United States Critical Infrastructure Protection Market Size, Share, Trends, and Forecast by Component, End User, and Region, 2025-2033

United States Critical Infrastructure Protection Market Overview:

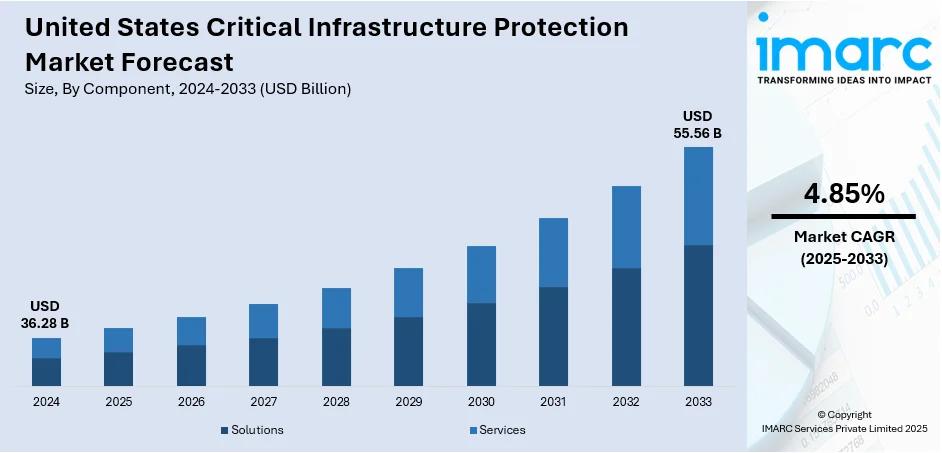

The United States critical infrastructure protection market size was valued at USD 36.28 Billion in 2024. Looking forward, the market is projected to reach USD 55.56 Billion by 2033, exhibiting a CAGR of 4.85% during 2025-2033. The market is driven by the rising adoption of digital monitoring solutions across infrastructure sectors, growing emphasis on proactive threat mitigation, and increased spending on smart utility networks. The widespread implementation of risk-based compliance standards, along with escalating concerns over data security, is encouraging the integration of advanced response technologies. Additionally, the expansion of automation systems, real-time surveillance, and multi-layered authentication tools is enhancing threat detection across national assets, further augmenting the United States critical infrastructure protection market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 36.28 Billion |

| Market Forecast in 2033 | USD 55.56 Billion |

| Market Growth Rate (2025-2033) | 4.85% |

The market in the United States stands is primarily driven by the growing dependency on integrated digital systems for operating transportation, energy, and financial services. In line with this, the expansion of national broadband coverage and increasing adoption of 5G infrastructure are also providing an impetus to the market. Moreover, the heightened focus on securing supply chains against cyber sabotage is also acting as a significant growth-inducing factor for the market. In addition to this, the increased frequency of state-sponsored cyber intrusions targeting strategic sectors is resulting in a surge in domestic resilience initiatives, creating a positive United States critical infrastructure protection market outlook. For instance, the water and wastewater sector’s importance, serving over 80% of the population, makes it a top customer segment within the market. With 152,000 drinking water systems and over 16,000 wastewater treatment facilities in the US, many of these are adopting SCADA systems and IoT-based monitoring. This creates opportunities for industrial control system (ICS) security and threat detection software vendors.

To get more information on this market, Request Sample

Besides this, the allocation of federal grants to support state and local cybersecurity planning is creating lucrative opportunities and contributing to the United States critical infrastructure protection market growth. Also, the emergence of regulatory compliance frameworks focused on infrastructure integrity and data protection is impacting the market positively. The market is further driven by the involvement of private defense contractors in co-developing advanced surveillance and response technologies. Apart from this, industry-wide efforts to standardize threat response protocols and workforce training programs are propelling the market. In December 2024, the U.S. Department of the Treasury’s Office of Cybersecurity and Critical Infrastructure Protection (OCCIP) issued a consumer advisory warning of heightened cyber fraud risks during the holiday shopping season and emphasized the need for vigilance against fraudulent schemes on platforms like LinkedIn, TikTok, and Instagram. Some of the other factors contributing to the market include growing public concern over digital infrastructure risks, increased visibility into OT network vulnerabilities, and the prioritization of cyber-physical system integration.

United States Critical Infrastructure Protection Market Trends:

Federal Investment Reinforcing National Energy Security

Government-led initiatives are playing a central role in shaping the United States critical infrastructure protection market, particularly in sectors deemed vital to national security. The energy sector, in particular, has emerged as a key focus for enhanced resilience against evolving physical and cyber threats. In a notable move, the U.S. Department of Energy (DOE) has announced nearly USD 23 Million in funding for ten new projects to enhance the resilience, security, and reliability of the nation’s energy systems, underlining the strategic importance of infrastructure protection. This investment highlights the strategic importance placed on shielding the country’s power infrastructure from disruptions ranging from cyber intrusions to extreme weather events. With the increasing integration of digital technologies into grid operations and the expansion of decentralized energy systems, the need for robust protection mechanisms has intensified. Federal support is driving the development of advanced intrusion detection systems, risk modeling platforms, and response automation tools, thus reinforcing the market's growth trajectory in the years ahead.

Rising Data Compromises Accelerating Cybersecurity Adoption

As critical infrastructure systems become increasingly digitized and interconnected, the frequency and severity of cyberattacks have escalated significantly, placing immense pressure on both public and private sector operators to adopt more advanced protection strategies. In 2024 alone, over 3,158 data compromises were reported, affecting more than 1.35 Billion individuals, underscoring the urgent need for comprehensive cybersecurity frameworks. These breaches often target vital sectors such as energy, transportation, healthcare, and telecommunications, where disruptions can have cascading national consequences. In response, infrastructure protection providers are deploying multilayered solutions that include identity and access management, encryption, firewalls, and endpoint detection systems. Additionally, regulations such as the Cyber Incident Reporting for Critical Infrastructure Act are mandating rapid threat disclosure and incident response measures, further shaping market behavior. The growing threat landscape has shifted cybersecurity from an IT concern to an operational imperative, making it a central pillar in the country’s infrastructure protection roadmap.

AI-Based Threats Driving Technology Innovation in Infrastructure Protection

The evolution of cyber threats driven by artificial intelligence (AI) has introduced a new dimension of complexity in the critical infrastructure protection landscape. As cybercriminals increasingly exploit AI to enhance attack vectors, ranging from phishing and impersonation to data poisoning and autonomous malware, defensive strategies are evolving, which is one of the major United States critical infrastructure protection market trends. In this context, critical infrastructure protection solutions in the U.S. strive to identify and mitigate potential security vulnerabilities through advanced technological integration. Notably, a recent industry report revealed that 84% of critical infrastructure organizations in the U.S. view the use of AI in cyber threats as a major current security concern. This growing awareness is propelling investment in AI-assisted threat detection systems, behavioral analytics, and automated incident response platforms. Furthermore, infrastructure operators are beginning to deploy predictive security models that preemptively flag anomalies across operational technology (OT) and industrial control systems (ICS). As adversarial use of AI becomes more sophisticated, so too must the defenses, fueling innovation and shaping the next generation of infrastructure security protocols.

United States Critical Infrastructure Protection Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States critical infrastructure protection market, along with forecasts at the regional levels from 2025-2033. The market has been categorized based on component and end user.

Analysis by Component:

- Solutions

- Physical Security Solutions

- Physical Identity and Access Control Systems

- Perimeter Intrusion Detection Systems

- Video Surveillance Systems

- Screening and Scanning

- Others

- Cyber Security Solutions

- Encryption

- Network Access Control and Firewall

- Threat Intelligence

- Others

- Physical Security Solutions

- Services

- Designing and Integration Services

- Consultation Services

- Risk Management Services

- Maintenance and Support Services

Solutions stand as the largest component in 2024, holding around 63.2% of the market, due to their comprehensive ability to secure both physical and cyber assets across multiple sectors. Physical security solutions, such as surveillance systems and perimeter intrusion detectors, are critical for safeguarding high-risk zones like power plants and transportation hubs. Simultaneously, cybersecurity tools like firewalls, encryption, and threat intelligence are vital for defending against increasingly sophisticated cyberattacks targeting national assets. As per the United States critical infrastructure protection market forecast, with mounting risks from both domestic and foreign threat actors, organizations are prioritizing integrated protection strategies. These multifaceted solutions ensure resilience, continuity, and compliance, making them indispensable for infrastructure security and market expansion.

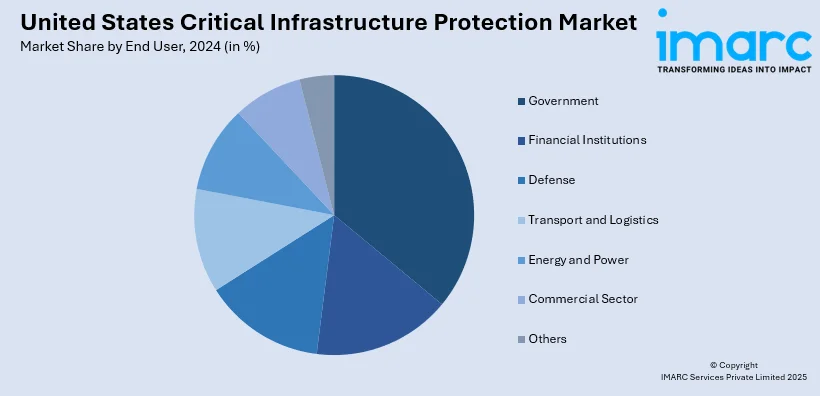

Analysis by End User:

- Financial Institutions

- Government

- Defense

- Transport and Logistics

- Energy and Power

- Commercial Sector

- Others

Government leads the market with around 25.8% of the market share in 2024, owing to its extensive responsibility over essential services like law enforcement, emergency response, and defense coordination. As the primary custodian of national infrastructure, government agencies are heavily investing in advanced protective technologies to mitigate threats from terrorism, cyberwarfare, and natural disasters. Mandates on homeland security, national grid protection, and digital infrastructure hardening are driving widespread implementation of physical and digital safeguards. These public investments not only foster innovation in threat detection and response but also serve as benchmarks for private sectors, reinforcing the overall market's structure and security posture.

Regional Analysis:

- Northeast

- Midwest

- South

- West

The Northeast region plays a pivotal role in the market due to its dense urban infrastructure, major financial hubs like New York City, and extensive public transit systems. Critical sectors such as banking, telecom, and healthcare in this region demand robust protection against both cyber threats and physical vulnerabilities. Given the high population density and economic importance, regional governments are advancing investments in smart surveillance, emergency alert systems, and cyber-resilience measures, which collectively elevate the region’s significance in driving critical infrastructure protection demand.

In the Midwest, the market is driven by the presence of key manufacturing hubs, industrial plants, and energy infrastructure, including oil pipelines and power stations. The region’s vulnerability to both cyberattacks and physical sabotage necessitates strong investment in security solutions, particularly for industrial control systems and perimeter defense. Government support for energy resilience and disaster preparedness across tornado-prone areas further fuels adoption. With increasing digitization of legacy infrastructure, cybersecurity upgrades are becoming essential, positioning the Midwest as a strategic growth contributor in the market.

The Southern region benefits from its vast energy networks, ports, and growing data center ecosystem, making it a critical area for infrastructure protection. States like Texas and Florida are investing heavily in both physical and cyber defense technologies to safeguard oil refineries, electric grids, and communication nodes. Hurricanes and other natural disasters also push demand for advanced risk management and emergency coordination systems. Rising urbanization and population growth increase the exposure of critical services, thereby accelerating public-private collaboration to strengthen regional infrastructure security.

The Western region is a major driver of the market due to its concentration of tech firms, defense contractors, and critical utilities in states like California and Washington. Wildfire risk, seismic activity, and cyber vulnerabilities in digital infrastructure highlight the need for end-to-end protection systems. The region is a frontrunner in adopting AI-based surveillance and advanced network protection solutions. Additionally, large-scale public transportation systems and airports necessitate tight security frameworks, reinforcing the region's leadership in piloting innovative approaches to infrastructure defense.

Competitive Landscape:

Key players in the United States critical infrastructure protection market are actively investing in advanced cybersecurity solutions tailored for industrial control systems, operational technology, and cloud-native environments. Companies are expanding their portfolios through AI-driven threat detection platforms, zero-trust architecture, and anomaly-based intrusion prevention systems to address evolving cyber threats. Strategic collaborations with federal agencies and critical infrastructure operators are being pursued to co-develop customized risk mitigation frameworks. Several firms are also acquiring specialized startups to strengthen capabilities in encryption, endpoint security, and real-time monitoring. Additionally, vendors are focusing on compliance-driven solutions aligned with national regulatory mandates such as NERC CIP and CISA advisories. These initiatives collectively support scalable, resilient, and future-ready infrastructure protection strategies across key sectors.

The report provides a comprehensive analysis of the competitive landscape in the United States critical infrastructure protection market with detailed profiles of all major companies.

Latest News and Developments:

- July 2025: Available Infrastructure introduced SanQtum, a cybersecurity and edge AI platform offering quantum-resilient encryption, zero trust architecture, and ultra-low-latency sovereign AI models. Designed to protect critical operational and cyber-physical systems, SanQtum met US federal standards and addressed rising cyber threats, particularly during historically high-risk periods, such as the July 4th holiday.

- June 2025: Deloitte unveiled cyber AI blueprints and services to help organisations embed AI into core cyber functions. Aimed at transforming legacy systems and elevating security governance, the tools supported AI-driven threat management, identity protection, and workforce enablement, aligning cybersecurity with enterprise growth and modernisation across critical infrastructures.

- April 2025: Check Point Research launched its first AI Security Report, highlighting how attackers weaponised AI for impersonation, data poisoning, malware creation, and hijacking AI models. The report urged critical infrastructure operators to adopt AI-assisted threat detection, multi-layered identity verification, and robust threat intelligence to combat rising AI-powered cybercrime.

- March 2025: LevelBlue, spun off from AT&T Cybersecurity, launched a new partner program enabling IT providers to offer managed security services. The initiative equipped MSPs with tools like USM Anywhere and threat detection solutions, helping them protect critical infrastructure through scalable, consumption-based cybersecurity services and enhanced incident response capabilities.

United States Critical Infrastructure Protection Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| End Users Covered | Financial Institutions, Government, Defense, Transport and Logistics, Energy and Power, Commercial Sector, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States critical infrastructure protection market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the United States critical infrastructure protection market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the keyword industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The market in the region was valued at USD 36.28 Billion in 2024.

The United States critical infrastructure protection market is projected to exhibit a CAGR of 4.85% during 2025-2033, reaching a value of USD 55.56 Billion by 2033.

The market is driven by increasing IoT adoption, escalating cyber threats, and significant government investments in securing national infrastructure. Advancements in 5G, wireless technologies, and AI-based surveillance further support robust infrastructure defense. Rising incidents of data breaches are intensifying the urgency for integrated cyber-physical security solutions.

Solutions account for the largest United States critical infrastructure protection segment market share in 2024, accounting for around 63.2% of the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)