United States Biocatalyst Market Size, Share, Trends and Forecast by Type, Application, Source, and Region, 2026-2034

United States Biocatalyst Market Size and Share:

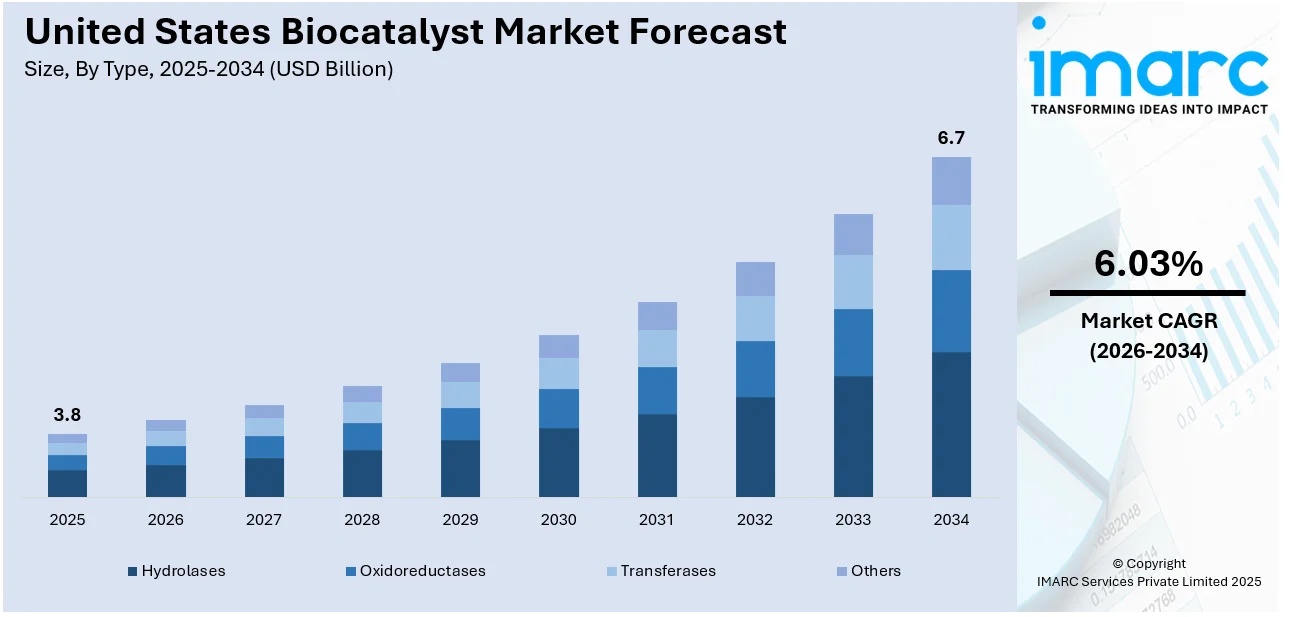

The United States biocatalyst market size was valued at USD 3.8 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 6.7 Billion by 2034, exhibiting a CAGR of 6.03% during 2026-2034. The market is driven by strong government investments, technological advancements in enzyme manufacturing, and robust R&D funding. These factors fuel innovation and market expansion across various industries. Growing demand and strategic initiatives are expected to boost the United States biocatalyst market share significantly.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 3.8 Billion |

|

Market Forecast in 2034

|

USD 6.7 Billion |

| Market Growth Rate (2026-2034) | 6.03% |

The market is propelled by increasing adoption of sustainable and eco-friendly industrial processes. Companies across pharmaceuticals, agriculture, and chemical manufacturing are leveraging biocatalysts to enhance product efficiency while minimizing environmental impact. For instance, in April 2024, Ginkgo Bioworks and Prozomix announced a collaboration to develop next-generation enzyme plates for sustainable active pharmaceutical ingredient (API) manufacturing. The partnership aims to accelerate the discovery of high-performance biocatalysts, enhance screening diversity and enzyme efficacy, and make novel enzyme plates freely accessible to pharmaceutical process chemistry teams in exchange for shared screening data. Moreover, the rising demand for biodegradable and green products aligns with stringent regulatory frameworks promoting sustainability, thereby fostering market growth. The expanding applications of biocatalysts in biofuels and waste management also contribute significantly by enabling cost-effective and energy-efficient solutions. Additionally, strategic collaborations between biotech firms and research institutions facilitate the development of novel biocatalyst technologies, further accelerating innovation and commercial adoption across diverse sectors

To get more information on this market Request Sample

Another key driver is the integration of advanced biotechnologies such as protein engineering and synthetic biology, which optimize enzyme performance for specific industrial applications. The availability of government grants and incentives aimed at fostering biotech innovation supports ongoing research and product development efforts. Furthermore, the market benefits from growing awareness regarding the advantages of biocatalysts, including improved reaction selectivity, reduced byproduct formation, and lower operational costs. Increasing investments in scalable manufacturing infrastructure also enable wider accessibility and application of biocatalysts, reinforcing market expansion throughout the United States.

United States Biocatalyst Market Trends:

Expanding Biotech Investments

The United States biocatalyst market growth is significantly propelled by the government's strong commitment to biotechnology advancement. In April 2025, the U.S. Commission under the International Bio Convention recommended a substantial investment of USD 15 billion over five years to strengthen the biotech ecosystem. This strategic funding supports innovation in biocatalyst technology and infrastructure expansion, fostering a favorable environment for research and commercialization. Increased financial backing also encourages private sector participation, enabling firms to develop advanced biocatalysts that cater to diverse industrial applications. This sustained investment trend underlines a robust foundation for the market’s future growth, positioning the U.S. as a global leader in biocatalyst development.

Innovation Driven by Enzyme Manufacturing and Molecular Engineering

Technological advancements in molecular engineering and enzyme manufacturing are one of the key United States biocatalyst market trends. Major industry players are actively producing artificial enzymes to improve biological functions, expanding applications across pharmaceuticals, biofuels, and food industries. According to IMARC Group, the U.S. enzymes market was valued at USD 4.3 billion in 2024, with a projected CAGR of 6.1% through 2033. This surge reflects growing demand for tailored enzymes with enhanced efficiency and stability. Cutting-edge research in molecular engineering is enabling the creation of novel biocatalysts with improved catalytic properties, significantly enhancing market competitiveness and adoption.

Robust R&D Support Catalyzing Biocatalyst Advancements

Extensive research and development efforts underpin the innovation landscape within the U.S. biocatalyst market. The National Institutes of Health (NIH) awarded USD 36.94 billion in extramural research funding across all states in FY 2024, bolstering scientific exploration in molecular biology and biocatalysis. This strong R&D ecosystem enables breakthroughs in enzyme design and sustainable bioprocessing technologies. Collaboration between academic institutions, government bodies, and industry accelerates technology transfer and commercialization of advanced biocatalysts. Continuous innovation driven by R&D is critical for addressing environmental challenges and enhancing industrial efficiency, thus creating a positive United States biocatalyst market outlook.

United States Biocatalyst Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States biocatalyst market, along with forecasts at the country/regional levels from 2026-2034. The market has been categorized based on type, application, and source.

Analysis by Type:

- Hydrolases

- Oxidoreductases

- Transferases

- Others

Hydrolases stand as the largest component in 2025. The hydrolases segment dominates the market due to its broad versatility and widespread application across multiple industries. Hydrolases, which catalyze hydrolysis reactions, are extensively used in pharmaceuticals, food processing, biofuels, and environmental sectors because they efficiently break down complex molecules under mild conditions. Their ability to enhance reaction specificity, reduce energy consumption, and minimize harmful byproducts makes them highly valuable in sustainable manufacturing processes. Additionally, ongoing advancements in enzyme engineering have improved hydrolase stability and activity, further increasing their industrial appeal. The strong demand for green chemistry solutions and biocatalytic efficiency continues to solidify Hydrolases’ leading market position in the U.S.

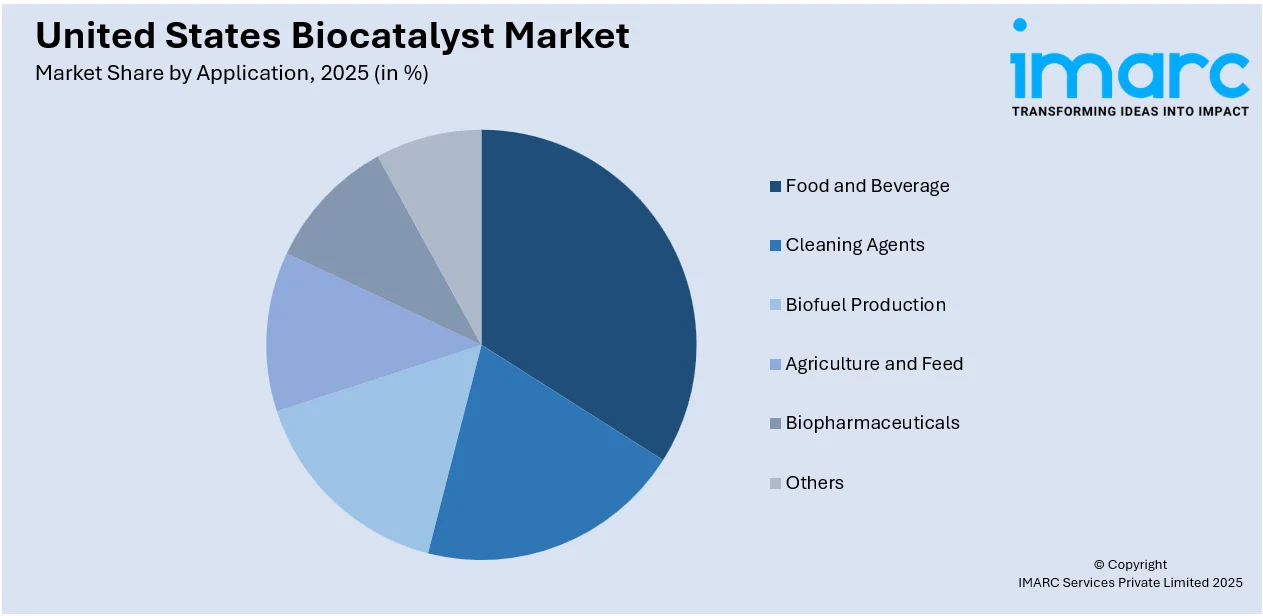

Analysis by Application:

Access the comprehensive market breakdown Request Sample

- Food and Beverage

- Cleaning Agents

- Biofuel Production

- Agriculture and Feed

- Biopharmaceuticals

- Others

Food and beverage leads the market in 2025. The food and beverage segment dominates the market due to the growing demand for natural, safe, and efficient processing methods in food production. Biocatalysts, particularly enzymes, are widely used to enhance flavor, texture, shelf life, and nutritional content of food products. Their ability to catalyze specific reactions under mild conditions supports clean-label trends and meets consumer preferences for minimally processed foods. Additionally, the rise in lactose-free and gluten-free product development has further driven enzyme utilization. Ongoing innovations in enzyme formulations, coupled with stringent food safety standards, continue to boost biocatalyst adoption, solidifying the segment's leading position in the U.S. market.

Analysis by Source:

- Microorganisms

- Plants

- Animal

Microorganisms stand as the largest component in 2025. The microorganisms segment dominates the market due to their inherent versatility, cost-effectiveness, and widespread use across industrial applications. Microorganisms such as bacteria, fungi, and yeast serve as natural sources for producing a wide range of enzymes used in pharmaceuticals, food processing, biofuels, and waste treatment. Their ability to be genetically modified for enhanced enzyme yield and specificity makes them highly adaptable for large-scale biocatalytic processes. Additionally, microbial fermentation is a scalable and sustainable method for enzyme production, aligning with the industry's push toward greener technologies. The rising investment in microbial biotechnology and industrial microbiology further supports this segment’s market leadership.

Regional Analysis:

- Northeast

- Midwest

- South

- West

In 2025, South accounted for the largest market share. The South segment dominates the market due to its strong industrial base, favorable regulatory environment, and significant presence of biotechnology and pharmaceutical manufacturing facilities. States such as Texas, North Carolina, and Georgia host numerous bioprocessing plants and research institutions that actively develop and apply biocatalyst technologies. Additionally, the region benefits from robust infrastructure, skilled workforce availability, and competitive energy costs, which attract investments in enzyme production and application. Supportive state-level policies and academic-industry collaborations further encourage innovation. The South’s strategic logistics networks also facilitate efficient distribution, making it a key hub for biocatalyst-related activities across various sectors.

Competitive Landscape:

The competitive landscape of the United States biocatalyst market is characterized by intense innovation, strategic collaborations, and robust research and development efforts. Numerous manufacturers are focusing on expanding their production capacities and enhancing enzyme performance through advanced protein engineering and synthetic biology. Companies are also prioritizing sustainability by developing eco-friendly and application-specific biocatalysts. For instance, in July 2024, BASF, in collaboration with the Austrian Research Centre of Industrial Biotechnology (acib) and the University of Graz, introduced a groundbreaking computer-assisted regression model designed to optimize enzyme performance in biocatalytic production. This model significantly reduces the number of lab experiments by calculating optimal temperature and solvent conditions, enabling faster scale-up from lab to industrial processes. The innovation enhances sustainability by lowering resource usage and costs. Market players are actively partnering with academic institutions and government bodies to accelerate product development and commercialization. Additionally, the growing presence of startups and niche biotech firms is fostering healthy competition and technological diversification. The United States biocatalyst market forecast predicts sustained growth driven by increasing demand across pharmaceuticals, food processing, and biofuels, alongside continuous investments in biotechnology infrastructure and regulatory support.

The report provides a comprehensive analysis of the competitive landscape in the United States biocatalyst market with detailed profiles of all major companies.

Latest News and Developments:

- November 2024: Ecovyst launched its AlphaCat advanced silica products to enable enzyme immobilisation in biocatalysis applications. Developed at its Conshohocken R&D facility and manufactured in Kansas City, the innovation supported the food, fuel, and chemical sectors. The product included a testing kit for functionalized silicas, enhancing process efficiency, safety, and sustainability.

United States Biocatalyst Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Hydrolases, Oxidoreductases, Transferases, Others |

| Applications Covered | Food and Beverage, Cleaning Agents, Biofuel Production, Agriculture and Feed, Biopharmaceuticals, Others |

| Sources Covered | Microorganisms, Plants, Animal |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States biocatalyst market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the United States biocatalyst market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States biocatalyst industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The United States biocatalyst market was valued at USD 3.8 Billion in 2025.

The United States biocatalyst market is projected to exhibit a CAGR of 6.03% during 2026-2034, reaching a value of USD 6.7 Billion by 2034.

The market is primarily driven by increasing demand for sustainable industrial processes, advancements in enzyme engineering, and rising adoption across pharmaceuticals and biofuels sectors. Additionally, growing investments in biotechnology research, stringent environmental regulations, and expanding applications in food and beverage industries are further propelling market growth across the region.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)