United States Crop Protection Chemicals Market Size, Share, Trends, and Forecast by Type, Origin, Application, and Region, 2026-2034

United States Crop Protection Chemicals Market Size and Share:

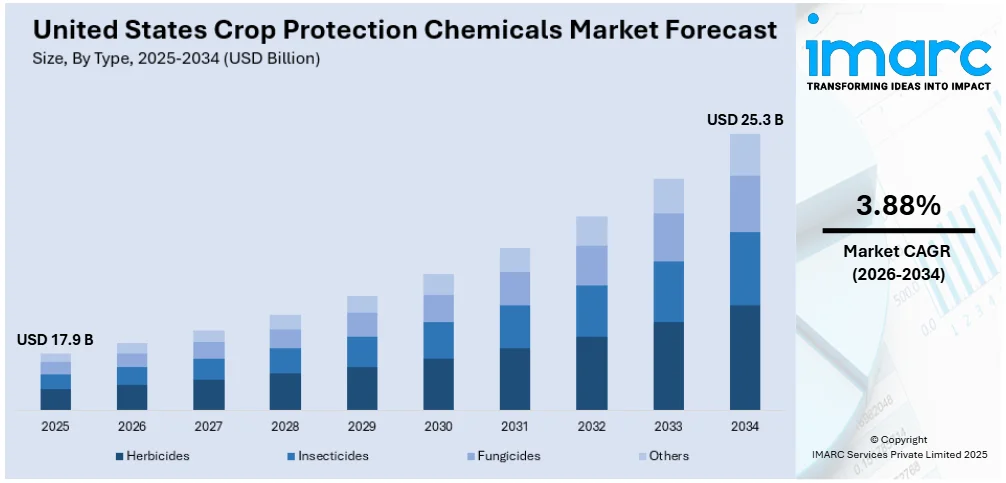

The United States crop protection chemicals market size was valued at USD 17.9 Billion in 2025. Looking forward, the market is expected to reach USD 25.3 Billion by 2034, exhibiting a CAGR of 3.88% during 2026-2034. Midwest currently dominates the market, holding a significant market share in 2025. The market is driven by increasing demand for higher agricultural productivity, adoption of advanced farming practices, and the expansion of genetically modified crops. Rising pest resistance and climate variability further fuel the need for effective crop protection solutions. Key players continue investing in innovation, influencing the competitive landscape of the United States crop protection chemicals market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 17.9 Billion |

| Market Forecast in 2034 | USD 25.3 Billion |

| Market Growth Rate (2026-2034) | 3.88% |

One of the primary drivers is the growing demand for food owing to a rising population, which necessitates higher crop yields and consistent agricultural productivity. With intensive use of farmland, farmers are turning to the use of herbicides, insecticides, and fungicides to ward off the impacts of rampaging weeds, pests, and diseases that undermine output. The other important factor includes the large-scale implementation of sophisticated farming practice that includes precision agriculture, the use of GPS-assisted equipment, and remote sensing. All these inventions enable them to use crop protection chemicals more effectively and with less wastage, without excessively impacting the environment. For instance, in October 2024, Syngenta Crop Protection, LLC, a prominent name in global crop protection, revealed a multi-year partnership with Taranis, a top AI-based crop intelligence platform. This collaboration aims to deliver AI-powered solutions that enhance agronomic productivity while promoting conservation-oriented innovations, specifically tailored for agricultural retail partners across the United States.

To get more information on this market Request Sample

The United States crop protection chemicals market growth is also driven by the shift toward genetically modified (GM) crops, which has spurred the use of specific chemicals tailored for GM varieties, particularly in the large-scale cultivation of corn, soybeans, and cotton. Climate change and unpredictable weather patterns have also led to increased pest pressure and disease outbreaks, further supporting market growth. Government support for sustainable agriculture and ongoing research and development (R&D) investments by both public institutions and private companies contribute to the development of newer, eco-friendly formulations. For instance, in January 2024, Syngenta Crop Protection, a prominent name in agricultural innovation, and Enko, a company focused on crop health, unveiled a newly discovered chemical compound aimed at combating fungal diseases in crops. This breakthrough was achieved through an advanced platform that significantly shortens the research and development timeline for new crop protection solutions. As regulatory frameworks evolve, the market is also shifting toward biological and less toxic chemical alternatives, diversifying the product landscape and reinforcing long-term market resilience.

United States Crop Protection Chemicals Market Trends:

Population Growth Driving Increased Food Demand

The market is significantly influenced by the country’s growing population, which directly correlates with increased food production needs. According to Worldometers, the US population reached 347,402,264 as of July 2025, representing 4.22% of the global total. This demographic pressure compels farmers to boost crop yields and protect harvests from potential losses caused by pests, diseases, and weeds. As a result, the demand for crop protection chemicals has surged. These chemicals are now seen as vital tools in ensuring food security across large-scale farming operations. The growing need for efficiency and crop preservation in response to population growth continues to be a central factor accelerating the adoption of crop protection solutions across the country.

Advancement and Adoption of Precision Agriculture

The rising adoption of precision farming and modern agricultural practices is creating a positive impact on the United States crop protection chemicals market outlook. These methods emphasize the targeted and efficient use of resources, including crop protection inputs. Between FY 2017 and FY 2021, the USDA and NSF collectively allocated around USD 200 Million toward research and development in precision farming, as reported by the US Government Accountability Office (GAO). Moreover, a 2023 USDA report indicates that approximately 27% of US farms and ranches have implemented precision farming techniques since the 1990s. This shift not only boosts productivity but also promotes responsible chemical usage through technologies such as GPS mapping, drone spraying, and variable rate applications, thereby expanding the market for specialized crop protection solutions.

Technological Innovations and New Product Development

According to the United States crop protection chemicals market trends, innovation in crop protection technologies continues to accelerate market growth in the United States. Manufacturers and regulatory bodies are focusing on developing products that are not only effective but also environmentally responsible. For instance, in January 2025, the US Environmental Protection Agency (EPA) announced its proposed registration conclusion for three products containing florylpicoxamid, a novel, broad-spectrum fungicide suitable for both food crops and turf, including golf courses. Florylpicoxamid supports Integrated Pest Management (IPM) by providing rotation options to delay resistance development in pathogens. This highlights a broader trend of innovation where research and development (R&D) efforts aim to enhance efficacy, safety, and sustainability. The continuous rollout of such advanced products ensures that the market remains dynamic and responsive to evolving agricultural challenges and environmental standards.

United States Crop Protection Chemicals Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States crop protection chemicals market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on type, origin, and application.

Analysis by Type:

- Herbicides

- Insecticides

- Fungicides

- Others

Herbicides stand as the largest component in 2025, holding 43.7% of the market due to the vast scale of commercial farming and the high prevalence of weed-related crop loss. US farmers rely heavily on herbicides to manage invasive weed species that compete with crops for nutrients, water, and sunlight. With crops like corn, soybeans, and wheat grown extensively across large acreage, herbicides offer an efficient and cost-effective solution for weed control. The adoption of herbicide-tolerant genetically modified (GM) crops has further fueled herbicide use, enabling more effective post-emergent weed management. Additionally, labor shortages in agriculture have driven a preference for chemical weed control over manual or mechanical alternatives, reinforcing herbicides as a cornerstone of modern crop protection strategies.

Analysis by Origin:

- Synthetic

- Bio-based

Synthetic leads the market with 78.3% of market share in 2025 due to its proven effectiveness, broad-spectrum action, and cost-efficiency. These chemicals offer quick, reliable control of a wide range of pests, weeds, and diseases, making them essential for large-scale, high-yield farming. US agriculture relies heavily on intensive cultivation practices, where consistent crop protection is critical to maintain productivity and profitability. Synthetic products are more widely available, have longer shelf lives, and are supported by established supply chains and regulatory frameworks. According to the United States crop protection chemicals market forecast, the dominance of genetically modified crops, which are often designed to work in conjunction with specific synthetic herbicides and insecticides, further strengthens their market presence. As a result, synthetic chemicals remain the preferred choice for conventional farming operations.

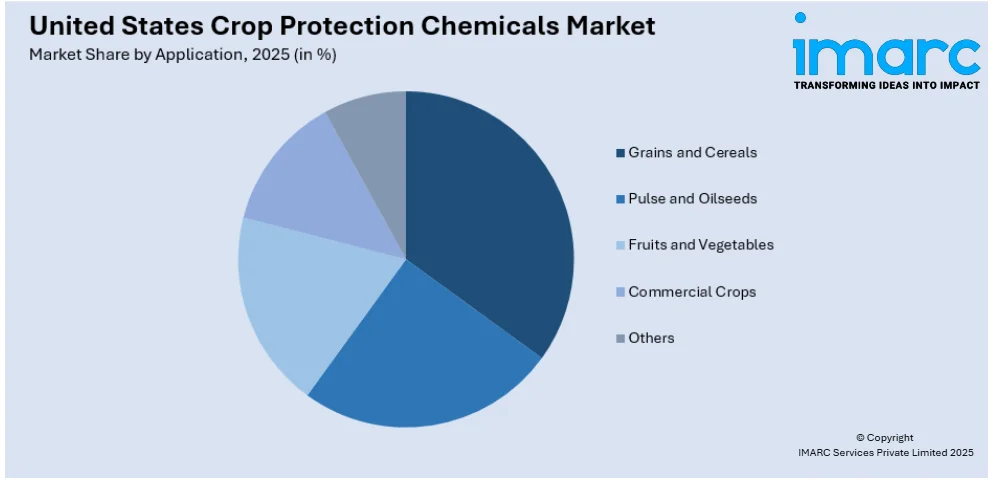

Analysis by Application:

Access the Comprehensive Market Breakdown Request Sample

- Grains and Cereals

- Pulse and Oilseeds

- Fruits and Vegetables

- Commercial Crops

- Others

Grains and cereals lead the market with 38.9% of market share in 2025 due to their vast cultivation area and critical role in both domestic consumption and export. Crops like corn, wheat, and rice are staple foods and essential components of animal feed, biofuels, and industrial products, making their consistent yield a national priority. These crops are highly susceptible to weeds, pests, and fungal infections, necessitating regular and effective chemical protection. Large-scale mechanized farming further encourages the use of herbicides, insecticides, and fungicides for efficient pest and disease control. Additionally, the adoption of high-yield and genetically modified cereal varieties that pair with specific crop protection chemicals has driven sustained demand, solidifying this segment's dominance in the market.

Regional Analysis:

- Northeast

- Midwest

- South

- West

The United States crop protection chemicals market demand in the Midwest is primarily driven by the region’s dominance in large-scale agriculture, particularly the cultivation of corn, soybeans, and wheat. These high-value crops require intensive protection from weeds, pests, and diseases to maintain yield and quality. The widespread adoption of genetically modified seeds, designed to work alongside specific herbicides and insecticides, further fuels demand. Additionally, the region’s unpredictable weather patterns can lead to pest outbreaks and fungal infestations, increasing reliance on crop protection solutions. Precision farming technologies, widely adopted in Midwestern states, support more efficient and targeted chemical application, enhancing effectiveness and reducing waste. Furthermore, ongoing research support and government subsidies for sustainable farming practices also contribute to market growth in this region.

Competitive Landscape:

The United States crop protection chemicals market is highly competitive, with key players focusing on innovation, strategic partnerships, and sustainability. Major companies like Bayer AG, Corteva Agriscience, Syngenta AG, BASF SE, and FMC Corporation dominate the market through extensive product portfolios and nationwide distribution networks. These players invest heavily in research and development (R&D) to develop eco-friendly and resistance-management solutions, including biologicals and precision-targeted chemicals. Mergers, acquisitions, and collaborations with agri-tech firms are increasingly common to enhance digital integration and improve application efficiency. Regional players and startups are also emerging, particularly in niche segments like biopesticides. Regulatory scrutiny from the EPA and evolving environmental standards continue to shape competitive dynamics, pushing companies toward safer, more sustainable crop protection innovations.

The report provides a comprehensive analysis of the competitive landscape in the United States crop protection chemicals market with detailed profiles of all major companies.

Latest News and Developments:

- June 2025: Corteva confirmed the release of the Forcivo fungicide, a novel crop protection chemical that utilizes three potent active ingredients—flutriafol, azoxystrobin, and fluindapyr—to combat foliar diseases in corn and soybeans. Awaiting registration from the US Environmental Protection Agency (EPA), the Forcivo fungicide will help protect crops from tar spot, southern rust, and frogeye leaf spot, among other diseases.

- May 2025: ADAMA Ltd. revealed that Temper More secured registration in the United States. By utilizing ADAMA's exclusive Sesgama Formulation Technology, this novel crop protection chemical provides US farmers with a more efficient way to control and combat herbicide-resistant weeds.

- April 2025: Syngenta disclosed the names of three foliar-applied insecticide products for its in-season insect control portfolio in the United States: Incipio, Vertento, and Zivalgo. Pending approval by the US Environmental Protection Agency (EPA), these foliar pesticide crop protection chemicals are expected to control insect pests in tree fruit crops, vegetables, cotton, and numerous other crops.

- March 2025: ADAMA US introduced Maxentis SC, a groundbreaking fungicide that incorporates two active components in order to give maize, soybean, and wheat growers an effective and long-term solution for managing the most harmful crop diseases and improving plant health. Maxentis SC combines the clinically established active substances azoxystrobin and prothioconazole in a single, convenient formulation.

- January 2025: FMC launched two new herbicides: Keenali Complete and Keenali GR herbicide, powered by Dodylex active. While Keenali Complete is expected to be available for rice growers in 2027, Keenali GR herbicide is scheduled to launch in 2028. Both herbicides are still pending approval from the US Environmental Protection Agency (EPA).

United States Crop Protection Chemicals Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Herbicides, Insecticides, Fungicides, Others |

| Origins Covered | Synthetic, Bio-based |

| Applications Covered | Grains and Cereals, Pulse and Oilseeds, Fruits and Vegetables, Commercial Crops, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States crop protection chemicals market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the United States crop protection chemicals market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States crop protection chemicals industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The crop protection chemicals market in the United States was valued at USD 17.9 Billion in 2025.

The United States crop protection chemicals market is projected to exhibit a CAGR of 3.88% during 2026-2034, reaching a value of USD 25.3 Billion by 2034.

The key factors driving the United States crop protection chemicals market include rising food demand due to population growth, adoption of precision farming techniques, and increasing pest resistance. Technological advancements and support for sustainable agriculture further boost demand for effective, eco-friendly solutions to enhance crop yields and protect agricultural productivity.

Midwest currently dominates the United States crop protection chemicals market due to intensive corn and soybean farming, advanced precision agriculture adoption, and recurring pest and disease pressures requiring efficient, large-scale chemical application solutions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)