United States Clinical Trial Supplies Market Size, Share, Trends and Forecast by Services, Phase, Therapeutic Area, End-Use Industry, and Region, 2025-2033

United States Clinical Trial Supplies Market Overview:

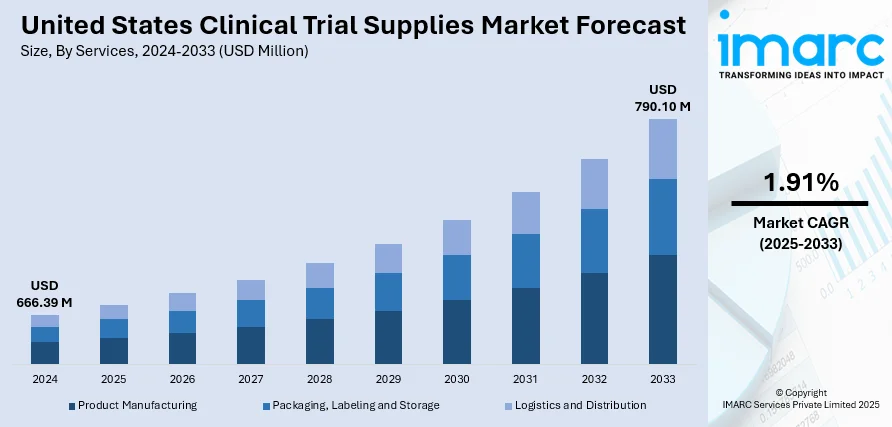

The United States clinical trial supplies market size was valued at USD 666.39 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 790.10 Million by 2033, exhibiting a CAGR of 1.91% during 2025-2033. Numerous advancements in medical research and drug development, which are ultimately contributing to the improvement of healthcare outcomes for patients across the country, are primarily driving the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 666.39 Million |

| Market Forecast in 2033 | USD 790.10 Million |

| Market Growth Rate 2025-2033 | 1.91% |

The growing complexity of clinical trials is driving a stronger focus on supply chain efficiency in the market. Sponsors are prioritizing timely delivery, real-time tracking, and temperature control for investigational products. Increasing adoption of advanced logistics solutions helps reduce delays and ensures regulatory compliance. As more trials become decentralized, efficient supply chain systems have become essential for reaching remote sites. Improved packaging technologies and automated inventory systems are also reducing waste and cost. Additionally, responsive warehousing and regional depot networks are improving trial material access. This trend is significantly enhancing trial execution timelines, improving site performance, and supporting the broader shift toward faster, patient-centric research approaches in the US.

To get more information on this market, Request Sample

Digital innovation is transforming the clinical trial supply process across the United States. The integration of e-labeling, real-time data tracking, and automated ordering systems is streamlining trial operations. These technologies reduce manual errors, improve inventory visibility, and enhance communication between trial sites and sponsors. With the growing use of hybrid and decentralized trial models, digital tools have become essential for managing complex supply needs. Platforms offering end-to-end visibility and secure data management are gaining traction. The use of AI-powered analytics also supports demand forecasting and inventory optimization. This trend is improving trial accuracy, speed, and compliance while increasing operational flexibility across the entire clinical supply chain.

United States Clinical Trial Supplies Market Trends:

Strengthening Localized Clinical Trial Supply

A growing strategic shift toward domestic manufacturing and infrastructure development is driving the United States clinical trial supplies market growth. This trend is largely influenced by increased focus on secure, consistent, and scalable supply chains that minimize external risks. Pharmaceutical companies are now investing more in US based trial supply facilities to ensure faster distribution, reduce dependency on imports, and meet regulatory expectations for supply transparency. This focus on localization enhances trial readiness and improves response to rapid changes in trial volume or design. For instance, in July 2025, AstraZeneca announced a USD 50 Billion investment in the United States, including the establishment of new clinical trial supply sites. These facilities aim to support production and distribution of investigational materials for upcoming therapies, significantly reinforcing local capabilities. As clinical trials become more complex and global demand grows, domestic facilities help streamline logistics, improve delivery timelines, and enable quicker trial start-ups. Government support, combined with pharma industry momentum, is reinforcing this trend across the country. The shift toward locally anchored infrastructure not only strengthens supply security but also improves cost efficiency and accelerates development timelines, positioning the U.S. as a leading hub for consistent and high-quality clinical trial supply solutions.

Digital Innovation Driving Workflow Efficiency

Digitization is rapidly reshaping clinical trial supply logistics by reducing manual processes and improving real-time coordination between sponsors, CROs, and investigator sites. With increasing protocol complexity, the need for faster, more reliable lab operations has become critical. Sponsors are now prioritizing digital tools that reduce errors, ensure compliance, and streamline sample handling workflows. Automated requisition systems, real-time data validation, and centralized tracking tools are improving supply chain transparency while minimizing delays. For example, in March 2025, IQVIA Laboratories introduced Site Lab Navigator with an advanced e-Requisition system, enabling electronic specimen management and end-to-end tracking. This innovation replaced paper-based processes, reduced visit queries, and simplified kit management, resulting in significant efficiency gains for clinical sites. As a result, investigator burden was reduced, data accuracy improved, and turnaround times accelerated creating a more robust and scalable trial supply environment. This digital shift is also supporting the wider adoption of decentralized and hybrid trials, where faster, more automated systems are essential for seamless execution. These United States clinical trial supplies market trends reflect a broader industry push toward smarter trial management, where automation and integration will be critical to meeting the future needs of high-volume, tech-enabled clinical research operations.

Expansion Supporting Innovation and Compliance

The United States clinical trial supplies market is a fundamental component of the healthcare and pharmaceutical industry, providing essential materials and resources crucial for the meticulous execution of controlled medical experiments. As per an industry report, 15.62% of trial completions in 2024 were Phase III studies. In total, 7,089 trials were completed in 2024, surpassing the 6,234 trials that finished in 2023. Additionally, this market encompasses a wide array of supplies, including investigational drugs, placebos, medical devices, and biological samples, which are vital for evaluating the safety and efficacy of new drugs, therapies, and medical devices through clinical trials. According to the NCBI, a total of 2,494 clinical trials involving artificial intelligence medical devices have been registered globally, with contributions from 66 countries or regions. The United States leads with 908 of these trials. Besides this, clinical trial supplies play a pivotal role in facilitating the seamless progress of trials, equipping researchers with the necessary tools to administer treatments, collect data, and maintain compliance with regulatory standards, which is bolstering the market growth across the nation. As the demand for innovative medical solutions continues to grow, the United States clinical trial supplies market is positioned for sustained expansion over the forecasted period. Accordingly, in May 2025, Siemens Healthineers invested USD 150 Million in expanding U.S. operations, including relocating Varian's manufacturing to California, opening mega supply depots, and building a 60,000 sq. ft. Experience Center in North Carolina, supporting healthcare digitization and innovative medical solutions.

United States Clinical Trial Supplies Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States clinical trial supplies market, along with forecasts at the regional, and country levels from 2025-2033. The market has been categorized based on services, phase, therapeutic area, and end-use industry.

Analysis by Services:

- Product Manufacturing

- Packaging, Labeling and Storage

- Logistics and Distribution

In 2024 the logistics and distribution led the market, accounted for the market share of 28.6%. This leadership position highlights the growing complexity and importance of efficient supply chain management in clinical research. With the increase in multi-site and decentralized trials across the US, the need for timely, accurate delivery of clinical materials has intensified. Sponsors and CROs are increasingly relying on advanced logistics solutions to manage temperature-sensitive drugs, maintain trial timelines, and ensure regulatory compliance. Innovations in real-time shipment tracking, cold chain management, and last-mile delivery services have greatly improved supply chain reliability. Additionally, rising demand for quick resupply and rapid protocol changes have further emphasized the need for flexible and responsive logistics systems. As clinical trials continue to scale in size and complexity, the logistics and distribution segment remains central to ensuring uninterrupted trial execution nationwide.

Analysis by Phase:

- Phase I

- Phase II

- Phase III

- Others

As per the United States clinical trial supplies market outlook, in 2024, the phase III segment led the market, accounted for the 46.8%. These late-stage trials typically involve large patient populations and multiple trial sites, significantly increasing demand for complex supply logistics and high-volume material distribution. Since Phase III trials are pivotal in determining product approval and market entry, sponsors place a strong emphasis on ensuring supply consistency, blinding, and timely replenishment. Managing varied dosing schedules, placebo control, and increased site activity in this phase requires robust inventory control and planning systems. Additionally, the lengthier duration of Phase III trials demands longer-term storage, more complex logistics coordination, and tight adherence to regulatory guidelines. The high stakes involved in this trial stage push companies to invest in more advanced supply chain solutions, reinforcing the segment’s influence over the broader clinical trial supplies landscape in the US.

Analysis by Therapeutic Area:

- Oncology

- Cardiovascular Diseases

- Respiratory Diseases

- Central Nervous System (CNS) and Mental Disorders

- Others

Based on the United States clinical trial supplies market forecast, in 2024 the cardiovascular diseases led the market, accounted for the market share of 33.2%. It is reflecting their significant role in driving demand for specialized supplies and distribution solutions. As the prevalence of heart-related conditions continues to rise across the United States, pharmaceutical companies are investing heavily in developing new treatments, requiring large-scale and often long-term clinical trials. These studies typically involve diverse patient populations and often include multiple comorbidities, demanding tailored packaging, dosing regimens, and monitoring equipment. Cardiovascular trials also tend to involve intensive data collection and stringent monitoring protocols, increasing the need for precision in sample handling, device calibration, and drug storage. Given the chronic nature of many cardiovascular conditions, these trials may run longer, necessitating reliable long-term supply and replenishment strategies. The scale and complexity of cardiovascular research are prompting increased investment in logistics infrastructure and trial site support services, strengthening the overall clinical trial supplies market in the United States.

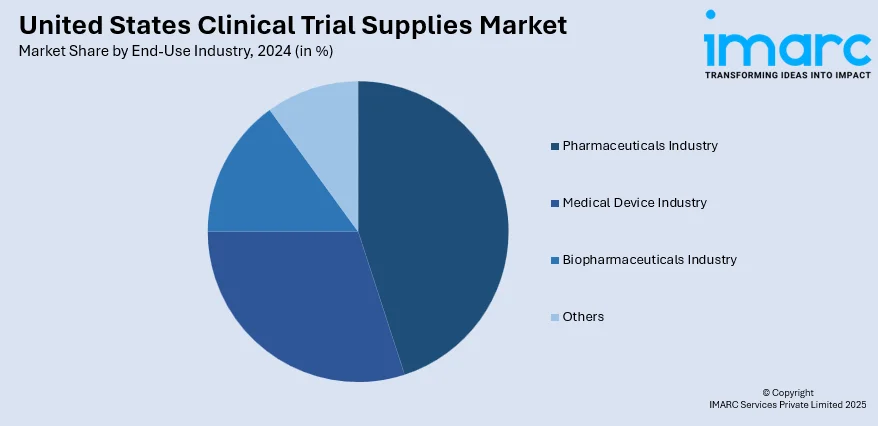

Analysis by End-Use Industry:

- Medical Device Industry

- Biopharmaceuticals Industry

- Pharmaceuticals Industry

- Others

In 2024 the pharmaceutical industry led the market, accounted for the market share of 48.1%. As drug development pipelines grow in volume and complexity, pharmaceutical firms require increasingly advanced support systems for trial execution. These companies are heavily invested in large-scale trials spanning multiple therapeutic areas, often with global distribution requirements and strict regulatory timelines. As a result, there is a consistent need for temperature-controlled shipping, advanced labelling, and adaptive inventory solutions to manage evolving trial protocols. Furthermore, the push toward personalized medicine and targeted therapies is increasing the complexity of trial designs, further driving reliance on sophisticated clinical trial supply services. The pharmaceutical industry’s aggressive expansion in both traditional and specialty drug development continues to influence innovations in packaging, blinding, and site supply models, ensuring its continued dominance in the market.

Regional Analysis:

- Northeast

- Midwest

- South

- West

The Northeast holds a strong position in the clinical trial supplies market due to its dense concentration of research institutions, hospitals, and biopharmaceutical companies. States like Massachusetts and New York host major academic medical centers and contract research organizations (CROs), which drive consistent trial activity. The region benefits from proximity to regulatory bodies and a well-established logistics network, supporting efficient distribution of trial materials. Investment in early-phase research and collaborations between academia and industry also contribute to rising demand for reliable, specialized supplies. These factors make the Northeast a high-priority zone for clinical trial material sourcing and distribution.

The Midwest serves as a growing hub for clinical trial logistics and manufacturing support, driven by its central location and access to cost-effective operational infrastructure. States like Illinois, Indiana, and Minnesota are home to major pharmaceutical and medical device firms that conduct large-scale trials. The region’s strong transportation network and warehousing capabilities offer logistical efficiency for distributing temperature-sensitive and time-critical supplies across the country. Additionally, academic institutions and hospital networks across the Midwest are increasingly involved in late-phase clinical studies. These conditions make the region strategically valuable for companies managing supply chains across multiple trial sites in the US.

The South is gaining importance in the clinical trial supplies market due to its expanding population, rising number of trial participants, and growing presence of CROs and pharmaceutical firms. States such as Texas, Florida, and North Carolina offer favorable conditions for trial operations, including lower costs, supportive state policies, and access to diverse patient demographics. The region’s mild climate also supports the storage and transportation of sensitive materials. Furthermore, the South is attracting investment in biotech and clinical infrastructure, helping to strengthen regional trial networks. These developments are accelerating demand for specialized logistics, storage, and supply management in clinical research.

The West region, particularly California, plays a major role in driving the clinical trial supplies market due to its leadership in biotech innovation and advanced medical research. The presence of top pharmaceutical companies, venture-backed startups, and world-class research universities fuels consistent trial activity. With many early-stage trials initiated in the region, demand for tailored, small-batch supply services remain strong. The West also leads in digital trial integration, requiring flexible supply chain models. Its well-developed infrastructure and access to global shipping hubs enable streamlined import and export of investigational materials. This combination makes the West a cornerstone of clinical supply operations.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latest News and Developments:

- June 2025: Oracle enhanced its Randomization and Trial Supply Management (RTSM) solution with drug pooling and interoperability advancements, enabling seamless supply management across multiple trials and vendors. This automation, integrated with platforms like SAP and Fisher Clinical Services, improves efficiency and accelerates clinical trial execution and innovation.

- April 2025: Suvoda and Greenphire completed their merger, forming a unified company offering a comprehensive platform to streamline clinical trials. The merged company, retaining the Suvoda name, combines expertise in trial supply management, financial tools, and patient support to enhance trial efficiency and improve patient outcomes.

- February 2025: Selkirk Pharma launched ClinFAST, a service designed to expedite fill/finish for clinical trials by reducing production timelines. This solution addresses the bottleneck in small-batch drug manufacturing, offering rapid turnaround, high-quality standards, and scalability, helping biotech and pharma companies meet critical clinical trial milestones.

- September 2024: PCI Pharma Services announced a USD 365 Million investment in US and EU facilities to support clinical and commercial-scale assembly and packaging of drug-device combination products. This expansion includes new centers in Philadelphia, Rockford, and Dublin, enhancing capabilities in advanced drug delivery systems, with operations beginning in 2024 and 2025.

- July 2024: MedPharm merged with Tergus Pharma to form an end-to-end CDMO, enhancing its scientific, clinical trial, and commercial production capabilities. The combined organization will focus on developing and manufacturing topical and transdermal pharmaceuticals, with expanded capabilities in hormone-based and potent drug production.

United States Clinical Trial Supplies Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Services Covered | Product Manufacturing, Packaging, Labeling and Storage, Logistics and Distribution |

| Phases Covered | Phase I, Phase II, Phase III, Others |

| Therapeutic Areas Covered | Oncology, Cardiovascular Diseases, Respiratory Diseases, Central Nervous System (CNS) and Mental Disorders, Others |

| End Use Industries Covered | Medical Device Industry, Biopharmaceuticals Industry, Pharmaceuticals Industry, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States clinical trial supplies market from 2019-2033.

- The United States clinical trial supplies market research report provides the latest information on the market drivers, challenges, and opportunities in the market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States clinical trial supplies industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The clinical trial supplies market in United States was valued at USD 666.39 Million in 2024.

The United States clinical trial supplies market is projected to exhibit a CAGR of 1.91% during 2025-2033, reaching a value of USD 790.10 Million by 2033.

Key factors driving the United States clinical trial supplies market include rising demand for advanced therapies, increasing Phase III trial activity, growth in personalized medicine, expanding pharmaceutical R&D investment, and improved logistics infrastructure supporting decentralized trials and efficient distribution of investigational products across multiple trial sites.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)