U.S. Crypto ATM Market Size, Share, Trends and Forecast by Type, Offering, Coin Type, Application, and Region, 2026-2034

U.S. Crypto ATM Market Size and Share:

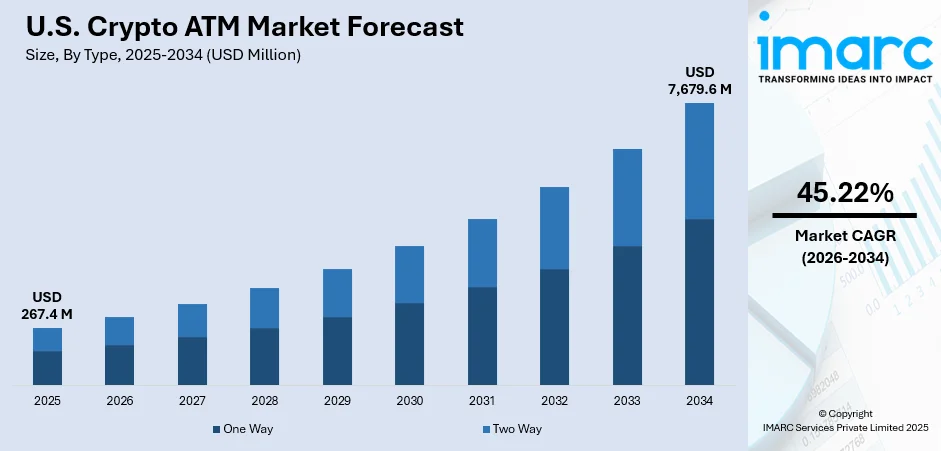

The U.S. crypto ATM market size is anticipated to reach USD 267.4 Million in 2025. Looking forward, IMARC Group estimates the market to reach USD 7,679.6 Million by 2034, exhibiting a CAGR of 45.22% from 2026-2034. The market is witnessing steady growth, driven by widespread product adoption in the hospitality industry, including restaurants and hotels, along with the implementation of various government initiatives to legalize the use of Bitcoins and other cryptocurrencies.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 267.4 Million |

| Market Forecast in 2034 | USD 7,679.6 Million |

| Market Growth Rate (2026-2034) | 45.22% |

Access the full market insights report Request Sample

As crypto gains extensive popularity in the country, it has a positive effect on the market. Offering easier trading options, and instant and secure transmission, the crypto ATMs provide an enhanced trading experience for customers. Furthermore, the informed effectual rise in digitization along with increasing adaptation of digital currency is turning out to be a substitute in most of the cash cultures that is likely to accelerate the growth of the market. Moreover, the gradual and well-informed increase in digitization, along with the growing acceptance of digital currency, is revolutionizing financial transactions in a number of ways. With governments and businesses realizing the potential of cryptocurrencies as a feasible alternative to traditional cash systems, these developments are turning out to be a strong substitute in many cash-dependent cultures.

To get more information on this market Request Sample

Technological advancements associated with progressive security systems; one-time password (OTP) service and biometric authentication are adopted to help prevent fraudulent transactions. The new cryptocurrencies accounting package, which aids traders, investors, tax consultants, and accountants by helping them follow clients' transactions and calculate taxes while tracking portfolios and helping to analyze profits, contributes significantly to market growth. In December 2024, Bitcoin Depot, the largest Bitcoin ATM operator in North America, announced Bitcoin surpassing US$ 100K. The company announced the expansion of BDCheckout Program in six new states along with the expansion in Puerto Rico.

U.S. Crypto ATM Market Trends:

Rapid Deployment of Crypto ATMs

Crypto ATM adoption and deployments across the United States have positioned the country as a global leader. The country houses a majority of installations worldwide, confirming a rather extensive adoption and interest in digital currencies. Major metropolitan areas see these ATMs coming into play - especially in venues such as malls, convenience stores, and airports, directing the use of the currency into public and convenient spots. Companies capitalize on the demand by expanding networks, bilingual interfaces, cash-to-crypto conversion, and integrating other sets of functions to reach diverse audiences with enhanced trading experience. As per CoinATMRadar, there are over 31,000 Bitcoin ATMs and tellers in the United States.

Integration of Advanced Technology

The advanced technologies in the form of biometric verification, blockchain analytics, and advanced security measures are revolutionizing the operational capabilities of crypto ATMs in the United States. These technologies are geared toward providing seamless and secure user experiences while dealing with fraud and identity theft. Moreover, many crypto ATMs now support multiple cryptocurrencies and provide real-time exchange rates, allowing users to diversify their portfolios without much hassle. As the U.S. market continues to mature, this sort of technological adoption will keep sustaining growth and allow the country to maintain its dominance globally in crypto ATM industries.

Growing Adoption in Underserved Communities

Crypto ATMs are gaining recognition as a financial instrument for underserved and unbanked communities in the United States. With millions of people who do not have access to traditional banking services, crypto ATMs are a means of joining the digital economy. Using these machines, users can convert cash into cryptocurrencies without necessarily having a bank account; hence, it is one way of bringing about financial inclusion in areas where banking infrastructure is not available. Moreover, the crypto ATM is simple and accessible and attracts migrant workers and other individuals who rely on low-cost cross-border remittances and is a critical solution for the reduction of economic disparities. This trend is likely to play a pivotal role in the sustained growth and adoption of crypto ATMs across the country.

U.S. Crypto ATM Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the U.S. crypto ATM market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on type, offering, coin type, application, and region.

Analysis by Type:

- One Way

- Two Way

In the U.S. crypto ATM market, one-way crypto ATMs dominate as the leading segment. These machines allow users to buy cryptocurrencies using fiat currency but do not support the selling of cryptocurrencies back into cash. The prominence of one-way ATMs can be attributed to their simplicity and accessibility, lower operational costs, and reduced regulatory and security challenges.

Analysis by Offering:

- Hardware

- Software

Hardware is the leading segment in the U.S. crypto ATM market due to its critical role in enabling physical access to cryptocurrency transactions. Crypto ATM hardware consists of robust components such as bill acceptors, dispensers, QR code scanners, and user interface systems, which ensure reliable and seamless transaction experiences. The demand for high-quality, durable hardware is a primary driver of this segment’s dominance, as it directly impacts the operational efficiency and customer satisfaction associated with these machines.

Breakup by Coin Type:

- Bitcoin

- Dogecoin

- Ethereum

- Litecoin

- Others

Bitcoin leads the U.S. crypto ATM market by coin type, as it is the first and most widely recognized cryptocurrency. As the pioneer in the digital currency space, Bitcoin has achieved unparalleled brand recognition and trust among consumers and investors. This familiarity makes it the default choice for most crypto ATM users, particularly those entering the cryptocurrency market for the first time.

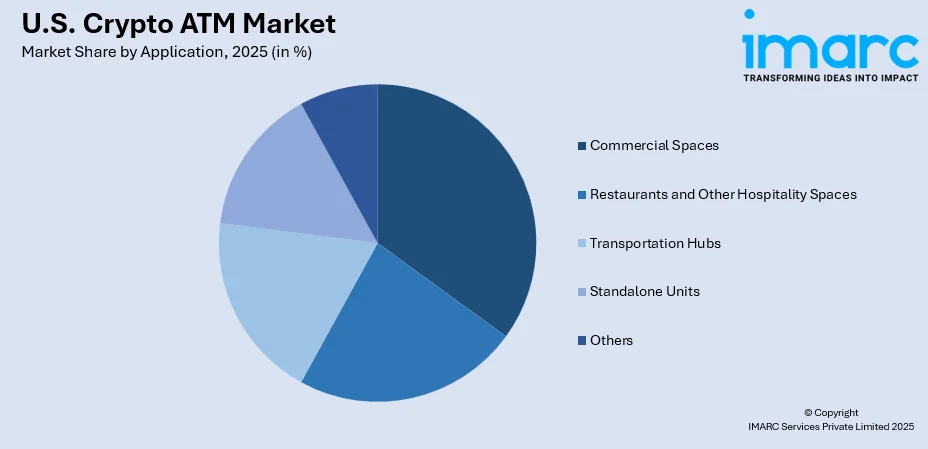

Analysis by Application:

To get detailed segment analysis of this market Request Sample

- Commercial Spaces

- Restaurants and Other Hospitality Spaces

- Transportation Hubs

- Standalone Units

- Others

Restaurants and other hospitality spaces lead the market by application due to their high foot traffic and frequent customer interactions, which provide ideal conditions for deploying crypto ATMs. These venues attract a diverse audience, including tech-savvy individuals and tourists, who are increasingly inclined to use digital currencies for convenience and accessibility. By installing crypto ATMs, restaurants and hospitality establishments create an added service that aligns with the growing demand for alternative payment options.

Regional Analysis:

- Northeast

- Midwest

- South

- West

The South leads the market by region due to its expansive population, growing interest in cryptocurrency adoption, and a strong presence of crypto-friendly businesses. States like Texas, Florida, and Georgia are at the forefront, driven by favorable business climates and an increasing number of tech startups and financial institutions embracing digital currencies. This regional dominance is further supported by the presence of several key crypto ATM operators who are strategically expanding their networks in the area to cater to the rising demand.

Competitive Landscape:

The key players in the market are actively engaged in several strategic initiatives to strengthen their positions and drive market growth. They are focusing on expanding their product offerings to include a wide range of cryptocurrencies and tokens to cater to the diverse needs of investors and traders. Additionally, major exchanges are enhancing security measures to protect user assets and gain trust in a market prone to cyber threats. Furthermore, there is a growing emphasis on compliance and regulatory adherence to address concerns about money laundering and fraud, with many exchanges working closely with authorities to establish industry standards. Overall, key players are working to provide a more secure, regulated, and user-friendly cryptocurrency ecosystem to attract a broader range of participants.

The report provides a comprehensive analysis of the competitive landscape in the U.S. crypto ATM market with detailed profiles of all major companies.

Latest News and Development:

- December 2024: Semler Scientific announced updates about its Bitcoin and ATM activity stating that the company acquired over 303 Bitcoins for US$ 29.3 million, with proceeds from its ATM offering for US$ 96,779 per bitcoin.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Type Covered | One Way, Two Way |

| Offering Covered | Hardware, Software |

| Coin Type Covered | Bitcoin, Dogecoin, Ethereum, Litecoin, Others |

| Application Covered | Commercial Spaces, Restaurants and Other Hospitality Spaces, Transportation Hubs, Standalone Units, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the U.S. crypto ATM market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the U.S. crypto ATM market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the U.S. crypto ATM industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

A crypto ATM is a physical kiosk that allows users to buy or sell cryptocurrencies using cash, debit cards, or credit cards. These machines connect to a cryptocurrency network, enabling secure transactions and providing a user-friendly way to access digital currencies without the need for traditional online exchanges.

The U.S. crypto ATM market size is anticipated to reach USD 267.4 Million in 2025.

IMARC estimates the U.S. crypto ATM market to exhibit a CAGR of 45.22% from 2026-2034.

Key factors driving the U.S. crypto ATM market include the growing adoption of cryptocurrencies, increased demand for easy access to digital currencies, and the rise of financial inclusion for unbanked populations. Additionally, advancements in technology, regulatory clarity, and the expanding use of cryptocurrency for payments and remittances are further fueling market growth.

In 2024, one way represented the largest segment by type, driven by its convenience and high demand for buying cryptocurrencies without the ability to sell.

Hardware leads the market by offering owing to its essential role in enabling seamless, secure, and efficient crypto transactions through physical ATMs.

The Bitcoin is the leading segment by coin type, driven by its status as the most recognized and widely accepted cryptocurrency with the highest liquidity.

On a regional level, the market has been classified into Northeast, Midwest, South, and West, wherein South currently dominates the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)