United States Automotive Steering System Market Size, Share, Trends, and Forecast by Type, Component, Vehicle Type, and Region, 2025-2033

United States Automotive Steering System Market Size and Share:

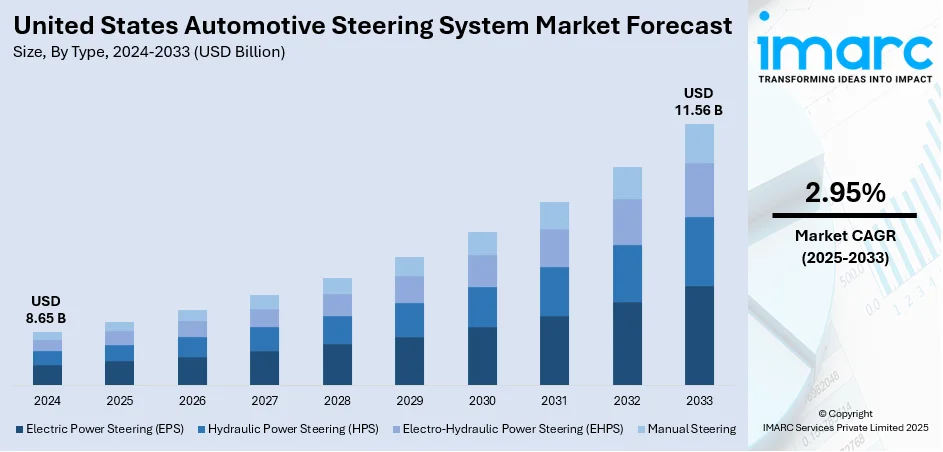

The United States automotive steering system market size was valued at USD 8.65 Billion in 2024. Looking forward, the market is expected to reach USD 11.56 Billion by 2033, exhibiting a CAGR of 2.95% during 2025-2033. The market is undergoing rapid modernization driven by the shift toward electric power steering, integration with advanced driver-assistance systems, and evolving vehicle electrification. OEMs and suppliers are advancing innovations in steer-by-wire and sensor-based control, while regulatory safety and fuel-efficiency standards further shape product development. This dynamic evolution influences the United States automotive steering system market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 8.65 Billion |

| Market Forecast in 2033 | USD 11.56 Billion |

| Market Growth Rate (2025-2033) | 2.95% |

One of the primary growth drivers is the rising demand for enhanced vehicle safety. For instance, in June 2025, Volvo enhanced its well-known dynamic steering system by introducing a new feature capable of detecting tire blowouts and instantly responding to maintain the truck’s stability and keep it safely on course. Consumer preference is shifting toward more safety-conscious and control-oriented, which means that automakers are introducing increasingly sophisticated steering systems with more precise response, and features in contemporary safety systems. Such systems recognize real-time changes and enhance handling, which leads to safe driving moments in various road environments. There is the further fact that steering is being transformed due to the trend of autonomous driving.

To get more information on this market, Request Sample

The United States automotive steering system market growth is driven by the industry's focus on sustainability and energy efficiency. Regulatory pressure to reduce vehicle emissions has accelerated the transition from traditional hydraulic steering systems to electric power steering (EPS). EPS systems are lighter, consume less energy, and support the broader trend of vehicle electrification. Furthermore, automakers are pursuing lightweight materials and innovative designs to improve fuel economy. For instance, in March 2025, Nexteer Automotive unveiled its Rear-Wheel Steering (RWS) system, designed with a focus on affordability, reduced weight, long-term durability, and easy integration. The newly developed system is fine-tuned to improve handling, vehicle stability, safety, and overall performance. It is particularly effective in enhancing the driving experience of large, long-wheelbase vehicles, including trucks, electric vehicles (EVs), and SUVs, by offering improved control and agility.

United States Automotive Steering System Market Trends:

Surge in Demand for Advanced Safety and Driver Assistance Systems

The growing emphasis on vehicle safety has significantly advanced steering system technologies in the United States. Consumers increasingly seek vehicles equipped with enhanced control and responsiveness, pushing automakers to integrate cutting-edge steering solutions. A prime example of this trend is the widespread adoption of Advanced Driver Assistance Systems (ADAS). According to recent estimates, more than 98 million vehicles on US roads are now equipped with ADAS, all of which rely on precise and responsive steering mechanisms to ensure optimal performance. This need for integration between safety systems and steering technologies is a central factor driving the United States automotive steering system market trends.

Growth of Autonomous Vehicle Ecosystem

The accelerating shift toward autonomous mobility is creating significant demand for next-generation automotive steering systems in the United States. As vehicles become more self-reliant, steering systems must evolve to interact with autonomous driving technologies seamlessly. These systems are designed for precision, electronic control, and real-time adaptability. The momentum is supported by a rapidly expanding market: the U.S. autonomous vehicle market reached USD 34.6 Billion in 2024, and is projected to soar to USD 307.1 Billion by 2033, at a CAGR of 27.5%. To support this trajectory, advanced steer-by-wire and electric steering technologies are becoming essential, driving rapid innovation and adoption.

Shift Toward Electrification and Fuel Efficiency Regulations

Increasing regulatory pressure to enhance fuel efficiency and reduce emissions is accelerating the adoption of electric power steering (EPS) systems across the US automotive market. EPS systems eliminate the need for hydraulic fluids and heavy components, reducing vehicle weight and improving fuel economy. This aligns with findings that a 10% reduction in vehicle weight can boost fuel efficiency by 6%–8%. As such, the market is seeing a significant transition from traditional hydraulic systems to electronically assisted solutions. Additionally, the industry’s ongoing push for lighter materials and smarter component design in steering assemblies further supports this shift, enhancing both environmental performance and operational efficiency.

United States Automotive Steering System Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States automotive steering system market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on type, component, and vehicle type.

Analysis by Type:

- Electric Power Steering (EPS)

- Hydraulic Power Steering (HPS)

- Electro-Hydraulic Power Steering (EHPS)

- Manual Steering

Electric Power Steering (EPS) is expected to dominate the US market due to its fuel efficiency, reduced maintenance needs, and compatibility with electric and hybrid vehicles. Unlike hydraulic systems, EPS eliminates the need for a pump, lowering energy consumption and emissions. Automakers favor EPS for its ease of integration with ADAS and autonomous driving technologies. The growing preference for lightweight, electronically controlled steering in passenger vehicles further boosts its adoption. With increasing demand for smarter, more responsive steering systems, EPS aligns well with the market shift toward electrification and digitalization in the US automotive industry.

Hydraulic Power Steering (HPS) continues to hold a notable share in the US market, particularly in heavy-duty vehicles and older vehicle models. Known for providing strong feedback and control, HPS is preferred in applications requiring robust performance under demanding driving conditions. Many commercial vehicles and full-size trucks still rely on this proven, cost-effective technology. Although EPS is gaining ground, the existing fleet of HPS-equipped vehicles and consumer familiarity with hydraulic systems sustain its relevance. Additionally, the relatively low upfront cost and widespread availability of parts contribute to HPS maintaining a consistent presence in specific automotive segments across the US.

Electro-Hydraulic Power Steering (EHPS) combines the best features of hydraulic and electric systems, making it a popular transitional technology in the US market. EHPS uses an electric motor to drive the hydraulic pump, enhancing fuel efficiency compared to traditional HPS while still offering strong steering feedback. According to the United States automotive steering system market forecast, this hybrid system is especially useful for larger vehicles that require greater steering power but benefit from reduced mechanical load. EHPS is often used where full EPS integration is not yet feasible due to technical or cost constraints. Its role as a bridge between conventional and fully electronic systems supports its continued market presence in the US.

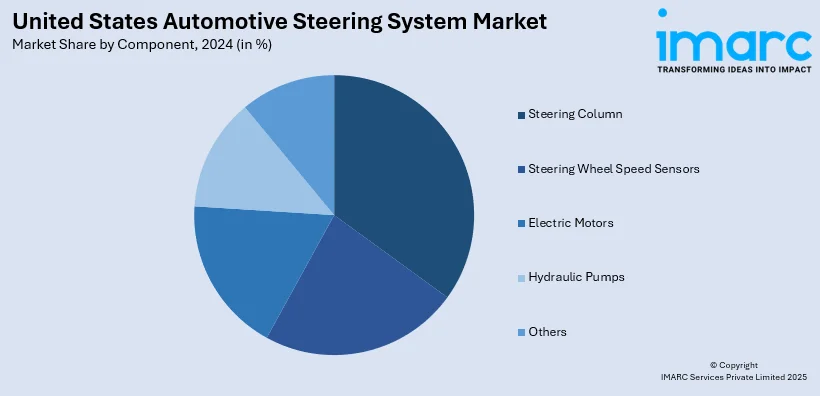

Analysis by Component:

- Steering Column

- Steering Wheel Speed Sensors

- Electric Motors

- Hydraulic Pumps

- Others

The steering column holds a major share of the US automotive steering system market due to its essential role in connecting the steering wheel to the steering mechanism. It not only transmits the driver’s input but also integrates advanced features like tilt/telescopic adjustment, energy absorption in collisions, and electronic controls. Modern steering columns are designed for enhanced safety, comfort, and performance, aligning with regulatory and consumer demands. As automakers focus on improving vehicle ergonomics and safety, the adoption of advanced multi-functional steering columns continues to grow, especially in passenger vehicles and light trucks that dominate the US automotive landscape.

Steering wheel speed sensors are increasingly vital in the US automotive market due to their role in vehicle safety and control systems. These sensors detect the steering wheel's rotation rate and direction, providing crucial input to systems like Electronic Stability Control (ESC), Electric Power Steering (EPS), and Advanced Driver Assistance Systems (ADAS). With the rising adoption of autonomous and semi-autonomous technologies in the United States, demand for precision steering feedback is surging. Speed sensors enhance driving dynamics and vehicle response, helping manufacturers meet regulatory standards and consumer expectations for safety, making them indispensable in modern steering architectures.

Electric motors are expected to hold a dominant share in the US automotive steering system market because they are core components of Electric Power Steering (EPS) systems, which are widely adopted across new vehicles. These motors provide efficient and variable power assistance based on driving conditions, improving both performance and fuel economy. Their integration supports smoother handling, lower energy consumption, and compatibility with ADAS features. As electric and hybrid vehicle production expands in the US, electric motors become even more critical. Their scalability, reliability, and responsiveness make them integral to modern steering systems, contributing to their growing presence across vehicle platforms.

Analysis by Vehicle Type:

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

Passenger cars are expected to dominate the US automotive steering system market due to their high production volume and strong consumer demand. With the rise in urbanization, increasing vehicle ownership, and preference for fuel-efficient, technologically advanced vehicles, automakers are integrating modern steering systems such as Electric Power Steering (EPS) in sedans, SUVs, and hatchbacks. Advanced driver-assistance systems (ADAS) and autonomous driving features also rely heavily on responsive, electronically controlled steering systems. As OEMs focus on safety, comfort, and fuel economy, the widespread adoption of innovative steering solutions in passenger cars contributes significantly to the segment’s leading market share.

Light commercial vehicles (LCVs) hold a substantial share in the US steering system market due to their broad use in logistics, e-commerce deliveries, and small-scale commercial operations. Their rising adoption, especially in last-mile delivery and fleet-based services, drives demand for efficient and durable steering technologies. Manufacturers are incorporating Electric Power Steering (EPS) systems in LCVs to improve fuel economy, maneuverability, and reduce maintenance costs. With the growing emphasis on vehicle electrification and urban goods transport, LCVs are being equipped with advanced steering solutions that enhance safety and performance, solidifying their importance in the overall United States automotive steering system market outlook.

Heavy commercial vehicles (HCVs) play a crucial role in freight and long-haul transportation across the US, leading to steady demand for robust and reliable steering systems. These vehicles require powerful steering mechanisms like Hydraulic Power Steering (HPS) and Electro-Hydraulic systems due to their weight and operational load. Additionally, the growing focus on safety, driver fatigue reduction, and efficiency has led to the adoption of technologically advanced steering systems in this segment. With infrastructure development and interstate logistics expanding, HCVs continue to require high-performance, durable steering solutions, ensuring their sustained presence and share in the market.

Regional Analysis:

- Northeast

- Midwest

- South

- West

The Northeast US is experiencing growth in the steering system market due to its dense population, urban infrastructure, and increasing preference for passenger vehicles with advanced safety features. States like New York and Massachusetts see high vehicle registrations, encouraging OEMs to integrate Electric Power Steering (EPS) and ADAS-compatible systems. Additionally, the region’s cold weather conditions require steering technologies with strong durability and control, which is driving the United States automotive steering system market demand. Consumer demand for compact and fuel-efficient cars also drives the adoption of EPS. With strict emissions and safety regulations, the Northeast leads in upgrading vehicle technology, contributing to the growing demand for sophisticated automotive steering systems.

Known as the manufacturing and automotive hub, the Midwest plays a vital role in driving the US steering system market. States like Michigan and Ohio are home to major OEMs and auto part suppliers, spurring innovation and adoption of advanced steering systems. The region’s large network of highways and freight corridors supports commercial vehicle use, boosting demand for durable and efficient steering solutions in trucks and utility vehicles. Moreover, strong research and development (R&D) activity and automotive testing centers contribute to the integration of technologies like EPS and electro-hydraulic systems. The Midwest’s mix of passenger and commercial vehicle production sustains market momentum.

The South’s rapidly growing population, expanding industrial base, and booming logistics sector drive the need for reliable steering systems. States like Texas and Georgia are experiencing increased sales of light trucks, SUVs, and commercial vehicles, all requiring robust, high-performance steering mechanisms. Warm climates reduce wear from harsh winters, making long-lasting steering solutions particularly important. Additionally, growing automotive investments and assembly plants across the region are fostering local demand for steering components. The region’s preference for heavy-duty and utility vehicles amplifies the market for hydraulic and electro-hydraulic systems, supporting both urban commuting and long-distance transportation needs.

The Western US, particularly states like California, leads in electric vehicle (EV) adoption and environmental regulations, driving demand for Electric Power Steering (EPS) systems. The region’s strong tech ecosystem and focus on autonomous driving fuel the development of smart steering technologies integrated with ADAS. High urban density and traffic congestion in cities like Los Angeles and San Francisco push automakers to offer steering systems that prioritize maneuverability and efficiency. Additionally, a growing population and strong car culture contribute to steady vehicle ownership and aftermarket demand. These combined factors position the West as a key growth region for steering innovation and adoption.

Competitive Landscape:

The US automotive steering system market is highly competitive, with leading global players focusing on innovation, electrification, and integration of advanced technologies. Key companies such as Nexteer Automotive, JTEKT Corporation, Robert Bosch GmbH, and ZF Friedrichshafen AG dominate the landscape, offering a broad range of solutions including electric power steering (EPS), steer-by-wire systems, and ADAS-integrated steering modules. These firms are expanding their research and development (R&D) efforts to meet rising demand for lightweight, energy-efficient, and autonomous-ready steering technologies. Strategic partnerships with automakers and investments in next-generation vehicle platforms are central to maintaining competitive advantage. The growing focus on vehicle safety, driver comfort, and regulatory compliance continues to shape the strategies of market participants, reinforcing their presence in the evolving US steering system market.

The report provides a comprehensive analysis of the competitive landscape in the United States automotive steering system market with detailed profiles of all major companies.

Latest News and Developments:

- April 2025: Mercedes-Benz poised to transform automotive steering by becoming the first German automaker to introduce a production vehicle featuring steer-by-wire technology, beginning in 2026. This cutting-edge system replaces the conventional mechanical link between the steering wheel and front wheels with an entirely electronic setup. Driver inputs are transmitted via electrical signals through a wire-based system, marking a significant leap in steering innovation.

- April 2025: Nexteer Automotive introduced its High-Output Column-Assist Electric Power Steering (HO CEPS), increasing assist capacity to 110 Nm for heavier vehicles. This innovation enhanced OEM flexibility by delivering precise steering and cost efficiency without complex systems, reinforcing Nexteer’s leadership in scalable, modular steering technologies for evolving vehicle demands.

- March 2025: Cadillac unveiled the fully electric 2026 ESCALADE IQL, which combines increased passenger and cargo space with powerful performance capabilities—boasting 750 horsepower and 785 lb-ft of torque. The model features upgraded steering dynamics, supported by Magnetic Ride Control 4.0 and Air Ride Adaptive Suspension, ensuring Cadillac’s hallmark refined precision. This advanced suspension and control setup delivers a smooth, responsive, and elevated driving experience.

United States Automotive Steering System Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Electric Power Steering (EPS), Hydraulic Power Steering (HPS), Electro-Hydraulic Power Steering (EHPS), Manual Steering |

| Components Covered | Steering Column, Steering Wheel Speed Sensors, Electric Motors, Hydraulic Pumps, Others |

| Vehicle Types Covered | Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States automotive steering system market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the United States automotive steering system market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States automotive steering system industry and its attractiveness.

- A competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The automotive steering system market in the United States was valued at USD 8.65 Billion in 2024.

The United States automotive steering system market is projected to exhibit a CAGR of 2.95% during 2025-2033, reaching a value of USD 11.56 Billion by 2033.

The key factors driving the United States automotive steering system market include rising demand for fuel-efficient vehicles, integration of advanced driver-assistance systems (ADAS), and increasing adoption of electric power steering. These trends support improved vehicle control, reduced emissions, and enhanced driver comfort, boosting innovation and adoption across passenger and commercial vehicle segments.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)