United States Cannabis Testing Market Size, Share, Trends and Forecast by Product Type, Test Type, End User, and Region, 2025-2033

United States Cannabis Testing Market Size and Share:

The United States cannabis testing market size was valued at USD 391.1 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 942.9 Million by 2033, exhibiting a CAGR of 10.3% from 2025-2033. The market is experiencing steady growth driven by expanding legalization across states, requiring compliance with stringent regulatory standards. Additionally, the growth of the recreational cannabis market and increasing awareness of health risks from untested products bolster demand for reliable testing services.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 391.1 Million |

| Market Forecast in 2033 | USD 942.9 Million |

| Market Growth Rate (2025-2033) | 10.3% |

The expanding legalization of cannabis across various U.S. states due to the escalating demand for reliable cannabis testing services is a significant factor propelling the market. As regulations become increasingly stringent, mandatory safety and quality checks are necessary to ensure product compliance with federal and state guidelines. This legal shift is fueling the need for advanced testing technologies to detect contaminants such as pesticides, heavy metals, and microbial impurities. Additionally, consumer demand for safe, high-quality cannabis products is accelerating, compelling manufacturers to invest in robust testing solutions to maintain trust and market share. Innovations in testing methodologies, including advanced chromatography and spectrometry techniques, are further supporting the growth of this market by enhancing accuracy, speed, and cost-effectiveness.

.webp)

The increasing use of cannabis for medicinal purposes is emerging as another critical market driver. As of February 2024, 47 states, 3 territories (Puerto Rico, U.S. Virgin Islands, and Guam) and the District of Columbia permit the usage of cannabis for therapeutic applications. Comprehensive programs for medical use of cannabis: 38 states, the District of Columbia, and 3 territories. Medical-only comprehensive programs: 14 states and 2 territories. 9 states have limited medical programs, which only CBD/low-THC products for qualifying medical condition(s) defined by the state. With more patients seeking cannabis-based treatments for conditions such as chronic pain, epilepsy, and anxiety, rigorous testing to ensure therapeutic efficacy and safety has become indispensable. Regulatory authorities demand precise labeling of cannabinoid content, driving investment in laboratory equipment and skilled professionals. Furthermore, the recreational cannabis market continues to expand, increasing the necessity for standardized testing protocols to meet consumer expectations. Growing awareness about the health risks associated with untested or contaminated products is also encouraging producers to prioritize transparency and accountability, enhancing the cannabis testing market’s growth.

United States Cannabis Testing Market Trends:

Advancements in Testing Technologies

The U.S. cannabis testing market is experiencing rapid technological advancements, particularly in analytical instruments such as high-performance liquid chromatography (HPLC) and gas chromatography-mass spectrometry (GC-MS). These innovations enable faster, more accurate detection of cannabinoids, terpenes, pesticides, heavy metals, and microbial contaminants. Automation in laboratory processes is also streamlining operations, reducing human error, and increasing sample throughput. On 2nd February 2024, ABB Robotics and US-based METTLER TOLEDO signed a Memorandum of Understanding (MOU) that promises to deliver an innovative solution seamlessly integrating ABB's robots with METTLER TOLEDO's laboratory instrument management software, LabX. The combined solution will allow for better levels of efficient and high-quality automated laboratory workflows in a wide array of industries, make research, testing, and quality control more flexible, accelerate time-to-market and address grave labor shortages. Moreover, the development of portable testing devices and cloud-based data solutions is empowering smaller facilities and on-site testing capabilities. As the cannabis industry grows, the push for standardization across states drives innovation, ensuring consistent and reproducible results.

Regulatory Standardization and Compliance Requirements

The shifting regulatory landscape is a key trend shaping the cannabis testing market in the United States. The government bodies are increasingly implementing uniform safety, labeling, and potency requirements, pushing laboratories to adopt standardized testing protocols. Emerging federal oversight discussions, including potential nationwide legalization, are further unifying regulations, eliminating cross-state inconsistencies. On 5th June 2024, the U.S. Department of Justice (DOJ) declared its intention to relax federal prohibitions on marijuana—decriminalized in 24 states by reclassifying the drug from Schedule I to Schedule III on the Controlled Substances Act (CSA). Besides this, laboratories must meet accreditation standards such as ISO 17025, emphasizing quality and reliability. This changing compliance framework incentivizes the use of advanced testing methods and fosters the development of accredited labs, which are pivotal in maintaining market credibility and consumer trust.

Increasing Focus on Consumer Safety and Transparency

Growing consumer awareness of health risks associated with untested or contaminated cannabis products is increasing the demand for rigorous testing and transparent labeling. Buyers increasingly seek detailed cannabinoid profiles and safety certifications, compelling producers to prioritize comprehensive testing protocols. Additionally, rising number of lawsuits and recalls linked to contaminated products have reinforced the importance of accurate testing. This trend encourages investment in research, technology, and skilled personnel to ensure safety and build trust. The push for transparency has also catalyzed partnerships between cannabis companies and testing labs to offer reliable third-party verification for products. On 30th May 2024, Florida-based vertically integrated cannabis multistate operator Cansortium has agreed to merge with RIV Capital, which runs the New York marijuana brand Etain Health. As per the deal terms, Cansortium – doing business as Fluent – will take over all the issued and outstanding Class A common shares of RIV Capital for Cansortium shares. The combined company will consist of eight cultivation and processing facilities, and 42 stores operating in four populous but limited-license markets -- Florida, New York, Pennsylvania, and Texas.

United States Cannabis Testing Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States cannabis testing market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on product type, test type, and end user.

Analysis by Product Type:

- Instruments

- Chromatography Instruments

- Spectroscopy Instruments

- Consumables

- Software

Instruments are the backbones of the market, as they allow for the precise measurement of cannabinoids, terpenes, and impurities. The most prevalent tools used are GC and LC combined with MS, which provide top accuracy and efficiency. Continuous innovation in instrument design enhances speed, sensitivity, and automation, making testing processes more streamlined and cost-effective.

The consumables include samples, reagents, column chromatography, and the standards to be used with calibration standards. These support accuracy and reliability when conducting these tests and include diverse applications such as testing potency or screening for contamination. The recurring demand for consumables, coupled with advancements in material quality, drives this segment’s growth, making it indispensable for laboratory operations.

Software solutions are important to manage and analyze data in the cannabis testing laboratory. A LIMS streamlines a lab's operations by tracking samples, automating workflows, and ensuring regulatory compliance. More advanced software can allow data integration, reporting, and real-time monitoring and improve productivity and accuracy within tight industry standards.

Analysis by Test Type:

- Heavy Metal Testing

- Microbial Analysis

- Potency Testing

- Residual Screening

- Others

Heavy metal testing is crucial in ensuring the safety of cannabis products by detecting toxic elements such as lead, cadmium, arsenic, and mercury. Advanced analytical techniques such as inductively coupled plasma mass spectrometry (ICP-MS) are commonly used to comply with stringent safety standards. This segment’s growth is driven by increased regulatory scrutiny and consumer demand for contaminant-free products.

Microbial analysis focuses on identifying harmful pathogens such as molds, yeasts, and bacteria in cannabis products. Techniques including polymerase chain reaction (PCR) and plate culture methods are employed to ensure products meet safety regulations. The rising focus on consumer health and regulatory compliance has accelerated the adoption of sophisticated microbial testing methods across the industry.

Potency testing measures the concentration of cannabinoids, such as THC and CBD, which helps ensure that products of medical and recreational cannabis have proper labeling. HPLC is one of the most used techniques due to its high precision. Consumer demand for transparency and state labeling requirements have driven the growth in this segment. It has helped to maintain consistency and safety in consumption.

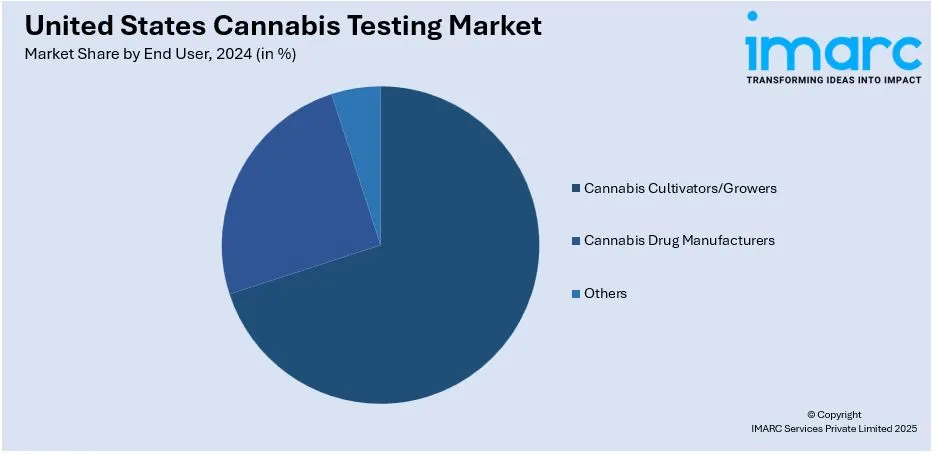

Analysis by End User:

- Cannabis Cultivators/Growers

- Cannabis Drug Manufacturers

- Others

Cannabis growers and farmers need testing services to improve crop quality, detect contaminants, and stay in regulation. Testing during the cultivation stage can help growers identify pesticide residues, microbial contaminants, and heavy metals within the crops. It therefore assists growers in optimizing their productions for safety standards. This is one of the fast-growing markets as growers are seeking to sell high-quality, compliant products.

The manufacturers of cannabis drugs use testing to ensure the safety, efficacy, and consistency of their products, especially for medical use. Potency testing, residual screening, and stability testing are essential to comply with regulatory requirements and provide exact therapeutic effects. The growing development of pharmaceuticals based on cannabis is boosting demand in this segment.

Regional Analysis:

- Northeast

- Midwest

- South

- West

The Northeast region is growing robustly in the market as more states legalize both recreational and medical cannabis. In states such as New York and New Jersey, the regulatory framework is becoming increasingly stringent, which is driving the demand for advanced testing facilities. Emphasis on quality assurance and consumer safety in the region propels the growth of testing services.

On the other hand, the cannabis testing market within the Midwest region is currently experiencing steady growth as the result of the gradual acceptance of marijuana legalization and expansion of cultivating activities. States such as Illinois and Michigan have led with already established regulations and industries thriving in the marijuana industry. The need for compliance testing and safety verification supports the growth of this segment in the region.

The South represents an emerging market for cannabis testing as more states legalize medical cannabis and explore recreational use. Limited but expanding legalization efforts, coupled with a growing focus on consumer safety, drive testing demand. States including Florida lead this region in cannabis testing infrastructure development.

The West remains the most mature market for cannabis testing in the U.S., with states such as California, Oregon, and Colorado setting the industry benchmark. Comprehensive regulatory frameworks and high cannabis production volumes fuel the need for advanced testing solutions. Consumer demand for safe and high-quality products further drives market growth in this region.

Competitive Landscape:

The U.S. cannabis testing market is extremely competitive with most players emphasizing innovation, strategic partnerships, and geographies expansion as means of raising the market stakes for them. There is a large investment by companies into highly advanced testing technologies such as high-performance liquid chromatography and mass spectrometry. Collaboration with the cannabis cultivator or manufacturer is common to provide a well-tailored solution to test such products. Many players are expanding their laboratory networks to cover regions with emerging legalization trends, ensuring broader service availability. Additionally, there is a growing emphasis on acquiring ISO 17025 certifications to ensure compliance and prove reliability. Developmental efforts to achieve cost-effective and automated testing solutions further drive competition and market growth.

The report provides a comprehensive analysis of the competitive landscape in the United States cannabis testing market with detailed profiles of all major companies.

Latest News and Developments:

- December 2, 2024: Oklahoma regulators plan to open a state-run cannabis testing lab to verify the accuracy of commercial lab results in the medical marijuana industry. This initiative aims to address concerns over inconsistent testing and ensure product safety and compliance. The lab will provide oversight by cross-checking samples from commercial facilities, reinforcing trust in the state's cannabis market.

- July 9, 2024: The National Institute of Standards and Technology (NIST) announced the availability for purchase of a hemp reference material that will help laboratories to measure accurately key components in cannabis plant products. This will help law enforcement agencies differentiate hemp from marijuana correctly, which will also aid manufacturers and regulatory agencies to make sure cannabis products are accurately labeled as well as safe.

United States Cannabis Testing Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Test Types Covered | Heavy Metal Testing, Microbial Analysis, Potency Testing, Residual Screening, Others |

| End Users Covered | Cannabis Cultivators/Growers, Cannabis Drug Manufacturers, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States cannabis testing market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the United States cannabis testing market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States cannabis testing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Cannabis testing refers to the scientific analysis of cannabis and its products to ensure safety, quality, and regulatory compliance. It involves detecting contaminants such as pesticides, heavy metals, and microbes, and verifying potency by measuring cannabinoid and terpene levels. Applications include medical, recreational, and industrial cannabis markets.

The United States cannabis testing market was valued at USD 391.1 Million in 2024.

IMARC estimates the United States cannabis testing market to exhibit a CAGR of 10.3% during 2025-2033.

Key drivers include expanding cannabis legalization across states, stringent regulatory compliance requirements, growing consumer demand for safe, high-quality products, and advancements in testing technologies such as chromatography and spectrometry. The rise of the medicinal cannabis market further fuels demand for reliable testing.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)