United States Cashew Market Size, Share, Trends and Forecast by Form, Distribution Channel, Application, and Region, 2025-2033

United States Cashew Market Size and Share:

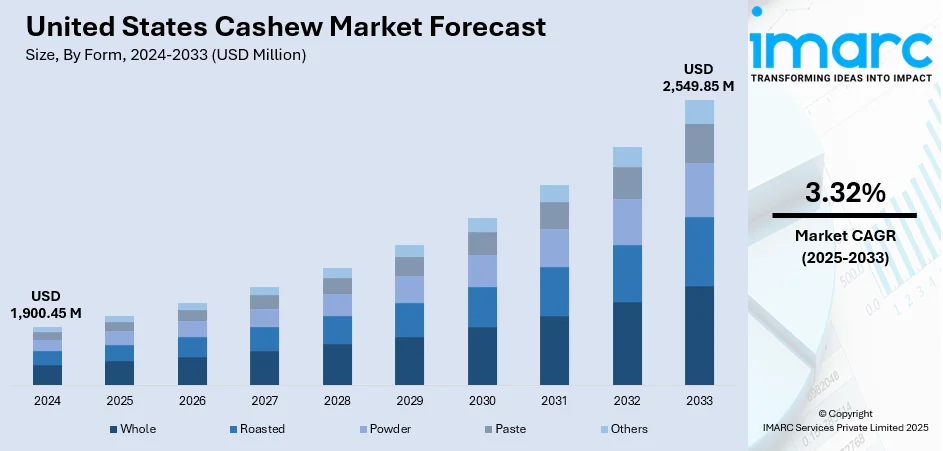

The United States cashew market size was valued at USD 1,900.45 Million in 2024. Looking forward, the market is expected to reach USD 2,549.85 Million by 2033, exhibiting a CAGR of 3.32% during 2025-2033. The United States cashew market is propelled by expanding consumer demand for nutritious snacks, plant-based protein, and dairy substitutes as cashews find greater application in vegan foods like cheese, milk, and spreads. Clean-label and minimally processed food trends are also fueling cashew consumption. Convenience and versatility also make cashews the go-to option in trail mixes, baked goods, and ready-to-eat snack foods. Imports from key producing countries ensure year-round availability, supporting consistent demand, which collectively contribute to the steady growth of the United States cashew market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 1,900.45 Million |

|

Market Forecast in 2033

|

USD 2,549.85 Million |

| Market Growth Rate 2025-2033 | 3.32% |

The growing focus on health and fitness among American consumers is one of the major factors propelling the cashew market in the US. As a rich source of plant protein, healthy fats, vitamins, and minerals, cashews are widely recognized for their health benefits. Cashews fit perfectly into an area where heart health, weight, and plant-based dietary patterns are the concern, especially since consumers are set on these objectives. Increased focus on clean eating patterns and the tendency toward natural foods with minimal processing have added to the popularity of cashews as a nutritional snack choice. On top of that, the transition away from animal-derived products has created increasing demand for vegan and dairy-free foodstuffs, and cashew-based milk, cheese, and sauces have become increasingly popular in mainstream grocery stores. US food manufacturers are adapting by broadening the range of their products to incorporate cashew ingredients to meet the increased demand from growing numbers of vegetarians, vegans, and health-oriented consumers. These wellness-based United States cashew market trends continue to fuel market growth in the US

To get more information on this market, Request Sample

A second dominant force in the United States cashew market is the convenience and versatility of cashews in culinary use. Cashews are increasingly popular with American consumers for being readily available and versatile enough to be used across a multitude of recipes, which makes them a core product in domestic kitchens as well as in institutional food service. Cashews are most often utilized in trail mixes, snack bars, desserts, stir-fries, and even sauce, providing a light, creamy taste that pairs well with both sweet and savory foods. In areas where there are good multicultural influences, like California, New York, and Texas, cashews are incorporated into Indian, Southeast Asian, and African foods, which are being increasingly popular in all over the US Additionally, the rise of plant-based and flexitarian diets has resulted in growing innovation for applying cashews as a staple for creamy, dairy-free versions, which have become popular among consumers with lactose intolerance or preference. The need for healthy, portable, and flexible food continues to propel the growth of the US cashew market within various consumer segments.

United States Cashew Market Trends:

Rising Health Awareness and Nutritional Benefits

The growing awareness about health and nutrition among consumers is creating the demand for cashews in the United States. The survey results indicate that healthfulness is a significant driver for US consumers when making food and food-purchasing decisions. Specifically, 62% of respondents prioritize healthfulness when selecting food, highlighting its importance in shaping consumer preferences and behaviors. Due to their high content of protein, good fats, vitamins, and minerals, these nuts are a nutrient-dense and appealing choice for those who are concerned about their health. Cashews are also loaded with magnesium, copper, and antioxidants, which help in promoting heart health, managing weight, and lowering cholesterol levels. Along with this, the increasing priority of consumers on choosing healthy eating habits and nutrient-dense snacks, is bolstering the growth of the industry. Additionally, the increased marketing of cashews as a healthy alternative to less nutritious snacks has resulted in heightened product consumption. Moreover, the introduction of health-focused campaigns by both private companies and public health organizations that highlight the benefits of incorporating nuts like cashews into daily diets is boosting their popularity and further influencing the United States cashew market growth.

Expanding Vegan and Plant-Based Diet Trends

The shifting trend toward veganism and plant-based diets in the United States is positively impacting the United States cashew market growth. They serve as a versatile ingredient in many plant-based recipes, including dairy alternatives like cashew milk, vegan cheeses, and cashew-based creams and sauces. Moreover, the heightened versatility of cashews in creating creamy textures without dairy makes them a staple in vegan kitchens. Additionally, the demand for plant-based products like cashews rises as more customers switch to plant-based diets for moral, environmental, and health reasons. The Good Food Institute (GFI) reports that the US plant-based food market was valued at USD 8.1 Billion in 2024, highlighting the scale of this shift. Besides this, the rise of vegan and vegetarian food products in mainstream grocery stores is also contributing to the increased United States cashew market demand, as these nuts are used as a primary ingredient in many plant-based packaged foods.

Increase in Snacking and On-the-Go Consumption

The snacking culture in the United States is expanding, with a growing number of consumers seeking convenient and nutritious options. A survey revealed that snacking has become a more frequent habit for Americans, with 73% of respondents indicating they snack at least once a day. Cashews are commonly consumed as a snack on their own and as part of mixed nuts or trail mixes. Additionally, the ongoing trend toward on-the-go consumption is leading to an increase in demand for portable and easy-to-eat snacks like cashews. Moreover, snack manufacturers are also increasingly incorporating cashews into various products, such as bars and mixes, catering to the demand for nutritious and filling snacks. The convenience of consuming cashews, coupled with their perceived health benefits, makes them an appealing choice for busy consumers who are looking for a quick and healthy snack option. The market for cashews is anticipated to grow as the trend toward healthier snacking continues throughout the United States cashew market outlook.

United States Cashew Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States cashew market, along with forecasts at the regional levels from 2025-2033. The market has been categorized based on form, distribution channel, and application.

Analysis by Form:

- Whole

- Roasted

- Powder

- Paste

- Others

Whole cashews are in great demand as a high-end snack and ingredient throughout the United States. Respected for their deep, luscious flavor and silky texture, they are usually sold plain, salted, or seasoned. Whole cashews are also utilized in gourmet cuisine and packaged in resealable forms for freshness and ease of use.

Roasted cashews are favorite due to their increased flavor and crunchy texture and are a best-selling snack choice in all US supermarkets and health food stores. They are found in dry-roasted or oil-roasted varieties and are suitable for different preferences, such as spicy, sweet, or savory, and are favored by a wide audience of snack consumers.

Cashew powder is becoming increasingly popular in the US marketplace due to its application in baking, smoothies, and vegetable recipes. Utilized as a protein extender or alternative gluten-free flour, it fits into clean-label consumer trends. The health-conscious consumer prefers it for nutrition and versatility as an ingredient in both desserts and savory foods.

Cashew paste is also a popular dairy substitute in America and is employed extensively in vegan cheese, sauces, and desserts. It is an excellent option for plant-based cuisine due to its bland flavor and smooth texture. Manufacturers and cooks alike appreciate its utility in the production of creamy, non-dairy foods with a silky texture.

Cashew splits offer a cost-effective alternative to whole nuts without compromising flavor or texture. They are commonly used in confectionery, snack mixes, granola bars, and baked goods. In the US market, splits are especially attractive to manufacturers seeking quality ingredients at a lower price point for bulk applications.

Analysis by Distribution Channel:

- Supermarkets

- Retailers

- Online Stores

- Others

Supermarkets are the major distribution channel for cashews in the US with a huge assortment of branded and private-label varieties. With large foot traffic and widespread availability, they serve occasional consumers looking for convenient, easy-to-eat snack foods, such as roasted, whole, and flavored cashews in a range of package sizes.

Retailers, such as health food stores and specialty grocery store chains, are important distributors of premium and organic cashew products. These retailers tend to emphasize quality, transparency in sourcing, and health-oriented choices, appealing to customers seeking plant-based diets, clean-label, and varying cashew formats like paste and powder.

Online stores are a rapidly growing channel for cashew distribution in the US, driven by convenience and wider product selection. Consumers can access specialty, bulk, and subscription-based offerings through e-commerce platforms. Direct-to-consumer brands leverage this channel to promote unique flavors, sustainable packaging, and targeted health-oriented marketing campaigns.

Analysis by Application:

- Dairy Products

- Bakery Products

- Snacks and Bars

- Confectionaries

- Cereals

- Desserts

- Beverages

- Cosmetic Products

- Others

Cashews find growing application in plant-based dairy substitutes like milk, cheese, yogurt, and cream. Cashews' rich texture and mild taste are best suited to vegan and lactose-free products, catering to the increasing demand within the US for healthy, non-dairy products that enhance clean-label and allergen-friendly diets.

In the American bakery industry, cashews are incorporated into cookies, breads, pastries, and crusts due to their richness of flavor and crunchiness. Whole and crushed cashews are favored, commonly used in gourmet and health-oriented baked goods, which appeal to consumers looking for indulgent yet healthy choices in craft and commercial bakeries.

Cashews are an ingredient in the US snacks and bars category, prized for their protein, healthy oils, and crunchy texture. Cashews are used frequently in trail mix, energy bars, and flavored nut packs, marketed to health-focused consumers wanting easy, convenient, on-the-go nutrition in sweet and savory forms of snacks.

Cashews are also extensively applied in US confectionery candies, such as chocolate-coated nuts, nut brittles, and nougats. They complement sweet tastes due to their buttery texture and are therefore a high-end ingredient used in gourmet and mass-market candies. Cashews are in demand by confectionery companies for their rich flavor and aesthetic in packaged candies.

Within the cereals category, cashews are added to granola, muesli, and mix grain mixes to provide texture and nutritional value. They increase protein and healthful fat levels to meet demand by consumers seeking a healthy, energizing breakfast or snack food. Cashews also add complexity of flavor to conventional and functional cereals.

Cashews are a major component of plant-based desserts such as cheesecakes, puddings, and ice creams, particularly in the vegan culinary movement. Their innate creaminess provides the dairy-like consistency, which is best suited for decadent, silky dessert bases. American dessert chefs employ cashews in making decadent yet healthy-friendly treats.

Cashew-based drinks are becoming popular in the US, particularly as dairy milk alternatives. Cashew milk has a creamy consistency and is consumed in coffee, smoothies, and health drinks. Cashew extracts are also being added to beverage brands for functional beverages based on wellness, hydration, and plant-based nutrition trends.

Cashew oil and extracts are increasingly used in US cosmetic products due to their moisturizing and antioxidant properties. Found in lotions, creams, and hair care items, cashew derivatives support skin nourishment and anti-aging benefits. The shift toward natural and plant-based beauty formulations boosts demand in this segment.

Regional Analysis:

- Northeast

- Midwest

- South

- West

According to the United States cashew market forecast, the Northeast is led by health-oriented consumers in urban markets such as New York and Boston. Demand is high for plant-based snacks and dairy substitute items, with cashew-based items becoming popular in specialty grocery stores, health food stores, and cafés emphasizing clean-label and sustainable food products.

In the Midwest, the market for cashews is enhanced by increasing interest in heart-healthy nutrition and protein-packed snacks. Chains and local retailers sell a variety of roasted and seasoned cashews, and trends toward plant-based eating are slowly encroaching on dairy and snack categories. Convenience and value at lower price points attract frugal consumers throughout the region.

The cashew market in the Southern US is growing with increasing demand for healthy snacks and plant-based foods. Texas and Florida consumers prefer the roasted and seasoned types, while regional stores and health food stores carry dairy-free alternatives made from cashews. Ethnic foods and dishes also benefit from cultural diversity in demand.

The Western United States, and California in particular, is the leader in cashew consumption with high demand for organic, sustainable, and vegan food products. Cashew-based drinks, cheese, and snack items are sold extensively through health-oriented retail chains. The environmentally sensitive consumers coupled with the progressive food culture of the region make it a significant driver of cashew market trends.

Competitive Landscape:

Major players in the industry are leading growth by leveraging a mix of product development, value-chain optimization, and sustainability programs, as per the United States cashew market analysis. Large food corporations and snack companies are launching new cashew-based products to meet the demands of health-forward and plant-based consumers, offering cashew milk, dairy-free cheese, protein bars, and upscale snack blends. These products are being created to capitalize on increasing consumer demand for clean-label, healthy, and allergen-free products. At the sourcing stage, major players are forming long-term alliances with producers in nations such as Vietnam, India, and Ivory Coast to guarantee steady quality and supply. Others are making investments in traceability and ethical sourcing initiatives to alleviate issues regarding labor practices and environmental footprint in cashew-producing areas. Packaging enhancements, including resealable and recyclable formats, also mirror the industry reaction to consumer sustainability trends. In the retail sector, major brands are using online marketing and e-commerce platforms to target health-oriented millennials and Gen Z consumers. Moreover, private-label cashew items are being found on more shelf space in big supermarket chains, providing value-for-money options while increasing market access. All these collective efforts by major players align with changing consumer needs and further support competitiveness and resilience in a dynamic food system.

The report provides a comprehensive analysis of the competitive landscape in the United States cashew market with detailed profiles of all major companies.

Latest News and Developments:

- August 2025: Forager Project announced the launch of The Cashew Project, a groundbreaking multi-year initiative aimed at supporting cashew farming communities in Côte d'Ivoire. The project focuses on providing organic farming training, financial literacy programs, and promoting sustainable agricultural practices. It is designed to improve farmers' livelihoods, empower women by challenging traditional gender roles in farming, and offer climate change adaptation solutions to ensure the sustainability of cashew production in the region.

- July 2025: Elmhurst 1925 expanded its Unsweetened range to include a new product: Unsweetened Vanilla Cashew Milk. This plant-based milk combines Elmhurst’s signature cashew milk with Madagascar vanilla, offering 4g of protein per serving. Being Elmhurst's first-ever flavored unsweetened cashew milk, it represents a noteworthy milestone in meeting the growing demand for plant-based, clean-label beverages that are both delicious and nutritious.

- December 2024: Octonuts California, a manufacturer of plant-based snacks, launched new cashew-based products, including two flavored butters and two snack packages. The flavored butters, Churro Inspired and Strawberry, were introduced alongside the Gochujang and Crème Brûlée flavored snacks. These products are free from peanuts, soy, and dairy, catering to consumers with specific dietary preferences and allergies.

United States Cashew Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Forms Covered | Whole, Roasted, Powder, Paste, Others |

| Distribution Channels Covered | Supermarkets, Retailers, Online Stores, Others |

| Applications Covered | Dairy Products, Bakery Products, Snacks and Bars, Confectionaries, Cereals, Desserts, Beverages, Cosmetic Products, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States cashew market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the United States cashew market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States cashew industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The cashew market in the United States was valued at USD 1,900.45 Million in 2024.

The United States cashew market is projected to exhibit a CAGR of 3.32% during 2025-2033, reaching a value of USD 2,549.85 Million by 2033.

The United States cashew market is driven by rising health consciousness, demand for plant-based and dairy-free products, and growing popularity of convenient, nutritious snacks. Cashews' versatility in cooking and clean-label appeal further boost their consumption, making them a staple in both households and the health food industry.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)