United States Camel Dairy Market Size, Share, Trends, and Forecast by Product Type, Distribution Channel, Packaging, and Region, 2026-2034

United States Camel Dairy Market Size and Share:

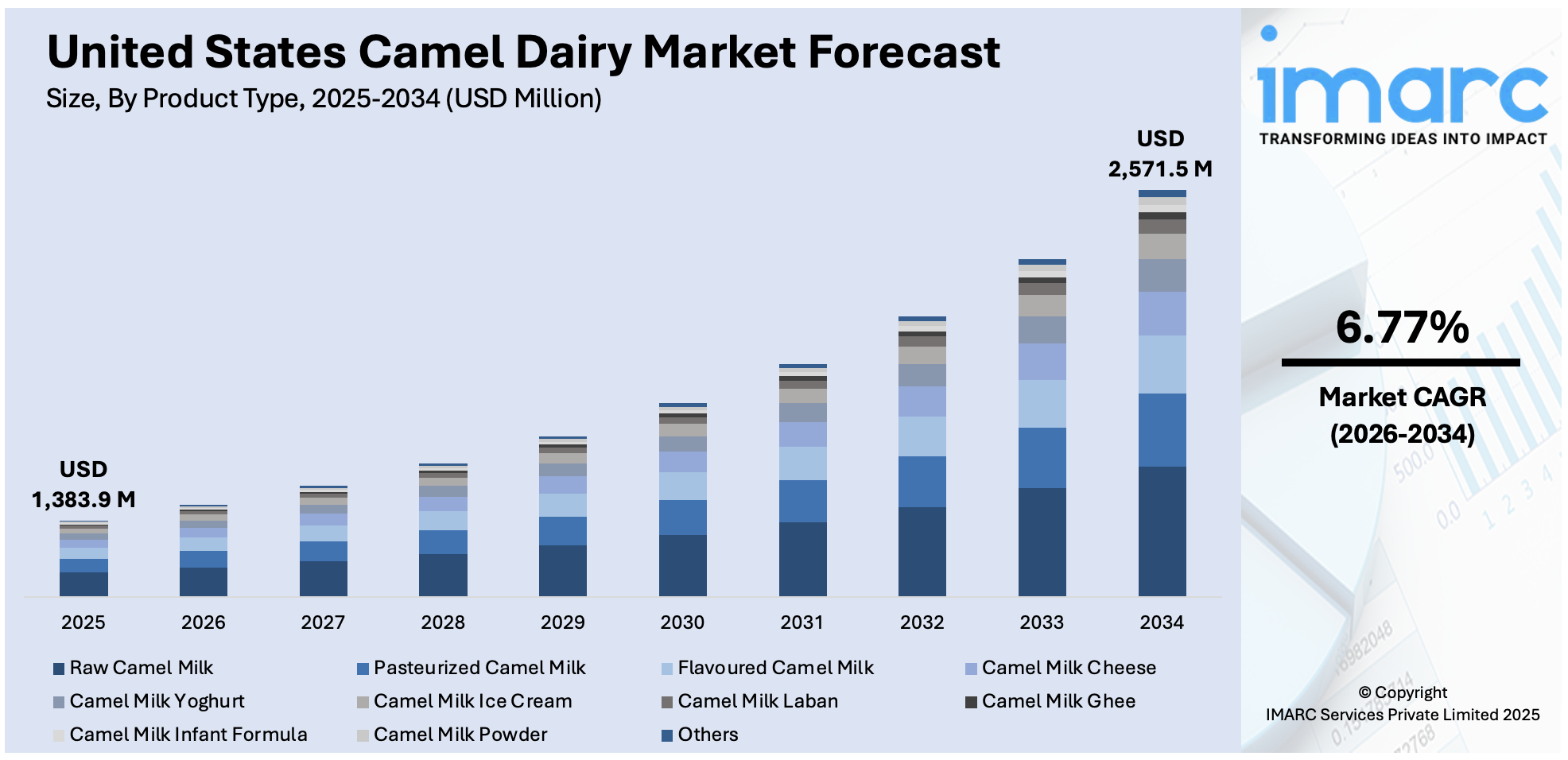

The United States camel dairy market size was valued at USD 1,383.9 Million in 2025. Looking forward, the market is expected to reach USD 2,571.5 Million by 2034, exhibiting a CAGR of 6.77% during 2026-2034. The market is gradually gaining traction due to rising awareness regarding camel milk’s nutritional benefits, especially among health-conscious and lactose-intolerant consumers. Niche demand is also expanding through specialty retailers and online platforms. Increasing interest in alternative dairy options is further expected to fuel the United States camel dairy market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 1,383.9 Million |

|

Market Forecast in 2034

|

USD 2,571.5 Million |

| Market Growth Rate (2026-2034) | 6.77% |

A primary driver is the escalating consumer awareness of camel milk's distinct health benefits. It contains naturally less lactose and saturated fat than cow milk, which is why it can be used by those who have lactose intolerance and by those who prefer a healthier dairy-based product. In addition, camel milk is more nutritious, with abundant quantities of vital vitamins (such as C and B-complex) and minerals (calcium, iron, potassium), has inherent probiotics and immuno-enriching antibodies, and marks the trend of functional foods. The overarching health and wellness trend in the US is playing a crucial role. Natural and wholesome offerings are becoming more of a top priority for consumers, and camel milk perfectly aligns with this type of demand based on its perceived therapeutic benefits, such as the potential to improve digestion, immunity, and the management of diseases like diabetes. This perception supports broadened usage among health-oriented segments of society.

To get more information on this market Request Sample

The United States camel dairy market growth is also driven by expanding product portfolios and enhanced distribution channels, which are making camel milk more accessible than ever before. Aside from conventional liquid milk, there are innovations in the form of camel milk powder, flavored milk, and even camel milk ice cream and yogurt, appealing to various consumer taste and use requirements. The convenience of online shopping platforms, coupled with growing stock availability at supermarkets and specialty outlets, greatly enhances market accessibility and consumer convenience. This enhanced access is key to making camel milk move from a specialty product to a more mainstream dairy substitute.

United States Camel Dairy Market Trends:

Rising Health Concerns and Awareness About Camel Milk Benefits

The growing prevalence of diabetes in the US is significantly influencing the demand for camel dairy products. Camel milk, known for its low glycemic index, natural probiotics, and immune-boosting properties, is gaining traction among health-conscious consumers. According to the International Diabetes Federation (IDF), around 38.5 million individuals aged 20–79 were affected by diabetes in 2024, and this figure is projected to reach 43.0 million by 2050. As awareness grows about camel milk’s potential in managing blood sugar and enhancing gastrointestinal health, demand continues to strengthen. Its positioning as a functional, nutrient-rich alternative to traditional milk plays a pivotal role in supporting its increasing adoption across both mainstream and niche health food segments.

Expansion of E-Commerce and Online Retail Channels

The rapid growth of e-commerce platforms in the US is offering camel dairy manufacturers new opportunities for market penetration. Consumers increasingly prefer online retail due to its convenience and attractive incentives such as cash-on-delivery (COD), cashback, and discounted pricing. This has enabled camel dairy producers to widen their consumer base beyond regional or specialty stores. According to the IMARC Group, the US e-commerce market was valued at USD 1,161.5 billion in 2024 and is anticipated to grow at a CAGR of 6.46% during 2025–2033. According to the United States camel dairy market trends, the digital shift not only supports easier product accessibility but also allows brands to engage directly with customers through targeted marketing and subscription-based services.

Short-Term Disruptions Due to COVID-19 Restrictions

The outbreak of COVID-19 temporarily hindered the momentum of the US camel dairy market due to lockdowns and supply chain disruptions. Government-imposed restrictions aimed at controlling the spread led to halted manufacturing, store closures, and transportation delays. These limitations reduced product availability and disrupted regular operations for both producers and retailers. While the camel dairy sector faced setbacks during peak restriction periods, recovery is expected with the easing of regulations and the resurgence of consumer demand. As operations normalize, manufacturers are likely to focus on strengthening distribution networks, enhancing inventory resilience, and improving crisis preparedness to mitigate future disruptions and sustain long-term market growth.

United States Camel Dairy Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States camel dairy market, along with forecasts at the regional and country levels from 2026-2034. The market has been categorized based on product type, distribution channel, and packaging.

Analysis by Product Type:

- Raw Camel Milk

- Pasteurized Camel Milk

- Flavoured Camel Milk

- Camel Milk Cheese

- Camel Milk Yoghurt

- Camel Milk Ice Cream

- Camel Milk Laban

- Camel Milk Ghee

- Camel Milk Infant Formula

- Camel Milk Powder

- Others

Raw camel milk is expected to hold a significant share due to rising demand among health-conscious consumers seeking minimally processed, nutrient-rich alternatives. Advocates claim raw camel milk offers superior probiotic, enzymatic, and immune-boosting properties. Though regulated in some states, it is popular through farm-direct sales and niche health food retailers. Consumers managing autism, diabetes, or lactose intolerance often prefer raw variants, which drives its growing popularity despite limited large-scale retail distribution.

Pasteurized camel milk leads in mainstream retail availability due to safety regulations and wider consumer acceptance. It retains most of camel milk’s nutritional value while reducing microbial risks, aligning with FDA guidelines and state food safety laws, creating a positive impact on the United States camel dairy market outlook. It is sold through supermarkets, online platforms, and specialty stores, making it accessible to a broader market. Pasteurized milk also allows for longer shelf life and better distribution logistics, making it the go-to format for both producers and consumers.

Flavored camel milk appeals to younger demographics and new users by masking the distinct taste of plain camel milk, thus encouraging wider trial and repeat consumption. Varieties like chocolate, vanilla, and fruit blends attract health-focused consumers seeking tasty yet functional beverages. It fits well in on-the-go lifestyles and is increasingly marketed as a premium, nutritious drink. Its versatility in product innovation and stronger retail presence makes flavored camel milk a fast-growing and commercially viable category in the market.

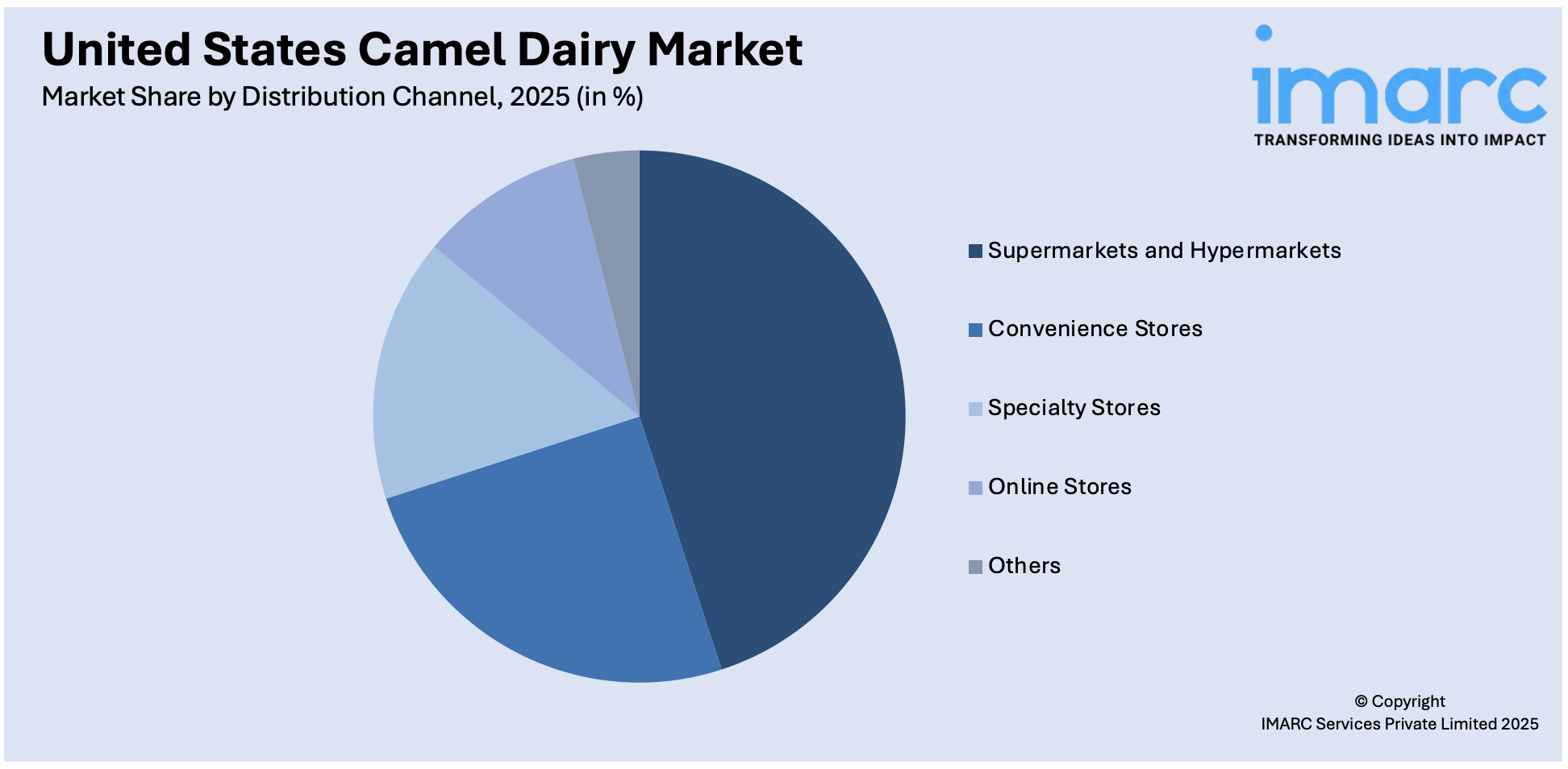

Analysis by Distribution Channel:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Stores

- Others

As per the United States camel dairy market analysis, supermarkets and hypermarkets hold the largest share in the United States camel dairy market due to their extensive reach, convenience, and ability to offer a diverse product range under one roof. These retail outlets attract a wide customer base, including health-conscious and curious consumers exploring alternative dairy options like camel milk. Their well-established cold storage infrastructure ensures the freshness and shelf stability of perishable items, including bottled camel milk and dairy-based products. In-store visibility and sampling opportunities also boost consumer awareness and trial. Moreover, partnerships between camel dairy producers and large retail chains enhance product accessibility across multiple regions. With increasing shelf space for health and specialty foods, supermarkets and hypermarkets remain key distribution points driving volume sales in this niche market.

Analysis by Packaging:

- Cartons

- Bottles

- Cans

- Jars

- Others

Bottles hold the largest share in the United States camel dairy market demand due to their convenience, hygiene, and suitability for various retail channels. They are ideal for packaging liquid camel milk, which is the most popular product form among consumers seeking functional, alternative dairy options. Bottled formats support ease of storage, transportation, and single-serve consumption, making them attractive for both households and on-the-go consumers. Additionally, bottles offer better preservation, especially when paired with cold chain logistics, extending shelf life and maintaining nutritional value. Their compatibility with branding and labeling also allows producers to highlight product benefits, certifications, and origins. As demand rises for clean-label, ready-to-drink options, bottles remain the preferred packaging choice for both manufacturers and consumers in this niche market.

Regional Analysis:

- Northeast

- Midwest

- South

- West

In the Northeast, rising health awareness and a strong demand for alternative dairy products are major growth drivers for the camel dairy market. Urban populations in cities like New York and Boston are increasingly adopting camel milk due to its perceived benefits for digestion, immunity, and lactose intolerance. The region’s growing population of health-focused consumers, including those seeking keto, paleo, or allergen-free diets, supports demand. Availability through specialty grocers and e-commerce further facilitates access. Additionally, the Northeast’s openness to functional and global foods helps drive interest in niche dairy products like camel milk and its derivatives.

In the Midwest, growth in the camel dairy market is supported by increasing consumer interest in local and sustainable farming practices, as well as growing awareness of camel milk’s health benefits. While traditional dairy dominates, a small but rising group of wellness-oriented consumers is turning to camel milk for its nutritional value and lower allergenic properties. Health food stores, co-ops, and farmers’ markets serve as distribution points, particularly in states like Illinois, Ohio, and Minnesota. The region’s strong agricultural base also allows smaller camel dairies to operate and reach local consumers through farm-to-table and direct sales initiatives.

The South is experiencing growing demand for camel dairy products due to its large and diverse population, including communities with cultural familiarity with camel milk. States like Texas and Florida are key growth zones, driven by increasing awareness of camel milk’s digestive and anti-inflammatory benefits. Health-conscious consumers and parents of children with autism or dairy allergies are also adopting camel milk as an alternative. Online shopping and specialty ethnic stores facilitate access. In addition, warm climates in southern states offer favorable conditions for camel farming, encouraging new entrants and increasing supply capabilities within the region.

The West, particularly California, is a major driver of camel dairy market growth in the US due to its progressive health trends and openness to alternative nutrition. The region has a strong base of consumers seeking functional, clean-label, and allergen-free products. Camel milk is gaining popularity among wellness enthusiasts, athletes, and parents of children with special dietary needs. The availability of camel dairy through health food chains, farmers' markets, and direct-to-consumer platforms further supports regional penetration. Additionally, favorable regulatory environments and a supportive agricultural climate encourage innovation and small-scale camel dairy operations across the West, especially in Arizona and Nevada.

Competitive Landscape:

The United States camel dairy market is a niche yet steadily growing, led by a few specialized players focusing on health-conscious consumers. Desert Farms dominates the space with a broad range of products, including fresh camel milk, milk powder, and flavored variants, distributed through both online and retail channels. Oasis Camel Dairy and Camelot Camel Dairy cater to regional markets with small-batch, farm-fresh offerings, emphasizing natural and ethical farming practices. Brands like DromeDairy Naturals and Nutra Wellness are expanding through powder-based and functional nutrition products, appealing to fitness and wellness communities. The market remains fragmented, with innovation in product formats, sustainable packaging, and direct-to-consumer models serving as key competitive differentiators amid rising demand for clean-label, alternative dairy solutions.

The report provides a comprehensive analysis of the competitive landscape in the United States camel dairy market with detailed profiles of all major companies.

Latest News and Developments:

- July 2016: California-based Desert Farms launched infant formula made from camel milk in the United States. This launch is a part of the company’s USD 2 Million investment strategy.

United States Camel Dairy Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Raw Camel Milk, Pasteurized Camel Milk, Flavored Camel Milk, Camel Milk Cheese, Camel Milk Yoghurt, Camel Milk Ice Cream, Camel Milk Laban, Camel Milk Ghee, Camel Milk Infant Formula, Camel Milk Powder, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Specialty Stores, Online Stores, Others |

| Packagings Covered | Cartons, Bottles, Cans, Jars, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States camel dairy market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the United States camel dairy market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States camel dairy industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The camel dairy market size in the United States reached USD 1,383.9 Million in 2025.

The United States camel dairy market is projected to exhibit a CAGR of 6.77% during 2026-2034, reaching a value of USD 2,571.5 Million by 2034.

The US camel dairy market is driven by increasing consumer awareness about camel milk's health benefits like lower lactose, high vitamins/minerals, rising demand for dairy alternatives, and expanding product portfolio. The growing distribution channels and investment in camel farms also contribute to its growth.

Bottles currently dominate the United States camel dairy market due to their convenience, extended shelf life, and suitability for liquid milk distribution. They ensure safe storage, easy handling, and appeal to consumers seeking ready-to-drink, portable dairy options.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)