United States Controlled Release Fertilizer Market Size, Share, Trends and Forecast by Type, Form, Application, and Region, 2025-2033

United States Controlled Release Fertilizer Market Size and Share:

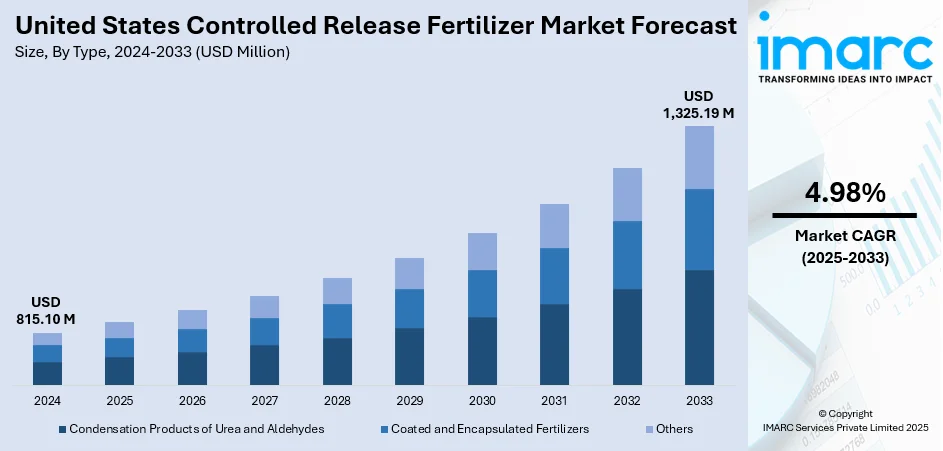

The United States controlled release fertilizer market size was valued at USD 815.10 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 1,325.19 Million by 2033, exhibiting a CAGR of 4.98% from 2025-2033. The market is witnessing significant growth due to the rising demand for sustainable agriculture practices aimed at reducing environmental impact while ensuring long-term food security. Farmers and stakeholders are increasingly focusing on improving crop yields through eco-friendly methods, driven by concerns over climate change and resource efficiency. Additionally, the adoption of precision farming technologies is accelerating, enabling better resource management, reduced input costs, and higher productivity. These factors collectively fuel market United States controlled release fertilizer market share and create opportunities for innovation in modern agriculture.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 815.10 Million |

| Market Forecast in 2033 | USD 1,325.19 Million |

| Market Growth Rate 2025-2033 | 4.98% |

The shift toward sustainable agricultural practices marks a major transformation in American farming, with modern farmers increasingly turning to controlled-release fertilizers (CRFs) as vital tools for optimizing nutrient management while reducing their environmental footprint. CRFs can cut nitrogen losses from leaching and volatilization by up to 60% and denitrification by over 10%, ensuring precise nutrient delivery that aligns with plant uptake patterns. This efficiency reduces surface runoff, enhances crop yields, and minimizes the need for repeated applications, supporting both profitability and sustainability. At the same time, the integration of smart farming technologies and precision agriculture systems is accelerating adoption, empowering farmers with data-driven solutions to maximize returns and resource efficiency.

To get more information on this market, Request Sample

The United States stands out as a significant region for controlled release fertilizer adoption, driven by advanced agricultural infrastructure and strong regulatory support for sustainable farming practices. Recent innovations in polymer coating technologies and bio-based release mechanisms have revolutionized the market landscape, offering farmers unprecedented control over nutrient timing and availability. The development of customizable fertilizer formulations tailored to specific crops and soil conditions has particularly gained traction among progressive agricultural operations. Furthermore, increasing investment in agricultural research and development, coupled with supportive federal policies promoting sustainable farming, continues to drive United States controlled release fertilizer market growth and technological advancement throughout the American agricultural sector.

United States Controlled Release Fertilizer Market Trends:

Increasing interest in sustainable farming

Escalating environmental concerns and the need for sustainable farming have led to a surge in demand for controlled release fertilizers (CRFs) in the United States. These fertilizers are designed to release nutrients slowly, paralleling the nutrient uptake pattern of plants. This helps avoid nutrient losses due to leaching, volatilization, and runoff. As reported, over half of the ammonium nitrogen from manure can be lost to the air under warm, dry conditions, greatly reducing the fertilizer value of the manure. Hence, farmers and agricultural enterprises are increasingly adopting CRFs to minimize the ecological impact of their operations. In addition to this, consumer interest in green products and growing demand for food organically and sustainably produced is driving interest in CRFs that improve crop yield, promote soil health, and reduce the carbon footprint of agricultural activities. According to USDA, National Agricultural Statistics Service (NASS) surveys (2011 and 2021), certified organic cropland acres increased by 79 percent (to 3.6 million acres).

Technology advancements in fertilizer formulations

Another significant United States controlled release fertilizer market trend is the ongoing technological changes. Better polymer coatings, encapsulation techniques, and bio-based release mechanisms have made CRF more efficient and effective, creating a positive outlook for market expansion. This technology enables precise regulation of the rate of nutrient release so that plants get their nutrients when they need them. Concurrent with this, the development of slow-release fertilizers with the intent of customizing to the crop and soil type is also aiding in market expansion. For instance, the formulation of the commonly used polymer-coated urea CRF to enhance nitrogen use efficiency and minimize environmental impact is bolstering market growth. Furthermore, the increasing use of nanotechnology in the development of fertilizers for even greater precision in nutrient delivery is propelling the United States controlled release fertilizer market outlook.

Increasing pressures from regulations

The Federal and state regulatory frameworks have been becoming increasingly stern about agricultural practices, with most of them focusing on nutrient management. Regulatory bodies, including the Environmental Protection Agency and its state counterparts, are implementing the rules more stringently to reduce the nutrient runoff responsible for water pollution and eutrophication in different water bodies. This is fueling the adoption of CRFs as an effective alternative in complying with these stringent regulatory demands due to their considerable reduction in the rate of nutrient leaching and runoff. Besides this, supportive government incentives and subsidies for the adoption of environmentally friendly agricultural practices further drive the market for CRFs in the United States. As such, U.S. nano-fertilizers market size is evaluated at USD 156.63 million in 2024 and is predicted to grow further.

United States Controlled Release Fertilizer Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States controlled release fertilizer market, along with forecast at the regional, and country levels from 2025-2033. The market has been categorized based on type, form and application.

Analysis by Type:

- Condensation Products of Urea and Aldehydes

- Urea Formaldehyde (UF)

- Isobutylidenediurea

- Crotonylidenediurea

- Coated and Encapsulated Fertilizers

- Sulfur-coated Fertilizers

- Polymer-coated Fertilizers

- Sulfur-polymer Coated Fertilizers

- Others

- Others

Condensation products of urea and aldehydes represent traditional controlled release technologies that provide slow nutrient release through chemical breakdown processes. Urea formaldehyde compounds offer reliable nitrogen release over extended periods, making them particularly suitable for perennial crops and turf applications. These formulations provide cost-effective solutions for farmers seeking extended nutrient availability without frequent reapplication requirements.

Coated and encapsulated fertilizers dominate the market segment due to their advanced technology and precise nutrient control capabilities. Polymer-coated fertilizers utilize sophisticated polymer membranes that regulate nutrient release based on soil temperature and moisture conditions. Sulfur-coated fertilizers provide dual benefits of nitrogen and sulfur nutrition while offering controlled release properties. Sulfur-polymer coated fertilizers combine the benefits of both coating technologies, providing enhanced nutrient management with improved durability and release consistency.

Analysis by Form:

- Granular

- Liquid

- Powder

Based on the United States controlled release fertilizer market forecast, the Granular controlled release fertilizers offer superior handling characteristics, storage stability, and application convenience. These formulations provide uniform nutrient distribution and are compatible with standard agricultural equipment, making them preferred choices for large-scale farming operations. Granular forms offer excellent flowability and reduced dust generation during application, enhancing worker safety and application accuracy.

Liquid controlled release fertilizers enable rapid nutrient availability and uniform soil distribution through irrigation systems or direct application. These formulations offer flexibility in application timing and methods, allowing farmers to integrate controlled release technology with existing liquid fertilizer programs. Liquid forms are particularly effective for specialty crops requiring precise nutrient management and fertigation systems.

Powder controlled release fertilizers provide high nutrient concentration and rapid dissolution characteristics. These formulations are particularly suitable for greenhouse applications and specialty crop production where precise nutrient control is essential. Powder forms offer excellent mixing capabilities with other agricultural inputs and provide cost-effective solutions for specific applications.

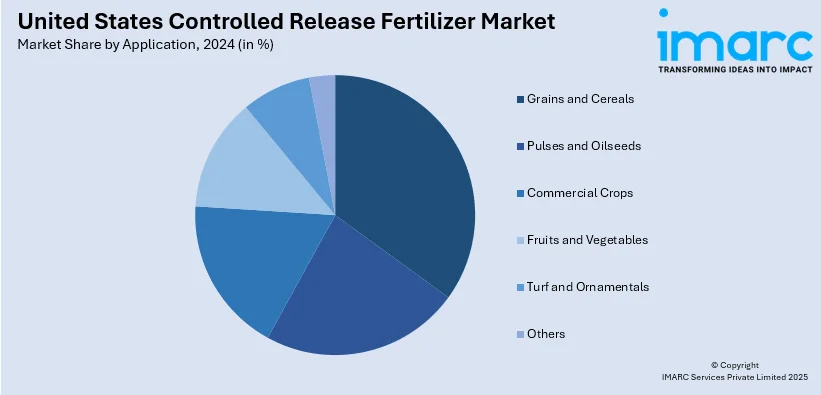

Analysis by Application:

- Grains and Cereals

- Pulses and Oilseeds

- Commercial Crops

- Fruits and Vegetables

- Turf and Ornamentals

- Others

Grains and cereals represent the largest application segment for controlled release fertilizers due to the extensive acreage devoted to these crops and their significant economic importance. Controlled release fertilizers provide essential nitrogen, phosphorus, and potassium nutrition throughout extended growing seasons, supporting optimal grain development and yield potential. These applications benefit from reduced fertilizer losses and improved nutrient use efficiency.

Pulses and oilseeds applications utilize controlled release fertilizers to support protein development and oil content optimization. These crops benefit from sustained nutrient availability during critical reproductive phases, enhancing both yield and quality parameters. Controlled release technology supports nitrogen fixation processes in leguminous crops while providing essential secondary nutrients.

Commercial crops, including cotton, tobacco, and specialty industrial crops, rely on controlled release fertilizers for consistent nutrient supply throughout extended growing seasons. These applications require precise nutrient timing to optimize fiber quality, processing characteristics, and market value.

Fruits and vegetables represent high-value applications where controlled release fertilizers support premium quality production. These crops benefit from sustained nutrient availability during fruit development and quality formation phases. Controlled release technology enables optimal color development, flavor enhancement, and shelf-life extension.

Turf and ornamental applications utilize controlled release fertilizers to maintain consistent growth, color, and appearance throughout the growing season. These applications benefit from reduced application frequency and improved nutrient use efficiency while supporting aesthetic and functional requirements.

Regional Analysis:

- Northeast

- Midwest

- South

- West

According to the United States controlled release fertilizer market analysis, the Northeast region exhibits strong controlled release fertilizer adoption due to intensive agricultural operations, environmental regulations, and proximity to research institutions. This region's focus on sustainable agriculture practices and high-value crop production drives demand for advanced nutrient management technologies. Farmers in this region prioritize environmental stewardship while maintaining productive agricultural systems.

The Midwest region, representing America's agricultural heartland, shows substantial controlled release fertilizer adoption for grain and oilseed production. Large-scale farming operations in this region utilize controlled release technology to optimize nutrient efficiency across extensive acreage. The region's commitment to precision agriculture and sustainable farming practices supports continued market growth.

The South region experiences robust controlled release fertilizer growth due to diverse cropping systems, extended growing seasons, and increasing environmental awareness. This region's agricultural operations benefit from controlled release technology's ability to maintain nutrient availability during challenging weather conditions and variable precipitation patterns.

The West region demonstrates significant controlled release fertilizer adoption for specialty crops, fruits, and vegetables. This region's focus on high-value crop production, water conservation, and precision agriculture drives demand for advanced nutrient management solutions. Controlled release technology supports optimal crop quality and yield under irrigation-dependent agricultural systems.

Competitive Landscape:

The competitive landscape is characterized by intense innovation and technological diversification among industry participants. Leading companies focus on developing comprehensive product portfolios that integrate advanced coating technologies, customizable release patterns, and application-specific formulations. Competition centers on providing cost-effective solutions, enhancing nutrient use efficiency, and developing user-friendly products for diverse agricultural applications. Strategic partnerships, mergers, and acquisitions with agricultural retailers, equipment manufacturers, and research institutions are common strategies to expand market reach and technological capabilities. Additionally, emphasis on regulatory compliance, sustainable production methods, and advanced analytical capabilities helps differentiate competitors, fostering continuous innovation and creating a dynamic environment focused on agricultural productivity, environmental stewardship, and farmer profitability.

The report provides a comprehensive analysis of the competitive landscape in the United States controlled release fertilizer market with detailed profiles of all major companies.

Latest News and Developments:

- August 2025: At Ag in Motion 2025, Crop Growth Sciences unveiled PhoSul, a new phosphorus fertilizer designed to reduce nutrient tie-up and improve soil health. PhoSul combines natural rock phosphate with elemental sulfur and incorporates amorphous silica, promising slow-release feeding throughout the growing season while enhancing nutrient availability and promoting healthier soil for improved crop yields.

- August 2025: Governor JB Pritzker and the Illinois Department of Commerce and Economic Opportunity announced a significant $2 billion investment from Cronus Chemicals LLC for constructing a new fertilizer production facility in Tuscola, Illinois. This project, supported by an Economic Development for a Growing Economy agreement, will create 130 new jobs and strengthen Central Illinois' economy by bolstering both manufacturing and agricultural industries.

United States Controlled Release Fertilizer Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Forms Covered | Granular, Liquid, Powder |

| Applications Covered | Grains and Cereals, Pulses and Oilseeds, Commercial Crops, Fruits and Vegetables, Turf and Ornamentals, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States controlled release fertilizer market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the United States controlled release fertilizer market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States controlled release fertilizer industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The controlled release fertilizer market in the United States was valued at USD 815.10 Million in 2024.

The United States controlled release fertilizer market is projected to exhibit a CAGR of 4.98% during 2025-2033, reaching a value of USD 1,325.19 Million by 2033.

The market is driven by increasing demand for sustainable agriculture practices, rising focus on enhancing crop yields while minimizing environmental impact, technological advancements in fertilizer formulations, stringent environmental regulations, and growing awareness among farmers about controlled nutrient release benefits for both productivity and environmental stewardship.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)