United States Courier, Express and Parcel (CEP) Market Size, Share, Trends and Forecast by Service Type, Destination, Type, End Use Sector, and Region, 2025-2033

United States Courier, Express and Parcel (CEP) Market Size and Share:

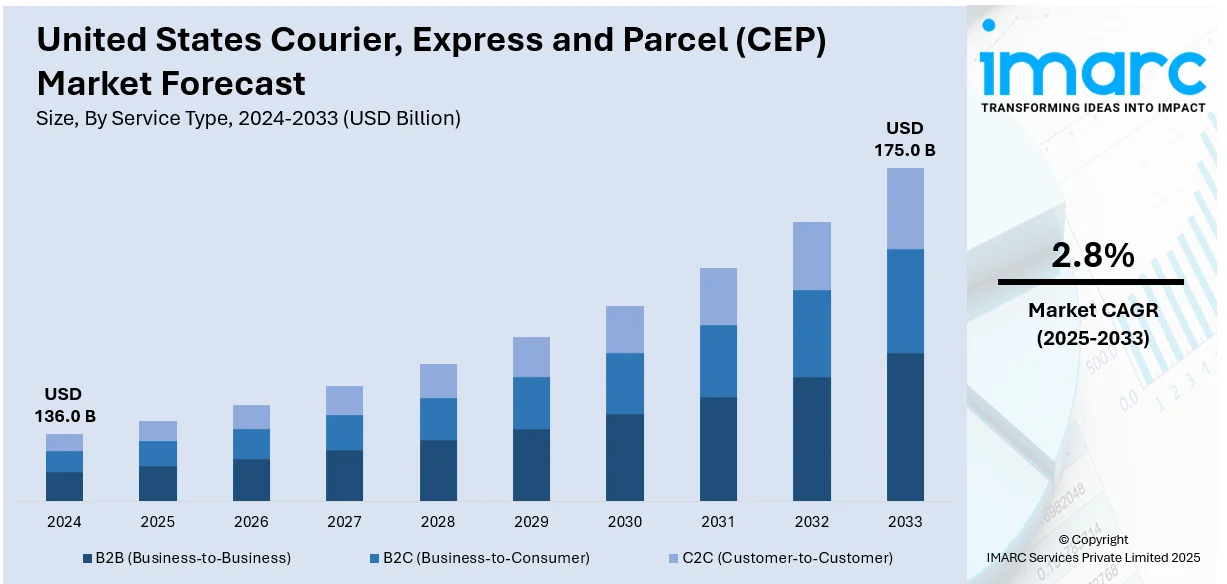

The United States courier, express and parcel (CEP) market size was valued at USD 136.0 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 175.0 Billion by 2033, exhibiting a CAGR of 2.8% from 2025-2033. The rapid expansion of the e-commerce sector, shifting consumer preference toward convenience, significant technological advancements, ongoing globalization and trade agreements, and growing demand for fast delivery services are some of the important factors bolstering the United States courier, express and parcel (CEP) market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 136.0 Billion |

| Market Forecast in 2033 | USD 175.0 Billion |

| Market Growth Rate (2025-2033) | 2.8% |

The expansion of the e-commerce industry continues to be a significant driver for the United States courier, express, and parcel (CEP) market growth. Recent reports from the U.S. Census Bureau reveal a consistent rise in e-commerce sales. In the third quarter of 2024, seasonally adjusted e-commerce sales reached $300.1 billion, marking a 7.4% increase from the same period in 2023. This growth outpaced the total retail sales increase of 2.1% during the same timeframe, with e-commerce accounting for 16.2% of total retail sales in Q3 2024. Projections for 2024 suggest that U.S. e-commerce sales will grow by 8.7%, approaching nearly $1.2 trillion and comprising 16.2% of total retail sales. This upward trend in online shopping has led to a corresponding increase in parcel deliveries, as consumers demand efficient and timely shipping services. The surge in e-commerce has necessitated advancements in logistics and supply chain operations to accommodate the higher volume of shipments, thereby fueling growth in the CEP market. With online retail claiming an ever-growing portion of total retail sales, the courier, express, and parcel (CEP) market in the US is set for continued growth, aligning itself with the changing demands of e-commerce businesses and consumers.

The rising consumer demand for convenience has been a major driver behind the expansion of the United States courier, express, and parcel (CEP) market share. This shift is evident in the substantial rise in online shopping activities, particularly during peak seasons. During the 2024 holiday season, U.S. consumers spent a record $241.4 billion online, marking an 8.7% increase from the previous year. This surge was largely driven by substantial discounts in key categories such as electronics, apparel, and furniture/home goods, with electronics experiencing markdowns peaking at 30.1%. Home delivery convenience has emerged as a key factor shaping consumer behavior. Approximately 54.5% of online transactions during this period were conducted via smartphones, indicating a growing reliance on mobile shopping platforms. The consistent growth in e-commerce underscores a broader consumer shift towards the convenience of online shopping and home delivery services, thereby driving the expansion of the U.S. CEP market.

United States Courier, Express and Parcel (CEP) Market Trends:

Significant Technological Advancements

Technological aspects are a dominant driver for the growth in the United States courier, express, and parcel market demand, as advanced technologies enhance both operational efficiency while reducing costs significantly and improving consumer satisfaction. Algorithms for route optimization, real time tracking systems and automated sorting centres streamline logistics-related operations, giving way to delivery that is even faster and more assured. AI/ML can be integrated to undertake predictive analytics for the company to forecast demand patterns to ensure optimal resource allocation. Drones and self-driving vehicles are quickly finding their way into last-mile delivery services, relieving urban congestion and cutting delivery time. Advanced warehouse automation involving robotics can also increase throughput and reduce human error, thereby ensuring on-time orders. Mobile apps and online platforms, for instance, have been implemented to make delivery tracking more transparent and flexible for customers. Additionally, blockchain technology is being investigated to secure supply chains with effective management and ensure less fraud with more trust in the process. These technologies improve not only the competitive advantage of CEP providers but also respond to the growing need of consumers to be more convenient, faster, and reliable in terms of parcel delivery services. The emerging technology will further evolve and revolutionize the CEP market, driving sustained growth and innovation.

Rapid Globalization and Trade Agreements

The development of international markets and the expansion of international trade have so far been key factors propelling growth in the United States CEP market. With innovations in technology and reduced barriers in international trade, increasing cross-border commerce has consequently made demand in overseas shipping solutions strong and stable. For instance, agreements like the United States-Mexico-Canada Agreement and continuing partnerships with global trade partners have streamlined logistics processes, thus reducing obstacles like tariffs and customs delay. This motivates companies to expand across borders, depending on CEP companies to facilitate complex cross-border delivery processes. The rapid growth of e-commerce has further fueled this movement, as more and more consumers purchase products from online retailers across the globe. For these companies, increasing demand has motivated enhanced global networks where real-time tracking and optimized routes improve accuracy in delivery as well as increase its speed. Growth in the number of emerging middle classes in many new markets has continued to strengthen requirements for importing those goods as a whole and also for international shipping.

Growing Demand for Fast Delivery Services

As per the latest United States courier, express, and parcel (CEP) market forecast, the industry has experienced significant growth driven by rising demand for expedited delivery services. Modern consumers now expect delivery to be faster and more reliable due to same-day and next-day delivery services introduced by e-commerce giants. The increasing demand is a direct response to the culture of "instant gratification," where speed and convenience greatly affect the final decision of consumers to buy a product. Retailers and CEP providers have already invested massively into infrastructure, technology, and solutions for the final mile. In fact, routes are being optimized with special route optimization software. Automated sorting, advanced tracking capacities, and increased use of self-driving technologies to accelerate speed continue to bring it down even more. End. The increased demand for perishable goods, such as groceries and pharmaceuticals, also places a higher demand on the need for rapid delivery services and thus requires customized logistics solutions like temperature-controlled vehicles and warehousing.

United States Courier, Express and Parcel (CEP) Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States courier, express and parcel (CEP) market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on service type, destination, type, and end use sector.

- B2B (Business-to-Business)

- B2C (Business-to-Consumer)

- C2C (Customer-to-Customer)

According to the latest United States courier, express, and parcel (CEP) market trends, B2B services dominate the market because of the steady demand from such industries as manufacturing, healthcare, and retail. There is a need to have on-time logistics for transporting goods and documents as supply chains and inventory supplies demand such movement. Related industrial expansion into just-in-time (JIT) manufacturing and increased reliance on logistics for smooth operations have also boosted B2B demand. With real-time tracking and increased service reliability through advancements in technology, businesses are opting for CEP providers, which means B2B services capture the largest market share.

Analysis by Destination:

- Domestic

- International

Domestic services lead the U.S. CEP market due to the high volume of e-commerce orders and intra-country trade. Consumers' growing preference for online shopping has increased parcel deliveries within the United States, especially for goods ordered on platforms offering fast and free shipping options. Domestic CEP services are supported by an extensive infrastructure, including warehouses, sorting centers, and road networks, ensuring efficient last-mile delivery. Additionally, businesses across various sectors require reliable domestic logistics for operations, further solidifying this segment’s dominance. The focus on quick turnarounds and localized service offerings has cemented domestic services as the market leader.

Analysis by Type:

- Air

- Ship

- Subway

- Road

As per the recent United States courier, express, and parcel (CEP) market outlook, road transportation dominates the market due to its cost-effectiveness, flexibility, and extensive infrastructure, including highways and local road networks. It is the preferred mode for short- to medium-distance deliveries, facilitating timely last-mile delivery for e-commerce orders and small parcels. Road transport allows for greater adaptability in addressing localized delivery demands, particularly in urban and suburban areas. Advancements in logistics technology, including route optimization and real-time tracking, have significantly improved the efficiency of road-based CEP services. The widespread availability of delivery vehicles, from vans to trucks, supports road transport’s position as the market’s leading type.

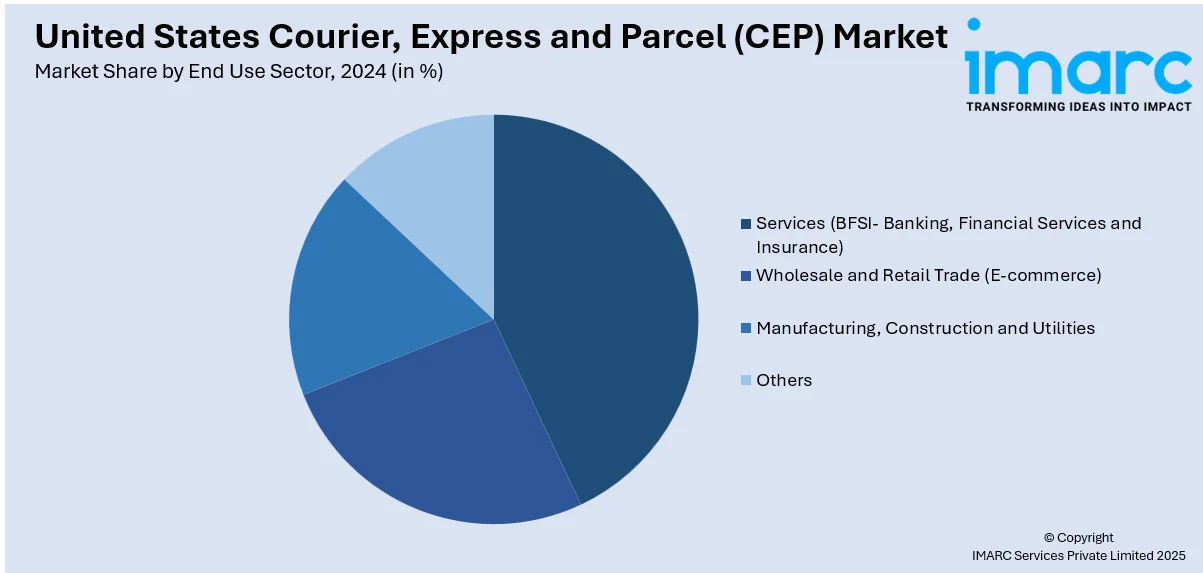

Analysis by End Use Sector:

- Services (BFSI- Banking, Financial Services and Insurance)

- Wholesale and Retail Trade (E-commerce)

- Manufacturing, Construction and Utilities

- Others

On the basis of latest U.S. courier, express, and parcel (CEP) market trends, the services sector holds the majority market share due to its reliance on logistics for delivering critical documents, contracts, and goods. Financial services, healthcare, legal firms, and educational institutions are key drivers in this segment. These industries often require secure, time-sensitive deliveries, such as legal documents, medical equipment, and laboratory samples. The growing emphasis on digitized logistics and tailored delivery solutions has made CEP providers indispensable to service-based businesses. With their need for precision, reliability, and swift transportation, the services sector’s dependency on CEP solutions underpins its dominant market share.

Regional Analysis:

- Northeast

- Midwest

- South

- West

The western United States leads the CEP market, driven by its high population density, economic activity, and strong e-commerce adoption. States like California are hubs for tech, retail, and entertainment, generating significant demand for courier and parcel services. Major urban centers in the region, such as Los Angeles and San Francisco, contribute to substantial delivery volumes, supported by advanced infrastructure and logistical networks. Additionally, the West’s proximity to major Pacific trade routes boosts international shipping. The region’s innovation-friendly environment also fosters advancements in delivery technologies, cementing its position as the largest market share holder in the U.S. CEP industry.

Competitive Landscape:

Leading players in the U.S. courier, express, and parcel (CEP) market are leveraging innovation, strategic partnerships, and enhanced service offerings to maintain competitive advantages and meet evolving consumer demands. They are heavily investing in technology, such as AI-powered route optimization, automated sorting systems, and real-time tracking, to improve operational efficiency and delivery speed. Many are also exploring sustainable solutions, including electric vehicles (EVs) and carbon-neutral delivery options, to address environmental concerns and align with corporate social responsibility goals. To cater to the growing e-commerce sector, leading companies are expanding their last-mile delivery networks and introducing flexible options like same-day delivery, pick-up points, and subscription-based services. Strategic acquisitions and partnerships with local logistics providers enable these players to extend their geographic reach and enhance service quality in underserved areas. Additionally, they are integrating digital tools like mobile apps and chatbot support to provide a seamless customer experience.

The report provides a comprehensive analysis of the competitive landscape in the United States courier, express and parcel (CEP) market with detailed profiles of all major companies, including:

- Aramex

- FedEx

- Qantas Airways Limited

- United Parcel Service of America, Inc.

- Yamato Transport U.S.A., Inc.

- DHL Group (A division of Deutsche Post AG)

- XPO, Inc.

- SkyWorld International Couriers, Inc

Latest News and Developments:

- In May 2024, United States Postal Service announced its plan to purchase 6 LDV190 electric vans for South Atlanta Sorting and Delivery Center to deliver mails.

- In September 2023, Oracle and Uber Direct introduced Collect and Receive, a new solution aimed at connecting retailers with consumers to improve and streamline last-mile delivery services.

- In June 2023, United Delivery Service, Lone Star Overnight, Better Trucks, and Courier Express have partnered with GLS to expand their package delivery network in Texas, Wisconsin, Georgia, Illinois, Ohio, and Florida.

- In September 2024, Amazon declared that in order to improve safety and create high-performing teams, it would invest $2.1 billion in the Delivery Service Partner program.

United States Courier, Express and Parcel (CEP) Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Service Types Covered | B2B (Business-to-Business), B2C (Business-to-Consumer), C2C (Customer-to-Customer) |

| Destinations Covered | Domestic, International |

| Types Covered | Air, Ship, Subway, Road |

| End Use Sectors Covered | Services (BFSI- Banking, Financial Services and Insurance), Wholesale and Retail Trade (E-commerce), Manufacturing, Construction and Utilities, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Companies Covered | Aramex, FedEx, Qantas Airways Limited, United Parcel Service of America, Inc., Yamato Transport U.S.A., Inc., DHL Group (A division of Deutsche Post AG), XPO, Inc., SkyWorld International Couriers, Inc, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States courier, express and parcel (CEP) market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the United States courier, express and parcel (CEP) market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States courier, express and parcel (CEP) industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The United States courier, express and parcel (CEP) market was valued at USD 136.0 Billion in 2024.

The rapid expansion of the e-commerce sector, shifting consumer preference toward convenience, significant technological advancements, ongoing globalization and trade agreements, and growing demand for fast delivery services are some of the important factors bolstering the United States courier, express and parcel (CEP) market share.

IMARC estimates the United States courier, express and parcel (CEP) market to exhibit a CAGR of 2.8% during 2025-2033, reaching USD 175.0 Billion by 2033.

B2B (Business-to-business) accounted for the largest service type market share.

Some of the major players in the United States courier, express and parcel (CEP) market include Aramex, FedEx, Qantas Airways Limited, United Parcel Service of America, Inc., Yamato Transport U.S.A., Inc., DHL Group (A division of Deutsche Post AG), XPO, Inc., SkyWorld International Couriers, Inc, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)