United States Data Center Construction Market Size, Share, Trends, and Forecast by Construction Type, Data Center Type, Tier Standards, Vertical, and Region, 2026-2034

United States Data Center Construction Market Size and Share:

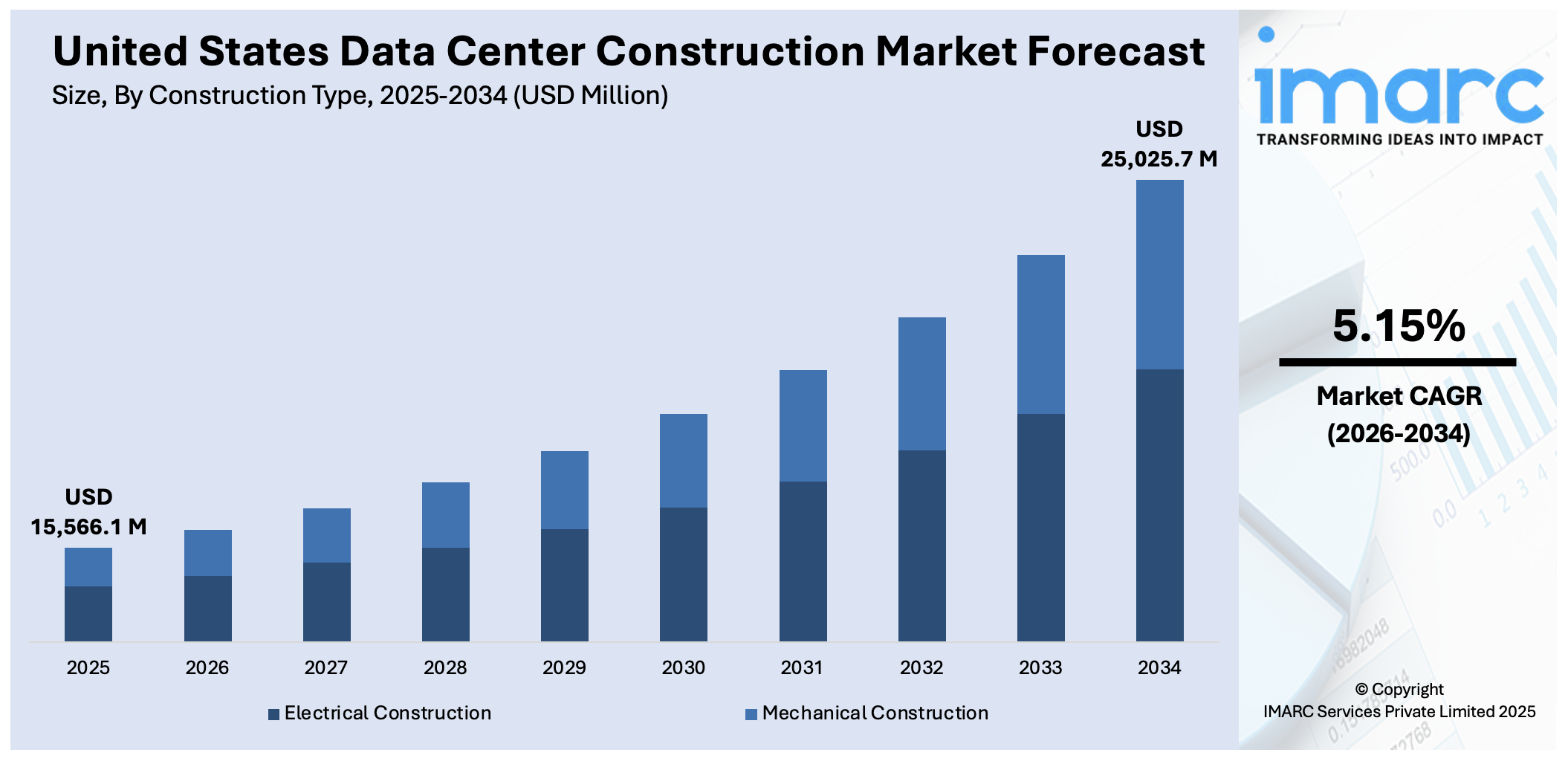

The United States data center construction market size was valued at USD 15,566.1 Million in 2025. Looking forward, the market is expected to reach USD 25,025.7 Million by 2034, exhibiting a CAGR of 5.15% during 2026-2034. The market is driven by demand from AI, cloud, and hyperscale computing needs. Key regions, such as Northern Virginia, Texas, and the Southeast, are rapidly expanding capacity with modern Tier‑3 and Tier‑4 facilities, advanced cooling systems, and modular designs. These developments are bolstering the United States data center construction market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 15,566.1 Million |

| Market Forecast in 2034 | USD 25,025.7 Million |

| Market Growth Rate (2026-2034) | 5.15% |

The market is being propelled by numerous key factors, primarily the surging demand for digital infrastructure across sectors. The exponential growth in data generation, fueled by trends like machine learning (ML), artificial intelligence (AI), the Internet of Things (IoT), and 5G, is pushing hyperscale cloud providers and enterprises to expand their data center footprints. This includes tech giants like Google Cloud, Microsoft Azure, and Amazon Web Services, which are building next-generation facilities with high power density and efficient cooling systems to support their expanding workloads. For instance, in January 2025, OpenAI, SoftBank, and Oracle launched a joint venture to invest $100 Billion in AI infrastructure, with potential expansion to $500 Billion by the end of Trump’s second term. The Stargate project includes 10 massive data centers, one already underway in Abilene, Texas, each spanning around 500,000 square feet.

To get more information on this market Request Sample

The United States data center construction market growth is also driven by the rising adoption of edge computing, as it drives the need for decentralized data centers closer to users for lower latency and better performance. Additionally, favorable government policies, tax incentives, and renewable energy mandates are encouraging sustainable and energy-efficient construction practices across new facilities. For instance, in March 2025, US-based real estate firm Related Companies officially introduced a new division dedicated to data center development, aiming to deliver gigawatts of capacity throughout the United States and Canada. The company unveiled the launch and funding of Related Digital, a fully integrated platform focused on both data center investment and infrastructure development. Further, demand for reliable IT infrastructure from industries such as healthcare, banking, and e-commerce is leading to large-scale investment in modular and scalable data centers. Regions like Northern Virginia, Texas, and Phoenix continue to be data center hotspots due to robust connectivity, favorable climates, and reliable power supply.

United States Data Center Construction Market Trends:

Emergence of AI, IoT, and Technological Innovations

The rapid evolution of artificial intelligence (AI), 5G connectivity, and Internet of Things (IoT) is generating immense demand for high-performance data centers. These technologies require real-time data processing, low latency, and robust computational infrastructure. In January 2025, President Trump introduced a $500 billion private-sector AI infrastructure initiative through Stargate, a joint venture involving OpenAI, SoftBank, and Oracle. The plan includes building 20 data centers and creating 100,000 jobs. These efforts reflect the growing need for hyperscale data center facilities to support intelligent applications, smart devices, and connected ecosystems, significantly accelerating market expansion. Additionally, widespread 5G integration enhances data transmission speeds, creating further demand for modern data center capacity.

Surging Data Consumption and Cloud Dependency

The skyrocketing data usage and the growing dependence on digital infrastructure are creating a positive United States data center construction market outlook. According to CTIA’s 2024 Annual Wireless Industry Survey, U.S. wireless networks transmitted a record-breaking 100.1 trillion megabytes of data in 2023, marking an 89% surge since 2021. This surge highlights the vital role data centers play in storing, processing, and managing digital information. At the same time, the rapid expansion of cloud computing services demands scalable and advanced data centers capable of handling vast workloads. As organizations increasingly migrate workloads to the cloud, demand continues to intensify for secure, high-capacity, and efficient data center facilities across the country.

Sustainability Focus, Remote Work, and Industry Investment

The market growth is further driven by a collective push for sustainable, energy-efficient data centers, spurred by environmental concerns and government regulations. According to the United States data center construction market trends, operators are adopting green practices, such as using renewable energy and optimized cooling systems. Simultaneously, tech giants are heavily investing in new facilities and expanding existing ones to meet rising infrastructure needs. The trend toward remote work also continues to influence market dynamics. Approximately 14% of the US workforce, or about 22 million individuals, now work fully remotely, with 68% of tech professionals operating off-site. This ongoing shift underscores the need for scalable, resilient data centers that can support distributed teams, real-time collaboration, and uninterrupted digital operations.

United States Data Center Construction Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States data center construction market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on construction type, data center type, tier standards, and vertical.

Analysis by Construction Type:

- Electrical Construction

- Mechanical Construction

Electrical construction is expected to hold a dominant share in the market due to the power-intensive nature of modern data centers. With servers, cooling systems, networking hardware, and backup equipment requiring constant electricity, a highly resilient and redundant electrical setup is essential. This includes switchgear, generators, UPS systems, and power distribution units (PDUs), all of which ensure uptime and prevent outages. As data centers scale to support AI, IoT, and cloud computing, the need for robust, scalable electrical infrastructure has surged, driving significant investment in this segment and boosting the United States data center construction market demand.

Mechanical construction plays a critical role in data center development, especially with the rising need for efficient thermal management. High-density servers generate immense heat, requiring advanced HVAC systems, liquid cooling, and airflow management to maintain optimal operating conditions. As energy efficiency becomes a priority, innovations in cooling technologies like immersion cooling and free-air cooling are gaining momentum, boosting mechanical construction demand. Additionally, the push for green data centers with sustainable designs has led to greater reliance on mechanical systems for energy conservation. These factors make mechanical construction a vital and high-value segment within the US data center construction market.

Analysis by Data Center Type:

- Mid-Size Data Centers

- Enterprise Data Centers

- Large Data Centers

Mid-size data centers are gaining prominence due to their balance of scalability, cost-efficiency, and deployment speed. These facilities are ideal for regional enterprises, content delivery networks, and service providers needing moderate capacity with lower latency. As edge computing grows and organizations decentralize IT operations, demand for mid-size data centers closer to end-users is rising. Their relatively lower capital requirement compared to hyperscale centers allows faster rollout, making them attractive in secondary US markets. Moreover, mid-size centers support hybrid cloud strategies, offering flexible solutions without the operational complexities of larger data centers, which contributes to their significant share in the market.

Enterprise data centers remain a major segment in the market as large organizations continue to maintain dedicated infrastructure for security, compliance, and data control. These centers offer complete flexibility for tailoring infrastructure to unique operational requirements, a critical advantage for sectors such as government, healthcare, and finance. According to the United States data center construction market forecast, the rise of data-driven decision-making, coupled with growing data storage and processing demands, fuels continued investment. Enterprises also seek hybrid environments where on-premise centers integrate with public clouds. Despite the cloud trend, enterprise data centers offer autonomy, reliability, and performance advantages, maintaining their relevance and large market share in construction activity.

Large data centers dominate the market as cloud providers, hyperscalers, and tech giants expand aggressively to support massive volumes of data and AI workloads. These facilities house thousands of servers and provide the infrastructure needed for global-scale platforms such as Google Cloud, Microsoft Azure, and AWS. The surge in demand for streaming, gaming, e-commerce, and real-time services has increased the need for large, scalable, and energy-efficient campuses. These data centers benefit from economies of scale and are often built in strategic US locations offering tax incentives, renewable energy access, and robust connectivity. Their scale and critical function ensure a substantial market share.

Analysis by Tier Standards:

- Tier I and II

- Tier III

- Tier IV

Tier I and II data centers are cost-effective solutions for small to mid-sized enterprises with moderate uptime requirements. Their lower construction and operational costs make them ideal for secondary markets and edge computing facilities. As regional businesses and startups grow digitally, demand for reliable but affordable data center infrastructure is increasing. These tiers provide essential redundancy without the complexity or investment needed for higher-tier models. Additionally, with digital expansion spreading beyond urban hubs, Tier I and II facilities are being rapidly developed to support localized processing needs, helping them secure a notable share in the US data center construction market.

Tier III data centers strike a balance between uptime, redundancy, and cost, making them the preferred standard for enterprises and colocation providers. Designed for high availability with concurrently maintainable infrastructure, these facilities offer 99.982% uptime—ideal for businesses demanding reliability without the premium costs of Tier IV. Tier III centers are widely used across financial services, healthcare, and cloud service sectors, contributing to their dominant market presence. Their adaptability for hybrid IT environments also makes them attractive amid evolving enterprise needs. With a strong emphasis on service continuity and regulatory compliance, Tier III remains a popular choice, driving significant new construction across the US.

Tier IV data centers are designed for mission-critical operations, offering the highest level of fault tolerance and 99.995% uptime. As sectors like defense, government, and hyperscale cloud computing demand zero downtime and maximum security, Tier IV construction is increasing. These facilities support simultaneous maintenance and fault resistance, making them ideal for organizations with no tolerance for interruptions. Though more capital-intensive, their robust design, redundant infrastructure, and operational reliability justify the investment for large corporations and tech giants. With the growing demand for AI, big data, and high-performance computing, Tier IV facilities are expanding in strategic locations, capturing a significant market share.

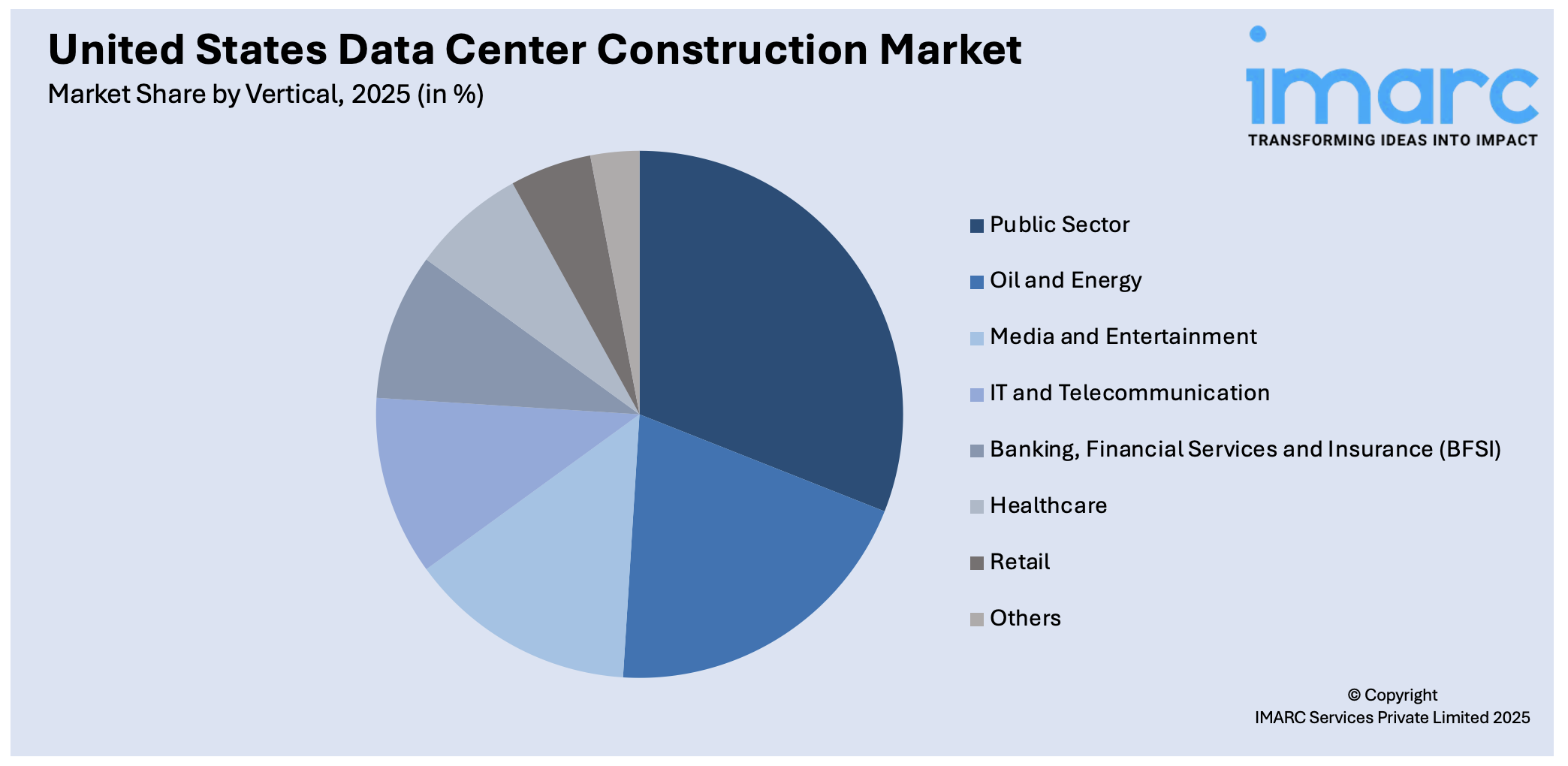

Analysis by Vertical:

Access the comprehensive market breakdown Request Sample

- Public Sector

- Oil and Energy

- Media and Entertainment

- IT and Telecommunication

- Banking, Financial Services and Insurance (BFSI)

- Healthcare

- Retail

- Others

The public sector, including federal, state, and local government bodies, is increasingly investing in secure, scalable, and resilient data infrastructure to support digital governance, public services, and national security. With growing data volumes from services like social security, defense, public health, and e-governance platforms, the need for localized and compliant data centers is accelerating. Furthermore, government-backed smart city projects and cybersecurity frameworks are pushing new data center builds. Strict data sovereignty and disaster recovery requirements also fuel demand for Tier III and Tier IV facilities. As a result, the public sector continues to drive considerable investment and construction activity across the US market.

The oil and energy sector is embracing digital transformation, with heavy reliance on real-time analytics, sensor data, and AI-driven decision-making. Operations like exploration, refining, and distribution generate massive data sets that require high-performance data centers for processing and storage. These companies are deploying edge and regional data centers to support field operations and ensure uptime in remote locations. Additionally, as energy firms increasingly adopt automation and predictive maintenance solutions, demand for secure, efficient, and scalable infrastructure grows. This ongoing digital evolution makes the sector a key contributor to US data center construction, especially in energy-rich regions such as Texas and Louisiana.

The media and entertainment industry drives high bandwidth and low latency requirements due to the explosion in video streaming, gaming, virtual reality, and content distribution platforms. With consumers demanding ultra-HD, real-time content delivery, companies are investing in robust data centers to ensure performance and uninterrupted user experiences. These facilities support content rendering, cloud editing, storage, and global distribution. Furthermore, the rise of over-the-top (OTT) services and interactive media platforms requires scalable infrastructure capable of managing peak traffic loads. To meet these performance standards, media firms are expanding data center capacity, particularly near urban hubs, making this sector a major force in market growth.

Regional Analysis:

- Northeast

- Midwest

- South

- West

The Northeast region benefits from proximity to major financial institutions, dense urban populations, and government agencies, making it a strategic location for data centers. The presence of technology hubs like New York City and Boston boosts demand for reliable IT infrastructure. Strict data compliance regulations and increased cloud adoption by financial and healthcare sectors also support growth. Additionally, aging infrastructure is being replaced with energy-efficient and secure data centers. Improved fiber connectivity and state-level incentives further attract investments. The region’s critical need for low-latency networks and disaster recovery sites continues to drive new construction and modernization of existing facilities.

The Midwest is becoming a central hub for data center development due to its lower land and utility costs, stable climate, and low risk of natural disasters. States like Ohio, Illinois, and Iowa offer tax incentives and access to renewable energy, making the region highly attractive for long-term data infrastructure investments. The Midwest also supports the growing edge computing demand from e-commerce, manufacturing, and logistics companies with its central location and strong fiber networks. As major cloud providers and hyperscalers expand beyond coastal areas, the Midwest's balance of affordability, infrastructure, and connectivity makes it a prime area for data center construction.

The Southern US is a leader in data center construction, driven by business-friendly regulations, ample land availability, and competitive energy pricing. States like Texas, Georgia, and Virginia offer generous tax breaks and are home to major technology companies and cloud providers. The South also has a strong presence in industries such as oil & gas, healthcare, and finance, all demanding extensive digital infrastructure. Rapid population growth and urban expansion fuel data traffic, increasing the need for localized centers. Furthermore, existing power grids and growing renewable energy projects enhance the region’s appeal, making it a data center construction hotspot.

The West region, particularly California and Washington, remains a major hub due to its concentration of tech giants, innovation clusters, and digital media companies. The surge in cloud services, AI, and IoT applications in Silicon Valley fuels massive data processing needs. While high real estate and energy costs pose challenges, access to skilled labor, advanced infrastructure, and sustainable energy solutions keeps the market robust. The region also leads in green data center initiatives and edge computing development. With increasing demand from the entertainment, e-commerce, and SaaS sectors, the West continues to be a critical driver of data center construction.

Competitive Landscape:

The United States data center construction market features a competitive and fragmented landscape, driven by a mix of global tech giants, real estate developers, engineering firms, and specialized contractors. Key players such as Turner Construction, DPR Construction, Jacobs Engineering, and Holder Construction dominate large-scale projects, often partnering with foremost cloud providers like Microsoft Azure, Google Cloud, and Amazon Web Services. Rising demand for hyperscale and edge data centers has attracted new entrants and intensified competition. Firms are increasingly focusing on modular builds, energy-efficient designs, and fast-track construction methods to differentiate themselves. Strategic alliances, geographic expansion, and sustainability initiatives remain central to maintaining competitive advantage in this rapidly evolving and capital-intensive market.

The report provides a comprehensive analysis of the competitive landscape in the United States data center construction market with detailed profiles of all major companies.

Latest News and Developments:

- June 2025: Sika announced smart, durable solutions for data center construction, supporting global investments projected to exceed CHF 400 Billion by 2028. With over 1,000 data centers built, Sika’s technologies improve sustainability, efficiency, and cooling while offering end-to-end support, benefiting from rising AI and cloud computing demand.

- June 2025: Amazon announced a USD 10 Billion data center expansion in North Carolina, part of its USD 100 Billion AI-focused capital plan for 2025. The 20-building campus will create 500 high-skilled jobs, strengthen AI and cloud capabilities, and support local workforce training and STEM education.

- January 2025: EDGNEX Data Centers by DAMAC announced a USD 20 Billion U.S. expansion targeting 2,000MW capacity, with plans to double investment based on demand. The project will cover Sunbelt and Midwest states, supporting hyperscalers and AI growth while strengthening DAMAC’s global digital infrastructure footprint.

- January 2025: Engine No. 1, Chevron, and GE Vernova announced plans to build U.S. data centers powered by up to four gigawatts of domestic natural gas. The “power foundries” will launch by 2027, supporting AI growth, creating jobs, and integrating lower-carbon solutions like carbon capture.

- December 2024: Meta announced a USD 10 Billion AI-optimized data center in northeast Louisiana, creating over 500 direct jobs, 1,000 indirect jobs, and employing 5,000 construction workers. The 4 million-square-foot campus will run on 100% renewable energy and invest USD 200 Million in local infrastructure upgrades.

- October 2024: Microsoft began building its first datacenters using cross-laminated timber to cut carbon emissions by up to 65% versus concrete. This hybrid approach supports Microsoft’s 2030 carbon-negative goal and leverages its USD 1 Billion Climate Innovation Fund to advance low-carbon steel, concrete, and sustainable construction technologies.

United States Data Center Construction Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Construction Types Covered | Electrical Construction, Mechanical Construction |

| Data Center Types Covered | Mid-Size Data Centers, Enterprise Data Centers, Large Data Centers |

| Tier Standards Covered | Tier I and II, Tier III, Tier IV |

| Verticals Covered | Public Sector, Oil and Energy, Media and Entertainment, IT and Telecommunication, Banking, Financial Services and Insurance (BFSI), Healthcare, Retail, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States data center construction market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the United States data center construction market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States data center construction industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The data center construction market in the United States was valued at USD 15,566.1 Million in 2025.

The United States data center construction market is projected to exhibit a CAGR of 5.15% during 2026-2034, reaching a value of USD 25,025.7 Million by 2034.

The key factors driving the United States data center construction market include surging data consumption, growing cloud adoption, and the rise of AI and IoT technologies. Demand for scalable, energy-efficient infrastructure, increased remote work, and major tech investments further propel expansion, reinforcing the country’s role as a global data center hub.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)