United States Digital Map Market Size, Share, Trends and Forecast by Type, Usage, Solution, Deployment Mode, Application, End Use Industry, and Region, 2026-2034

United States Digital Map Market Size and Share:

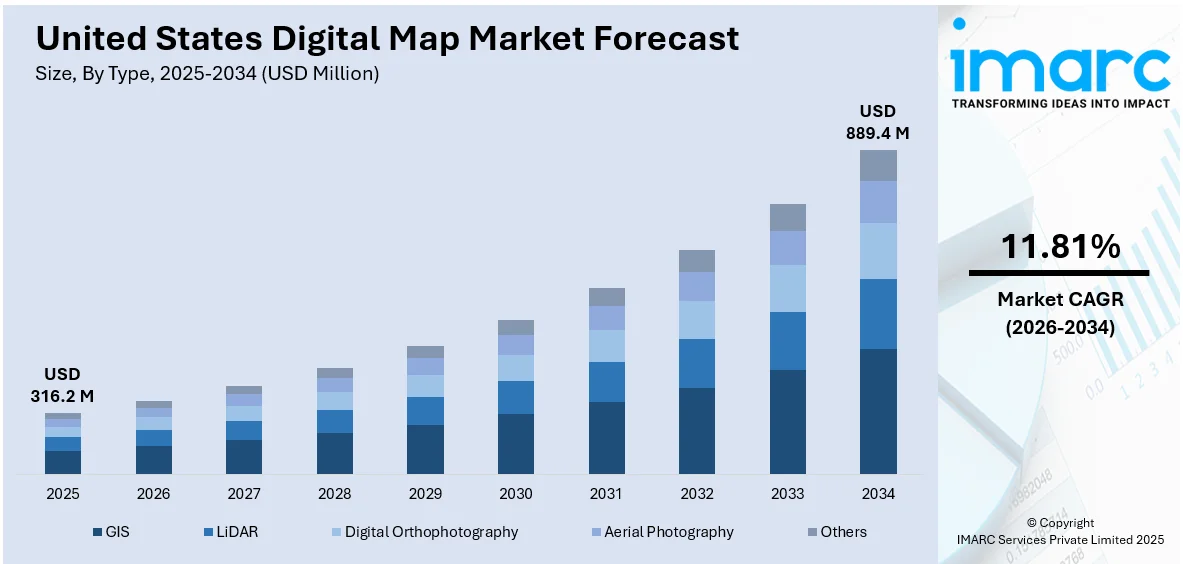

The United States digital map market size was valued at USD 316.2 Million in 2025. The market is projected to reach USD 889.4 Million by 2034, exhibiting a CAGR of 11.81% from 2026-2034. The market is growing robustly based on rising demand for real-time navigation, urban planning, and location-based services among various industries like logistics, transport, and defense. Market penetration is being improved by technological improvements, Internet of Things (IoT) and artificial intelligence (AI) integration, and growing adoption of geographic information systems (GIS) tools. The growth of smart infrastructure and digital transformation programs further intensifies usage. Such trends combined determine the rising United States digital map market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 316.2 Million |

| Market Forecast in 2034 | USD 889.4 Million |

| Market Growth Rate (2026-2034) | 11.81% |

The quick growth of smart infrastructure and urbanization in the United States are the major drivers of the digital map industry's growth. As the cities implement data-driven planning and development, digital maps act as key visual aids for representing land use, simulating infrastructure layouts, and predicting future growth. These maps deliver real-time information regarding population distribution, traffic patterns, and utility grids, assisting planners and decision-makers in maximizing resource utilization and enhancing public service delivery. The combination of digital mapping and smart technologies also facilitates dynamic tracking of the transportation system, energy system, and public safety services. The need for precise, interactive, and scalable geographic information has now become imperative as cities aim at sustainable development and environmental efficiency. From traffic management to zoning, digital maps enable a wide range of urban management functions. With increasing municipalities adopting smart city initiatives, dependence on geospatial intelligence is deepening further, driving long-term demand and innovation in digital mapping technology. For example, in January 2025, Mapbox and Hyundai AutoEver introduced AI-driven 3D Live Navigation and MapGPT upgrading in-car mapping and EV solutions—further fueling innovation and uptake in the United States digital map market.

To get more information on this market Request Sample

Increasing need for real-time navigation and location-based services is a major driver behind the development of the digital map industry in the United States. As smartphone penetration becomes ubiquitous, as car connectivity and on-demand mobility platforms become increasingly popular, digital maps have become essential in everyday life. Users are expecting more and more seamless, real-time routes, optimized routing, and contextual data such as proximity services and traffic updates. They have driven the creation of high-precision mapping systems based on real-time data sources that improve accuracy and user experience. For instance, in July 2024, Apple introduced Apple Maps on the web in public beta allowing browser access through Safari, Chrome, and Edge, boosting user bases and heightening competition with Google Maps. Moreover, businesses in logistics, field services, and emergency response industries depend more or less on real-time location data to control fleets, monitor assets, and organize operations effectively. Having access to, understanding, and responding to location-based data in real time provides substantial benefits in responsiveness, cost-effectiveness, and service levels. When real-time capability becomes an expectation, the digital mapping market increasingly grows in penetration and significance.

United States Digital Map Market Trends:

Increasing Use of GIS and Location-Based Technologies

The United States digital map market growth is driven by the amplifying use of Geographic Information Systems (GIS) and location-based technologies by different industries. Companies, government agencies, and developers alike are highly adopting advanced mapping solutions in order to enhance operational effectiveness and decision-making. For instance, in January 2021, California-based Esri launched the ArcGIS Platform, a platform-as-a-service (PaaS) solution that allows developers to integrate geospatial functionalities into their applications using preferred APIs and web frameworks. The ability to access Esri’s robust location services is a key enabler in applications related to logistics, public safety, infrastructure development, and retail analytics. The need for real-time visualization of data and spatial analysis has propelled GIS to a mass market need from its initial status as a specialty technology. This ubiquitous integration is part of a larger trend in digital revolution and sets the U.S. digital map industry up for continued growth as users increasingly demand more interactive, scalable, and real-time location intelligence solutions.

Mapping Technology and Data Layer Advancements

Technological advancement is a hallmark of the United States digital map market outlook. The incorporation and improvement of high-resolution satellite images, GPS, aerial imagery, and survey data have significantly improved the reliability and usability of digital maps. Such maps now possess multi-level information, including infrastructure patterns, land use models, and environmental factors, providing holistic geographic coverage. This degree of specificity is priceless for use in urban planning, environmental management, and resource management. For instance, in April 2024, Esri broadened its collaboration with Autodesk to add ArcGIS Basemaps to Autodesk Forma, AutoCAD, and Civil 3D—to equip architecture, engineering, and construction professionals with more precise design tools. These advancements enable stakeholders to minimize environmental impact and enhance spatial awareness at the planning and design phases. The digital maps' layering and analytical functions are therefore not only improving user experiences but also solidifying the market's technological superiority in geospatial intelligence.

Wider Applications in Urban Planning and Public Services

As per United States digital map market analysis, public and private sector applications are major growth drivers for the market, with growing utility of digital maps. In the United States, digital maps are pivotal in urban planning, emergency response, environmental conservation, and transportation infrastructure development. Their ability to provide real-time, precise geographic data helps local governments and municipalities make data-informed decisions regarding zoning, traffic management, and disaster preparedness. For instance, integrated systems powered by platforms like Esri’s ArcGIS enable authorities to visualize population density, land use, and resource distribution. This feature is highly useful in urbanizing areas where spatial planning is vital to sustainable development. Further, public services like health, utilities, and law enforcement increasingly depend upon location intelligence for efficient delivery and functioning. With digital maps becoming more interactive and easily accessible, their uptake among U.S. institutions is gaining momentum, making them crucial resources in creating smarter and more resilient cities nationwide.

United States Digital Map Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States digital map market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on type, usage, solution, deployment mode, application, and end use industry.

Analysis by Type:

- GIS

- LiDAR

- Digital Orthophotography

- Aerial Photography

- Others

GIS dominates the digital map landscape, providing spatial analysis and visualization for industries such as urban planning and disaster response. It facilitates layered mapping, real-time tracking, and big data integration, spurring adoption for intelligent decision-making and effective geographic data management in government, logistics, and utilities sectors.

LiDAR technology provides highly accurate elevation and terrain mapping, employed extensively by autonomous vehicles, environmental surveys, and infrastructure construction. Its capacity to create accurate 3D models improves accuracy for mapping purposes. Amplifying demand for smart mobility and topography surveys increases its significance in geospatial intelligence processes and analytics.

Digital orthophotography fuses aerial photography with cartographic precision, allowing for high detail, scale-accurate maps for land use, zoning, and urban planning. Application in environmental monitoring and property evaluation is increasingly on the rise, spurred by government infrastructure projects and the demand for accurate visual presentation in spatial planning and cadastral mapping.

Aerial photography is a core mapping method that continues to provide high-resolution images for agriculture, construction, and environmental surveys. It is cost-effective to use and deploy, which makes it widely used for real-time tracking and change detection. Use in conjunction with digital tools makes it highly accessible for layered mapping and geographic analysis in various industry applications.

Other map types, such as sonar, radar mapping, and satellite remote sensing, underpin specialized uses in marine navigation, defense, and climatology. Such technologies form part of extensive geospatial data ecosystems complementing conventional cartography and allowing greater depths of insight across inaccessible and remote areas in the digital cartography space.

Analysis by Usage:

- Indoor

- Outdoor

Indoor digital mapping is increasingly used in airports, shopping malls, hospitals, and corporate campuses. It facilitates better navigation, asset tracking, and emergency response based on precise interior plans. Indoor mapping becomes an essential factor with the expansion of location-based services and intelligent buildings for the optimization of space and user experience.

Outdoor mapping remains prevalent, underpinning applications like navigation, surveying, route optimization, and environmental monitoring. Facilitated by satellite, drone, and aerial data, outdoor maps are critical to city planning, logistics, and agriculture. Improvements in GPS precision and real-time data have extended its use across primary sectors.

Analysis by Solution:

- Software

- Services

Mapping software encompasses GIS platforms, navigation systems, and analytics tools that render geospatial data into actionable information. Software solutions dominate the market with customization, scalability, and integration with enterprise systems. Regular updating and cloud compatibility make them a necessity for both commercial and public sector users.

Mapping services include collection, consulting, integration, and maintenance of data. Service providers assist organizations in executing customized geospatial solutions, particularly for non-technical users. With growth in adoption in sectors, increasing demand for managed services and technical support is observed, which ensures precise deployment and maximized utilization of digital mapping infrastructure.

Analysis by Deployment Mode:

- Cloud-based

- On-premises

Cloud-based deployment offers scalability, remote access, and cost-efficiency, making it ideal for organizations requiring real-time geospatial updates. It supports collaboration, disaster recovery, and integration with IoT and AI. This mode is increasingly preferred across industries for its flexibility and minimal infrastructure investment.

On-premises deployment is used by organizations with stringent data privacy, security, or compliance needs. It provides more control over data storage and access but includes greater initial costs. Government, defense, and sensitive commercial environments frequently utilize this model for secure geospatial operations.

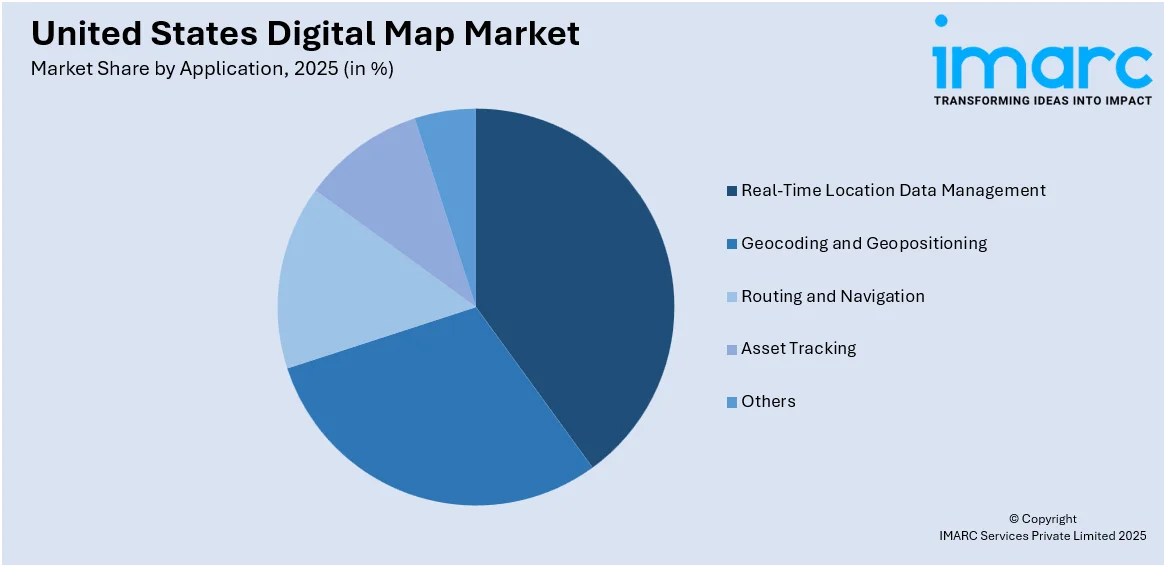

Analysis by Application:

Access the comprehensive market breakdown Request Sample

- Real-Time Location Data Management

- Geocoding and Geopositioning

- Routing and Navigation

- Asset Tracking

- Others

Real-time location data management supports round-the-clock tracking of assets, vehicles, and people. Applied to logistics, emergency services, and smart city management, it improves operational effectiveness and awareness of situations. Demand for real-time visibility is pushing broad adoption of location intelligence-enabled digital map platforms.

Geocoding converts physical addresses to geographic coordinates, which is required for navigation, planning, and spatial analysis. Geopositioning enables accurate location tracking and mapping. These technologies form the backbone of most mapping applications, providing commercial and civic uses with accuracy in delivery, route optimization, and demographic targeting.

Routing and navigation are fundamental capabilities, allowing users to recognize optimum routes and real-time substitutions. Used extensively in transportation, mobility services, and logistics, the application maximizes fuel consumption and time taken. Ongoing updates and real-time integration of live data are essential capabilities influencing uptake by users.

Digital maps support monitoring and management of physical assets, ranging from fleets to field equipment. Asset tracking improves visibility, security, and productivity in industries such as utilities, construction, and transportation. Integration with sensors and IoT enhances this application's contribution to operational continuity and cost savings.

Other uses include demographic analysis, land use planning, risk assessment, and environmental monitoring. These applications play specialized but valuable roles in policy-making, scientific research, and agricultural forecasting. With the increasing role of spatial data in decision-making, these specialized applications will intensely become more popular.

Analysis by End Use Industry:

- Automotive

- Engineering and Construction

- Logistics and Transportation

- Energy and Utilities

- Military, Aerospace and Defense

- Others

Digital maps are critical in automotive usage like navigation, driver assistance systems, and self-driving vehicle guidance. Sensor integration and real-time traffic information facilitate safer and more efficient driving. The industry transition to smart mobility solutions further amplifies mapping innovations and demand.

Construction and engineering companies employ digital maps to survey, plan projects, and track progress. Precise geospatial information guarantees compliance, safety, and cost management. Mapping technologies combined with BIM and CAD improve visualization and coordination, which are essential for infrastructure and large-scale development work.

Digital mapping is at the heart of logistics routing, scheduling, and delivery tracking. Operational efficiency is supported by real-time navigation, fleet visibility, and traffic avoidance. With e-commerce and same-day delivery models on the rise, logistics companies increasingly depend on cutting-edge mapping tools for optimizing performance.

Energy and utilities utilize digital maps for network planning, asset management, and outage detection. Mapping facilitates visualization of pipelines, grid topology, and environmental factors. Integration of real-time data allows quicker maintenance and more intelligent deployment of resources, minimizing disruptions to services and costs.

This industry relies on high-precision digital maps for mission planning, monitoring, and situational awareness. Reliable, real-time geospatial information improves strategic operations, terrain analysis, and threat detection. Sophisticated mapping capabilities are essential in defense applications where confidentiality and accuracy are needed.

Other sectors like telecommunications, agriculture, and public health gain through digital maps for network planning, crop monitoring, and disease surveillance. These sectors make use of geospatial understanding to enhance service provision, sustainability, and policy enforcement across different regional and operational environments.

Regional Analysis:

- Northeast

- Midwest

- South

- West

The densely populated and urbanized Northeast area is characterized by a high adoption of digital mapping in transportation, public planning, and emergency response. Government-initiated smart city initiatives and GIS projects ensure sustained demand and innovation in geospatial technologies.

Digital mapping in the Midwest enables agriculture, manufacturing, and infrastructure growth. Precision farming and rural broadband deployment are significant uses. The region's industrial base and varied geography make it increasingly a hotspot for location-based services and real-time asset tracking.

The Southern United States experiences accelerating adoption of geospatial maps for disaster response, power distribution, and city planning. With increased weather occurrences and growing metropolitan populations, the need for real-time geospatial intelligence and infrastructure monitoring equipment grows throughout the West.

Western United States is at the forefront in embracing digital maps to monitor the environment, facilitate intelligent mobility, and drive technology-based urban planning. Seismic activity and extensive natural reserves require thorough mapping. State-level green initiatives and innovation centers further drive regional spending on mapping technology.

Competitive Landscape:

United States digital map market competition features a combination of established tech vendors, geospatial data companies, and new entrants providing specialized mapping solutions. Firms compete on the real-time capabilities, scalability, and accuracy of their digital maps. Innovation is a major focus, with companies investing in next-generation technologies like artificial intelligence, machine learning, and cloud computing to boost geospatial analysis and user experience. Seamless integration of digital maps with Internet of Things (IoT) devices and enterprise software is a major differentiator. Collaborations with transportation, logistics, and government communities are prevalent, allowing providers to customize mapping solutions to industry-specific requirements. Growing interest from developers and startups is also being observed in the market who use open APIs to develop specialized location-based apps. With digital maps becoming an integral part of navigation, urban planning, and real-time services, competition remains on the rise, pushing persistent innovation and deeper market penetration. These dynamics are expected to shape the United States digital map market forecast over the coming years.

The report provides a comprehensive analysis of the competitive landscape in the United States digital map market with detailed profiles of all major companies.

Latest News and Developments:

- May 2025: The State of Colorado Governor's Office and Department of Local Affairs (DOLA) released its new state property tax map in partnership with OIT's Geographic Information System (GIS) team. The innovative Colorado Property Tax Map provides a centralized and readily accessible source of property tax estimates and tax jurisdictions, keeping property owners and stakeholders up to date.

- April 2025: Planet Labs PBC announced a multi-year extension of its agreement with onX, a leading supplier of outdoor digital navigation solutions such as digital maps. Under this deal, onX will have continuous access to Planet Labs' near-daily satellite imagery to be utilized in their collection of apps for outdoor pursuits, such as onX Offroad, onX Hunt, onX Fish, and onX Backcountry.

- March 2025: Esri formed a strategic alliance with the Google Maps Platform. Under this alliance, Google's Photorealistic 3D Tiles will be integrated into the ArcGIS platform, enabling users to make extremely accurate and visually beautiful 3D digital maps and environments.

- February 2025: The initial major update of North American charts for 2025 was introduced by C-MAP, a leader in cloud-based mapping and digital naval cartography. This comprehensive update features enhanced satellite imagery of the United States East Coast, including the Carolinas and Chesapeake Bay. Coastal High-Resolution Bathymetry and Shaded Relief have also been updated considerably in Florida, the Gulf Coast, and the Great Lakes.

- April 2024: The Bowman Consulting Group Ltd. revealed acquisition plans for Surdex Corporation, a St. Louis-based geospatial and engineering solutions provider. With the acquisition, Bowman will have the potential to augment its catalog of services to include digital intelligent mapping, high-altitude digital orthoimagery, and other sophisticated geospatial services.

United States Digital Map Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | GIS, LiDAR, Digital Orthophotography, Aerial Photography, Others |

| Usages Covered | Indoor, Outdoor |

| Solutions Covered | Software, Services |

| Deployment Modes Covered | Cloud-based, On-premises |

| Applications Covered | Real-Time Location Data Management, Geocoding and Geopositioning, Routing and Navigation, Asset Tracking, Others |

| End Use Industries Covered | Automotive, Engineering and Construction, Logistics and Transportation, Energy and Utilities, Military, Aerospace and Defense, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States digital map market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the United States digital map market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States digital map industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The digital map market in the United States was valued at USD 316.2 Million in 2025.

The United States digital map market is projected to exhibit a CAGR of 11.81% during 2026-2034, reaching a value of USD 889.4 Million by 2034.

Major drivers of the United States digital map market are the heightening need for real-time navigation, the increasing use of GIS in city planning and infrastructure, and expanding applications across logistics, automotive, and defense industries. Advances in mapping technologies, IoT and AI integration, and growing applications in public and private sectors also fuel consistent market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)