United States Catheters Market Size, Share, Trends and Forecast by Product Type, End User, and Region, 2025-2033

United States Catheters Market Size and Share:

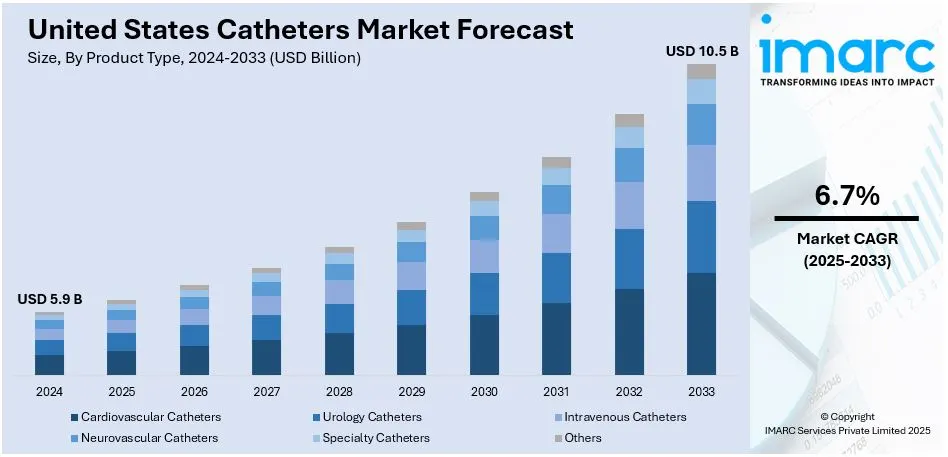

The United States catheters market size was valued at USD 5.9 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 10.5 Billion by 2033, exhibiting a CAGR of 6.7% from 2025-2033. The rising occurrence of chronic diseases is a key factor driving the market, rising geriatric population, growing preference for minimally invasive (MI) procedures, the expansion of home healthcare services, and the burgeoning surgical interventions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 5.9 Billion |

| Market Forecast in 2033 | USD 10.5 Billion |

| Market Growth Rate (2025-2033) | 6.7% |

In the United States, the prevalence of chronic illnesses such renal ailments, diabetes, and cardiovascular issues is rising, which is greatly increasing the need for catheters. Six out of ten people in the country suffer from a chronic illness, and four out of ten have two or more, according to the Centers for Disease Control and Prevention (CDC). Additionally, around 1.7 million American residents are diagnosed with cancer each year, which results in the deaths of over 600,000. Likewise, the rising prevalence of end-stage renal illness, which necessitates catheter-assisted dialysis, is driving the market expansion.

The growing number of people 65 and older in the US is contributing to a demographic shift toward an older population. This age group is more prone to chronic illnesses such urine incontinence and cardiovascular disorders, which frequently necessitate catheterization. The need for catheters to treat age-related health conditions is expected to increase in tandem with the growing number of senior people. All American baby boomers will be 65 years of age or older by 2030, and by 2040, almost 78.3 million people will be in that age range. Additionally, it has been shown that 94.9% of persons 60 and older have at least one chronic condition, and 78.7% have two or more. These findings significantly raise the need for catheters in the country.

United States Catheters Market Trends:

Rising Preference for Minimally Invasive (MI) Procedures

MI procedures are increasingly being preferred by both patients and healthcare providers because of their benefits, including shorter recovery times, lowered risk of infection, and less postoperative pain. The market for these procedures is rising rapidly in the country with over 3.93% growth rate. It is also expected to reach US$ 35.3 billion by the year 2032, as per the IMARC Group report. Catheters are integral to many of these procedures, ranging from cardiac ablations to laparoscopic surgeries. For instance, in interventional cardiology, catheters are used to access the heart and blood vessels without requiring large incisions. This trend is supported by advancements in catheter-based robotic systems and imaging technologies that improve precision during minimally invasive treatments.

Expansion of Home Healthcare Services

Another primary impact on the catheter market is the trend of home-based care. Patients who have chronic conditions are increasingly managing their health at home with the help of catheters because it plays an important role concerning this transformation. An industry report suggests that about $265 billion of care now offered in traditional settings for Medicare fee-for-service (FFS) and Medicare advantage (MA) beneficiaries may be shifted to the home. For example, self-catheterization for urinary issues and at-home dialysis for kidney conditions are ways catheters make it possible for out-of-facility care support. This trend is further supported by new designs of easy-to-carry, user-friendly catheter systems.

Growing Surgical Interventions

The rising number of surgical procedures across various medical specialties is another driver causing growth in the U.S. catheters market. Each year, approximately 40 to 50 million surgical procedures are conducted in the United States. By 2028, that annual surgeries rate is expected to increase by 3.4%. Catheters are invaluable during surgery with instrumentation involving the cardiovascular system, urology, or gastrointestinal tract along with diagnostic therapeutic purposes. For example, procedures like angioplasty, endoscopic surgeries, and nephrostomy rely heavily on specialized catheter systems. As surgical techniques continue to evolve, the role of catheters in ensuring precision, safety, and efficiency becomes even more critical. This demand is further amplified by the growing number of outpatient surgical centers, where catheters are frequently used for short-term and post-operative care.

United States Catheters Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States catheters market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on product type and end user.

Analysis by Product Type:

- Cardiovascular Catheters

- Urology Catheters

- Intravenous Catheters

- Neurovascular Catheters

- Specialty Catheters

- Others

Cardiovascular catheters are the most popular catheters interpreted from their extensive applications in angiography, biopsy, electrophyology, and other diagnostic and therapeutic methods. These catheters can be used in the treatment of coronary artery disease and arrhythmias. Continued improvements being developed for current treatment therapies, such as drug-eluting and steerable catheters, along with the rising cases of chronic conditions are contributing to its growing popularity.

This segment within urology catheters is emerging rapidly as one of the major segments, propelled by increasing incidents of urinary incontinence, bladder dysfunction, and prostate disorders. Currently, Foley, external, and intermittent catheters are predominantly used for short-term to long-term urinary management because millions of Americans are suffering from urinary incontinence. With the increasing aging population, it now increases the demand for more user-friendly and infection-resistant urology catheters into the market.

Intravenous (IV) catheters are a life-saving device within the hospital or outpatient facility used to administer fluids, medications, or nutrients. This segment is enormously increasing owing to the catheter's improvement in safety features by minimizing infection risks through closed-system designs. Furthermore, increases in surgical procedures and dehydration or sepsis patients needing intensive feeding through fluid treatments are fueling demands for IV catheters.

Neurovascular catheter is an advanced form of catheter used to treat complex intracranial neurosurgical issues such as the treatment of aneurysms, strokes, or arteriovenous malformations. Increasing incidence of neurovascular disorders, which ranks among the leading causes of disability and death in the U.S., is driving the demand for advanced catheters that are highly flexible and accurate. Increased adoption of minimally invasive (MI) neurovascular interventions are also supporting this segment’s growth.

Specialty catheters are used in niche applications, such as electrophysiology, temperature monitoring, and hemodialysis. They usually form part of a custom-designed complete solution for certain targeted medical applications, which adds tremendous value to high-complexity or high-risk procedures. Advances in technology for use of these catheters in outpatient or at-home health care facilities drive this segment increasingly toward popularity.

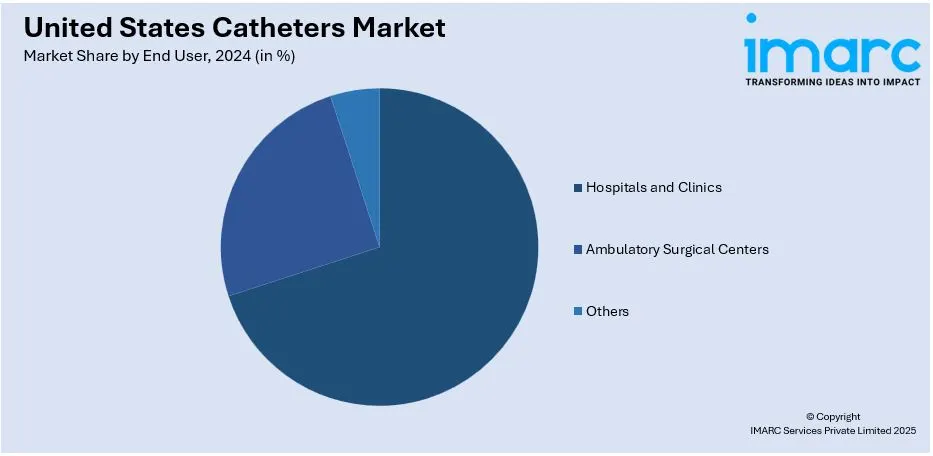

Analysis by End User:

- Hospitals and Clinics

- Ambulatory Surgical Centers

- Others

The huge volume of surgeries, inpatient treatments, and chronic illness care services performed in hospitals and clinics makes them the primary locations for catheter usage. They are necessary for many medical procedures, such as intravenous treatment, urine control, and cardiovascular surgery. The development of this segment is also fueled by hospitals and clinics' sophisticated infrastructure, knowledgeable staff, and extensive reimbursement practices. In addition, the growing number of patients with complicated illnesses that necessitate catheter-based therapies, such as end-stage renal disease and neurological disorders, increases the demand in this end-user category.

Ambulatory surgery centers (ASCs) are quickly emerging as an important end-user sector as outpatient treatments become more popular. ASCs are a desirable option for MI operations that commonly employ catheters, including angioplasty and endovascular treatments, because of their reputation for providing economical and effective management. Improvements in catheter technology that enhance patient safety and procedure results are also contributing to the segment's growth. Catheter-based therapies are also becoming more popular in ASCs because of an increasing move toward value-based care and shorter hospital stays.

Regional Analysis:

- Northeast

- Midwest

- South

- West

The major share of the catheter market in the U.S. is the Northeast due to factors such as high population density, sophisticated healthcare system, and easy access to advanced medical care. Catheters are largely used in procedures for cardiovascular, neurovascular and urological diseases in states like New York and Massachusetts which host some high-reputed hospitals and research facilities. Higher incidence of chronic diseases coupled with increasing geriatrc population has raised the need for catheter-based therapy in this region.

In the Midwest, however, there are an increasing number of outpatient clinics with a growing tendency towards accessible healthcare. Catheters have turned out to be increasingly relevant in this region because of lifestyle diseases such as diabetes and heart problems. In an effort to increase their footprints, some states such as Illinois and Ohio have established healthcare manufacturing consortia that are important in driving or advancing the localized availability and innovation of catheter technology.

The South is one of the regions with the quickest rate of growth for the catheters market in the United States. This market is growing because of its huge and diverse population as well as the comparatively high prevalence of chronic illnesses including obesity, diabetes, and cardiovascular ailments. The need for catheters in hospitals, clinics, and home-based settings is rising mainly because of the expanding network of health care institutions and a growing elderly population in Florida and Texas. This sector is additionally being strengthened by the favorable policies and investments in the health care infrastructure.

With states like California and Washington, the Western area is a significant pioneer in the adoption of cutting-edge medical technology, including creative catheter designs. There is a greater need for specialized catheters in this area due to the higher prevalence of cardiovascular and neurovascular illnesses. The presence of highly developed healthcare facilities and a strong emphasis on minimally invasive treatments are further characteristics of this area that contribute to the robust expansion of the catheter market.

Competitive Landscape:

The major players in the market are attempting product innovation, mergers and acquisitions, and regulatory approvals as part of the strategy to strengthen their market positions. These entities are also investing in advanced technologies such as bioresorbable, biocompatible, and drug-eluting materials to minimize the invasiveness of certain procedures while reducing complications. Other initiatives include mergers and acquisitions, wherein firms acquire developmental stage companies to enrich their product portfolios and catch a more extensive patient base. Strategic alliances and facility are also being employed to achieve synergies in capabilities and resources to increase competitiveness.

The report provides a comprehensive analysis of the competitive landscape in the United States catheters market with detailed profiles of all major companies.

Latest News and Developments:

- In September 2024, Shockwave Medical Inc. said that they have introduced the Shockwave E8 Peripheral IVL Catheter in the US. The Shockwave E8 catheter, which has been approved by the FDA in the United States, is intended to treat patients with complicated chronic limb-threatening ischemia (CLTI) as well as calcified femoro-popliteal and below-the-knee peripheral artery disease (PAD) as effectively as possible.

- In March 2024, Cook Medical and Bentley said that the BeBack Catheter will be distributed in the US. In the coming months, Cook Medical will take on the commercial responsibilities for this Bentley product, a crossing catheter specifically designed for navigating chronic total occlusions (CTO) and delivering targeted performance.

United States Catheters Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Cardiovascular Catheters, Urology Catheters, Intravenous Catheters, Neurovascular Catheters, Specialty Catheters, Others |

| End Users Covered | Hospitals and Clinics, Ambulatory Surgical Centers, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States catheters market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the United States catheters market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States catheters industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Catheters are thin, flexible tubes used in medical procedures to deliver or drain fluids, access blood vessels, or perform diagnostics. It is used in cardiovascular procedures, urinary management, dialysis, and neurovascular interventions. They are essential in minimally invasive (MI) surgeries and chronic disease management for improved patient care.

The United States catheters market was valued at USD 5.9 Billion in 2024.

IMARC estimates the United States catheters market to exhibit a CAGR of 6.7% during 2025-2033.

The U.S. catheters market is driven by the rising prevalence of chronic diseases, an aging population, advancements in catheter technologies, increasing demand for minimally invasive procedures, expanding home healthcare services, growing surgical interventions, and supportive reimbursement policies.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)