United States CCTV Market Size, Share, Trends and Forecast by Type, End User Vertical, and Region, 2025-2033

United States CCTV Market Overview:

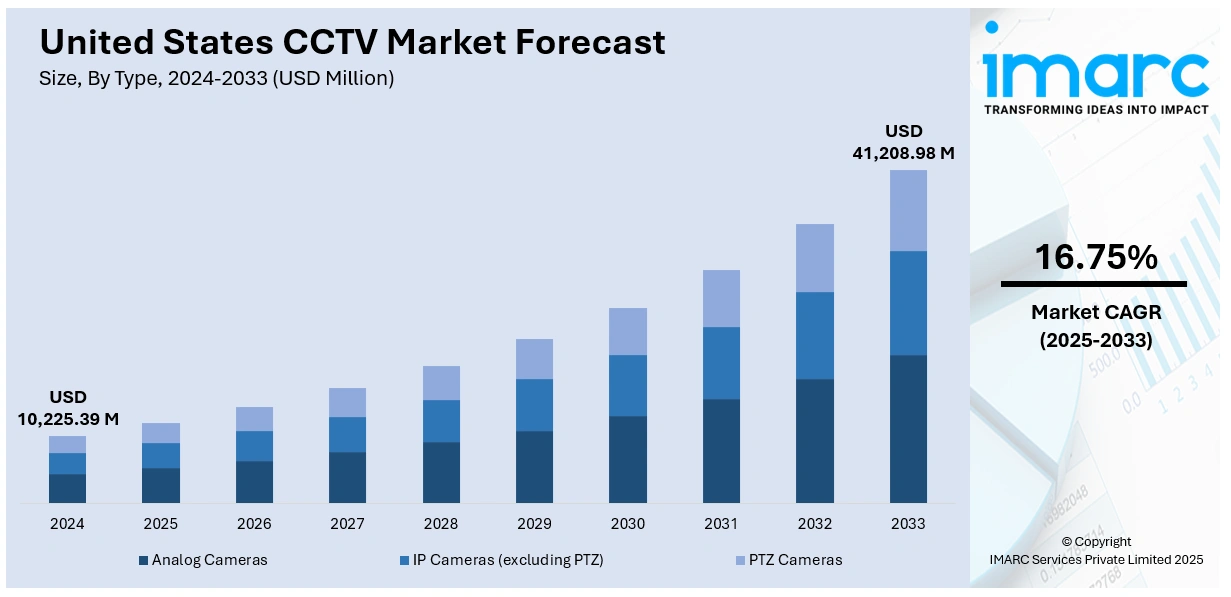

The United States CCTV market size reached USD 10,225.39 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 41,208.98 Million by 2033, exhibiting a growth rate (CAGR) of 16.75% during 2025-2033. The market is driven by heightened concerns over public safety, growing infrastructure investments, and rising adoption of advanced surveillance technologies. The integration of artificial intelligence and cloud-based storage further enhances effectiveness. Expanding use across commercial and residential settings contributes to the expansion of the United States CCTV market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 10,225.39 Million |

| Market Forecast in 2033 | USD 41,208.98 Million |

| Market Growth Rate 2025-2033 | 16.75% |

United States CCTV Market Trends:

Adoption of AI and Analytics

The integration of artificial intelligence is a defining trend in the United States CCTV market. AI-enabled systems offer facial recognition, behavior analysis, and real-time alerts that enhance security management. Businesses and government bodies are investing in smart surveillance networks capable of predictive analytics. The adoption of AI reduces dependence on manual monitoring while improving accuracy in identifying threats. These advanced solutions support proactive security, ensuring faster response times. With the increased threat of crime and terrorism, the deployment of AI-enhanced CCTV systems is accelerating across the country. This technological integration is reshaping surveillance infrastructure and remains a vital factor contributing to United States CCTV market growth. For instance, according to industry reports, the U.S. video surveillance market is expected to grow from $11.27 Billion in 2024 to $18.06 Billion by 2030 at a CAGR of 8.2%, fueled largely by the rapid adoption of AI technologies. AI-powered cameras with features like facial recognition, behavior analysis, and real-time alerts are transforming surveillance, especially in government and commercial sectors. In 2024, 15.4 million CCTV units were shipped, projected to reach 26.1 million by 2030. AI-driven smart city initiatives and predictive analytics are driving demand, while $300 Million in 2025 venture funding supports wireless AI-enabled systems. Regulations like the Fourth Amendment and VPPA ensure ethical AI deployment.

To get more information on this market, Request Sample

Increasing Adoption in Residential Sector

Residential adoption is emerging as a strong trend in the United States CCTV market. Consumers are increasingly prioritizing safety, leading to a rise in smart home surveillance systems. Affordable pricing, wireless connectivity, and integration with home automation platforms are encouraging household adoption. For instance, in May 2024, Eufy launched the S330, a fully autonomous security camera featuring 360-degree pan and 70-degree tilt capabilities for extensive area coverage. Equipped with AI tracking, the device supports both WiFi and LTE connectivity, including a SIM card with data allowance. The S330 utilizes a 9400 mAh battery charged via an integrated solar panel, enabling near-continuous operation. It offers 4K color vision day and night, a 100-lumen spotlight, and two-way audio. CCTV systems are no longer limited to commercial establishments but are being integrated into everyday living spaces. Companies are offering user-friendly solutions that combine convenience with high performance. Demand for neighborhood security is further fueling growth, supported by local government incentives in some states. These changes are making home-based monitoring a key segment, reinforcing the momentum of the United States CCTV market growth.

United States CCTV Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type and end user vertical.

Type Insights:

- Analog Cameras

- IP Cameras (excluding PTZ)

- PTZ Cameras

The report has provided a detailed breakup and analysis of the market based on the type. This includes analog cameras, IP cameras (excluding PTZ), and PTZ cameras.

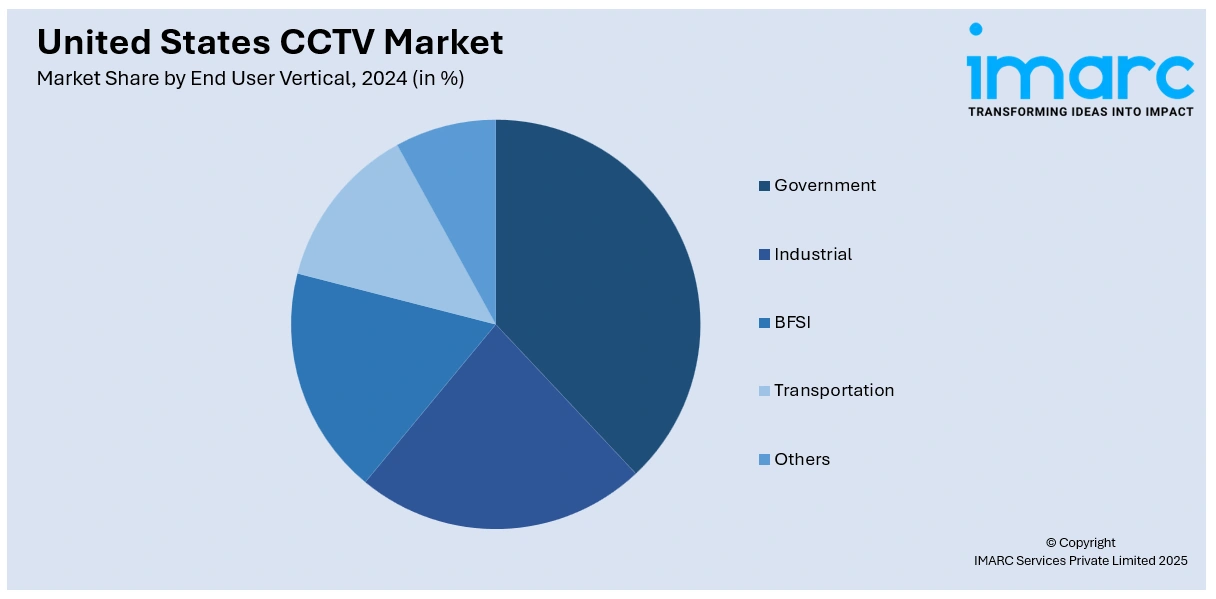

End User Vertical Insights:

- Government

- Industrial

- BFSI

- Transportation

- Others

A detailed breakup and analysis of the market based on the end user vertical have also been provided in the report. This includes government, industrial, BFSI, transportation, and others.

Regional Insights:

- Northeast

- Midwest

- South

- West

The report has also provided a comprehensive analysis of all the major regional markets, which include Northeast, Midwest, South, and West.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

United States CCTV Market News:

- In March 2025, Motorola Solutions unveiled new features for its Avigilon enterprise security suite at ISC West 2025, including Alta SOS, which enables real-time sharing of emergency data (e.g., floor plans, camera feeds) with 911 responders. The Avigilon Unity platform now uses large language models to detect complex video events, enhancing threat detection and response. The update supports critical infrastructure, hospitals, and large enterprises. Motorola also announced the acquisition of visitor management company InVisit, set to close in Q2 2025, strengthening its integrated cloud-based security offerings.

United States CCTV Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Analog Cameras, IP Cameras (Excluding PTZ), PTZ Cameras |

| End User Verticals Covered | Government, Industrial, BFSI, Transportation, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the United States CCTV market performed so far and how will it perform in the coming years?

- What is the breakup of the United States CCTV market on the basis of type?

- What is the breakup of the United States CCTV market on the basis of end user vertical?

- What is the breakup of the United States CCTV market on the basis of region?

- What are the various stages in the value chain of the United States CCTV market?

- What are the key driving factors and challenges in the United States CCTV market?

- What is the structure of the United States CCTV market and who are the key players?

- What is the degree of competition in the United States CCTV market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States CCTV market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the United States CCTV market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States CCTV industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)