tested semen have further accelerated demand, allowing producers to optimize herd productivity and genetic progress. Additionally, the swine and poultry sectors increasingly rely on AI to accelerate genetic improvement and biosecurity. With growing emphasis on precision breeding and genetic traceability, semen’s role in driving herd efficiency and profitability ensures its continued market leadership.

Analysis by Services:

- Genetic Trait Testing

- Genetic Diseases Testing

- DNA Typing

Genetic trait testing leads the market with around 45.8% of market share in 2024, fueled by the livestock industry’s demand for data-driven breeding decisions. Advanced genomic testing enables producers to identify superior traits, such as disease resistance, feed efficiency, and reproductive performance, with unprecedented accuracy, reducing generational gaps in genetic improvement. Dairy and beef sectors are primary adopters, leveraging DNA-based evaluations to enhance herd productivity and profitability, while swine and poultry producers increasingly rely on marker-assisted selection to accelerate breeding programs. The declining cost of sequencing and the rise of precision livestock farming have further democratized access to these technologies. Additionally, consumer preferences for traceability and sustainable production practices are pushing producers to adopt genetic testing as a tool for transparency and quality assurance. As the industry prioritizes efficiency and resilience, genetic trait testing will remain indispensable for optimizing animal health and performance.

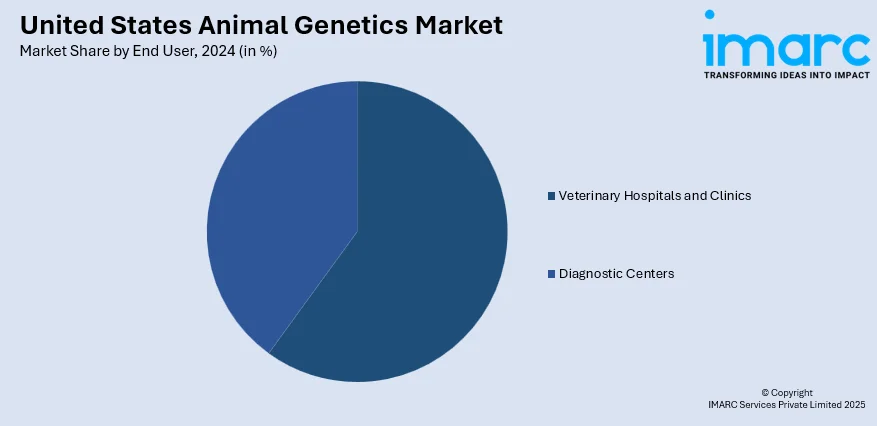

Analysis by End User:

- Veterinary Hospitals and Clinics

- Diagnostic Centers

Veterinary hospitals and clinics lead the market with around 56.5% of market share in 2024, serving as critical hubs for genetic testing, reproductive services, and precision medicine. These facilities leverage advanced diagnostics, such as carrier screening for hereditary conditions and pre-breeding genomic evaluations, to guide breeding decisions for companion animals and livestock. The companion animal sector, particularly dogs and horses, drives significant demand, with veterinarians utilizing DNA tests to assess breed-specific risks, optimize health outcomes, and support responsible breeding practices. In livestock, veterinary clinics collaborate with producers to implement embryo transfer and artificial insemination programs, ensuring genetic merit and herd health. Regulatory emphasis on disease control and biosecurity further amplifies their role, as clinics integrate genetic tools for pathogen surveillance and resistance breeding. With pet ownership rising and livestock producers prioritizing genetic gains, veterinary providers remain indispensable in bridging cutting-edge genetics with practical animal management.

Regional Analysis:

- Northeast

- Midwest

- South

- West

The Northeast U.S. animal genetics market is characterized by a strong focus on dairy cattle genomics, driven by the region’s dense concentration of small to mid-sized dairy farms. Demand for high-genetic-merit semen and embryo transfer services is robust, as producers prioritize milk yield and component traits to remain competitive in a tightening margin environment. The region also sees growing adoption of genetic testing for niche livestock, such as heritage breed poultry and goats, catering to local artisanal food markets. Urbanization limits large-scale livestock operations, but companion animal genetics—particularly for dogs and cats—thrives in affluent metropolitan areas, including Boston and New York, where pet owners invest in health screening and breed-specific diagnostics. Strict environmental regulations further incentivize genetics that enhance sustainability, such as low-methane-emitting dairy cattle.

As the epicenter of U.S. livestock production, the Midwest represents a major share of the animal genetics market, with beef cattle, swine, and poultry genetics accounting for the majority of demand. The region’s expansive feedlots and vertically integrated pork operations rely heavily on AI and genomic selection to optimize feed efficiency and lean meat yield. Iowa and Illinois lead in swine genetics, leveraging CRISPR-based innovations for disease resilience amid PRRS outbreaks. Dairy remains critical in Wisconsin and Minnesota, where sexed semen adoption exceeds 50% of inseminations. The Midwest’s robust agricultural infrastructure—including university research hubs and private breeding cooperatives—accelerates commercialization of novel traits. However, labor shortages are pushing automation in genetic data collection, with sensor-based phenotyping gaining traction in large-scale operations.

The Southern U.S. animal genetics market is shaped by its warm climate and diverse livestock mix, with poultry genetics commanding the largest share due to the region’s dominance in broiler production. Georgia and Arkansas lead in adopting rapid-growth, high-yield broiler strains to meet export demand, while heat-tolerant beef cattle breeds (e.g., Brahman-influenced lines) are prioritized for grazing systems. The region’s equine industry, particularly in Kentucky and Florida, drives demand for elite sport horse cloning and gait genetics. Challenges such as feral hog incursions in Texas spur investments in gene-edited disease-resistant swine. Meanwhile, aquaculture genetics—especially for catfish and tilapia is emerging as a growth niche, with selective breeding programs targeting feed conversion in Mississippi and Alabama. Labor-intensive sectors face pressure to adopt genetics that reduce manual handling, such as docility traits in cattle.

The Western U.S. animal genetics market is defined by its focus on extensive ranching systems and specialty segments. Beef cattle dominate, with ranchers in Montana and Wyoming selecting for drought-adapted genetics to mitigate climate volatility, while California’s dairy industry pioneers methane-reduction traits to align with state emissions mandates. The region leads in niche markets such as alpaca fiber genetics and grass-fed beef genomics, catering to premium consumer preferences. Aquaculture genetics thrives in the Pacific Northwest, where salmon breeding programs emphasize disease resistance for net-pen operations. Urban centers such as Los Angeles and Seattle fuel demand for companion animal services, including genetic wellness panels for designer dog breeds. Water scarcity pressures are driving innovation in low-input genetics, particularly for sheep and goats in arid regions, though regulatory hurdles for gene-edited livestock persist.

Competitive Landscape:

The competitive landscape of the U.S. animal genetics market is marked by strategic investments in precision breeding technologies and vertical integration to strengthen product portfolios. Leading players are expanding their genomic databases through partnerships with research institutions, enhancing trait prediction accuracy for livestock and companion animals. Several companies are commercializing gene-edited lines with disease resistance and improved productivity, particularly in swine and poultry, to address industry challenges such as avian influenza. Others are acquiring smaller breeding firms to diversify genetic offerings, while some focus on direct-to-producer digital platforms that integrate genetic testing with herd management software. In the companion animal segment, competitors are differentiating through breed-specific health panels and cloning services. Consolidation remains a key trend, as larger entities aim to control supply chains from semen production to genetic diagnostics, ensuring end-to-end solutions for commercial producers and veterinarians.

The report provides a comprehensive analysis of the competitive landscape in the United States animal genetics market with detailed profiles of all major companies.

Latest News and Developments:

- May 2025: The U.S. Food and Drug Administration (FDA) approved a gene-editing technique that produces pigs resistant to the extremely contagious and cost-prohibitive porcine reproductive and respiratory disease (PRRS). This approval is one of the very first regarding permits for gene-edited animals in the United States and was granted after years of intensive research and cooperation between the FDA and Pig Improvement Company (PIC), a division of the animal genetics business Genus.

- January 2025: Texas-based Colossal Biosciences revealed that it has successfully secured USD 200 Million in a Series C funding round by TWG Global. With the help of this most recent round of funding, Colossal will continue to develop its animal genetic engineering capabilities and develop cutting-edge hardware, software, and wetware solutions that will find uses beyond de-extinction, such as the preservation of species.

- December 2024: Under the direction of Professor Noelle Cockett, an animal geneticist at Utah State University, a new research partnership network of animal scientists received an over USD 3.25 Million grant from the U.S. Department of Agriculture (USDA). The project aims to encourage more cooperation among animal genetics experts, educate student researchers, and create a way to link livestock producers and advisors with information and researchers.

- September 2024: ABS, a bovine genetics pioneer based in Texas, announced that it acquired full control of De Novo Genetics LLC, the ABS dairy genetics core. By gaining complete control of its dairy genetics engine, this large strategic investment will open the door for further innovation, market validation, and genetic advancement, marking an important milestone in the company's future.

- April 2024: Phibro Animal Health announced plans for the acquisition of the medicated feed additive (MFA) product portfolio of Zoetis with a transaction value of USD 350 Million. The contract serves as a capital allocation plan that will enable the business to concentrate its investments on sustainability, productivity, and animal health solutions. Among these solutions are genetic, biologic, and vaccine programs for livestock.

United States Animal Genetics Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Live Animals Covered | Porcine, Bovine, Poultry, Canine, Others |

| Genetic Materials Covered | Embryo, Semen |

| Services Covered | Genetic Trait Testing, Genetic Diseases Testing, DNA Typing |

| End Users Covered | Veterinary Hospitals and Clinics, Diagnostic Centers |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States animal genetics market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the United States animal genetics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States animal genetics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The United States animal genetics market was valued at USD 1.78 Billion in 2024.

Technological advancements such as CRISPR and genomic selection, rising consumer demand for sustainable, high-quality animal products, and government funding in agricultural biosecurity and innovation are propelling the market. Additionally, increasing protein consumption and meat exports and enhanced biosecurity and disease resistance strategies are also favoring the market.

The United States animal genetics market is projected to grow at a CAGR of 4.94% during 2025-2033, reaching a value of USD 2.81 Billion by 2033.

Poultry accounted for the largest share of the United States animal genetics market by live animal segment in 2024, holding approximately 39.5% of the market. This dominance is due to rapid breeding cycles, high consumption, and strong export demand.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)