United States Biosensors Market Size, Share, Trends and Forecast by Product, Technology, Application, End Use, and Region, 2026-2034

United States Biosensors Market Summary:

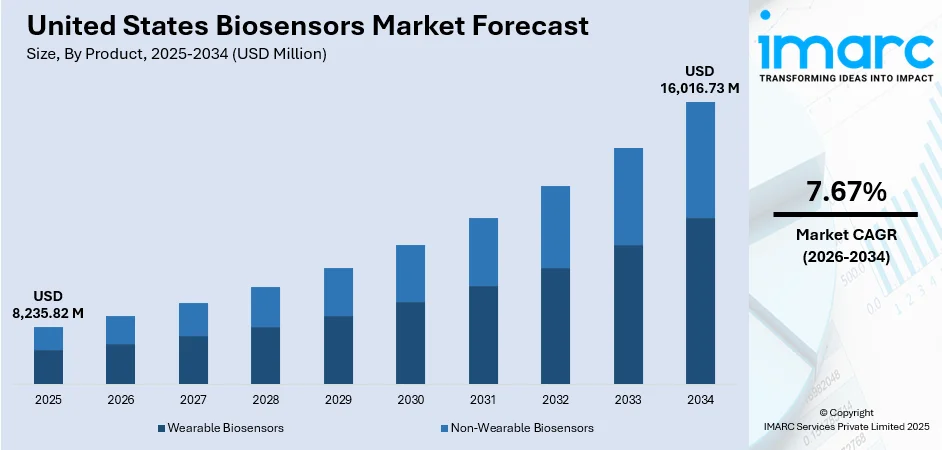

The United States biosensors market size was valued at USD 8,235.82 Million in 2025 and is projected to reach USD 16,016.73 Million by 2034, growing at a compound annual growth rate of 7.67% from 2026-2034.

The United States biosensors market is experiencing robust growth driven by the rising prevalence of chronic diseases, particularly diabetes and cardiovascular conditions, coupled with increasing demand for rapid diagnostic solutions. Technological advancements in miniaturization, wireless connectivity, and artificial intelligence integration are transforming diagnostic capabilities across healthcare settings. Growing consumer preference for continuous health monitoring, supportive regulatory frameworks facilitating over-the-counter device approvals, and expanding applications in point-of-care testing are strengthening market expansion. The convergence of healthcare digitalization and personalized medicine approaches is reshaping the biosensors landscape, positioning the market for sustained growth in the United States biosensors market share.

Key Takeaways and Insights:

-

By Product: Non-wearable biosensors dominate the market with a share of 57% in 2025, driven by widespread adoption in clinical diagnostics and point-of-care testing applications requiring immediate, accurate results without continuous user interaction.

-

By Technology: Electrochemical biosensors lead the market with a share of 72% in 2025, owing to their cost-effectiveness, high specificity, and extensive utilization in glucose monitoring devices for diabetes management across healthcare and home settings.

-

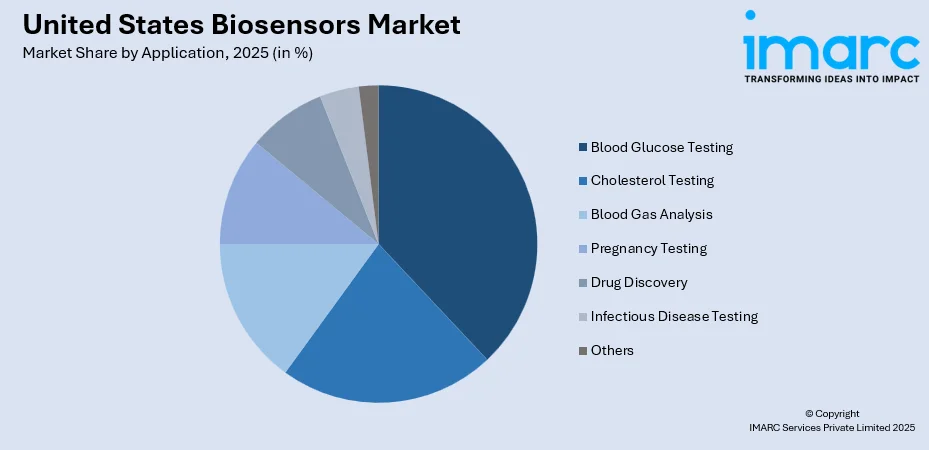

By Application: Blood glucose testing represents the largest segment with a market share of 38% in 2025, reflecting the substantial diabetic population in the United States and growing adoption of continuous glucose monitoring systems.

-

By End Use: Point of care testing holds the largest share of 38% in 2025, supported by the demand for rapid diagnostics in hospitals, clinics, and emergency departments enabling immediate clinical decision-making.

-

Key Players: The United States biosensors market exhibits a competitive landscape with established medical device corporations and innovative technology companies driving advancements. Major players are focusing on product innovation, strategic partnerships, and regulatory approvals to strengthen market positioning while expanding accessible healthcare solutions.

To get more information on this market Request Sample

The United States biosensors market is advancing as healthcare systems increasingly adopt diagnostic technologies enabling rapid, accurate detection of biological markers across clinical and home settings. The market benefits from a robust healthcare infrastructure, substantial research and development investments, and favorable regulatory pathways supporting medical device innovation. The United States Food and Drug Administration cleared the first over-the-counter continuous glucose monitoring devices in 2024, with Dexcom receiving approval for its Stelo Glucose Biosensor System in March 2024, followed by Abbott obtaining clearance for its Lingo and Libre Rio systems in June 2024, marking a significant expansion of accessible glucose monitoring technologies. Strategic industry collaborations, such as the Abbott-Medtronic partnership announced in August 2024 to develop integrated continuous glucose monitoring systems, are accelerating innovation and expanding market opportunities across the diabetes care ecosystem.

United States Biosensors Market Trends:

Expansion of Over-the-Counter Continuous Glucose Monitoring Devices

The regulatory landscape is transforming with FDA approvals enabling direct consumer access to continuous glucose monitoring technologies. This democratization of biosensor technology extends glucose monitoring beyond traditional prescription-based diabetes management to wellness-oriented consumers seeking metabolic health insights. The FDA's clearance of Dexcom's Stelo Glucose Biosensor System in March 2024, followed by Abbott's Lingo and Libre Rio systems in June 2024, represents a paradigm shift enabling individuals without insulin requirements to monitor glucose patterns without healthcare provider involvement. The first over-the-counter glucose biosensor in the United States, Stelo, was introduced in August 2024 and is intended for persons with Type 2 diabetes and prediabetes who do not take insulin. This demonstrates significant consumer demand for accessible metabolic monitoring solutions and supporting United States biosensors market growth.

Integration of Artificial Intelligence in Biosensor Technologies

Artificial intelligence and machine learning algorithms are increasingly embedded within biosensor platforms, enhancing diagnostic accuracy, predictive capabilities, and personalized health insights. AI-powered biosensors analyze complex biological datasets in real-time, enabling early disease detection and optimized treatment protocols. As of March 2025, the United States FDA has approved approximately 1,016 AI/ML-enabled medical devices, reflecting regulatory acceptance of intelligent diagnostic technologies. In October 2024, researchers at Pennsylvania State University received a three-year grant of USD 1.5 Million from the U.S. National Science Foundation to advance AI-designed biosensor research, demonstrating institutional commitment to intelligent biosensing innovations.

Strategic Industry Partnerships and Ecosystem Integration

Major industry players are forming strategic alliances to develop integrated health monitoring ecosystems combining biosensor data with comprehensive wellness platforms. These partnerships leverage complementary technologies to deliver holistic health management solutions exceeding standalone device capabilities. In August 2024, Abbott and Medtronic announced a unique global partnership to develop integrated continuous glucose monitoring systems, with Abbott providing FreeStyle Libre-based sensors for Medtronic's automated insulin delivery systems. Additionally, in November 2024, Dexcom invested USD 75 Million in Oura, enabling two-way data flow between Dexcom's biosensors and the Oura Ring for comprehensive metabolic health monitoring.

Market Outlook 2026-2034:

The United States biosensors market is positioned for substantial expansion driven by technological advancements, regulatory support for accessible diagnostics, and increasing chronic disease prevalence. The convergence of miniaturization, wireless connectivity, and artificial intelligence is enabling next-generation biosensor platforms offering unprecedented diagnostic capabilities across healthcare and consumer wellness applications. Healthcare system initiatives emphasizing preventive care, remote patient monitoring, and value-based outcomes are accelerating biosensor adoption across clinical settings. The market generated a revenue of USD 8,235.82 Million in 2025 and is projected to reach a revenue of USD 16,016.73 Million by 2034, growing at a compound annual growth rate of 7.67% from 2026-2034.

United States Biosensors Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product | Non-Wearable Biosensors | 57% |

| Technology | Electrochemical Biosensors | 72% |

| Application | Blood Glucose Testing | 38% |

| End Use | Point of Care Testing | 38% |

Product Insights:

- Wearable Biosensors

- Non-Wearable Biosensors

The non-wearable biosensors segment dominates with a market share of 57% of the total United States biosensors market in 2025.

Non-wearable biosensors integrated into diagnostic devices deliver substantial advantages through simplified operation, enhanced precision, and the capability to provide immediate diagnostic outcomes without requiring continuous user engagement. These devices have become indispensable in point-of-care testing environments, empowering healthcare professionals to obtain rapid diagnostic insights that support timely clinical decision-making. Their practicality and reliability make them essential tools across various medical settings and diagnostic applications.

The segment continues benefiting from ongoing technological advancements that improve detection sensitivity, enable device miniaturization, and enhance digital connectivity for seamless data transmission to healthcare management systems. These innovations are expanding the functional capabilities of non-wearable biosensors while improving their integration with existing medical infrastructure. Manufacturers are increasingly focusing on developing compact, connected solutions that streamline diagnostic workflows and support comprehensive patient monitoring across healthcare facilities.

Technology Insights:

- Electrochemical Biosensors

- Optical Biosensors

- Piezoelectric Biosensors

- Thermal Biosensors

- Nanomechanical Biosensors

- Others

The electrochemical biosensors segment leads the market with a share of 72% of the total United States biosensors market in 2025.

Electrochemical biosensors measure analyte concentrations through changes in electrical signals, offering low cost, high specificity, and scalability across medical and non-medical applications. These sensors are widely utilized in glucose monitoring devices for diabetic patients and in systems monitoring cardiac biomarkers and blood gases. The increasing prevalence of chronic conditions, particularly diabetes, drives substantial demand for electrochemical sensors as essential diagnostic tools supporting disease management and clinical decision-making across healthcare settings.

Material innovations continue advancing electrochemical biosensor capabilities, particularly with carbon nanotubes and graphene-based electrodes enhancing sensitivity and response times. Glucose monitoring strips and wearable electrochemical sensors for blood analysis are widely adopted in home diagnostics, enabling convenient self-monitoring for diabetic patients. Recent regulatory approvals for extended-duration continuous glucose monitoring systems represent significant advancements in electrochemical biosensor technology, extending sensor longevity while maintaining accuracy and reducing the frequency of device replacements.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Blood Glucose Testing

- Cholesterol Testing

- Blood Gas Analysis

- Pregnancy Testing

- Drug Discovery

- Infectious Disease Testing

- Others

The blood glucose testing segment holds the highest revenue with a 38% share of the total United States biosensors market in 2025.

Blood glucose testing represents the most established biosensor application, driven by the substantial diabetic population requiring regular glucose monitoring for effective disease management. The National Diabetes Statistics Report 2024 indicates that over 38.4 million Americans have diabetes, with 29.2% of adults aged 65 years or older affected, highlighting the extensive demand for glucose monitoring solutions.

The segment is experiencing transformation with the emergence of over-the-counter continuous glucose monitoring devices expanding market access beyond traditional prescription-based diabetes care. Regulatory clearances for OTC continuous glucose monitor systems represent significant milestones, enabling individuals managing diabetes with oral medications or those seeking metabolic insights to access CGM technology without prescriptions. This shift toward consumer accessibility is democratizing glucose monitoring and creating new growth opportunities across broader population segments seeking proactive health management solutions.

End Use Insights:

- Point of Care Testing

- Home Healthcare Diagnostics

- Research Laboratories

- Security and Biodefense

- Others

The point of care testing segment exhibits clear dominance with a 38% share of the total United States biosensors market in 2025.

Point-of-care testing encompasses diagnostic examinations conducted near the patient care site, delivering rapid results enabling immediate clinical decision-making. The growing incidence of chronic conditions requiring routine monitoring, combined with healthcare system emphasis on decentralized diagnostics, is accelerating biosensor adoption across hospitals, clinics, and ambulatory care facilities. The United States point-of-care diagnostics market size reached USD 13.1 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 23.3 Billion by 2033, exhibiting a growth rate (CAGR) of 6.6% during 2025-2033, reflecting substantial demand for rapid diagnostic solutions.

Technological innovations including IoT integration, AI-powered analytics, and cloud-based data sharing are significantly enhancing point-of-care testing capabilities and clinical utility. Remote patient monitoring has been incorporated into Medicare care models, with a substantial proportion of beneficiaries utilizing these services. This demonstrates growing institutional adoption of connected biosensor technologies across healthcare systems, enabling real-time health tracking and improved patient outcomes through seamless data connectivity.

Regional Insights:

- Northeast

- Midwest

- South

- West

The Northeast Region represents a significant biosensors market driven by the concentration of leading academic medical centers, research institutions, and biotechnology companies. Massachusetts and New York serve as innovation hubs with substantial venture capital investment in medical device startups and established presence of major diagnostics manufacturers supporting biosensor development and commercialization.

The Midwest Region demonstrates steady biosensors market growth supported by extensive healthcare networks, major medical device manufacturing facilities, and agricultural applications driving biosensor demand. Minnesota and Ohio host significant medical technology operations, while regional healthcare systems increasingly adopt point-of-care diagnostics for efficient patient management.

The South Region experiences robust biosensors market expansion driven by substantial population growth, increasing prevalence of chronic diseases particularly diabetes, and healthcare infrastructure investments. Texas and Florida represent major markets with growing demand for home healthcare diagnostics and point-of-care testing solutions serving diverse patient populations.

The West Region leads in biosensor innovation with California serving as the primary hub for medical technology development, venture capital funding, and regulatory expertise. The region benefits from proximity to Silicon Valley's technology ecosystem, fostering integration of digital health capabilities with biosensor platforms and driving wearable health monitoring device adoption.

Market Dynamics:

Growth Drivers:

Why is the United States Biosensors Market Growing?

Rising Prevalence of Chronic Diseases Driving Diagnostic Demand

The escalating burden of chronic diseases, particularly diabetes and cardiovascular conditions, is generating substantial demand for biosensor-based diagnostic and monitoring solutions across the United States healthcare system. The management and controlling of chronic conditions require continuous monitoring capabilities that biosensors uniquely provide, enabling patients and healthcare providers to track disease progression and treatment efficacy in real-time. Additionally, approximately 805,000 Americans suffer a heart attack each year. Of these, 200,000 have already experienced a heart attack, and 605,000 are experiencing their first. reinforcing the importance of biosensor-based cardiac surveillance for early detection and improved patient outcomes.

Technological Advancements Enhancing Biosensor Capabilities

Continuous technological advancements in miniaturization, wireless connectivity, artificial intelligence integration, and materials science are expanding biosensor functionality and application scope across healthcare settings. Innovations in sensor design, fabrication techniques, and data analysis algorithms are significantly improving the accuracy, convenience, and accessibility of biosensor-based diagnostics. The integration of machine learning algorithms enables predictive healthcare capabilities, identifying potential health risks before symptoms manifest.

Supportive Regulatory Environment Expanding Market Access

The U.S. Food and Drug Administration's evolving regulatory framework is facilitating biosensor innovation through expedited approval pathways, breakthrough device designations, and expanded over-the-counter access for consumer health technologies. Regulatory support for digital health technologies and medical device software is accelerating the integration of connected biosensor platforms into healthcare delivery systems. The FDA's clearance of the first over-the-counter continuous glucose monitors in 2024 represents a landmark regulatory decision expanding accessible health monitoring technologies to broader consumer populations. The agency's commitment to advancing digital health is demonstrated by the approval of AI/ML-enabled medical devices as of March 2025, providing regulatory clarity for intelligent biosensor development.

Market Restraints:

What Challenges the United States Biosensors Market is Facing?

Stringent Regulatory Requirements and Approval Timelines

The biosensors market faces challenges associated with stringent regulatory requirements governing medical device development, clinical validation, and market authorization. The FDA's rigorous approval process, while ensuring patient safety, requires substantial time and financial investment that can delay product launches and increase development costs for innovative biosensor technologies.

High Cost of Product Development and Commercialization

The development of advanced biosensor technologies requires substantial capital investment in research and development, clinical trials, manufacturing capabilities, and regulatory compliance. High upfront costs associated with bringing innovative biosensor products to market can limit participation from smaller companies and constrain innovation pace across the industry.

Sensor Stability and Biocompatibility Challenges

Technical challenges related to sensor stability, biocompatibility, and long-term accuracy continue to affect certain biosensor applications. Maintaining consistent performance across varying physiological conditions, ensuring biocompatibility for wearable and implantable devices, and addressing signal drift over extended use periods remain areas requiring ongoing research and development investment.

Competitive Landscape:

The United States biosensors market exhibits a highly competitive landscape characterized by the presence of established multinational medical device corporations, specialized diagnostics companies, and innovative technology startups. Market leaders are focusing on product portfolio expansion, technological differentiation, and strategic partnerships to strengthen competitive positioning. Companies are investing substantially in research and development to introduce advanced biosensor platforms featuring enhanced sensitivity, wireless connectivity, and artificial intelligence integration. Strategic collaborations between medical device manufacturers, technology companies, and healthcare providers are fostering ecosystem development and accelerating innovation. The competitive environment is further intensified by venture capital investment in biosensor startups and the entry of consumer technology companies into the health monitoring space.

Recent Developments:

- April 2025: Medtronic announced FDA approval in the United States for the use of the Simplera Sync sensor with the MiniMed 780G system. The Simplera Sync is an all-in-one disposable sensor featuring no fingerstick requirements with SmartGuard, overtape-free design, and a simplified two-step insertion process, advancing integrated diabetes management solutions.

- September 2024: The United States Food and Drug Administration approved Senseonics' Eversense 365, the first continuous glucose monitoring system designed to function for an entire year. The fully implantable CGM represents a significant advancement in long-term glucose monitoring technology, reducing the burden of frequent sensor changes typically required every 10-14 days with alternative systems.

United States Biosensors Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Wearable Biosensors, Non-Wearable Biosensors |

| Technologies Covered | Electrochemical Biosensors, Optical Biosensors, Piezoelectric Biosensors, Thermal Biosensors, Nanomechanical Biosensors, Others |

| Applications Covered | Blood Glucose Testing, Cholesterol Testing, Blood Gas Analysis, Pregnancy Testing, Drug Discovery, Infectious Disease Testing, Others |

| End Uses Covered | Point of Care Testing, Home Healthcare Diagnostics, Research Laboratories, Security and Biodefense, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The United States biosensors market size was valued at USD 8,235.82 Million in 2025.

The United States biosensors market is expected to grow at a compound annual growth rate of 7.67% from 2026-2034 to reach USD 16,016.73 Million by 2034.

Non-wearable biosensors, holding the largest share of 57%, dominate the United States biosensors market, driven by their extensive utilization in point-of-care testing environments where they deliver immediate diagnostic results with high accuracy for clinical decision-making.

Key factors driving the United States biosensors market include the rising prevalence of chronic diseases particularly diabetes, technological advancements in miniaturization and artificial intelligence integration, supportive regulatory environment expanding over-the-counter access, growing demand for point-of-care diagnostics, and increasing adoption of continuous health monitoring solutions.

Major challenges include stringent regulatory requirements and lengthy approval timelines, high costs associated with product development and commercialization, technical challenges related to sensor stability and biocompatibility, and the need for continuous innovation to meet evolving healthcare requirements.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)