United States Biofertilizer Market Size, Share, Trends and Forecast by Type, Crop, Microorganism, Mode of Application, and Region, 2026-2034

United States Biofertilizer Market Size and Share:

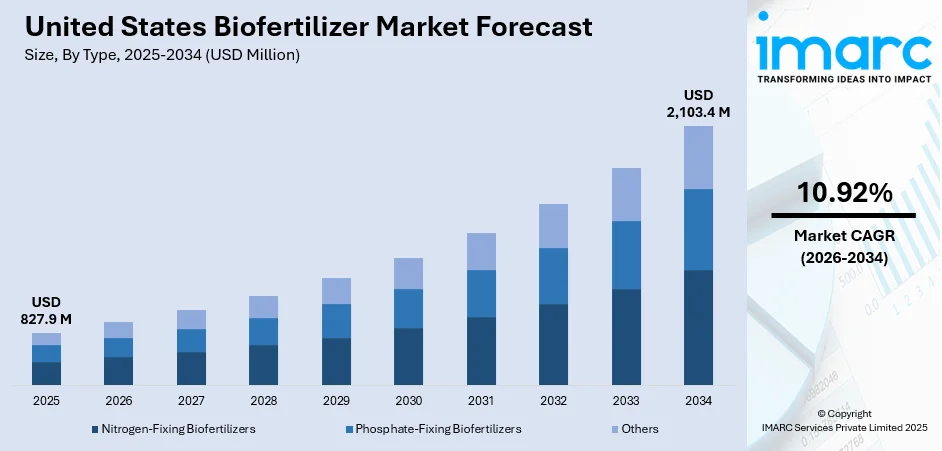

The United States biofertilizer market size was valued at USD 827.9 Million in 2025. Looking forward, the market is projected to reach USD 2,103.4 Million by 2034, exhibiting a CAGR of 10.92% from 2026-2034. Midwest currently dominates the market, holding a significant share in 2025. The market is experiencing steady growth due to rising demand for sustainable farming practices and organic food products. Increasing awareness about soil health, along with government support for eco-friendly agricultural inputs, is boosting market expansion. Innovations in microbial formulations, coupled with a shift toward reducing chemical fertilizer dependency, are driving growth and attracting both domestic and international players as the United States biofertilizer market share continues to expand.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 827.9 Million |

|

Market Forecast in 2034

|

USD 2,103.4 Million |

| Market Growth Rate 2026-2034 | 10.92% |

Access the full market insights report Request Sample

A major factor driving the biofertilizer market in the United States is the increasing demand for sustainable agricultural methods fueled by concerns about soil degradation and the excessive use of chemicals. In March 2023, four US universities launched SoilTech a five-year project analyzing soil health to combat land degradation which costs USD 67 Billion annually. Funded by the National Science Foundation the initiative will focus on soil properties, carbon sequestration, and developing tools for real-time agricultural data sharing to enhance food security. Farmers are turning to biofertilizers to enhance soil fertility, boost crop yields, and promote the health of the soil microbiome in an environmentally friendly manner. Additionally, government initiatives that support organic farming and sustainable practices are encouraging the use of bio-based inputs. This transition is further influenced by consumer demand for organically produced food motivating agricultural producers to seek out more natural and sustainable farming techniques.

To get more information on this market Request Sample

Technological progress in microbial strains and product formulations is also driving the market growth. Research institutions and biotech firms are focusing on developing biofertilizers that provide greater efficiency, longer shelf life, and wider applicability across various crops and soil types. The escalating costs of synthetic fertilizers and the growing awareness of their environmental impact are further driving this market shift. For instance, in August 2025, BioConsortia secured USD 15 Million in funding to launch Always-N, a next-generation nitrogen-fixing biofertilizer aimed at transforming industrial corn production. This innovative seed treatment promises to enhance crop yields while reducing reliance on synthetic fertilizers, thus supporting sustainable agriculture and decreasing greenhouse gas emissions. Furthermore, increased educational campaigns and training programs are enhancing farmers' understanding and confidence in using biofertilizers, leading to a wider adoption across the United States.

United States Biofertilizer Market Trends:

Expansion of Customized Formulations

A significant trend in the United States biofertilizer market is the creation of customized formulations specifically designed for individual crops and local soil conditions. Companies are increasingly focusing on developing targeted microbial blends that address the nutritional requirements of particular crops like corn, soybeans, and various vegetables. For instance, in March 2025, Pivot Bio launched CERT-N™, a new gene-edited nitrogen-fixing product for cotton in the US Cotton Belt. Initially available to select growers for the 2025 season, it enhances crop yields and fiber quality. This strategy promotes better nutrient absorption, enhances yields, and improves adaptation to specific climate and soil characteristics. Farmers enjoy increased efficiency and cost savings, while producers gain a competitive advantage through specialization. According to the United States biofertilizer market forecast, this trend is anticipated to accelerate adoption across various agricultural regions.

Increased Focus on R&D

The biofertilizer market in the United States is experiencing a notable emphasis on research and development aimed at improving microbial efficacy and product performance. Scientists and biotechnology companies are focusing their efforts on discovering new strains that enhance nutrient uptake, withstand environmental challenges, and are compatible with various crops. Furthermore, innovative formulation methods are being created to extend shelf life and simplify application processes. These advancements not only enable farmers to achieve greater productivity but also align with environmental goals by decreasing dependence on chemical fertilizers. As the sector becomes increasingly driven by innovation, United States biofertilizer market demand is anticipated to see significant growth across both conventional and organic farming sectors.

Collaborations and Partnerships

Strategic alliances among key players are essential in reinforcing the biofertilizer ecosystem throughout the United States. Biotech firms are collaborating with agricultural cooperatives, research institutions, and governmental bodies to enhance product accessibility, educate farmers, and expand distribution channels. These partnerships are crucial for increasing awareness about the advantages of biofertilizers, providing training, and conducting field trials to validate efficacy. Public-private collaborations are further aiding in policy formation and funding for innovation. As these cooperative initiatives grow and evolve, they are likely to lead to higher adoption rates and improved product availability, positively influencing the United States biofertilizer market outlook.

United States Biofertilizer Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States biofertilizer market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on type, crop, microorganism, and mode of application.

Analysis by Type:

- Nitrogen-Fixing Biofertilizers

- Phosphate-Fixing Biofertilizers

- Others

Nitrogen-fixing biofertilizers dominate the US market due to their essential function in restoring nitrogen levels in the soil, particularly for nitrogen-demanding crops such as corn and wheat. These biofertilizers, containing strains such as Rhizobium and Azotobacter, enhance soil fertility by converting atmospheric nitrogen into a plant-accessible form. Their affordability and eco-friendly nature make them appealing to farmers moving away from synthetic fertilizers. With the increasing focus on organic and sustainable farming practices, nitrogen-fixing biofertilizers are anticipated to continue driving United States biofertilizer market growth in the upcoming years.

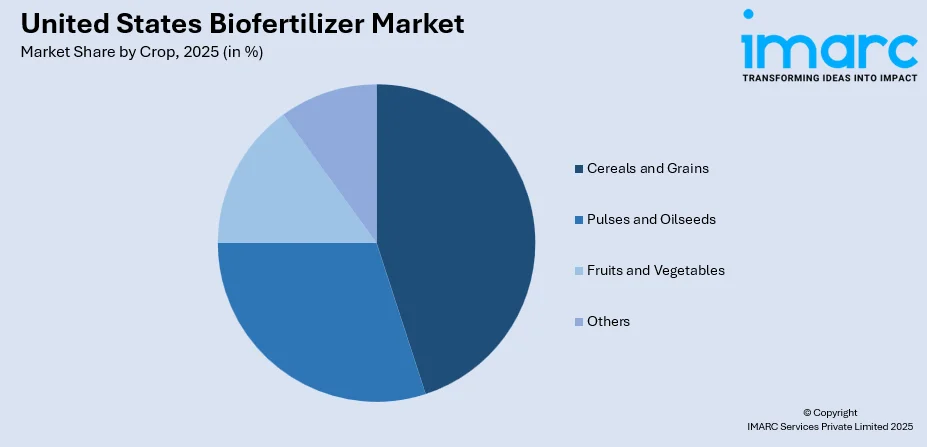

Analysis by Crop:

To get detailed segment analysis of this market Request Sample

- Cereals and Grains

- Pulses and Oilseeds

- Fruits and Vegetables

- Others

Cereals and grains account for the largest segment of crops utilizing biofertilizers in the United States. Crops such as corn, wheat, and barley require significant nutrient input, rendering them ideal for biofertilizer applications. Farmers are progressively incorporating nitrogen-fixing and phosphate-solubilizing biofertilizers to enhance crop yields, lower input costs, and sustain soil health over the long term. Demand is particularly robust in the Midwest, a central hub for cereal cultivation. As the push to minimize chemical inputs in staple food production intensifies, the biofertilizer market within the cereals and grains category is poised for substantial expansion.

Analysis by Microorganism:

- Cyanobacter

- Rhizobium

- Phosphate Solubilizing Bacteria

- Azotobacter

- Others

Cyanobacter, often called blue-green algae, rank among the most efficient microorganisms in the biofertilizer sector, particularly for nitrogen fixation. Their capacity to fix atmospheric nitrogen without forming symbiotic associations allows them to adapt well across diverse soil types and crops. They are particularly popular in sustainable agricultural practices due to their natural source and environmental advantages. Cyanobacter are frequently utilized in waterlogged conditions, such as rice cultivation, but are increasingly being applied to dryland farming thanks to advancements in application methods. Their rising use highlights a growing recognition of natural inputs and eco-friendly agricultural techniques. As farmers seek natural and efficient alternatives to chemical fertilizers, cyanobacter-based products are becoming integral to evolving United States biofertilizer market trends.

Analysis by Mode of Application:

- Seed Treatment

- Soil Treatment

- Others

Seed treatment is the predominant method of biofertilizer application in the US because of its precision, simplicity, and cost-effectiveness. Applying biofertilizers directly to seeds enables early root colonization, resulting in better nutrient uptake from the startup phases of plant growth. This technique minimizes waste and guarantees that the microorganisms are in close contact with the developing root system. Seed treatment is particularly favored by cereal and grain farmers seeking reliable outcomes and improved crop resilience. Its increasing popularity reflects a wider trend towards preventive agricultural strategies rather than corrective measures.

Regional Analysis:

- Northeast

- Midwest

- South

- West

The Midwest stands out as the leading region in the US biofertilizer market, fueled by the extensive cultivation of corn, soybeans, and wheat. Farmers in this area are increasingly adopting biofertilizers within integrated nutrient management strategies to boost yields while safeguarding soil health. The region benefits from robust agricultural infrastructure, awareness initiatives, and research institutions that promote innovation and training. Furthermore, state-level support for sustainable farming methods accelerates adoption. As environmental issues and fertilizer costs escalate, the Midwest is likely to remain a pioneer in biofertilizer usage and innovation within the US market.

Competitive Landscape:

The competitive landscape of the United States biofertilizer market consists of a blend of established agrochemical corporations, emerging biotechnology companies, and specialized manufacturers of organic inputs. Firms are concentrating on innovative product development, especially in creating formulations that are specific to different crops and resilient to various climate conditions. Strategic alliances with research organizations and agricultural cooperatives are enhancing research and development capabilities as well as expanding market reach. Efforts are also focused on widening distribution networks, implementing farmer education initiatives, and promoting sustainable branding to enhance market presence. Numerous companies are dedicating resources to the development of microbial strains to boost product efficiency and shelf life. With a rising focus on organic agriculture and environmental sustainability, competition in the market is intensifying, with businesses setting themselves apart through tailored solutions, comprehensive technical support, and alignment with sustainable farming practices.

The report provides a comprehensive analysis of the competitive landscape in the United States biofertilizer market with detailed profiles of all major companies.

Latest News and Developments:

- June 2025: AMVAC and DPH Biologicals announced that TerraTrove AmplAphex, a liquid biofertilizer, received the OMRI Listed seal for certified organic production. The biofertilizer had been recognized for enhancing soil structure, nutrient efficiency, and stress resilience in crops across the Western and Southern U.S.

- May 2025: Syngenta acquired California-based Intrinsyx Bio, a start-up focused on nutrient use efficiency, to strengthen its biofertilizer portfolio. The acquisition supported Syngenta’s aim to expand NUELLO iN seed treatment and other biofertilizer solutions across global markets.

- April 2025: DPH Biologicals® announced mode of action findings and multi-year field trial results for its next generation biofertilizer TerraTrove® AmplAphex™. The study demonstrated the biofertilizer’s transformative effects on crop yields and soil health.

- January 2025: AMVAC® entered into a regional distribution agreement with DPH Biologicals® to expand access to biofertilizer and biological products across the U.S. The deal enhanced American Vanguard’s GreenSolutions portfolio and widened DPH Bio’s reach into specialty crop markets.

- January 2025: DPH Biologicals and Aginnovation forged a strategic partnership to advance biological seed treatment products for North America's vegetable and specialty markets. The collaboration focused on enhancing seed solutions using biofertilizer technologies.

United States Biofertilizer Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Nitrogen-Fixing Biofertilizers, Phosphate-Fixing Biofertilizers, Others |

| Crops Covered | Cereals and Grains, Pulses and Oilseeds, Fruits and Vegetables, Others |

| Microorganisms Covered | Cyanobacter, Rhizobium, Phosphate Solubilizing Bacteria, Azotobacter, Others |

| Mode of Applications Covered | Seed Treatment, Soil Treatment, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States biofertilizer market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the United States biofertilizer market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States biofertilizer industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The biofertilizer market in the United States was valued at USD 827.9 Million in 2025.

The United States biofertilizer market is projected to exhibit a CAGR of 10.92% during 2026-2034, reaching a value of USD 2,103.4 Million by 2034.

The market is driven by rising demand for organic food, growing environmental concerns over chemical fertilizers, supportive government initiatives, and increasing awareness of sustainable farming practices. Technological advancements in microbial formulations also contribute to improved efficiency and wider adoption.

Midwest accounts for the largest share in the United States biofertilizer market, driven by its extensive agricultural activity, particularly in crops like corn and soybeans, along with strong adoption of sustainable farming practices.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)