United States Biopsy Devices Market Size, Share, Trends and Forecast by Procedure Type, Product, Application, Guidance Technique, End User, and Region, 2026-2034

United States Biopsy Devices Market Size and Share:

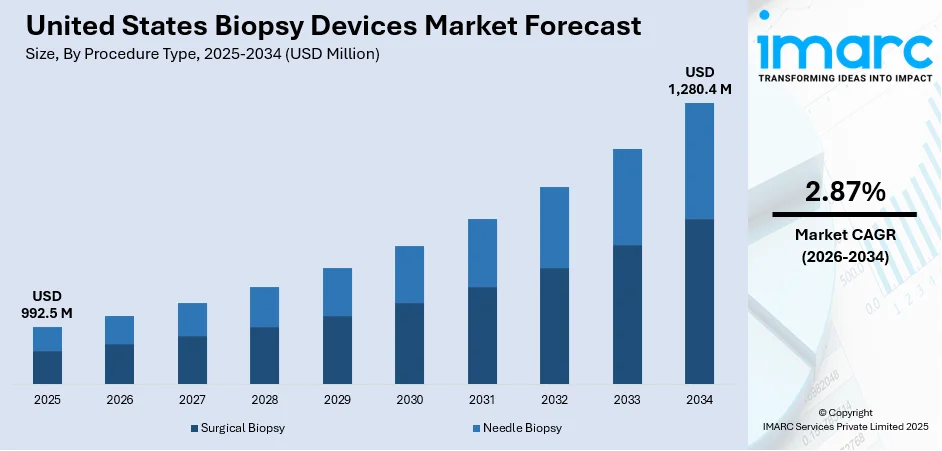

The United States biopsy devices market size was valued at USD 992.5 Million in 2025. The market is expected to reach USD 1,280.4 Million by 2034, exhibiting a CAGR of 2.87% during 2026-2034. South currently dominates the market share in 2025. A significant rise in the prevalence of chronic diseases such as cancer, continuous technological advancements in biopsy guidance systems, favorable reimbursement policies, and the presence of a robust healthcare infrastructure in the United States are some of the major factors propelling the United States biopsy devices market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 992.5 Million |

| Market Forecast in 2034 | USD 1,280.4 Million |

| Market Growth Rate (2026-2034) | 2.87% |

Access the full market insights report Request Sample

United States Biopsy Devices Market Analysis:

- Drivers of Growth: Growing emphasis on detection of disease at an early stage, improving technology in biopsy instruments, and increasing healthcare infrastructure are major growth drivers. Growing awareness and better access to diagnostic services also drive United States biopsy devices market demand.

- Kry Market Trends: Minimally invasive, image-guided biopsy, and AI-borne are on the trend. There's an increasing demand for automated, precise, and easy-to-use devices that enhance diagnosis speed and patient outcome in the clinical environment.

- Market Opportunities: Liquid biopsy and intelligent diagnostic device development creates significant opportunities. Growth in outpatient services, personalized medicine, and sample collection technique innovation fuels potential for long-term growth and uptake.

- Market Challenges: Advanced devices are expensive, and regulatory issues and occasional product recalls present challenges. Competition from new diagnostic techniques and clinician resistance can also affect market penetration and confidence in the United States biopsy devices market analysis.

To get more information on this market Request Sample

One of the driving forces behind the United States biopsy devices market is the nation's robust innovation ecosystem and fast tech-upgrade environment. The US has numerous of the world's top medical device companies and research facilities, allowing for ongoing advancement in diagnostic equipment, including biopsy devices. These advances have resulted in the development of minimally invasive, image-guided, and precision biopsy devices, which are more accurate and less uncomfortable for patients. As a case in point, vacuum-assisted biopsy systems and real-time imaging systems offer increased adoption rates with the ability to obtain better tissue samples and minimize procedure-related risks. These advances benefit greatly in fields like oncology where diagnosis needs to be timely and accurate. The FDA's moderately structured but accommodating regulatory environment also allows for more rapid market entry for new biopsy technologies, promoting continued R&D. Consequently, the US continues to be a center for next-generation biopsy devices, solidifying its dominance in international diagnostics, and further contributing to the United States biopsy devices market outlook.

Another key growth driver of the US biopsy devices market is the strong healthcare infrastructure of the country and rising incidence of chronic conditions, most notably many types of cancer. The United States boasts a very advanced system of hospitals, diagnostic laboratories, and specialty clinics with the latest imaging and procedural facilities, thus being favorable for extensive deployment of biopsy technology. The increasing disease load of conditions such as breast, lung, and prostate cancer, frequently linked with lifestyle and an aging population, drives a strong need for precise and early diagnostic tools. Biopsy operations are critical for final diagnosis of cancer, which in turn drives treatment and prognosis. In addition, public and medical awareness of the benefits of early disease detection has resulted in an increase in screening rates. Insurance coverage and government programs like Medicare and Medicaid also promote access to diagnostic procedures like biopsies, thereby making advanced biopsy devices more prevalent and driving the United States biopsy devices market growth.

United States Biopsy Devices Market Trends:

Rise in the Prevalence of Chronic Diseases

In recent years, the incidence of cancer has significantly escalated, making it one of the leading causes of death in the United States. For instance, it was estimated that in 2024, there would be 611,720 cancer-related fatalities and 2,001,140 new cases of cancer in the US. Effective diagnostic techniques are required to enable early diagnosis and treatment due to the increase in the burden of chronic diseases. Biopsy procedures serve as a cornerstone in the diagnostic pathway for cancer and many other diseases, offering insights at the cellular or tissue level that other diagnostic methods cannot provide. The demand for biopsy devices increases owing to the growing number of cancer cases as medical professionals seek more accurate and rapid diagnostic solutions. This urgency has translated into sustained investment in the sector and increased procurement of biopsy devices by healthcare institutions. As a result, the need for early and accurate diagnosis, fueled by the high prevalence of chronic conditions, acts as a significant driving force behind the growth of the biopsy devices market in the United States. In January 2023, the Prevent Cancer Foundation conducted its annual Early Detection Survey, which revealed that 65% of participants are not up to date on at least one of their routine cancer tests.

Ongoing Advancements in Technology

Advancements in technology, particularly in automation and imaging guidance, are driving the market further according to the United States biopsy devices market forecast. Emerging technologies are enhancing the capabilities of biopsy devices, making them more efficient, precise, and less invasive. Innovations such as real-time imaging guidance using ultrasound, MRI, or CT scans ensure higher accuracy during tissue sampling. This reduces the chances of repeat procedures and minimizes complications, improving patient outcomes. Moreover, the incorporation of automation in biopsy devices simplifies the procedure, making it more accessible for healthcare providers. These technological advancements bolster the effectiveness of biopsy procedures and elevate the confidence of medical practitioners in these diagnostic tools. As a result, healthcare institutions across the United States are increasingly adopting these advanced biopsy devices, fueling market growth.

Rising Geriatric Population

The other important market driver for the United States biopsy devices market is the increasing geriatric population. Chronic diseases such as cancer are major risk factors for aging as it brings about an accumulation of cellular damage and compromised immune response with age. With the U.S. population growing increasingly older and the Census Bureau predicting that by 2034 older adults will be more numerous than children for the first time, demand for diagnostic equipment like biopsy devices is projected to increase substantially. Older people are more likely to have routine health screens and diagnostic tests performed, so more accurate and less invasive procedures will be needed. This population trend is pressuring healthcare professionals to increase diagnostic offerings, resulting in greater use of biopsy technologies. As a result, the elderly population is likely to be a long-term driver for prolonged growth in the biopsy devices market throughout the nation.

United States Biopsy Devices Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States biopsy devices market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on procedure type, product, application, guidance technique, and end user.

Analysis by Procedure Type:

- Surgical Biopsy

- Needle Biopsy

Surgical biopsy stands as the largest component in 2025 in the United States biopsy devices market forecast. Surgical biopsy is often considered the gold standard for diagnosing various forms of cancer and other serious conditions, as it allows for the removal of a larger tissue sample. This provides a more comprehensive view of the cells and their architecture, facilitating a more accurate diagnosis. Besides this, the United States has a robust healthcare infrastructure with advanced surgical facilities, making surgical biopsies readily accessible to patients. Additionally, the favorable reimbursement environment encourages the use of surgical biopsy, as these procedures are often covered by insurance policies, reducing the financial burden on patients. Furthermore, the expertise and specialization available in the United States healthcare system enable a higher rate of surgical biopsies. Also, surgical biopsy is frequently used in cases where other types of biopsies, such as fine-needle aspiration or core needle biopsy, may not be suitable or have produced inconclusive results. This adds an additional layer of utility, making surgical biopsy a versatile and trusted option for diagnosis, thereby contributing to the segment growth.

Analysis by Product:

- Biopsy Guidance Systems

- Needle Based Biopsy Guns

- Biopsy Needles

- Biopsy Forceps

- Others

Biopsy guidance systems lead the market share in 2025. Biopsy guidance systems enhance the accuracy and precision of biopsy procedures by providing real-time imaging guidance, which is crucial for targeting specific tissue samples. This high degree of accuracy minimizes the likelihood of repeated procedures and reduces potential complications, thus improving patient outcomes and experience. Moreover, the integration of advanced technologies like ultrasound, MRI, and CT scans in biopsy guidance systems offers an additional layer of reliability and efficacy, making them indispensable in modern healthcare settings. Moreover, the country’s robust healthcare is well-equipped to adopt and implement these technologically advanced systems.

Healthcare providers highly value the contribution of guidance systems in ensuring successful biopsy procedures and, consequently, accurate diagnoses. The existing favorable reimbursement landscape in the United States further incentivizes healthcare institutions to invest in high-quality biopsy guidance systems, as these systems often meet the criteria for insurance coverage. Besides this, biopsy guidance systems are often compatible with various types of biopsy devices, ranging from fine-needle to vacuum-assisted biopsies, making them versatile and widely applicable across different medical conditions and tissue types. This adaptability increases their market penetration, as they can be used in multiple healthcare scenarios, thus fostering segment growth.

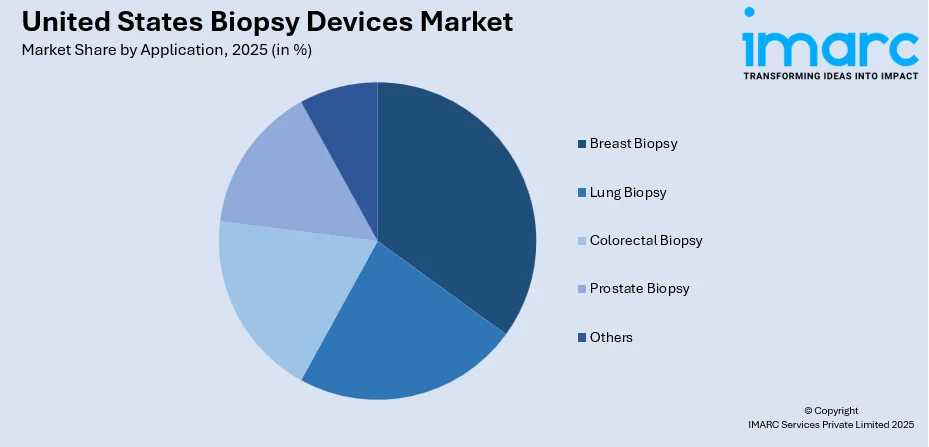

Analysis by Application:

To get detailed segment analysis of this market Request Sample

- Breast Biopsy

- Lung Biopsy

- Colorectal Biopsy

- Prostate Biopsy

- Others

Breast biopsy leads the market share in 2025. Breast cancer is one of the most common cancers in the United States, especially among women. The high incidence rate necessitates frequent and early-stage biopsies to confirm or rule out malignancies. Early detection is vital for effective treatment, and breast biopsies offer a reliable diagnostic tool for this purpose. In addition, the heightened public awareness about breast cancer, partly due to advocacy, educational initiatives, and widespread screening programs like mammography, prompts more women to seek early diagnosis, thereby fueling the demand for breast biopsy procedures. Advanced imaging modalities like MRI, ultrasound, and mammography, often used in conjunction with biopsy guidance systems, have improved the precision of breast biopsies. This ensures that the most suspicious tissue is sampled, enhancing the procedure’s diagnostic accuracy.

The United States, with its state-of-the-art healthcare infrastructure, is particularly well-suited for the widespread adoption of these advanced technologies. Additionally, the reimbursement landscape in the United States favors the use of biopsy procedures for breast cancer detection. Many insurance plans cover the costs of these procedures, thus encouraging more women to undergo breast biopsies without the deterrence of financial burden. Apart from this, the presence of leading market players in the country, who continually innovate in this space, ensures that the most efficient and least invasive breast biopsy devices are readily available, thus propelling the segment growth.

Analysis by Guidance Technique:

- Ultrasound-guided Biopsy

- Stereotactic-guided Biopsy

- MRI-guided Biopsy

- Others

Ultrasound guided biopsy leads the market share in 2025. Ultrasound-guided biopsy is minimally invasive, reducing the risk of complications and speeding up patient recovery. This makes it a highly preferred option for both healthcare providers and patients. Also, the procedure is generally quicker and less expensive than other imaging-guided techniques such as MRI or CT scans, which plays a significant role in a healthcare environment that is highly cost-sensitive. Technological advancements have also contributed to its dominance. Modern ultrasound equipment offers high-resolution imaging, allowing for precise targeting of the tissue to be biopsied. This accuracy is crucial for ensuring that the most diagnostically useful sample is obtained, thereby improving the quality of diagnoses. Moreover, ultrasound equipment is widely available in the United States and is often more accessible in various healthcare settings, including smaller or rural facilities, compared to more complex imaging systems like MRI machines. The flexibility of ultrasound-guided biopsy is another contributing factor. It is versatile and can be used for a range of tissue types and anatomical locations, including liver, kidney, and breast tissues, making it a highly adaptable diagnostic tool. Furthermore, the favorable reimbursement policies in the United States further accelerate the adoption of ultrasound-guided biopsy procedures. Many insurance plans recognize its diagnostic value and offer coverage, thus encouraging its use over other, more costly alternatives, supporting the segment growth.

Analysis by End User:

- Hospitals and Clinics

- Academic and Research Institutes

- Others

Hospitals and clinics lead the market with around 46.4% of market share in 2025. Hospitals and clinics are often the primary settings where advanced diagnostic procedures, including biopsies, are performed. They have the necessary infrastructure, ranging from state-of-the-art imaging equipment to specialized surgical facilities, which allows them to offer a broad range of biopsy methods. This comprehensive capability makes them a preferred choice for patients requiring biopsy procedures. Moreover, hospitals and clinics benefit from a multidisciplinary approach to patient care, with ready access to pathologists, radiologists, and specialists in various fields. This promotes effective and rapid diagnosis, enhancing the utility of biopsy devices in these settings. The availability of skilled medical personnel also ensures that biopsies are conducted under highly controlled conditions, which is crucial for the accuracy and reliability of the procedure.

Additionally, hospitals and clinics in the United States are more likely to receive insurance reimbursements for biopsy procedures, given their established record-keeping and compliance with healthcare regulations. The favorable reimbursement landscape encourages more patients to opt for biopsies within these settings, thus driving demand for biopsy devices. Along with this, hospitals and clinics are more accessible for the majority of the population, offering both emergency and scheduled healthcare services. This accessibility further boosts the number of biopsy procedures in these facilities, contributing to their leading market share. Besides this, the presence of in-house pathology labs in many hospitals and clinics enables quick turnaround times for biopsy results, which is a significant factor for patients and healthcare providers alike in urgent diagnostic scenarios, thereby catalyzing segment growth.

Regional Analysis:

- Northeast

- Midwest

- South

- West

In 2025, South accounted for the largest market share. South held the biggest share in the United States biopsy devices market since the region has a high population density and a diverse demographic makeup, leading to a higher prevalence of diseases that require biopsy for diagnosis, such as cancer. In addition, the South is home to several major cities and healthcare hubs equipped with advanced medical facilities, including state-of-the-art hospitals and specialized clinics. These healthcare institutions have the necessary infrastructure to adopt and utilize sophisticated biopsy devices, thereby driving the market. The region also benefits from a network of renowned academic and research institutions that focus on medical research and innovation. These organizations often collaborate with healthcare providers, spurring the adoption of cutting-edge biopsy technologies and methodologies. Another major contributing aspect is the availability of favorable insurance and healthcare policies, which make biopsy procedures more accessible and affordable to a broader range of people. The South region is witnessing significant healthcare investment both from the public and private sectors, which aids in the procurement of advanced medical devices, including biopsy devices. Furthermore, the extensive reach of healthcare services in the South, including in rural and underserved areas, fuels the uptake of biopsy devices. These areas often rely on larger healthcare hubs for advanced diagnostic services, which include biopsy procedures, positioning South as a leading regional market for biopsy devices in the United States.

Competitive Landscape:

The market is experiencing moderate growth as major companies are actively engaging in various strategies to maintain and enhance their market position. They are heavily investing in research and development (R&D) to create more advanced, efficient, and less invasive biopsy devices. Innovations often focus on improving accuracy, minimizing discomfort, and speeding up the diagnostic process. The development of new technologies, such as real-time imaging guidance systems, is a significant area of investment. Another critical strategy is mergers and acquisitions. Companies are strategically acquiring or partnering with other firms, including technology startups and specialized medical device companies, to expand their product portfolios and reach. This consolidation allows them to offer a more comprehensive range of biopsy solutions and strengthens their competitive edge. Furthermore, industry leaders are also concentrating on regulatory approvals to ensure their products meet the strict quality and safety standards set by healthcare authorities. Gaining approval from agencies like the U.S. Food and Drug Administration (FDA) lends credibility and facilitates the adoption of their devices in healthcare institutions. These leaders are also focusing on product launches to introduce new biopsy devices to the market, aiming to keep up with the United States biopsy devices market trends, and meet the evolving needs of healthcare providers and patients. These launches are often supported by robust marketing campaigns to increase product awareness and adoption rates. Additionally, players in the market are enhancing their distribution networks to ensure that their products are readily available across various healthcare settings, including hospitals, clinics, and diagnostic centers. They are often working with healthcare providers to offer training and support, ensuring that medical staff are well-equipped to use the new technologies effectively. Moreover, customer engagement and after-sales service are increasingly becoming focal points as providing timely maintenance, training, and customer support is crucial for retaining market share and building long-term relationships with healthcare institutions.

The report provides a comprehensive analysis of the competitive landscape in the United States biopsy devices market with detailed profiles of all major companies, including:

Latest News and Developments:

- May 2025: BiBBInstruments AB and TaeWoong Medical USA signed a Letter of Intent to commercialize EndoDrill® GI biopsy devices in the United States, aligning on a framework for a definitive distribution deal. The move followed FDA clearance, first U.S. sales in January 2025, and marked a pivotal step in BiBB’s U.S. expansion in biopsy devices.

- April 2025: Labcorp expanded its biopsy devices portfolio in the United States by launching Plasma Detect for assessing recurrence risk in stage III colon cancer and offering the FDA-authorized PGDx elio plasma focus Dx for treatment selection. The company enhanced its precision oncology reaches with blood-based liquid biopsy solutions that supported personalized cancer care.

- April 2025: The United States FDA granted Breakthrough Device Designation to Mursla Bio’s EvoLiver biopsy device, highlighting its potential for early liver cancer detection using Dynamic Biopsy technology. EvoLiver had shown 86% early-stage sensitivity and 88% specificity in U.S.-based trials for hepatocellular carcinoma surveillance.

- February 2025: Limaca Medical launched its Precision-GI™ biopsy device in the United States, backed by FDA clearance, CMS TPT reimbursement, and strong clinical trial results. The device consistently delivered high-quality biopsy samples for gastrointestinal and adjacent organ cancers, and initial U.S. sales began in the New York/New Jersey Metro area with cases completed at key medical centers.

- January 2025: At GRACE Breast Imaging & Medical Spa in Iowa, Siemens Healthineers installed its Mammomat B.brilliant mammography system, which has sophisticated 3D imaging and breast biopsy capabilities. The system provided the fastest tomosynthesis acquisition and improved early breast cancer detection with enhanced image quality.

United States Biopsy Devices Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

|

Scope of the Report

|

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Procedure Types Covered | Surgical Biopsy, Needle Biopsy |

| Products Covered | Biopsy Guidance Systems, Needle Based Biopsy Guns, Biopsy Needles, Biopsy Forceps, Others |

| Applications Covered | Breast Biopsy, Lung Biopsy, Colorectal Biopsy, Prostate Biopsy, Others |

| Guidance Techniques Covered | Ultrasound-guided Biopsy, Stereotactic-guided Biopsy, MRI-guided Biopsy, Others |

| End Users Covered | Hospitals and Clinics, Academic and Research Institutes, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States biopsy devices market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the United States biopsy devices market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States biopsy devices industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The United States biopsy devices market was valued at USD 992.5 Million in 2025.

The United States biopsy devices market is projected to exhibit a CAGR of 2.87% during 2026-2034, reaching a value of USD 1,280.4 Million by 2034.

The United States biopsy devices market is driven by the increasing prevalence of cancer, particularly breast, lung, and prostate cancers, necessitates early and accurate diagnostic methods, fueling demand for biopsy procedures. Technological advancements in biopsy devices, such as needle-based biopsy guns and vacuum-assisted systems, enhance precision and patient comfort, further driving market growth. Additionally, supportive healthcare policies and reimbursement frameworks facilitate access to these diagnostic tools, encouraging widespread adoption.

South currently dominates the United States biopsy devices market, driven by government investments in healthcare infrastructure enhance access to advanced diagnostic tools. The increasing prevalence of chronic diseases and cancer also drives demand for early detection methods. Additionally, the adoption of minimally invasive procedures improves patient outcomes and reduces recovery times.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)