United States Data Center Liquid Cooling Market Size, Share, Trends and Forecast by Component, Data Center Type, End Use, Application, and Region, 2025-2033

United States Data Center Liquid Cooling Market Size and Share:

The United States data center liquid cooling market size was valued at USD 759.40 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 3,153.70 Million by 2033, exhibiting a CAGR of 17.10% during 2025-2033. The increasing demand for data processing and storage, and growing emphasis on energy efficiency and sustainability. Rising high-performance computing applications, expanding edge computing, escalating data traffic, and the need for 24/7 data service availability are some of the major factors stimulating the United States data center liquid cooling market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 759.40 Million |

| Market Forecast in 2033 | USD 3,153.70 Million |

| Market Growth Rate (2025-2033) | 17.10% |

The proliferation of machine learning (ML), artificial intelligence (AI), and big data analytics has led to increased computational workloads, generating substantial heat within data centers. Traditional air-cooling methods are often insufficient for these high-density environments, prompting a shift towards liquid cooling solutions that offer superior thermal management. For instance, in March 2025, NeuGuard, a complete support program created to offer unparalleled cooling dependability in the age of artificial intelligence and advanced computing, was launched by AccelsiusTM, a pioneer in cutting-edge two-phase, direct-to-chip liquid cooling technology. The US Department of Energy has allocated funds to support the adoption of advanced cooling technologies in data centers, aiming to enhance energy efficiency and reduce carbon footprints. Programs like ARPA-E's COOLERCHIPS are instrumental in promoting liquid cooling innovations.

.webp)

With rising energy costs and environmental concerns, data center operators are seeking energy-efficient cooling solutions, which is driving the United States data center liquid cooling market growth. Liquid cooling systems can significantly reduce power consumption compared to air cooling, aligning with sustainability initiatives and reducing operational expenses. For instance, in January 2024, Aligned, a data center company, introduced a novel liquid cooling technology. The liquid cooling system, known as DeltaFlow~, can cool densities up to 300kW per rack and is intended to accommodate supercomputers and high-density computing requirements. As a turnkey solution, DeltaFlow supports both present and future liquid cooling methods, such as immersion cooling, rear-door heat exchangers, and direct-to-chip.

United States Data Center Liquid Cooling Market Trends:

Rising Demand for High-Performance Computing (HPC) and AI Workloads

The growing reliance on artificial intelligence (AI), machine learning (ML), big data analytics, and scientific modeling is fueling demand for high-performance computing (HPC) infrastructure. These applications require extremely dense server configurations, which generate large volumes of heat that traditional air-cooling systems struggle to handle efficiently. Liquid cooling technologies—such as direct-to-chip and immersion cooling—offer better thermal performance and enable reliable operation at much higher computing densities. As more enterprises deploy AI and HPC systems across industries like finance, healthcare, and energy, the need for advanced cooling infrastructure intensifies. Liquid cooling is becoming essential for maintaining server performance, reducing thermal throttling, and ensuring uptime in compute-intensive environments, making it a critical enabler of next-generation data center operations in the United States. For instance, in March 2024, Equus Compute Solutions (ECS) and AccelsiusTM, whose patented direct-to-chip liquid cooling systems allow data center and edge computer operators to achieve previously unheard-of levels of compute density and high-performance computing, today announced a strategic partnership to help meet data centers' demand for cutting-edge, creative liquid cooling solutions.

Growth of Hyperscale and Edge Data Centers

The rapid expansion of cloud computing, content delivery, IoT, and 5G networks has driven growth in hyperscale and edge data centers. According to the United States data center liquid cooling market forecast, these facilities often operate at much higher rack densities and require more robust cooling solutions than traditional enterprise setups. Liquid cooling technologies are ideal for managing these high-heat environments, enabling efficient operation without increasing footprint. Hyperscalers like Google, Microsoft, and Meta are already adopting liquid cooling to support their expanding AI and cloud workloads. At the same time, edge data centers in urban and remote areas demand compact, high-efficiency cooling systems due to space and power constraints. Liquid cooling’s scalability and efficiency make it a critical enabler of modern data center infrastructure in the United States. For instance, in November 2024, SEGUENTE, a global technology company that offers cutting-edge liquid-cooled IT hardware and AI software platforms for high-performance computing, is partnering with Sabey Data Centers, a leading designer, builder, and operator of multi-tenant data centers, to improve both businesses' capacity to offer customers sustainable, optimized, and scalable data center solutions across Sabey's portfolio.

Energy Efficiency and Sustainability Requirements

With the increasing focus on energy conservation and carbon footprint reduction, liquid cooling is gaining traction for its superior energy efficiency compared to traditional air cooling. Data centers consume vast amounts of electricity, with cooling accounting for a substantial share of this usage. Liquid cooling reduces power consumption by transferring heat more efficiently, enabling data centers to operate with a lower Power Usage Effectiveness (PUE). It also aligns with corporate ESG goals and regulatory pressure to adopt greener technologies. As energy prices fluctuate and environmental standards tighten, data center operators in the US are prioritizing solutions that reduce operational costs and meet sustainability benchmarks. Liquid cooling is seen as a future-ready technology that helps meet both performance and environmental objectives, which is further creating a positive United States data center liquid cooling market outlook. For instance, in February 2025, ZutaCore, a trailblazing developer of two-phase direct-to-chip liquid cooling technology for data centers, is partnering with Carrier Global Corporation, a global leader in intelligent climate and energy solutions, through an investment and technology partnership led by Carrier Ventures. Carrier's approach of offering sophisticated, integrated cooling solutions to satisfy the vital cooling requirements of data center clients is in line with this investment.

United States Data Center Liquid Cooling Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States data center liquid cooling market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on component, data center type, end use, and application.

Analysis by Component:

- Solution

- Direct Liquid Cooling

- Indirect Liquid Cooling

- Services

- Design and Consulting

- Installation and Deployment

- Support and Maintenance

Liquid cooling solutions—including direct-to-chip, immersion cooling, and two-phase systems—are rapidly gaining adoption due to their ability to handle high thermal loads from AI and high-performance computing. These systems provide better energy efficiency, higher rack densities, and reduced operational costs, making them ideal for modern data centers. US hyperscalers and colocation providers are investing heavily in these technologies to meet growing computing demands. The market is seeing strong demand for turnkey liquid cooling infrastructure, driving the dominance of solutions in revenue share. Additionally, innovations in modular and scalable solutions further accelerate their deployment across diverse data center environments.

The increasing complexity of liquid cooling systems has led to higher demand for specialized installation, maintenance, retrofitting, and consulting services. Data centers transitioning from air to liquid cooling require expert support to manage integration, optimize performance, and ensure uptime. Service providers play a key role in designing custom solutions, managing operational risks, and ensuring regulatory compliance. As more facilities adopt liquid cooling, lifecycle services—from planning and deployment to monitoring and upgrades—are becoming essential. This growing dependency on third-party expertise and the need for continuous optimization and support is why services are expected to hold a significant share in the US market.

Data Center Type Insights:

- Large Data Centers

- Small and Medium-sized Data Centers

- Enterprise Data Centers

Large data centers—especially hyperscale facilities—require advanced cooling to support intensive workloads like AI, machine learning, and cloud computing. These facilities house high-density server racks that generate immense heat, making liquid cooling essential for thermal efficiency and energy savings. Operators such as Google, Meta, and Amazon Web Services are rapidly deploying liquid cooling systems to enhance performance, sustainability, and cost-efficiency. Their significant capital investment, large-scale infrastructure, and constant need to improve PUE (Power Usage Effectiveness) position large data centers as key drivers of market growth. Their early adoption and continuous expansion ensure they hold a dominant market share.

SMDCs are increasingly adopting liquid cooling to handle rising compute density within constrained spaces. These facilities often serve edge computing or regional service needs and lack the footprint for traditional air-cooling systems. Liquid cooling offers compact, efficient, and scalable alternatives that fit their size and performance requirements. As workloads grow and latency-sensitive applications expand, SMDCs are modernizing to stay competitive, especially in sectors like healthcare, finance, and retail. Vendors offering modular and cost-effective solutions are targeting this segment aggressively, driving its adoption. The combination of scalability and thermal efficiency makes SMDCs a growing share of the market.

Enterprise data centers, operated by corporations for private cloud, on-premises storage, or sensitive data, are adopting liquid cooling to support data-intensive operations such as analytics, simulations, and digital twins. These enterprises increasingly seek sustainable, efficient, and secure infrastructure amid rising energy costs and ESG (Environmental, Social, Governance) pressures. Liquid cooling enables better space utilization and energy savings, aligning with corporate sustainability goals. Moreover, the move to hybrid IT models requires more powerful hardware on-site, making thermal management a priority. As enterprises look to modernize legacy systems without massive overhauls, liquid cooling provides an efficient and forward-looking solution, boosting their market share.

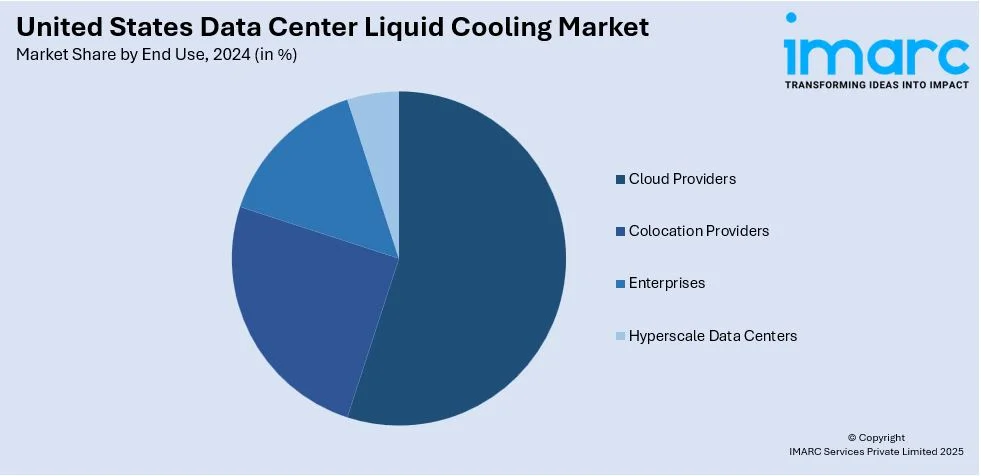

End Use Insights:

- Cloud Providers

- Colocation Providers

- Enterprises

- Hyperscale Data Centers

Cloud providers such as Amazon Web Services, Microsoft Azure, and Google Cloud operate hyperscale data centers that run AI, big data, and machine learning workloads—all of which demand high-density computing and advanced thermal management. To meet efficiency, scalability, and sustainability goals, these providers are rapidly adopting liquid cooling solutions. Their ability to make large capital investments, along with their constant need to upgrade infrastructure, drives significant demand for cutting-edge cooling technologies. Additionally, their global visibility and ESG commitments make them early adopters of energy-efficient solutions, positioning them as dominant players in the US data center liquid cooling market.

Colocation providers host IT infrastructure for multiple clients, requiring flexible and scalable cooling solutions that meet diverse workload needs. As tenant demands shift toward high-performance computing and dense rack configurations, colocation facilities are adopting liquid cooling to maintain thermal efficiency without expanding physical space. Liquid cooling also helps reduce operational costs and improve power usage effectiveness (PUE), which is critical in competitive colocation markets. Providers are modernizing facilities to attract cloud, enterprise, and AI-focused clients, further accelerating adoption. Their role in enabling digital transformation across industries makes them a key segment in driving market growth for liquid cooling solutions.

Enterprises increasingly operate hybrid IT environments, combining on-premises infrastructure with cloud-based solutions. Their need to manage data-intensive workloads, ensure data sovereignty, and meet compliance standards is driving investment in high-performance private data centers. Liquid cooling allows enterprises to support growing compute demands while minimizing energy consumption and physical footprint. Additionally, rising electricity costs and corporate sustainability mandates are pushing companies to modernize with energy-efficient technologies. As more enterprises adopt AI, analytics, and automation, the thermal load increases, necessitating more efficient cooling. This shift positions enterprises as a significant and growing segment in the US data center liquid cooling market.

Application Insights:

- BFSI

- IT and Telecom

- Media and Entertainment

- Healthcare

- Government and Defense

- Retail

- Research and Academic

- Others

The BFSI sector handles massive volumes of sensitive, real-time data requiring ultra-low latency and high reliability. With the growth of AI-driven trading, fraud detection, blockchain, and digital banking, the demand for high-density computing infrastructure has surged. Liquid cooling offers the efficiency, reliability, and performance needed to support these advanced workloads while reducing operational costs and improving sustainability. Regulatory pressures and the need for uninterrupted operations make cooling efficiency critical. As banks modernize legacy data centers and expand private cloud operations, the adoption of liquid cooling systems ensures scalability, security, and performance, solidifying BFSI’s major share in this market.

The IT and telecom industries are at the forefront of digital infrastructure, supporting cloud computing, 5G, edge computing, and IoT networks. These technologies require powerful servers and low-latency performance, which generates significant heat. Liquid cooling provides the thermal efficiency and space savings essential for managing dense workloads in both central and edge data centers. As data volumes and user demand grow, telecom operators and IT firms are upgrading their facilities to handle greater compute density and improve energy efficiency. The sector’s continuous infrastructure expansion, innovation-driven focus, and reliance on high-performance computing ensure its leading position in liquid cooling adoption.

Media and entertainment companies increasingly rely on real-time rendering, video streaming, animation, gaming, and content delivery networks (CDNs)—all of which demand high-density GPU servers and fast processing power. These operations generate substantial heat loads, especially in post-production and cloud-based streaming environments. Liquid cooling is ideal for maintaining optimal temperatures while enabling uninterrupted performance. The industry’s shift toward 4K/8K video, VR/AR, and AI-enhanced content increases computing needs, making traditional air cooling insufficient. To support latency-sensitive applications and sustainable growth, media firms are investing in modern, efficient cooling systems, securing their position as a major contributor to market growth.

Regional Analysis:

- Northeast

- Midwest

- South

- West

The Northeast is a hub for financial services, healthcare, and government institutions, all requiring secure, high-performance data centers. Urban density and aging infrastructure make space and energy efficiency critical, positioning liquid cooling as a preferred solution. Strict environmental regulations and ESG targets further encourage sustainable technologies. The region also hosts multiple colocation and edge data centers that benefit from compact, high-density cooling solutions. High electricity costs make energy-efficient liquid cooling economically attractive. With increasing digital transformation and data privacy regulations, enterprises in the Northeast are upgrading to modern cooling systems to support expanding workloads and reduce operational overhead.

The Midwest is gaining momentum as a strategic location for hyperscale and enterprise data centers due to affordable land, cooler climate, and stable energy costs. While natural cooling is beneficial, the rise in AI, IoT, and machine learning is driving demand for dense computing environments, which require liquid cooling. The region’s growing tech footprint, including edge and cloud deployments, supports this shift. Additionally, several states offer incentives for green data centers, accelerating the adoption of energy-efficient liquid cooling systems. As regional and national companies build out their IT infrastructure in the Midwest, the need for advanced thermal management continues to rise.

The Southern US hosts a growing number of hyperscale and colocation facilities due to low power costs, favorable tax policies, and available land. However, the hot and humid climate increases the burden on traditional air-cooling systems, making liquid cooling more efficient and cost-effective. Cities like Dallas, Atlanta, and Northern Virginia are major data center hubs with increasing AI and high-performance computing (HPC) workloads. Additionally, the region’s focus on digital infrastructure investment and support for renewable energy initiatives aligns with liquid cooling’s energy-saving benefits. These factors collectively drive strong demand for modern, scalable cooling technologies across the Southern market.

The Western US, particularly California and Washington, is home to many tech giants, cloud providers, and AI firms, creating immense demand for high-density, high-performance data centers. With stringent environmental regulations and growing pressure to reduce water and energy consumption, liquid cooling provides a more sustainable alternative to traditional methods. The region also faces power constraints and high electricity rates, making efficiency critical. The expansion of edge data centers to support content delivery and autonomous systems further boosts demand for compact, efficient cooling. Combined with strong innovation culture and ESG focus, these factors fuel liquid cooling adoption in the West.

Competitive Landscape:

The United States data center liquid cooling market is highly competitive, influenced by rising demand for energy-efficient and high-performance cooling solutions. Key players like Schneider Electric, Vertiv, LiquidStack, Submer, and CoolIT Systems are actively innovating in direct-to-chip and immersion cooling technologies. These companies are forming strategic partnerships, expanding product portfolios, and investing in R&D to meet the growing needs of hyperscale, enterprise, and edge data centers. Startups and niche players are also entering the market with advanced, sustainable cooling solutions tailored for AI and high-density computing environments. The competitive landscape is shaped by rapid technological advancements, aggressive expansion strategies, and increasing focus on ESG compliance and total cost of ownership optimization.

The report provides a comprehensive analysis of the competitive landscape in the United States data center liquid cooling market with detailed profiles of all major companies.

Latest News and Developments:

- May 2025: Chemours and DataVolt announced a strategic partnership to advance liquid cooling solutions for data centers, focusing on AI and high-density computing. The collaboration aims to enhance efficiency, sustainability, and performance using Chemours' Opteon dielectric fluids, reducing energy costs and environmental impact.

- February 2025: Vertiv started its Liquid Cooling Services portfolio to support high-performance computing and AI systems in the US. The services include installation, fluid management, emergency support, and lifecycle maintenance, ensuring system reliability and long-term performance in data centers.

- December 2024: AWS unveiled new data center innovations to enhance energy efficiency for AI workloads. These include modular power, liquid cooling, and optimized rack designs, aiming for up to 6x higher rack power density. The advancements support AI, improve sustainability, and reduce carbon emissions in data centers.

- October 2024: Wesco announced the acquisition of Ascent LLC, a data center facility management firm, for USD 185 million. The acquisition strengthens Wesco's data center solutions portfolio, including liquid cooling design and implementation, and expands its service offerings in the growing data center market.

- October 2024: Vertiv launched the CoolPhase CDU and CoolChip Fluid Network, expanding its liquid cooling solutions for AI data centers. These systems enable modular, cost-effective liquid cooling in existing facilities, enhancing efficiency and supporting high-density AI workloads, while reducing the complexity and cost of traditional cooling methods.

- October 2024: JetCool and Flex announced a partnership to obtain liquid cooling-ready servers for AI and high-density workloads. The servers utilize JetCool's micro-convective cooling technology, providing precision cooling for AI applications and offering scalable solutions to meet the growing power demands of hyper-scalers and enterprise customers.

United States Data Center Liquid Cooling Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Components Covered |

|

| Data Center Types Covered | Large Data Centers, Small and Medium-sized Data Centers, Enterprise Data Centers |

| End Uses Covered | Cloud Providers, Colocation Providers, Enterprises, Hyperscale Data Centers |

| Applications Covered | BFSI, IT and Telecom, Media and Entertainment, Healthcare, Government and Defense, Retail, Research and Academic, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States data center liquid cooling market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the United States data center liquid cooling market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States data center liquid cooling industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The data center liquid cooling market in the United States was valued at USD 759.40 Million in 2024.

The United States data center liquid cooling market is projected to exhibit a CAGR of 17.10% during 2025-2033, reaching a value of USD 3,153.70 Million by 2033.

Key factors driving the United States data center liquid cooling market include rising demand for high-performance computing, growth of AI and machine learning workloads, increasing energy efficiency and sustainability goals, and limitations of traditional air-cooling methods in managing high-density servers. These trends are reshaping thermal management across modern data centers.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)