United States Construction Equipment Rental Market Report by Equipment Type (Earthmoving, Material Handling), Propulsion System (Electric, ICE), Application (Residential, Commercial, Industrial), and Region 2025-2033

Market Overview:

United States construction equipment rental market size reached USD 30,333.10 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 45,702.86 Million by 2033, exhibiting a growth rate (CAGR) of 4.66% during 2025-2033. The rapid advancements in construction equipment technology that have led to more efficient and productive machines, are driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 30,333.10 Million |

|

Market Forecast in 2033

|

USD 45,702.86 Million |

| Market Growth Rate 2025-2033 | 4.66% |

United States Construction Equipment Rental Market Analysis:

- Key Market Drivers: The United States construction equipment rental market analysis indicates rising infrastructure investments, urbanization, and cost-saving preferences among contractors propel growth. Rentals minimize capital expense, maintenance charges, and equipment downtime, enabling sophisticated equipment to be utilized by small and mid-sized construction companies.

- Key Market Trends: Trends in the growth of electric and sustainable construction equipment, digital fleet management, and integration of telematics are transforming the U.S. construction equipment rental market. Fluctuations in seasonal demand and extension of rental services to residential and specialized construction segments are driving market trends.

- Competitive Landscape: The United States construction equipment rental market demand is highly competitive with leading players responding to market conditions by growing their fleets, providing value-added services, and using technology-driven solutions. Strategic acquisitions and regional alliances assist in capturing the market share and increasing the brand presence.

- Challenges and Opportunities: Rise in fuel costs, equipment maintenance expenditure, and regulatory costs are challenges to the U.S. construction equipment rental market. Opportunities include pushing into growth markets, adopting environment-friendly equipment, digital equipment tracking platforms in real time, and flexible packaging of rentals to cater to varying customer needs.

Construction equipment rental is a practice where companies or individuals lease machinery and tools for temporary use on construction sites. Instead of purchasing expensive equipment outright, renting provides a cost-effective and flexible solution. This arrangement allows construction businesses to access a wide range of specialized machinery, such as excavators, bulldozers, cranes, and concrete mixers, without the burden of ownership costs. Rental services often include maintenance and repairs, relieving renters of the responsibility for upkeep. This approach is particularly beneficial for short-term projects or when specific equipment is required infrequently. Construction equipment rental promotes efficiency, financial savings, and adaptability in the dynamic construction industry, enabling businesses to scale their operations according to project needs without the long-term commitment of ownership. Overall, it facilitates access to modern and well-maintained equipment, contributing to safer and more productive construction practices.

United States Construction Equipment Rental Market Trends:

Growing Use of Sustainable and Electric Equipment

The United States construction equipment rental market expansion is being driven considerably by the transition towards green and electric equipment. Contractors are increasingly turning to low-emission, efficient equipment in order to comply with regulations and decrease operating expenses. Electric loaders, excavators, and compact equipment are becoming highly available through the rental method, allowing companies to access state-of-the-art technology without excessive capital expenditure. The use of these sustainable solutions bolsters goals of sustainability and minimizes environmental footprint on job sites. Moreover, rental companies are increasing fleets to incorporate hybrid and all-electric equipment, mimicking shifting market demand. The access to these innovative options in rental fleets maximizes project efficiency and prepares construction firms to comply with changing industry standards. This trend will propel the United States construction equipment rental market share, with contractors demanding versatile, sustainable solutions meeting environmental and fiscal goals.

Merging of Digital Fleet Management and Telematics

Digitalization is revolutionizing the construction equipment rental industry in the United States, with telematics and fleet management systems taking center stage. Equipment rental companies more and more incorporate GPS tracking, real-time monitoring, and predictive maintenance capabilities into their services. Such digital capabilities enable contractors to maximize equipment utilization, minimize idle time, and improve operating efficiency. Real-time data analytics support informed decision-making for project planning, machine assignment, and cost control. Rental operators are using AI-based platforms to automate booking, delivery, and maintenance scheduling, with a seamless user experience. Widespread implementation of these technologies is boosting transparency and enhancing accountability in construction sites. As more dependence on data-led operations is being created, the market is observing a transition toward smart rental services that offer actionable insights for improved resource management while favoring sustained United States construction equipment rental market growth.

Growth in Rental Services in the Specialized and Residential Segments

The United States construction equipment rental market is being diversified as rental services for non-traditional commercial and infrastructure projects are growing. Rental demand for specialized equipment for landscaping, residential building, and small-scale city projects is also growing. Rentals are being favored by contractors and independent operators to obtain costly machinery on a short-term or seasonal basis without incurring excessive capital investment. Rental providers are reacting by presenting customized packages, accommodating lease periods, and a broader range of specialized equipment and tools. This strategy optimizes project efficiency and completes projects on time while minimizing financial risk. The growing penetration of rental services into specialty markets is expanding the customer base and improving access to modern equipment across different segments of construction. Hence, this trend is likely to have a positive impact on the United States construction equipment rental market share, indicating increasing usage and varied pattern of demand in the country.

United States Construction Equipment Rental Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on equipment type, propulsion system, and application.

Equipment Type Insights:

To get more information on this market, Request Sample

- Earthmoving

- Excavator

- Loader

- Backhoe

- Motor Grader

- Others

- Material Handling

- Crawler Crane

- Trailer-Mounted Crane

- Truck-Mounted Crane

- Concrete and Road Construction

The report has provided a detailed breakup and analysis of the market based on the equipment type. This includes earthmoving (excavator, loader, backhoe, motor grader, and others) and material handling (crawler crane, trailer-mounted crane, truck-mounted crane, and concrete and road construction).

Propulsion System Insights:

- Electric

- ICE

A detailed breakup and analysis of the market based on the propulsion system have also been provided in the report. This includes electric and ICE.

Application Insights:

- Residential

- Commercial

- Industrial

The report has provided a detailed breakup and analysis of the market based on the application. This includes residential, commercial, and industrial.

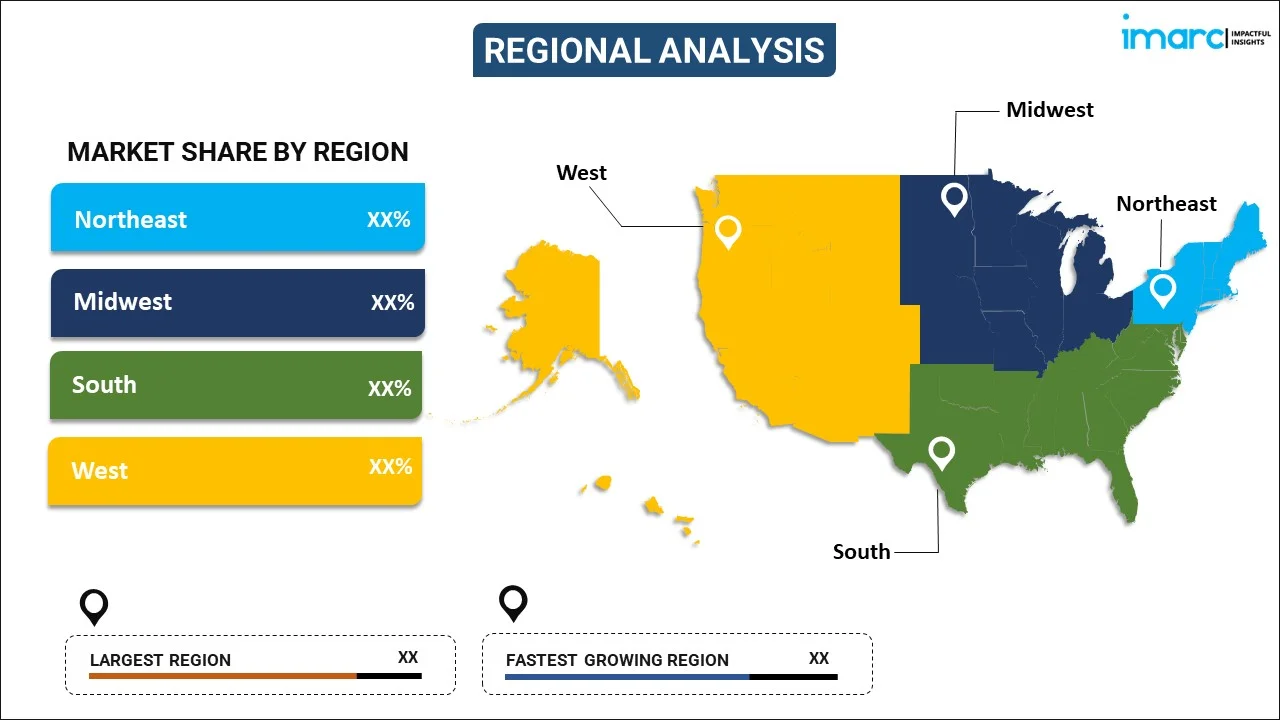

Regional Insights:

- Northeast

- Midwest

- South

- West

The report has also provided a comprehensive analysis of all the major regional markets, which include Northeast, Midwest, South, and West.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided. . Some of the key players include:

- Caterpillar Inc.

- H&E Equipment Services Inc.

- Herc Rentals Inc.

- United Rentals Inc.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Latest News and Developments:

- In February 2024, CASE Construction Equipment unveiled more than 30 new products, such as backhoe loaders, mini excavators, and small articulated loaders, at The ARA Show in New Orleans. Launching on a note of versatility, integration of telematics, and support from the dealer, the unveiling offers rental companies powerful tools to maximize productivity and efficiency in operations.

- In January 2025, United Rentals announced a $4.8 billion acquisition of H&E Equipment Services, a Louisiana-based company. The transaction is intended to diversify United Rentals' fleet of aerial work platforms and earth-moving equipment as well as use technology and operating expertise to improve service offerings and consolidate its leadership in the United States construction equipment rental market.

United States Construction Equipment Rental Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Equipment Types Covered |

|

| Propulsion Systems Covered | Electric, ICE |

| Applications Covered | Residential, Commercial, Industrial |

| Regions Covered | Northeast, Midwest, South, West |

| Companies Covered | Caterpillar Inc., H&E Equipment Services Inc., Herc Rentals Inc., United Rentals Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States construction equipment rental market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the United States construction equipment rental market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States construction equipment rental industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The United States construction equipment rental market was valued at USD 30,333.10 Million in 2024.

The United States construction equipment rental market is projected to exhibit a CAGR of 4.66% during 2025-2033, reaching a value of USD 45,702.86 Million by 2033.

The United States construction equipment rental market is driven by rising infrastructure projects, high equipment costs, and a preference for operational flexibility. Contractors favor rentals to reduce maintenance expenses and adapt to project-specific needs, while technological advancements and demand for modern, efficient machinery further support rental growth across diverse construction sectors.

Some of the major players in the United States construction equipment rental market include Caterpillar Inc., H&E Equipment Services Inc., Herc Rentals Inc., United Rentals Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)