United States Automotive Software Market Size, Share, Trends and Forecast by Product, Vehicle Type, Application, and Region, 2025-2033

United States Automotive Software Market Size and Share:

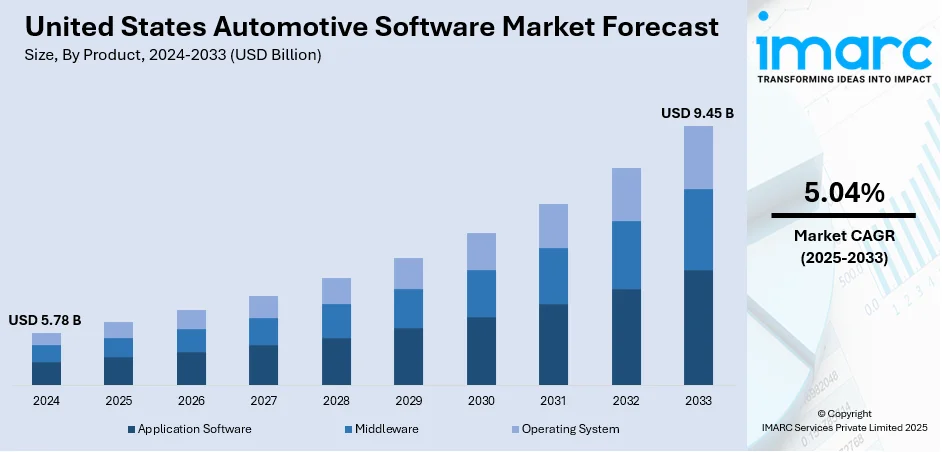

The United States automotive software market size was valued at USD 5.78 Billion in 2024. Looking forward, the market is expected to reach USD 9.45 Billion by 2033, exhibiting a CAGR of 5.04% during 2025-2033.The market is spurred by increasing demand for connected cars, innovation in autonomous driving technologies, and rising consumer expectations for in-car digital experiences. The proliferation of electric and hybrid cars also drives software development, particularly in battery monitoring and energy optimization. Government policies encouraging vehicle safety and emission control and partnerships among car manufacturers and technology companies are driving innovation in real-time data analytics, artificial intelligence, and security, which together fuel the growing United States automotive software market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 5.78 Billion |

| Market Forecast in 2033 | USD 9.45 Billion |

| Market Growth Rate (2025-2033) | 5.04% |

The rapid use of advanced driver assistance systems (ADAS) and autonomous vehicle technologies in the US is one of the key factors propelling the country's automotive software market. Software platforms that enable features like adaptive cruise control, lane-keeping assistance, automatic parking, and even full self-driving capability are being heavily invested in both Silicon Valley tech companies and Detroit-based automakers. That trend is fueled by the country's strong innovation ecosystem, in which auto companies are in close collaboration with Silicon Valley software developers as well as AI start-ups. The regulatory climate in states such as California, Arizona, and Michigan also support autonomous vehicle testing in real-world situations, generating a feedback loop that drives software development more quickly. These demands sophisticated, real-time processing of complex data and the integration of machine learning, requiring progressively more advanced and responsive software platforms. The US consumer market, which has robust appetite for high-tech, safety-oriented vehicles, also fuels this momentum, turning autonomous and semi-autonomous driving into a key growth driver for the United States automotive software market outlook.

To get more information on this market, Request Sample

The increased demand for connected vehicle technologies and rich in-car digital experiences is another strong driver in the US automotive software market. American drivers have increasingly lofty expectations for their cars to provide smooth smartphone integration, real-time navigation, entertainment, voice commands, and over-the-air updates. That has resulted in massive adoption of infotainment systems based on platforms such as Android Automotive and Apple CarPlay, which depend on regularly updated software. In addition, the advent of electric cars, led by US innovators such as Tesla, has compelled traditional auto manufacturers to improve their software game to keep pace. These digital experiences are user-facing, and fleet operators, logistics, and ride-share services rely on telematics and predictive maintenance software to deliver top-level performance. As 5G connectivity is spreading to urban and suburban areas, the potential for automakers to provide real-time services, diagnostics, and feature upgrades through over-the-air updates is increasing at a fast rate, making software a significant value differentiator in the American automotive market.

United States Automotive Software Market Trends:

Multifunctional Role of Automotive Software in Enhancing Safety and Interfaces

Automotive software in the United States has become a key, multifunctional part of vehicle construction and operation. Initially restricted to simple functions, it is now central to everything from user interface design to sophisticated safety systems. Contemporary cars depend on software to drive interactive dashboards, real-time navigation, voice commands, and driver warnings. These digital features make driving more enjoyable and safer on the road. According to NHTSA's 2022 report, there were roughly 5.93 million traffic crashes that were recorded to the police, with an estimated 2.38 million people injured and 42,514 fatalities. Notably, sophisticated software makes collision alert possible, lane departure alerts, blind spots detection, and automatic emergency braking. American automakers are investing heavily in these technologies as consumers and regulators both target accident and fatality reduction. In addition, American technology firms are inherently rooted in automotive software development, making innovation quick-paced. With automotive software still being the driving force behind convenience features and safety features, its importance is becoming invaluable to American manufacturers and consumers alike, which further contributes to the United States automotive software market growth.

Demand Increase with Shift to Connected and Intelligent Autos

The American automotive market is experiencing a fundamental change, characterized by an increased focus on connectivity and intelligence in cars. As consumers want their vehicles to act increasingly like smartphones, complete with wireless connectivity, real-time feeds, and customized experiences, automakers are competing to embed more advanced software platforms. An industry report revealed that 91% of cars sold in the United States in 2020 were connected vehicles. By 2027, it's projected that 175 million drivers in the US will be using these smart cars. From intelligent voice assistants to AI-driven driving insights, software is transforming the way cars drive and talk to users. In urban cities such as San Francisco, Austin, and Detroit, availability of automotive innovation clusters enables quick development and deployment of features like this. Automakers are also fashioning long-term plans around connected ecosystems, such as collaborations with cloud service providers and data analytics companies. This transformation from hardware-focused cars to software-based platforms is establishing a competitive marketplace in which the latest digital capabilities become value differentiators. As this shift persists, the need for customized, secure, and updatable software solutions along with the United States automotive software market demand will increase exponentially.

Leveraging Smart Mobility in an Era of Digitized Transportation

The US is moving into a smart mobility and digitization age, in which the car industry is closely linked with wider trends in intelligent transport infrastructure. An industry survey found that 92.2% of organizations have engaged in digitization projects in the past five years. Urban centers in the US are testing smart traffic systems, electric vehicle charging infrastructure, and mobility-as-a-service (MaaS) platforms that all depend on real-time information and consolidated software. Automotive software is the enabling foundation for this change, allowing vehicle-to-everything (V2X) communication, remote diagnostics, and ride optimization. In this context, software is not merely an option on the car, it is a portal to a wider mobility experience. The need for scalable, high-performing software solutions that can manage everything from route planning to energy management is also being highlighted by the shift to electric and driverless vehicles. In the United States, where adoption is strong and innovation ecosystems are mature, car makers are taking these strengths to lead new mobility services. With the development of smart cities and digital infrastructure, software will continue to be at the core of United States automotive software market trends and transportation future.

United States Automotive Software Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States automotive software market, along with forecasts at the country, and regional levels from 2025-2033. The market has been categorized based on product, vehicle type, and application.

Analysis by Product:

- Application Software

- Middleware

- Operating System

Application software in the US automotive industry consists of navigation, infotainment, driver assistance functions, and telematics. It speaks directly to users, improving safety, comfort, and convenience. As cars become more connected, manufacturers increasingly depend on personalized applications to provide real-time services, entertainment, and communications tools. Demand for smarter in-car experiences keeps driving investment and innovation in application software development.

Middleware is a middleman that bridges an automobile's operating system and application software in facilitating effortless data transfer and system integration. In the United States, where automobiles are becoming more complex and software-based, middleware is necessary to handle communication between sensors, control units, and cloud platforms. It also facilitates over-the-air updates and real-time analytics and is thus key to connected, autonomous, and electric vehicle functionality across the auto industry.

Operating systems provide the base for every automotive software function, handling hardware and executing applications with efficiency. In the US auto market, Android Automotive and QNX platforms reign because of their versatility and capabilities in supporting real-time functionality. These operating systems drive infotainment, safety features, and vehicle control with ease and high reliability. With vehicles being increasingly software-defined, efficient and secure operating systems are more important than ever.

Analysis by Vehicle Type:

- ICE Passenger Vehicle

- ICE Light Commercial Vehicle

- ICE Heavy Commercial Vehicle

- Battery Electric Vehicle

- Hybrid Electric Vehicle

- Plug-in Hybrid Electric Vehicle

- Autonomous Vehicles

ICE passenger cars employ motor vehicle software for infotainment, diagnosis, and driver aids. In America, they are more and more incorporating intelligent systems to compete in the age of electrification. Software enables safety improvements, fuel efficiency tracking, and enhanced user experience, rendering it an essential element even on standard combustion-engine cars.

Internal combustion engine-powered light commercial vehicles are dependent on software in terms of fleet management, route planning, and telematics. In the USA, these vehicles are deployed in logistics, retail, and service sectors. Software enhances operational productivity, lowers maintenance expenses, and enables real-time data transfer, allowing companies to manage small- to mid-sized delivery and utility fleets.

In the United States, heavy-duty commercial ICE trucks rely on software for load monitoring, emissions management, and fleet connectivity. The systems allow the logistics operators to meet regulations, optimize fuel management, and ensure vehicle uptime. Software also plays an important role in diagnostics and predictive maintenance for long-haul and freight use cases.

Battery electric vehicles (BEVs) in the United States are extremely software-dependent, with features handling battery performance, charging, and energy efficiency. Software enables over-the-air updates, autonomous capabilities, and user interface. US automakers employ sophisticated platforms to provide smooth digital experiences, powertrain optimization, and safety and connectivity for electric vehicles.

Hybrid electric vehicles combine combustion engines with electric motors, requiring software to coordinate energy usage, regenerative braking, and system transitions. In the US, software in hybrids plays a key role in boosting fuel efficiency and performance. It also enhances driving experience by managing complex dual powertrains and monitoring environmental impact.

Plug-in hybrid electric vehicles (PHEVs) employ software to adjust between electric and fuel modes, manage charging, and maximize energy use. PHEVs are widely used in the US by environmentally friendly drivers who require flexibility. Sophisticated software allows for instant power source switching, remote capabilities, and compatibility with public and domestic charging infrastructures.

Self-driving cars in the US are at the center of automotive software development. These cars employ advanced software for real-time decision-making, sensor fusion, and AI-driven navigation. Software controls perception, mapping, and safety features to provide autonomous capabilities. As testing in the US grows, autonomous software development continues to be a top priority for automakers and technology companies.

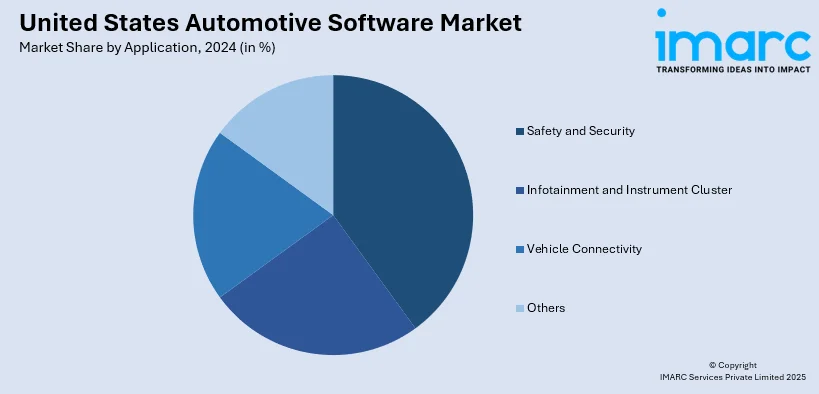

Analysis by Application:

- Safety and Security

- Infotainment and Instrument Cluster

- Vehicle Connectivity

- Others

Safety and security solutions are a top priority in the US automotive software industry. These features range from advanced driver assistance, collision avoidance, and emergency braking to cybersecurity technologies. Software provides enhanced real-time monitoring and protection of the vehicle, minimizing the risk of accidents and theft. According to the United States automotive software market analysis, with increasing regulations and consumer demand for secure vehicles, manufacturers keep investing in smart software-based safety technologies in every vehicle segment.

Infotainment and instrument cluster features are at the forefront of improving the in-car experience for US buyers. Software drives touchscreen screens, navigation, multimedia, and smartphone integration via Apple CarPlay and Android Auto platforms. Digital instrument clusters provide real-time information about driving, customizable layouts, and voice command controls. Such features are becoming more ubiquitous across vehicle segments, consistent with the rising role of connectivity, entertainment, and convenience in US automotive design.

Connected vehicle software provides end-to-end communication between the vehicle, driver, cloud services, and outside infrastructure. Within the US, this segment facilitates telematics, over-the-air update, remote diagnostic, and real-time traffic information. Connectivity improves fleet management, predictive maintenance, and user personalization. As smart mobility and 5G grow, software-based connectivity solutions are becoming a key to enhancing vehicle performance, safety, and overall digital driving experience for the American public.

Regional Analysis:

- Northeast

- Midwest

- South

- West

The Northeast US region, which comprises states such as New York and Massachusetts, prioritizes automotive software solutions for urban mobility, safety, and emissions compliance. With congested cities and robust regulatory environments, a greater need arises for connected vehicle technology, electric mobility software, and intelligent traffic integration. Regional tech centers also fuel innovation around autonomous driving and public-private collaborations to enhance urban transportation systems and vehicle software systems.

The Midwest is where the US automotive manufacturing belt is located, and it takes a leading role in spurring software integration in legacy vehicles and next-generation vehicles. Michigan and Ohio state the most R&D on embedded automotive systems, particularly on safety, diagnostics, and autonomous technologies. Strong OEM and supplier bases exist in the region, which emphasizes bridging innovation with practical vehicle use in both commercial and passenger car markets.

The South US is an emerging automotive center, with Texas, Georgia, and Tennessee enticing automakers and software engineers. The South is anchored by a blend of manufacturing plants and tech investment, facilitating development of telematics, infotainment, and fleet management software. In addition to its robust logistics networks and growing EV infrastructure, the South is becoming increasingly important in software-centric vehicle innovation and intelligent mobility solutions.

The Western United States, particularly California, is a hotbed for auto software development with its high number of tech giants and startups. The region is pushing innovation in autonomous vehicle software, electric mobility platforms, and digital in-car experiences. Robust regulatory backing and live testing environments in the West make it perfect for testing out cutting-edge automotive technologies, and hence it stands as a trendsetter in the drive towards software-defined vehicles in the US market.

Competitive Landscape:

Major players according to the United States automotive software market forecast are making substantial efforts to spur innovation, increase vehicle intelligence, and consolidate their market presence. Top automakers such as General Motors, Ford, and Tesla are investing heavily in native software development and forming strategic collaborations with technology firms to accelerate their move towards software-defined vehicles. Tesla, for instance, continually enhances its over-the-air (OTA) update functionality, pushing live improvements to vehicle performance, safety capabilities, and infotainment systems. Ford and GM are working on standalone operating systems and platforms to enable autonomous driving and connected vehicle services. Technology companies like Google (via Android Automotive) and Apple (with CarPlay) are tightly embedded in vehicle ecosystems, providing seamless digital experience that customers now demand. Startups and software companies are also adding value by providing sophisticated driver-assistance systems (ADAS), cybersecurity, and AI-based diagnostics. Meanwhile, cooperation between car manufacturers and cloud providers such as Amazon Web Services and Microsoft Azure enables scalable data analysis, remote monitoring, and predictive maintenance. These combined actions represent a larger industry trend toward mobility innovation, where software takes center stage in the functionality, security, and user experience of vehicles, driving sustained growth in the US automotive software market.

The report provides a comprehensive analysis of the competitive landscape in the United States automotive software market with detailed profiles of all major companies, including:

- Airbiquity Inc.

- BlackBerry Limited

- Intellectual Technology Inc.

- RisingMax Inc.

Latest News and Developments:

- July 2025: QNX and Vector announced a partnership to develop a Foundational Vehicle Software Platform aimed at simplifying software-defined vehicle development. This platform combines safe middleware and certified operating systems, reducing complexity, accelerating production, and enhancing vehicle safety and performance, with an official release scheduled for late 2026.

- June 2025: Plus Automation and Churchill IX merged to form PlusAI, focusing on AI-powered virtual driver software, SuperDrive, for autonomous trucking. The software has been successful in trials with DSV and IVECO, with potential partnerships with OEMs like Traton Group and Hyundai to scale adoption.

- May 2025: HARMAN open-sourced its connected services platform through the Eclipse Foundation, aiming to accelerate the transition to software-defined vehicles (SDVs). The platform supports cloud-native vehicle architectures and enables scalable deployment, vehicle-to-cloud connectivity, and data management, fostering collaboration and innovation within the automotive industry.

- April 2025: Infineon Technologies announced its acquisition of Marvell's Automotive Ethernet business for USD 2.5 Billion. This move strengthens Infineon's position in software-defined vehicles, enhancing their Ethernet technology and real-time control systems. The deal is expected to generate USD 225-USD 250 Million in revenue by 2025.

- January 2025: NXP Semiconductors announced its acquisition of TTTech Auto for USD 625 Million. The deal strengthens NXP’s automotive portfolio, combining TTTech's safety-critical systems with NXP's CoreRide platform, enhancing the development of software-defined vehicles (SDVs) and accelerating automotive industry transformation towards scalable, secure solutions.

United States Automotive Software Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Products Covered | Application Software, Middleware, Operating System |

| Vehicle Types Covered | ICE Passenger Vehicle, ICE Light Commercial Vehicle, ICE Heavy Commercial Vehicle, Battery Electric Vehicle, Hybrid Electric Vehicle, Plug-in Hybrid Electric Vehicle, Autonomous Vehicles |

| Applications Covered | Safety and Security, Infotainment and Instrument Cluster, Vehicle Connectivity, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Companies Covered | Airbiquity Inc., BlackBerry Limited, Intellectual Technology Inc., RisingMax Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States automotive software market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the United States automotive software market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States automotive software industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The automotive software market in the United States was valued at USD 5.78 Billion in 2024.

The United States automotive software market is projected to exhibit a CAGR of 5.04% during 2025-2033, reaching a value of USD 9.45 Billion by 2033.

The United States automotive software market is driven by increasing demand for connected vehicles, advancements in autonomous driving, and the rise of electric and hybrid models. Consumer preference for enhanced safety, infotainment, and real-time diagnostics also fuels growth, alongside strong collaboration between automakers and technology companies across the country.

Some of the major players in the United States automotive software market include Airbiquity Inc., BlackBerry Limited, Intellectual Technology Inc., RisingMax Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)