United States Biometrics Market Size, Share, Trends and Forecast by Technology, Functionality, Component, Authentication, End User, and Region, 2026-2034

United States Biometrics Market Size and Share:

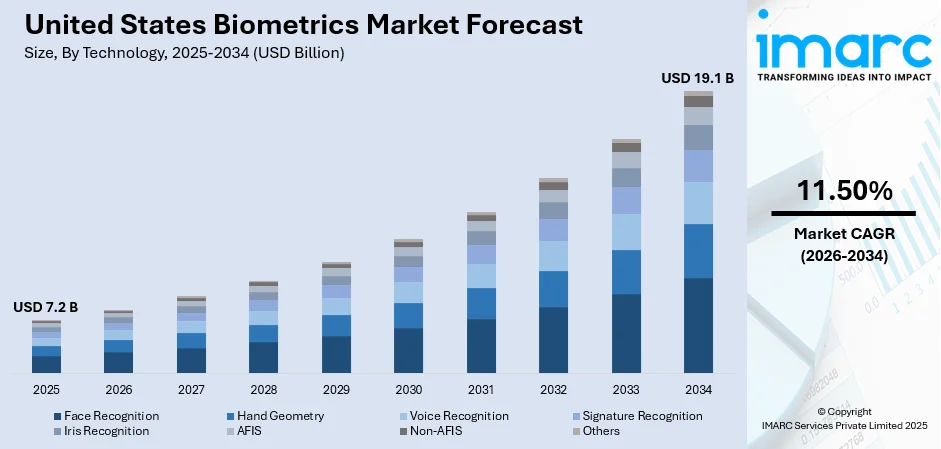

The United States biometrics market size was valued at USD 7.2 Billion in 2025. The market is projected to reach USD 19.1 Billion by 2034, exhibiting a CAGR of 11.50% from 2026-2034. The market is witnessing robust growth fueled by rising adoption in government security, healthcare authentication, and contactless solutions demand. Non-AFIS technologies, contact-based systems, and hardware components dominate technology, functionality, and infrastructure segments, respectively. Single-factor authentication continues to dominate owing to its simplicity and cost-effectiveness, with government being the leading end user owing to large-scale deployment across national security and identification programs. These trends in combination reflect the changing dynamics of the United States biometrics market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 7.2 Billion |

|

Market Forecast in 2034

|

USD 19.1 Billion |

| Market Growth Rate 2026-2034 | 11.50% |

Access the full market insights report Request Sample

One of the prime drivers for the United States biometrics market is the growing need for advanced security infrastructure for key government operations. With growing fears for national security, border security, and identity theft, government agencies are investing significant budgets for the updating and enhancement of identification systems. Technologies like face recognition, fingerprint identification, and iris scanning are being incorporated in border management, law enforcement, and civilian identification schemes to enhance accuracy, accelerate processing, and ensure that unauthorized people cannot access systems. As per the reports, in May 2025, Tools for Humanity rolled out its biometric iris-scanning ID project "World" in the U.S., seeking to install 10,000 orbs nationwide as part of its cryptocurrency-linked digital identity rollout. Furthermore, biometric systems possess a major benefit over other forms of identification since they provide quick, tamper-resistant verification that enables real-time decision-making. This is highly applicable at highly trafficked U.S. entry points, where the sensitivity and scale of operations call for highly scalable and resilient biometric systems. With regulatory frameworks shifting and digital transformation in public safety on the rise, these highly noticeable deployments require increasing amounts of growth, further cementing biometrics as an essential element in securing national infrastructure.

To get more information on this market Request Sample

Another key driver of the United States biometrics market outlook is the fast pace of adoption of digital health systems and resultant need for secure, authenticated access to sensitive medical data. The widespread adoption of electronic health records (EHRs), telemedicine, and remote patient monitoring has led to healthcare providers increasingly adopting biometric technologies for securing patient identification, fraud prevention, and protecting data privacy. With the difference from passwords or physical cards that they cannot be lost or forgotten, biometric identifiers lower administrative errors significantly and enhance operational efficiency. Where healthcare systems have more patient data, duplication and misidentification of such data increase, and this threatens patient safety and leads to loss of revenue. Biometric solutions—from palm vein readers to facial authentication—provide a secure solution for matching patients to their medical record in both face-to-face and virtual care environments. According to the sources, in May 2025, Worldcoin's parent firm World launched iris-scanning biometric Orbs in six major U.S. cities, linking digital assets through Visa and Circle to support privacy-centered identity verification. Moreover, this identification security function is becoming a requirement, as federal data security compliance requirements and pressure for frictionless patient experience continue to escalate.

United States Biometrics Market Trends:

Adoption of Biometrics by Government for National Security

The growing adoption of biometrics in public sectors, most notably in national security activities, is a key trend influencing market development. The United States Department of Homeland Security continues to spend lavishly on sophisticated biometric tools, with more than USD 300 million spent per acquisition program. Facial recognition is an important area, with it being used at major points of entry throughout the nation to rationalize identity check-in and increase security. These systems facilitate real-time monitoring, cross-referring databases, and enhancing threat detection capacity at borders. Because biometric authentication minimizes dependence on manual verification and decreases margins of error, government agencies consider it crucial for counterterrorism and migration management. The focus on biometric-enabled surveillance aligns with overarching federal efforts directed at establishing a secure, digitally empowered infrastructure. This trend is anticipated to grow larger, propelled by rising geopolitical uncertainties and the imperative to safeguard national assets and citizens through advanced identification systems, reinforcing the United States biometrics market forecast.

Growing Application of Biometrics in Healthcare to Avoid Replication

Biometric technology is gaining fast steam in healthcare as providers seek to remove duplication of patient records and enhance secure access to electronic health records (EHRs). As per the American Health Information Management Association (AHIMA), EHR system duplication levels are between 5% and 10%, posing significant patient safety and administrative efficiency challenges. Hospitals and clinics are responding with greater adoption of biometric identification—like fingerprint and iris recognition—to identify patients correctly across systems. This provides continuity of care, decreases medical errors, and streamlines insurance verification. In addition, biometric solutions facilitate secure remote access to telehealth platforms and promote adherence to data protection laws. As the amount of digital medical data increases, integration of biometrics into healthcare IT infrastructure becomes crucial. The practice is predicted to grow more intensive as healthcare organizations update their systems to address increasing patient demand for security, privacy, and efficient care delivery.

Contactless and Multi-Modal Biometrics Drive Post-Pandemic

The transition to contactless biometric systems accelerated after the pandemic, with end-use sectors embracing safer, contactless authentication processes. In June 2025, prominent U.S. airports like ATL and JFK rolled out expanded biometric screening initiatives to decrease wait times and increase passenger throughput. ATL alone reported 2.3 million international boardings, a 5.5% year-over-year increase. At DFW, average processing time decreased from 50 to 35 minutes due to facial recognition deployment. These advancements offer both security and convenience, especially amid rising travel volumes. Additionally, biometric-based one-time-password (OTP) hardware devices are being integrated with facial or fingerprint readers to strengthen multi-factor authentication in sectors like banking and enterprise IT. Some tech vendors have also introduced solutions that marry temperature screening with biometric access control, addressing persistent public health issues. This convergence of hygiene, speed, and security is poised to further accelerate the use of contactless biometrics in transport, retail, and commercial settings.

United States Biometrics Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States biometrics market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on technology, functionality, component, authentication, and end user.

Analysis by Technology:

- Face Recognition

- Hand Geometry

- Voice Recognition

- Signature Recognition

- Iris Recognition

- AFIS

- Non-AFIS

- Others

Non-AFIS (Automated Fingerprint Identification System) technology commanded a leading 37.0% of the United States biometrics market growth in 2025. This segment includes biometric modalities such as facial recognition, iris scanning, and voice recognition, which are gaining traction due to their speed, accuracy, and contactless nature. Non-AFIS systems are widely adopted in sectors such as transportation, healthcare, and retail, where swift identity verification and user convenience are critical. Unlike AFIS, which primarily supports forensic and criminal investigations, Non-AFIS technologies are highly scalable and suitable for high-volume environments. Their integration with machine learning and AI further improves fraud detection and recognition accuracy. Increasing demand for convenient and secure authentication in mobile banking, online transactions, and border control also drives the growth of this segment. While the transition from legacy systems gains speed, the Non-AFIS segment is likely to lead through increased flexibility and cross-industry suitability.

Analysis by Functionality:

- Contact

- Non-contact

- Combined

Contact-based biometric functionality accounted for 37.0% of the United States market in 2025, a testament to steady demand from law enforcement, commercial security, and civil use. Fingerprint scanning is still the most dominant contact-based modality because it's used broadly to authenticate identities in the public and private spheres based on its precision and cost-effectiveness. In spite of increasing demand for contactless options, contact biometrics remains necessary to address mission-critical authentication requirements where high accuracy is more important than ease of use. Most government ID programs, time and attendance systems, and secure entry points continue to use contact-based verification due to its established dependability. Moreover, existing infrastructure within institutions also enables ongoing use of contact biometrics, especially in prisons, financial institutions, and healthcare settings. Technological advancements, including pressure-sensitive and 3D touch sensors, have enhanced hygiene and speed, propelling this segment's value. The resilience and established trust in contact biometrics form the foundation for its sustained relevance in an evolving market.

Analysis by Component:

- Hardware

- Software

As per United States biometrics market analysis, in 2025, the hardware component leads the market with a dominating 42.3% share, reflecting the pivotal role physical devices play in facilitating biometric identification. Hardware comprises scanners, readers, sensors, cameras, and biometric terminals installed in different industries like government, banking, healthcare, and transportation. The rising deployment of biometric kiosks at airports, fingerprint readers at offices, and facial recognition cameras in smart city initiatives has heavily contributed to hardware demand. As biometric use spreads beyond high-security settings into ordinary uses, reliable and heavy-duty hardware solutions are needed for functionality and dependability. In addition, hardware advancements are enhancing device portability, power efficiency, and ease of use, making them more viable for mobile and remote authentication environments. Hardware continues to be essential to data capture and on-site validation despite the growth of software-based and cloud-supported biometric platforms. Continued infrastructure modernization in both public and private sectors continues to support the hardware segment's dominant market position.

Analysis by Authentication:

- Single-Factor Authentication

- Multifactor Authentication

Single-factor authentication led the United States biometrics market of 2025, holding 57.3% of the overall share. The process is based on the use of a single biometric characteristic—e.g., fingerprint, iris, or facial scan—to verify identity, presenting a simple and low-cost solution for secure access control. Commonly applied in banking, healthcare, mobile phones, and government initiatives, single-factor authentication strikes a balance between speed, ease of use, and suitable security for low-to-moderate risk applications. Most consumer-facing platforms also like single-factor systems because they are simple and familiar to end-users, especially in mobile payment and device unlocking applications. Several legacy systems also still support only single-modal recognition, creating long-term demand for this category. Although multi-factor and multi-modal authentication are increasing in popularity in high-security applications, single-factor systems continue to lead because they are cheaper to deploy, easier to integrate, and cause lesser user friction. Their ongoing dominance in mass-market consumer devices continues to support the segment's leadership position in 2024.

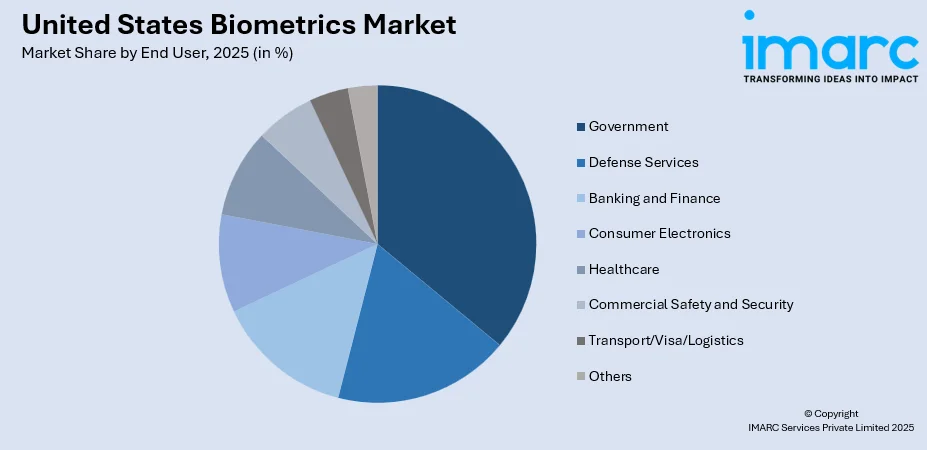

Analysis by End User:

To get detailed segment analysis of this market Request Sample

- Government

- Defense Services

- Banking and Finance

- Consumer Electronics

- Healthcare

- Commercial Safety and Security

- Transport/Visa/Logistics

- Others

Government, in 2025, became the top end user of the United States biometrics market, accounting for 27.6% of the overall share. Government agencies widely employ biometric systems for national defense, immigration management, civil ID programs, and law enforcement activities. Technologies like fingerprint scanners, facial recognition, and iris scanning are embedded in border control systems, passport authentication, and digital identity systems. The ongoing federal government investment in upgrading homeland security infrastructure has also propelled adoption strongly, with biometric screening used more and more at airports, seaports, and border checkpoints. In addition, public sector programs such as Real ID compliance and electronic voting solutions are also contributing to strong demand for secure biometric identity verification. These systems provide not just national security but also administrative effectiveness, accuracy of identity, and anti-fraud. With the level of government services increasingly going digital, the requirement for safe, scalable biometric solutions further boosts this sector's market leadership.

Regional Analysis:

- Northeast

- Midwest

- South

- West

The Northeast region has strong growth in the adoption of biometric technology in healthcare, finance, and government administration. With concentrated urban populations and advanced IT infrastructure, New York and Massachusetts are implementing facial recognition, iris scanning, and fingerprint systems for secure patient identity, financial authentication, and government identification programs.

The Midwest is seeing consistent growth in biometric use, with investments in healthcare modernization, workforce security, and automated logistics. Illinois, Ohio, and Michigan are applying biometric devices in hospitals, manufacturing facilities, and public safety activities and utilizing fingerprint, facial, and voice recognition to suppress fraud, streamline processes, and enhance data access security.

The South exhibits increased adoption of biometric technology in various industries like border security, transportation, and health. Texas, Florida, and Georgia are implementing palm, iris, and facial scan systems for safe identification in hospitals, public facilities, and airports in sync with digital infrastructure refreshes and privacy compliance models.

The Western registers robust demand for sophisticated biometric systems because of a concentration of technology firms and changing data protection standards. In states such as California, biometrics are extensively used in fintech platforms, enterprise access control, and mobile authentication, with mounting focus on privacy-preserving methods and decentralized digital identity frameworks.

Competitive Landscape:

Technological advancement, collaboration or partnership, and industry-specific tailoring are some of the key drivers of competition in the United States biometrics market. Firms are also increasingly concentrating on creating next-generation biometric modalities like multi-modal platforms that integrate face, fingerprint, and iris recognition for higher accuracy and lower fraud. Competition is also heating up in the field of contactless biometrics with healthcare, banking, and transport industries demanding hygienic and convenient authentication products. Furthermore, a number of players are acquiring AI-based biometric platforms that enable real-time identification and behavior analytics to address government and enterprise requirements for greater surveillance and security. The market is also seeing growth in public-private partnerships, particularly in smart city initiatives and airport security upgrade. Vendors are also looking at vertical integration by providing hardware, software, and analytics solutions on single platforms. This dynamic setting drives ongoing innovation, making biometrics a key facilitator of safe identity authentication in numerous industries.

The report provides a comprehensive analysis of the competitive landscape in the United States biometrics market with detailed profiles of all major companies, including:

Latest News and Developments:

- June 2025: NEXT Biometrics received a NOK 6.3 million order for its new FAP 20 Basalt L1 Slim fingerprint sensor, certified for India’s Aadhaar program. Using U.S.-certified Active Thermal technology, the sensor ensures secure, fast authentication. NEXT anticipates NOK 25 million in annual orders across India, the U.S., and other markets.

- June 2025: The U.S. Open golf tournament deployed facial recognition for seamless ticketing access, enhancing fan experience. Meanwhile, Los Angeles’ Intuit Dome uses facial ID for personalized fan engagement. Despite benefits, U.S. venues face privacy concerns, with regulation varying by state amid growing facial recognition use in entertainment.

- April 2025: Sam Altman’s World launched six U.S. locations for eye-scanning ID using Orb devices in Austin, Atlanta, Los Angeles, Nashville, Miami, and San Francisco. The system creates unique IrisCodes for identity verification, partnering with Visa and Match Group, aiming to combat fraud and integrate with platforms like Reddit and Discord.

- April 2025: U.S.-based Wink and Phoenix Managed Networks merged to combine AI, biometrics, and payment infrastructure. Serving over 220,000 merchants and 10M+ monthly transactions, the new entity aims to accelerate secure, AI-driven commerce across the U.S. and globally with face/palm pay, voice biometrics, and fraud prevention technologies.

- January 2025: Idemia Public Security North America launched STORM LP-X, a cloud-based latent fingerprint biometrics software. It enhances forensic examiners’ capabilities by enabling searches against FBI’s NGI system and state databases. The system supports drag-and-drop uploads, auto-encoding, and flexible use from offices or crime scenes in the U.S

- September 2024: NEC launched a biometric authentication system capable of identifying up to 100 people per minute in motion. Using advanced face recognition and movement analysis, it reduces congestion at airports and venues. The system is easily installed, globally deployed, and integrates with various applications for enhanced efficiency and security.

- August 2024: J.P. Morgan Payments expanded its partnership with PopID to roll out face-based biometric payments across U.S. merchants. Whataburger extended adoption nationwide. The system enhances speed, security, and loyalty. Miami’s F1 Grand Prix successfully piloted the tech, with near-instant authentication. U.S. users can opt in anytime.

United States Biometrics Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Face Recognition, Hand Geometry, Voice Recognition, Signature Recognition, Iris Recognition, AFIS, Non-AFIS, Others |

| Functionalities Covered | Contact, Non-contact, Combined |

| Components Covered | Hardware, Software |

| Authentication Covered | Single-Factor Authentication, Multifactor Authentication |

| End Users Covered | Government, Defense Services, Banking and Finance, Consumer Electronics, Healthcare, Commercial Safety and Security, Transport/Visa/Logistics, Others |

| Region Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States biometrics market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the United States biometrics market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the biometrics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The biometrics market in the United States was valued at USD 7.2 Billion in 2025.

The United States biometrics market is projected to exhibit a CAGR of 11.50% during 2026-2034, reaching a value of USD 19.1 Billion by 2034.

Key drivers in the United States biometrics market are national security demand growth, digital identity system adoption, and growth in healthcare digitization. Contactless solution growth during the post-pandemic period and facial recognition and fingerprint sensor technology growth is also driving adoption across industries like transportation, banking, healthcare, and smart city infrastructure.

In 2025, the hardware component segment dominated the United States biometrics market with a share of 42.3%. The success is attributed to extensive application of biometric scanners, sensors, and cameras in airports, government centers, and hospitals. Biometric hardware forms the basis for identity verification, which is essential in facilitating security in both public and private sector applications.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)