United States Business Travel Market Size, Share, Trends and Forecast by Type, Purpose Type, Expenditure, Age Group, Service Type, Travel Type, End User, and Region, 2025-2033

United States Business Travel Market Size and Share:

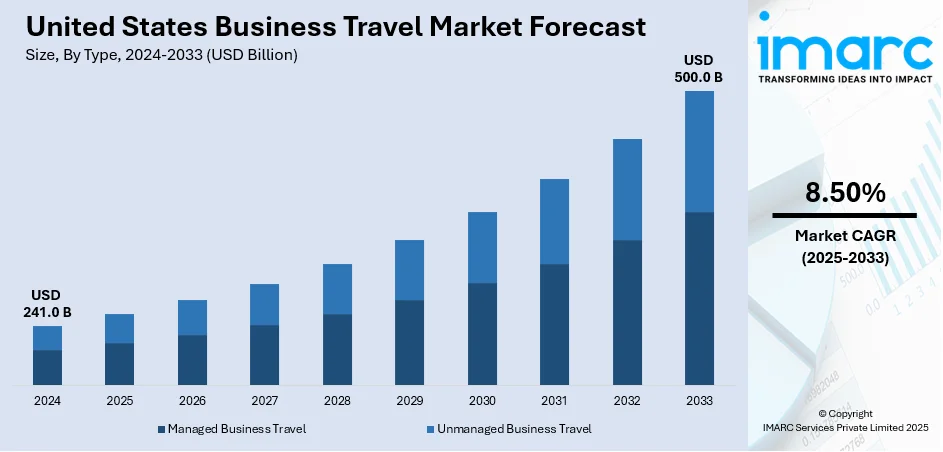

The United States business travel market size reached USD 241.0 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 500.0 Billion by 2033, exhibiting a growth rate (CAGR) of 8.50% during 2025-2033. The market is transforming with phenomena like the blurring of corporate and leisure travel, increased focus on sustainable business travel, and the universal use of digital management tools. These changes are a response to altered employee expectations, greater environmental concerns, and optimizing operations. With companies more and more customizing business travel policies according to contemporary needs, the market is experiencing a widespread diversification of destinations and services, affecting the United States business travel market share considerably.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 241.0 Billion |

|

Market Forecast in 2033

|

USD 500.0 Billion |

| Market Growth Rate 2025-2033 | 8.50% |

United States Business Travel Market Insights:

- Major Market Drivers: United States business travel market size is fueled by the resurgence of face-to-face meetings, growth of corporate activities across geography, and hybrid work arrangements requiring regular face-to-face collaboration to facilitate relationship development, negotiation, and project implementation.

- Key Market Trends: Dominant trends in the industry are the convergence of business and leisure travel, growing corporate emphasis on sustainability, and pervasive adoption of digital platforms to enable more efficient bookings, expense reporting, and compliance tracking, positively impacting traveler experience and management control.

- Competitive Landscape: Market competition is between legacy travel agencies, corporate travel management firms, and newer technology-focused platforms. Players are segmenting by offering personalized services, dynamic pricing, and data analytics features to cater to changing corporate needs and maintain traveler safety and satisfaction.

- Challenges and Opportunities: Challenges are increased travel expenses, compliance with sustainability, and risk management. Opportunities lie in embracing digital solutions, making travel policies responsive to remote workers, and delivering innovative services aligned with the needs of modern businesses as well as the preferences of employees.

To get more information on this market, Request Sample

In America, business travel is shaped in largely by the existence of the nation's key financial and corporate centers that necessitate recurring face-to-face contact. New York, Chicago, San Francisco, and Houston alone have the high-profile headquarters of finance, technology, and energy and act as hubs for pivotal industry conferences, investor meetings, and board-level gatherings. US firms value face-to-face deal-making highly, especially in fields such as Boston's biotech and Seattle's aerospace, where engineering test models or strategic alliances frequently demand on-site visits. Moreover, the connectivity of these clusters, facilitated by widespread domestic air networks and more than one hub-and-spoke model flown by US carriers, facilitates effective travel between regional offices. The need for physical attendance in contract closures, merger negotiations, or company leadership retreats compels bookings in business class and premium economy, whereas frequent-flier reward schemes continue to be a key factor for US corporate travel planners to optimize rewards to employees and minimize overall cost effects.

The United States business travel market growth is also influenced by the region’s dynamic adoption of digital platforms and flexible work patterns. While virtual meetings are becoming increasingly prevalent, American business leaders typically see in-person engagement as necessary for establishing trust and showing commitment, particularly in client pitches or key project reviews. Therefore, hybrid travel approaches are being developed, balancing remote work and travel days scheduled around key client-facing activities. Meanwhile, technology adoption—be it mobile-first cost reporting and AI-supported itinerary planning or e-visas and digital health credentials—has made corporate travel more efficient. Startups and Silicon Valley-, Austin-, and Boston-based tech-savvy companies are leading the charge with digital solutions that minimize administrative tasks for employees on the move, making business travel convenient and flexible. These innovations invite mid-level employees as well as top executives to travel for training seminars, roadshows for sales, or strategy meetings. Additionally, the cultural significance given to networking and mentorship within US corporate hierarchies assures that face-to-face travel retains high priority levels in the face of increasing digital options, assuring continued development and refinement in business travel products and corporate policy direction.

United States Business Travel Market Trends:

Increased Bleisure Travel Among United States Professionals

As per the United States business travel market analysis, the growing tendency of travel industry is the convergence of business and leisure travel, typically referred to as bleisure travel. Industry professionals and business travelers are intensely taking business travel beyond the office by adding leisure time to work trips, particularly in city or culturally vibrant locations. This move is driven by changing work-life choices and the growth of hybrid and remote work regimes that accommodate flexible schedules and longer stays. According to a May 2025 YouGov/Crowne Plaza survey, 74% of American professionals would take a friend or relative on a business trip, and nearly 1 in 5 have done so in secret, highlighting a blurring of work and leisure, particularly in Gen Z and millennials. Moreover, business travelers increasingly demand accommodations that provide both productivity-inducing amenities and entertainment opportunities. This mode supports local tourism economies and urges service vendors to develop more tailored packages. Specifically, younger executives are more likely to favor destinations with dining, cultural, or wellness facilities. United States business travel market outlook is being highly diversified as the trend drives bookings into a broader array of travel service categories beyond traditional corporate requirements, including high-end leisure resorts and boutique accommodations that increasingly serve working professionals.

Focus on Green Corporate Travel Policies

Environmental consciousness is influencing U.S. corporate travel choices. Companies are making a conscious effort to incorporate sustainability into their business travel policies by promoting low-emission transport, eco-certified hotels, and remote meetings when possible. Travel management practices increasingly involve tracking emissions, environmentally friendly vendor relationships, and carbon offsetting. It is all about taking a step in line with overall environmental, social, and governance (ESG) objectives. Additionally, procurement staff are also under greater pressure to assess sustainability qualifications prior to making a contract with travel service providers. This change is transforming pattern of demand in the United States business travel market trends, impacting supply chain and destination promotion. Consequently, companies are not only concerned about cost-effectiveness and efficiency but also reducing environmental footprints. Sustainable travel initiatives also are boosting employee engagement, since most professionals want to work for organizations that emphasize responsible traveling habits and sustainability in their mobility strategies.

Expansion of Digital Solutions for Trip Management

Technology is reshaping how business travel is organized and managed in the United States. From AI-driven itinerary planning to real-time expense management tools, digital solutions are streamlining operations and simplifying administrative tasks for traveling professionals. Integrated platforms now enable seamless booking, approval workflows, communication, and compliance tracking within a unified system. Moreover, predictive analytics and mobile travel assistants integration augments personalization and security while traveling. These advancements facilitate increased operational efficiency for both travel managers and employees. Additionally, the GBTA had indicated that 68% of U.S. business travelers now extend their stays for leisure purposes an average of 2.8 additional days compared to 2023 levels, which indicates how streamlined digital tools are also facilitating the growth in bleisure travel. Further, with accelerating businesses automating travel-related activities, the United States business travel market growth is being fueled by increased demand for end-to-end, technology-enabled solutions. At the same time, these sites also provide data-driven insights to policy optimization and cost management. These kinds of digital shifts form the core of the market analysis, creating an extensible platform for travel programs that are more responsive, compliant, and aligned with corporate objectives.

United States Business Travel Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States business travel market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on type, purpose type, expenditure, age group, service type, travel type, and end user.

Analysis by Type:

- Managed Business Travel

- Unmanaged Business Travel

Unmanaged business travel stands as the largest component in 2024. Unmanaged business travel has become the top form segmentation in the United States business travel market, fueled by small to mid-size businesses' changing requirements and the growing adaptability of hybrid workspaces. Unlike travel programs, unmanaged travel permits employees to reserve flights, hotels, and transportation individually on their own, frequently utilizing consumer-facing channels. This model resonates with startups, freelancers, and emerging businesses concerned with cost savings and expediency at the expense of aggressive policy compliance. The distributed nature of unmanaged travel reflects American business culture that emphasizes autonomy and fast decision-making. Staff have greater access to control over schedules and preferences, usually resulting in higher satisfaction levels and faster trip realization. In addition, the growth of easy-to-use travel apps and online booking tools has increased the ease of implementing this model without full-fledged travel departments. As flexibility and agility become increasingly important, unmanaged travel continues to characterize much of the US business travel market.

Analysis by Purpose Type:

- Marketing

- Internal Meetings

- Trade Shows

- Product Launch

- Others

Marketing stands as the largest component in 2024. Marketing is the dominant purpose type segmentation in the United States business travel economy, fueled by the nation's vibrant economy and extremely competitive business environment. Firms in industries spend on travel to aid product launches, client visits, brand promotion, trade shows, and industry conferences. Between tech expos in San Francisco and fashion weeks in New York, marketing-related travel is crucial for brand discovery and customer interaction. American companies realize the importance of face-to-face communication in establishing trust, demonstrating innovations, and securing high-value transactions. Local marketing teams frequently move across the country to coordinate campaigns, participate in workshops, and collaborate with outside agencies. Furthermore, with digital marketing growing at a breakneck pace, live conferences and industry summits provide the essential networking and learning opportunities difficult to achieve online. Consequently, business travel with a marketing emphasis is promotion along with an investment in growth and relationship-building throughout the United States and global markets.

Analysis by Expenditure:

- Travel Fare

- Lodging

- Dining

- Others

Lodging stands as the largest component in 2024. Lodging is the leading segmentation within the United States business travel market, mirroring both the length of time and frequency of corporate travel throughout the United States. With a geographically widespread and economically varied landscape, business travelers frequently need overnight stays in major hubs such as New York, San Francisco, Chicago, and Atlanta. Hotels targeting this clientele of professionals have an array of amenities designed for professionals, including high-speed internet, meeting facilities, co-working areas, and variable check-in times. In addition, the increase in premium and boutique hotels has forced consumers to change their preference towards more comfortable and experiential stays. Businesses are increasingly focusing on traveler comfort to enhance productivity and wellness, leading to willingness to pay more for high-quality accommodations. Multi-day business trips, travel for projects, and blended work arrangements also lead to lengthier stays, contributing further to higher accommodation spend. As corporate travel policies continue to shift, lodging is the most stable and substantial category of spend on, as observed through the United States business travel market trends.

Analysis by Age Group:

- Travelers Below 40 Years

- Travelers Above 40 Years

Travelers below 40 years stands as the largest component in 2024. Travelers under 40 years of age account for the most dominant age group segmentation in the US business travel industry, driven in large part by the increased prevalence of younger professionals in decision and client-facing positions. This age group, comprised mostly of millennials and young Gen X professionals, is heavily embedded in fast-paced industries like technology, media, finance, and consulting—industries that value agility, innovation, and direct interaction. These younger corporate travelers are also more likely to adopt hybrid work cultures, frequently mixing work and play in travel arrangements. They are also digital natives, preferring mobile apps and self-service platforms to book, expense, and manage itineraries. Their experience-oriented travel style has shaped the market towards boutique hotels, sustainable accommodation facilities, and adaptable workspaces. Since businesses are hence increasingly assigning outreach, sales, and collaboration tasks to younger talent, the age group continues to lead the number of domestic and international business trips throughout the United States, impacting future travel policies and trends.

Analysis by Service Type:

- Transportation

- Food and Lodging

- Recreational Activities

- Others

Food and lodging lead the market share in 2024. Food and lodging are the top service type segmentation of the United States business travel market, mirroring professionals' basic needs when traveling for long durations or to unfamiliar cities. Accommodation, including hotels and extended-stay facilities, provides amenities of comfort, security, and productivity elements like Wi-Fi, work areas, and proximity to business centers. Food services—hotel dining to corporate meal stipends—provide essential energy and convenience to sustain through demanding schedules. Business travelers usually look for high-quality dining commensurate with their diet needs and time pressures, spurring demand for on-site dining options, room service, and alliances with local restaurants. Numerous corporate travel programs combine food and accommodations into per diems per day, making it easier to reimburse and budget. Hotels too have confirmed by providing company-oriented meal plans and flexible mealtimes in conformity with diverse schedules. Both food and accommodations comprise the majority of corporate travel spend, enabling performance and comfort throughout the experience.

Analysis by Travel Type:

- Group Travel

- Solo Travel

Group travel leads the market share in 2024. Group travel is the number one type of segmentation in the United States corporate business travel sector that is dictated by corporate meetings, conferences, team-building retreats, and industry conferences. Businesses often send groups of employees to trade shows, product launches, training workshops, or strategic planning sessions. Group travel encourages collaboration and sharing of knowledge, as well as assists organizational aims such as unit cohesion and collective brand presence. The U.S. has a vast array of convention centers, resort-convention properties, and corporate hotels that specialize in group traveling with block reservations, meeting packages, and customized services. In addition, corporate planners typically negotiate discounted transportation and accommodations for groups, making it an affordable choice for corporations. Group travel also follows along with increased interest in experiential and well-being-focused events, where teams work and play together. This makes group travel a productivity and employee engagement tool of strategy for US businesses, which further helps increase the United States business travel market demand.

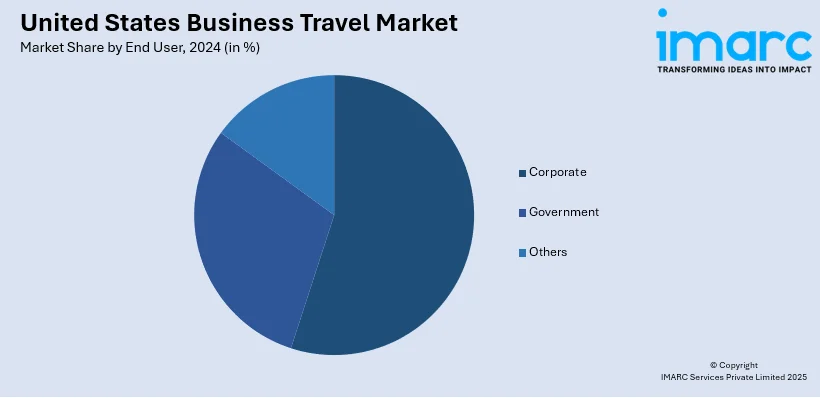

Analysis by End User:

- Government

- Corporate

- Others

Corporate leads the market share in 2024. Corporate organizations are the prominent end user segment of United States business travel, driven by the nation's huge and diversified economy. Ranging from Fortune 500 firms to medium-sized businesses, organizations in various industries depend upon business travel to generate sales, oversee alliances, visit industry conferences, and facilitate operations in several locations. Corporate travel is deeply embedded in sectors such as finance, technology, pharmaceuticals, and manufacturing, where face-to-face interactions are critical for decision-making, client retention, and competitive positioning. These companies often have structured travel policies, dedicated travel managers, and partnerships with travel service providers to streamline logistics and control costs. In addition, US companies are spending on personalized travel options that reconcile productivity with employee wellness, including preferred hotel programs, loyalty memberships, and online expense tools. With company travel at the heart of business strategy, expansion, and employee development, the corporate industry continues to lead demand and expenditure in the US business travel market.

Regional Analysis:

- Northeast

- Midwest

- South

- West

In 2024, Midwest accounted for the largest market share. The Midwest is the most prominent regional breakdown of the United States business travel market because it has a strategic position, diversified economy, and robust infrastructure. Cities such as Chicago, Minneapolis, St. Louis, and Detroit are key centers for financial services, manufacturing, healthcare, and logistics industries. Chicago specifically serves as a hub gateway with O'Hare International Airport providing vast domestic and international routes, making it suitable for business meetings, conventions, and inter-regional travel. The affordability of the region over coastal regions also makes it suitable to host large corporate events and team meetings. The Midwest is also home to various Fortune 500 corporations and an increasing number of tech startups, further contributing to business travel demand. Conference facilities, corporate hotels, and combined transit systems facilitate quick movement and mass transit. The alliance of affordability, mid-point access, and economic power makes the Midwest a force in determining US business travel trends.

Competitive Landscape:

Major players in the United States business travel space are resorting to strategic measures to fuel growth and keep pace with changing corporate requirements. Top travel management firms are heavily investing in technology to simplify bookings, expense reports, and itineraries, providing integrated platforms to improve user experience and policy adhesion. Airlines and hotel brands are joining forces with companies to offer customized loyalty programs, negotiated rates, and flexible cancellation policies to poach and retain business travelers. Moreover, big players such as American Express Global Business Travel and SAP Concur are using data analytics to offer actionable data, enabling companies to better optimize travel spend and enhance safety tracking. Hotels are enhancing their facilities with specialized co-working areas, wellness centers, and touchless services to appeal to younger business travelers' tastes. Further, businesses are partnering with event planners to host hybrid conferences and off-site retreats that foster team interaction. Major players are also focusing on sustainability through introducing carbon offsetting possibilities and encouraging eco-friendly stays. These joint efforts demonstrate a collective industry-wide emphasis on maximizing convenience, cost savings, and employee welfare, hence maintaining the pace of corporate travel rehabilitation. Such actions by leading stakeholders further consolidate the base and growth of the United States business travel market.

The report provides a comprehensive analysis of the competitive landscape in the United States business travel market with detailed profiles of all major companies, including:

Latest News and Developments:

- In May 2025, JTB Business Travel introduced Teal, a cloud-based travel platform run on the Spotnana engine, that seeks to redefine corporate travel management. Teal provides end-to-end visibility in real-time, smooth global rollouts, and mobile-optimized booking for air, hotels, rail, and car rentals, with support available in more than 15 countries with future plans to cover 25.

- In November 2024, U.S. Bank introduced a new Travel Center with Booking.com, providing credit cardholders with deeper hotel, flight, and rental car booking powered by Rocket Travel by Agoda's cutting-edge technology. The site features discounts, 24/7 customer service, and secure checkout options to enhance the traveling experience.

United States Business Travel Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

|

Scope of the Report

|

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Managed Business Travel, Unmanaged Business Travel |

| Purpose Types Covered | Marketing, Internal Meetings, Trade Shows, Product Launch, Others |

| Expenditures Covered | Travel Fare, Lodging, Dining, Others |

| Age Groups Covered | Travelers Below 40 Years, Travelers Above 40 Years |

| Service Types Covered | Transportation, Food and Lodging, Recreational Activities, Others |

| Travel Types Covered | Group Travel, Solo Travel |

| End Users Covered | Government, Corporate, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States business travel market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global United States business travel market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States business travel industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The business travel market in the United States was valued at USD 241.0 Billion in 2024.

The United States business travel market is projected to exhibit a CAGR of 8.50% during 2025-2033, reaching a value of USD 500.0 Billion by 2033.

The market is spurred on by increasing corporate globalization, expansion in small and medium-sized businesses, and greater involvement in global trade activities. High-speed connectivity, luxury travel experiences, and AI-driven itinerary optimization are also key drivers of market expansion. Furthermore, the trend toward sustainable travel and work-from-wherever policies facilitates changing business travel requirements.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)