United States Business Process Management Market Size, Share, Trends and Forecast by Deployment Type, Component, Business Function, Organization Size, Vertical, and Region, 2026-2034

United States Business Process Management Market Size & CAGR:

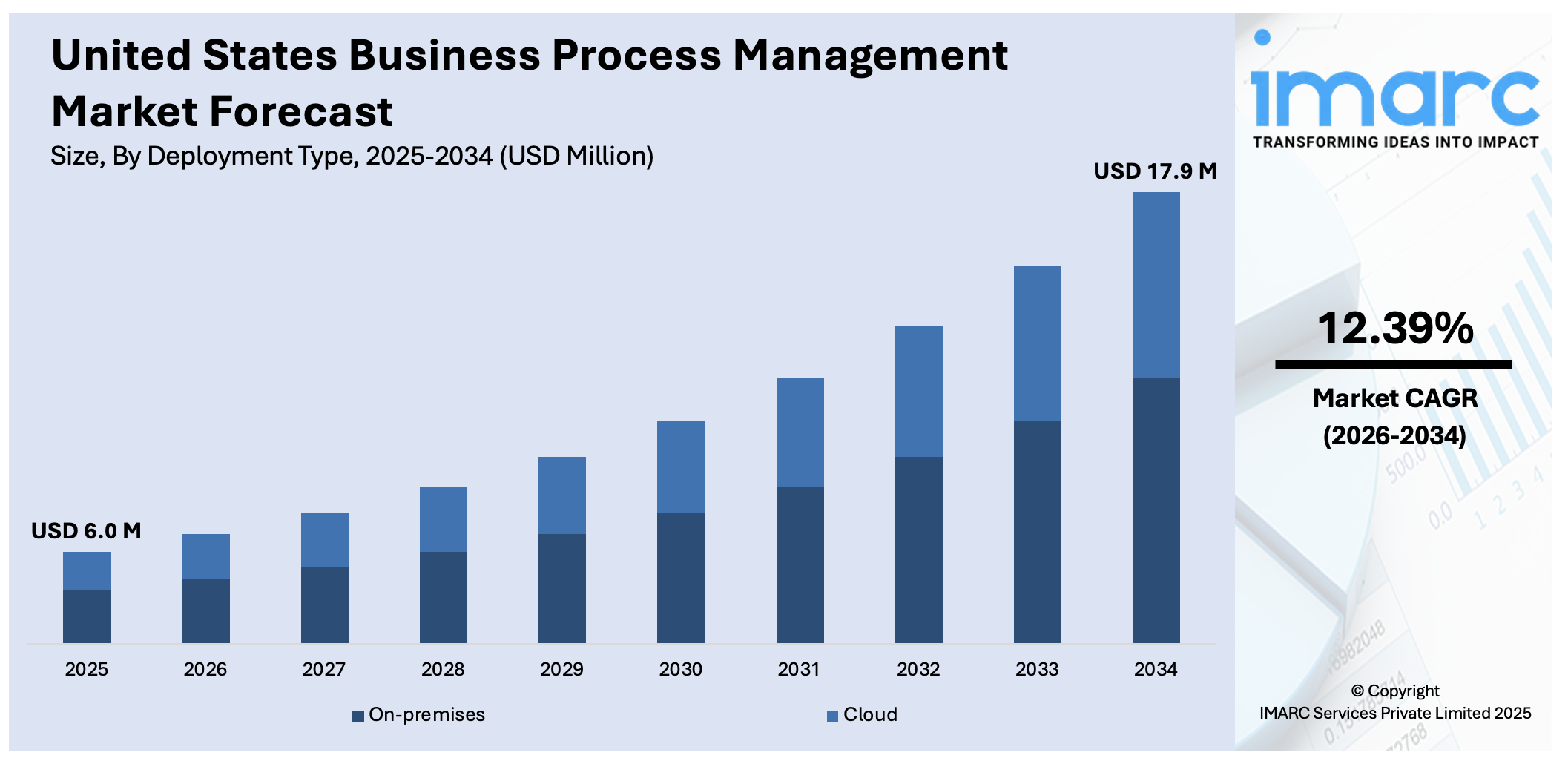

The United States business process management market size is calculated at USD 6.0 Million in 2025 and is forecasted to reach USD 17.9 Million by 2034, accelerating at a CAGR of 12.39% from 2026-2034. South dominates the market, holding a significant share in 2025. The market is witnessing significant growth as companies increasingly adopt BPM solutions to enhance efficiency, reduce costs, and streamline operations. The integration of AI, automation, and cloud-based platforms is driving innovation and improving decision-making across industries. With the growing focus on digital transformation and process optimization, the market is poised for continued growth, contributing to a significant United States business process management market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 6.0 Million |

| Market Forecast in 2034 | USD 17.9 Million |

| Market Growth Rate 2026-2034 | 12.39% |

The United States business process management market is primarily driven by the increasing need for operational efficiency and cost reduction. Businesses in various sectors are implementing BPM solutions to optimize workflows, automate routine tasks, and improve overall efficiency. BPM systems enable businesses to optimize resource utilization, reduce manual errors, and improve service delivery. With the growing emphasis on improving customer satisfaction and internal processes BPM is becoming integral to organizations aiming for better performance and competitive advantage in their sectors.

To get more information on this market Request Sample

Another key driver of United States BPM market is the growing demand for digital transformation and cloud-based solutions. As businesses move away from traditional legacy systems there is a surge in adoption of AI and cloud-based BPM platforms that offer scalability, flexibility, and seamless integration with other technologies. For instance, in April 2024, Brand Engagement Network (BEN) and Provana announced their partnership to integrate AI assistants into Provana’s contact center solutions, thereby enhancing compliance and business process management across various sectors, including health insurance and legal services. This collaboration aims to enhance customer experiences and operational efficiency by leveraging advanced conversational AI technology. These platforms empower organizations to adapt quickly to market changes, enhance collaboration, and enable real-time monitoring and data-driven decision-making, further contributing to the growth of the BPM market.

United States Business Process Management Market Trends:

Automation and AI Integration

The convergence of artificial intelligence (AI) and robotic process automation (RPA) is revolutionizing business processes through automating routine tasks and supporting better decision-making. AI-driven tools and RPA allow organizations to process huge amounts of data, minimize human errors, and maximize operational effectiveness. Automating routine tasks frees up capacities in businesses for more strategic initiatives. For instance, in May 2025, Boomi announced its partnership with AWS to enhance enterprise AI integration, automation, and SAP migration. This collaboration introduces the Boomi Agent Control Tower, integrated with Amazon Bedrock, to improve AI agent management and governance across multi-cloud environments, enabling organizations to scale AI initiatives securely and efficiently. This trend is increasingly being adopted across industries, driving growth in the business process management market outlook in the United States, as companies seek smarter, more efficient ways to streamline processes and improve overall productivity.

Cloud-Based BPM Solutions

Cloud-based Business Process Management (BPM) solutions are gaining widespread adoption in the United States due to their scalability, flexibility, and cost-effectiveness. By leveraging the cloud, businesses can streamline operations and scale their processes without the need for heavy upfront investments in infrastructure. Cloud BPM platforms allow organizations to quickly adapt to changing market conditions, integrate with other systems, and provide remote access, which enhances collaboration. For instance, in April 2025, Informatica unveiled new AI-driven features for its Intelligent Data Management Cloud, enhancing developer productivity and enterprise integration. The CLAIRE AI engine facilitates natural language processing for data pipelines and master data management, streamlining complex tasks and improving data accessibility. These innovations aim to accelerate AI initiatives across organizations. As more businesses migrate to the cloud, the United States business process management (BPM) market continues to expand, driven by the need for efficient, on-demand solutions.

Real-Time Data and Analytics

The need for real-time data monitoring and sophisticated analytics is growing quickly, as companies understand the importance of actionable insights to enhance decision-making and streamline processes. With real-time data, organizations can monitor performance indicators, pinpoint inefficiencies, and make quick modifications to boost results. Advanced analytics tools, powered by AI and machine learning, provide deeper insights into trends and patterns, enabling businesses to predict future challenges. This growing reliance on real-time analytics is expected to significantly influence the United States business process management market forecast, driving further adoption of BPM platforms with integrated data capabilities.

United States Business Process Management Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States business process management market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on deployment type, component, business function, organization size, and vertical.

Analysis by Deployment Type:

- On-premises

- Cloud

Cloud stands as the largest deployment type in 2025, holding around 63.5% of the market. This is driven by its scalability, flexibility, and cost-effectiveness, enabling businesses to manage their processes more efficiently without heavy infrastructure investments. Cloud-based BPM platforms provide smooth integration, instant access to data, and the ability to work remotely, which are essential for today's businesses. As organizations continue to embrace digital transformation, the United States business process management market outlook remains positive, with cloud solutions playing a central role in driving growth and innovation.

Analysis by Component:

- IT Solution

- Process Improvement

- Automation

- Content and Document Management

- Integration

- Monitoring and Optimization

- IT Service

- System Integration

- Consulting

- Training and Education

IT solutions have emerged as the leading force in the United States business process management market due to their ability to integrate advanced technologies such as AI, automation, and cloud computing. These solutions assist organizations in optimizing their operations, enhancing their decision-making processes, and boosting overall efficiency. By focusing on process improvement, IT-driven BPM platforms allow businesses to automate routine tasks and derive valuable insights. As digital transformation accelerates, the United States business process management market growth continues to be fueled by the increasing adoption of IT solutions that drive operational efficiency and innovation.

Analysis by Business Function:

- Human Resource

- Accounting and Finance

- Sales and Marketing

- Manufacturing

- Supply Chain Management

- Operation and Support

- Others

The human resource segment in the United States business process management market focuses on automating and optimizing HR functions like recruitment, onboarding, payroll, performance management, and employee engagement. BPM solutions improve efficiency, reduce errors, and enhance employee satisfaction, leading to cost savings and streamlined HR operations. This segment is crucial for organizations seeking to enhance their workforce management and compliance.

In the accounting and finance sector, BPM solutions help automate processes such as invoicing, budgeting, reporting, financial planning, and compliance management. By streamlining these activities, businesses can ensure greater accuracy, reduce manual errors, improve financial visibility, and accelerate decision-making. BPM solutions offer enhanced security and support regulatory compliance, allowing organizations to operate more efficiently in a complex financial environment.

BPM in sales and marketing focuses on streamlining lead generation, campaign management, customer relationship management, and sales reporting. By automating marketing processes, companies can reach their target audience more effectively, improve customer engagement, and increase conversion rates. Sales teams benefit from optimized workflows, accurate data analytics, and timely insights, ultimately driving higher sales and ROI through enhanced marketing efficiency.

In the manufacturing sector, business process management streamlines production workflows, inventory management, procurement, and quality control. BPM solutions enhance the speed and accuracy of manufacturing processes, reduce downtime, and improve operational efficiency. By automating repetitive tasks and integrating systems, manufacturers can achieve better resource utilization, lower operational costs, and improve product quality, leading to increased productivity and competitiveness.

BPM solutions in supply chain management focus on optimizing procurement, logistics, inventory management, and order fulfillment. By automating these processes, businesses can gain real-time visibility into their supply chains, reduce delays, and enhance coordination between suppliers, distributors, and customers. BPM also helps improve demand forecasting, reduce operational costs, and ensure timely deliveries, driving supply chain efficiency and improving customer satisfaction.

The operation and support function in BPM helps optimize routine business operations, such as IT service management, customer support, and business continuity planning. By automating and integrating support processes, organizations can improve response times, reduce costs, and enhance service quality. BPM tools enable real-time monitoring, improve issue resolution, and ensure better management of operational risks, thereby supporting seamless business continuity and customer satisfaction.

Analysis by Organization Size:

- Small and Medium-sized Enterprises

- Large Enterprises

Large enterprises lead the market with around 73.2% of market share in 2025 due to their complex operational needs and vast scale. These organizations require advanced BPM solutions to streamline processes, optimize workflows, and enhance efficiency across multiple departments. With significant resources and budgets, large enterprises are able to invest in comprehensive BPM systems that integrate AI, automation, and analytics for improved decision-making and process optimization. As companies increasingly adopt BPM solutions, they significantly influence the market by establishing industry benchmarks and promoting technological progress.

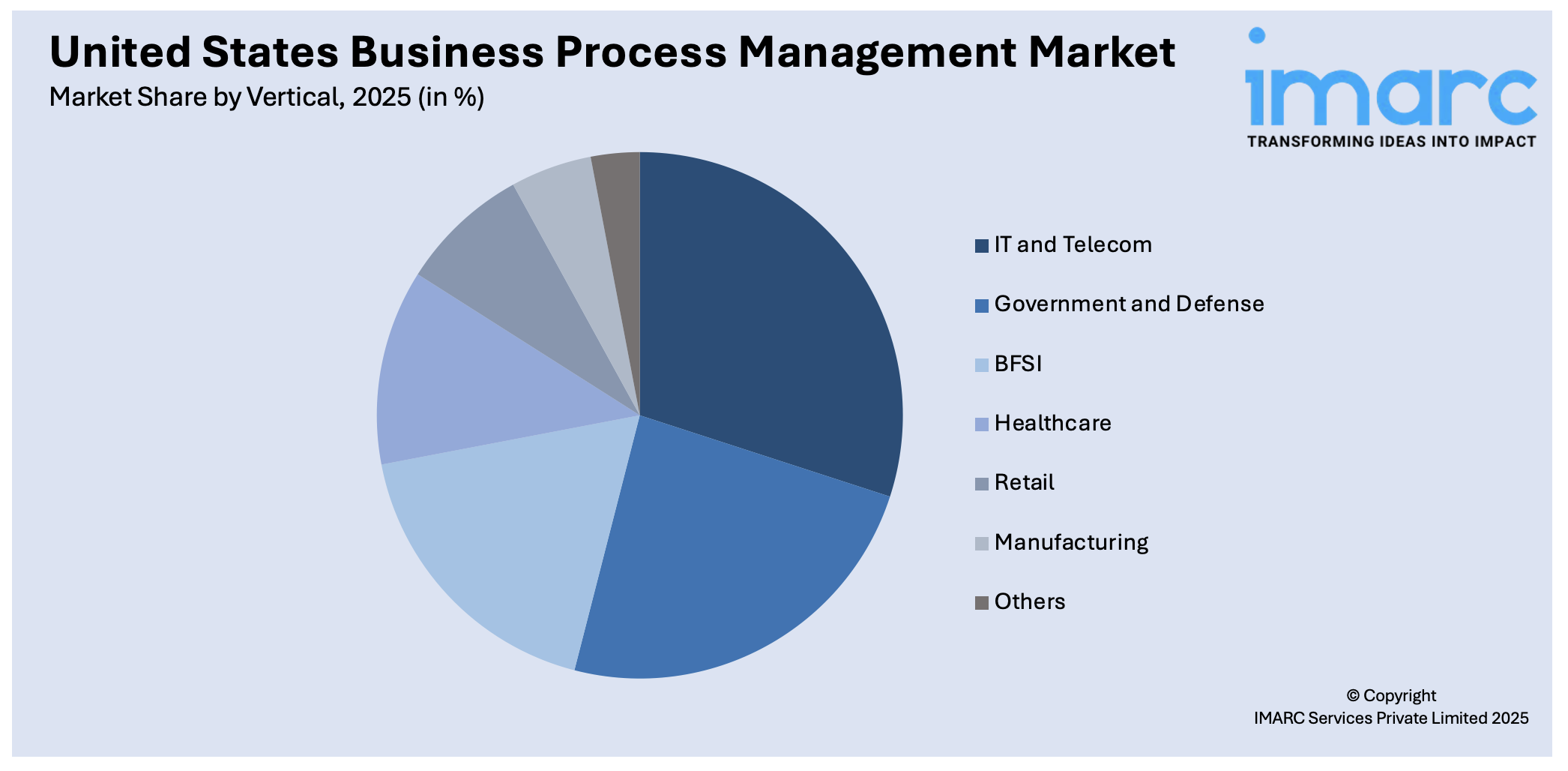

Analysis by Vertical:

Access the comprehensive market breakdown Request Sample

- Government and Defense

- BFSI

- IT and Telecom

- Healthcare

- Retail

- Manufacturing

- Others

IT and telecom lead the market with around 18.9% of market share in 2025 due to their need for enhanced efficiency, automation, and real-time data management. These industries rely on BPM solutions to streamline complex processes such as network management, customer support, service delivery, and billing systems. BPM helps these sectors reduce operational costs, improve service quality, and ensure compliance with industry regulations. By integrating automation, data analytics, and cloud technologies, IT and telecom companies can optimize workflows, improve customer experiences, and respond quickly to market demands, driving the significant growth of BPM in these industries.

Regional Analysis:

- Northeast

- Midwest

- South

- West

The Southern United States leads the business process management (BPM) market due to a strong presence of key industries such as manufacturing, healthcare, and logistics. Companies in this region are increasingly adopting BPM solutions to streamline operations, improve efficiency, and optimize supply chains. The region benefits from a growing number of businesses investing in digital transformation and automation technologies. Additionally, the Southern US has seen significant growth in tech hubs and a rising demand for BPM solutions to address the complex needs of various sectors, driving United States business process management market expansion.

Competitive Landscape:

The competitive environment of the U.S. business process management market is characterized by a mix of established companies and new entrants that provide a variety of solutions. These providers are focusing on enhancing product capabilities with advanced technologies such as AI, automation, and cloud-based platforms. Key strategies include continuous innovation, strategic partnerships, and acquisitions to expand market share. With increasing demand for process optimization, companies are focusing on developing scalable, flexible solutions tailored to various industries, driving intense competition within the market.

The report provides a comprehensive analysis of the competitive landscape in the United States business process management market with detailed profiles of all major companies.

Latest News and Developments:

- April 2025: Slingshot and Pronto BPO announced a strategic merger to enhance business process outsourcing services. The combined entity will serve US businesses initially, expanding to Europe, offering solutions like software development, telemarketing, virtual assistants, and tech support, with a focus on innovation and customer-centric service delivery.

- March 2025: ResultsCX acquired Aucera, expanding its presence in the US healthcare, BFSI, and utilities sectors. The deal adds 1,200 employees and strengthens CXM capabilities, complementing ResultsCX’s global footprint and technology investments, including AI and predictive analytics, to enhance customer experience management solutions.

- February 2025: FBSPL launched its Licensed Account Management Services in North America, integrating advanced business process management (BPM) strategies to streamline insurance operations. This offering enables agencies to outsource policy servicing, renewals, and compliance to licensed experts, enhancing efficiency, reducing administrative workload by 40%, and improving customer satisfaction and scalability.

- January 2025: OPEXUS and Casepoint merged with majority investment from Thoma Bravo to form a leading platform in data discovery and business process management. Serving over 100,000 government users, the merger enhances workflow automation, compliance, and data transparency across public and regulated enterprises, accelerating digital transformation and operational efficiency.

- August 2024: WNS announced a multi-year partnership with Pacific International Lines (PIL) to manage process automation using its Malkom.ai platform. This collaboration aims to enhance PIL’s digital transformation, improving operational efficiency and cost optimization across its global shipping network while supporting long-term innovation and customer centricity.

United States Business Process Management Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Deployment Types Covered | On-premises, Cloud |

| Components Covered |

|

| Business Functions Covered | Human Resource, Accounting and Finance, Sales and Marketing, Manufacturing, Supply Chain Management, Operation and Support, Others |

| Organization Sizes Covered | Small and Medium-sized Enterprises, Large Enterprises |

| Verticals Covered | Government and Defense, BFSI, IT and Telecom, Healthcare, Retail, Manufacturing, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States business process management market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the United States business process management market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States business process management industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The business process management market in the United States was valued at USD 6.0 Million in 2025.

The United States business process management market is projected to exhibit a CAGR of 12.39% during 2026-2034, reaching a value of USD 17.9 Million by 2034.

Key factors driving the United States business process management (BPM) market include the increasing need for operational efficiency, cost reduction, and automation across industries. The growing adoption of cloud-based BPM solutions, digital transformation initiatives, and the demand for enhanced customer experiences are also significant contributors to market growth.

The South region accounts for the largest share in the United States business process management market. This is driven by the concentration of key industries such as healthcare, manufacturing, and retail in the region, along with a growing emphasis on digital transformation and operational efficiency. The presence of several BPM service providers and the adoption of cloud-based solutions further contribute to the region’s dominance.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)