United States Digital PCR Market Size, Share, Trends and Forecast by Product Type, Technology, Application, and Region, 2026-2034

United States Digital PCR Market Size and Share:

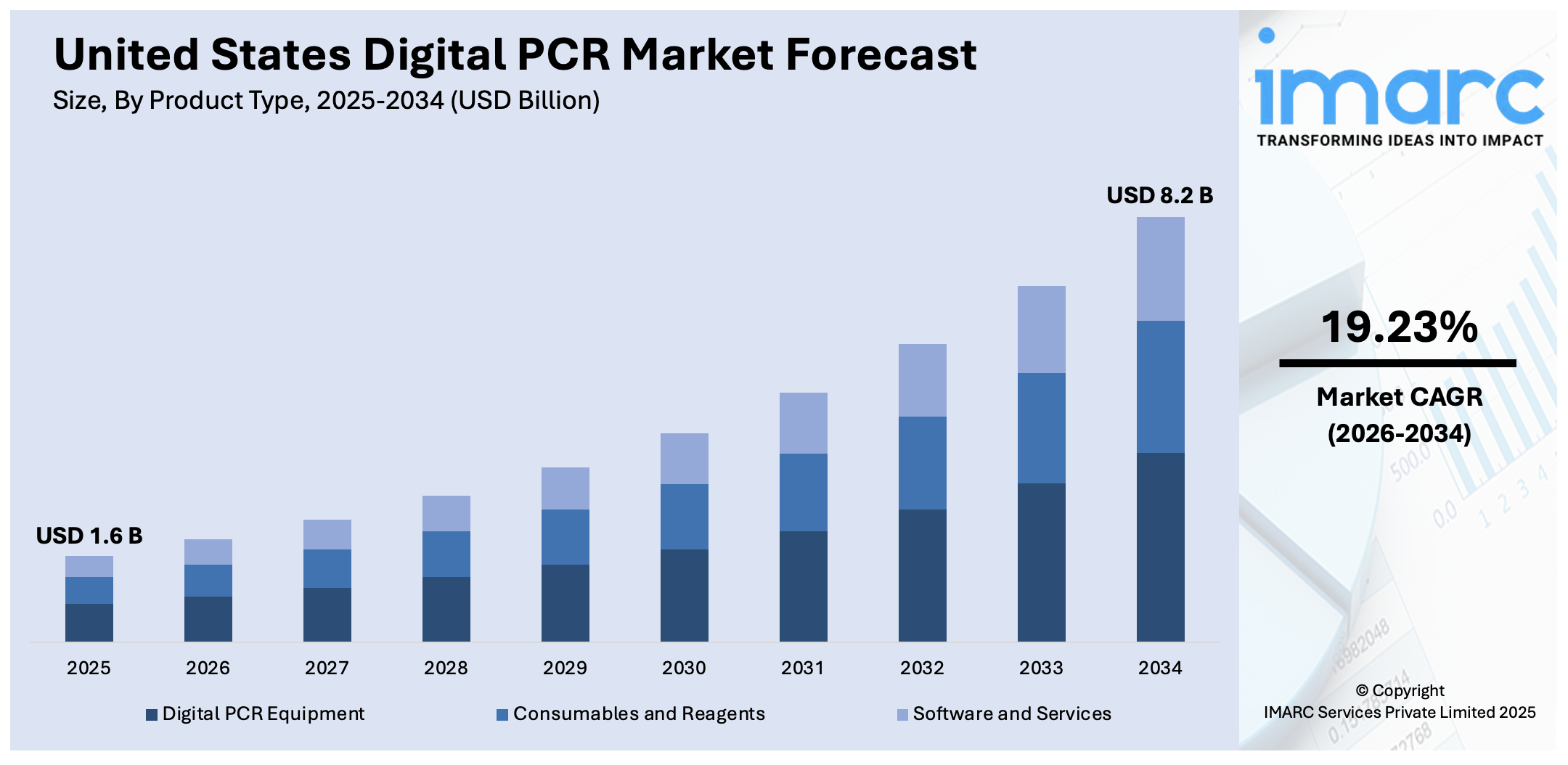

The United States digital PCR market size was valued at USD 1.6 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 8.2 Billion by 2034, exhibiting a CAGR of 19.23% during 2026-2034. Northeast currently dominates the market, holding a significant share in 2025. The market is fueled by innovation in clinical diagnostics, especially in oncology, infectious disease identification, and genetic analysis. The nation's high focus on precision medicine and customized therapies drives demand for high-sensitivity molecular devices such as digital PCR. Other areas of growing application in agricultural biosecurity, environmental analysis, and food safety help drive wider adoption across industries. Research organizations, biotechnology companies, and public health authorities actively invest in the technology to enhance detection precision and regulatory compliance. Innovation centers and federal funding further augment market momentum, adding to an expanding United States digital PCR market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1.6 Billion |

| Market Forecast in 2034 | USD 8.2 Billion |

| Market Growth Rate 2026-2034 | 19.23% |

The US digital PCR market is being driven by growing demand in clinical diagnostics and personalized medicine markets, where accurate quantification of nucleic acids, particularly low-abundance variants, is critical. Academic institutions and medical research centers throughout clusters such as Boston, San Diego, and the Research Triangle in North Carolina are constantly seeking out digital PCR for uses as broad as detecting rare mutations in cancer to tracking minimal residual disease. This need is bolstered by federal and state-level programs aimed at building molecular diagnostics infrastructure, such as federal funding for genomic centers and translational research initiatives. Diagnostic data providers in urban medical centers depend on the high sensitivity of digital PCR to treat complicated case mixes and heterogeneous patient populations, such as those in ethnically diverse urban settings where genetic backgrounds demand differentiated assay performance. By fulfilling precision medicine's strict accuracy requirements like identifying fine expression variations or confirming gene edits, providers are able to enhance decision-making clinically and outcomes for patients. Thus, investment in healthcare innovation ecosystems, the spread of personalized therapies, and a strong diagnostics market collectively drive the United States digital PCR market demand.

To get more information on this market Request Sample

Another significant force behind the US digital PCR industry is agriculture and food safety, where biosecurity assurance and the detection of trace pathogens or genetically modified organisms are paramount, particularly in a nation with a large, internationally connected agrifood system. Agricultural areas like California's Central Valley, the Midwest corn belt, and Florida's citrus belt are under perpetual attack from plant diseases, GMO infestation, or new pests. State and national agricultural departments, as well as private agritech firms, increasingly use digital PCR due to its precision in detecting and quantifying low-level pathogen presence in crop monitoring programs and food chains. Applications vary from the early detection of plant pathogens to GMO threshold monitoring for export purposes. US agricultural biotech and food processing leaders, often situated in rural innovation clusters, appreciate the sensitivity and consistency of the technique to ensure biosecurity and respect for international trade partners. This convergence of agricultural regulation, food export policy, and the imperative for sophisticated molecular tools elevates the urgency of digital PCR in protecting one of the country's most important economic drivers.

United States Digital PCR Market Trends:

Enlargement of Precision Medicine Propelling Technology Integration

The growth of targeted therapy and its integration into the growing field of precision medicine are two of the most important trends in the US digital PCR industry. As more American healthcare systems move toward patient-specific treatment paradigms, demand for precise, quantitative nucleic acid analysis has escalated significantly. An industry survey revealed that 88% of healthcare consumers expect their medical care to be as personalized as their experiences with online shopping or vacation planning, underscoring the rising demand for tailored, patient-centric healthcare solutions. Digital PCR is unique in that it can identify low-level genetic mutations, track tumor burden, and enable companion diagnostics—all key elements of personalized care. Top research institutions and hospitals in places such as Boston, San Francisco, and New York are integrating digital PCR into clinical practice, from cancer diagnosis to post-treatment surveillance. The US also anticipates intensive biotech and pharmaceutical developer partnerships to integrate dPCR into the drug development pipeline, particularly for drugs that need genetic stratification of patient populations. The demand is also supported by US government-funded programs that encourage genomic medicine, and digital PCR becomes a scientific instrument as well as a strategic facilitator of sophisticated, data-driven delivery of healthcare.

Increasing Burden of Genetic Disorders and Infectious Diseases

The increasing incidence of genetic diseases and infectious diseases in the United States has emerged as a priority impetus propelling the increased significance of digital PCR. An industry report showed that as genetic testing advanced, the number of diseases diagnosed rose from 51 in 2002 to 509 in 2022. Multi-gene panels identified 984 unique genetic diseases, covering 63% of all observed conditions. Increased consciousness about such conditions as cystic fibrosis, Duchenne muscular dystrophy, and rare hereditary cancers means that demand for early diagnosis and exact genetic screening is greater than ever before. Concurrently, the nation experiences periodic outbreaks of infectious disease issues, ranging from influenza and antibiotic-resistant pathogens to emerging viruses. Digital PCR offers unprecedented sensitivity and specificity, allowing early detection and quantification of pathogens that standard methods may overlook. In US public health laboratories, including those with CDC and state health department affiliations, digital PCR is being increasingly employed for epidemiological surveillance and outbreak response. The precision of the tool to measure viral load also helps in monitoring treatment and assessment of vaccine effectiveness. This dual function of genetic diagnostics and pathogen detection makes digital PCR a core technology in countering both chronic and emerging health challenges as per the United States digital PCR market forecast.

Technological Inventions and Regional Innovation Clusters

The US digital PCR market is similarly influenced by fast-paced innovation emanating from local innovation centers that combine biotech, software, and life sciences. Regions like Silicon Valley, Cambridge (Massachusetts), and the BioHealth Capital Region in the Midwest are seeing more startup ventures and academic–industry partnerships aimed at streamlining digital PCR platforms. Developments include miniaturization devices, accelerated workflows, better droplet generation systems, and cloud-based data analysis software. These advances are bringing dPCR within reach of smaller laboratories, decentralized testing centers, and even point-of-care testing. Moreover, financing by US government agencies, such as NIH and DARPA, enable the development of scalable platforms that can be used for large-scale deployments. There's also a move toward combining dPCR with AI-driven diagnostics and wearable health technologies, which are applications made possible by the US's robust tech ecosystem. Such regional strengths speed up product development and help create the United States as a world leader in digital PCR innovation and adoption.

United States Digital PCR Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States digital PCR market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on product type, technology, and application.

Analysis by Product Type:

- Digital PCR Equipment

- Consumables and Reagents

- Software and Services

Consumables and reagents stand as the largest component in 2025, holding 57.0% of the market share. According to the United States digital PCR market trends, reagents and consumables are the predominant product type segmentation because they are used repeatedly and play a vital part in each testing cycle. Contrary to digital PCR instruments, which are a single-time capital expenditure, consumables like reaction plates, microfluidic chips, and reagents like enzymes, buffers, and probes must be used for each assay. This creates stable demand across research laboratories, clinical diagnostics, and drug development. High-quality reagents are highly dependent upon by American labs, especially those dealing with high-throughput genomic research or precision cancer research. Moreover, US-based producers and international companies with operations in the country provide a broad selection of specialized kits for particular uses like rare mutation identification, viral load measurement, or GMO testing. This ongoing demand for high-performance and customized consumables fuels continued market expansion, making this segment the most lucrative and active in the larger US digital PCR product market.

Analysis by Technology:

- Droplet Digital PCR

- BEAMing Digital PCR

Droplet digital PCR stands as the largest component in 2025, holding 68.2% of the market share. Droplet digital PCR (ddPCR) is the top technology segmentation in the United States digital PCR market because of its higher precision, sensitivity, and ease of operation. This technology functions through dividing a sample into thousands of nanoliter-scale droplets, permitting absolute quantification of target DNA or RNA molecules in the absence of standard curves. In the USA, ddPCR is used extensively throughout clinical diagnostics, oncology, infectious disease tracking, and agricultural biotechnology. Its capability to identify rare genetic mutations, minimal residual disease, and low-level pathogens makes it extremely useful in research as well as clinical applications. Leading US pharmaceutical and biotechnology companies prefer ddPCR due to its high-throughput capabilities and robustness. Clinically, the technology also enjoys widespread support through academic research institutions and federal health care organizations, further establishing its value and promoting widespread application. Clinically, therefore, ddPCR remains a dominant force in the US digital PCR market, propelling innovation and consistent molecular testing.

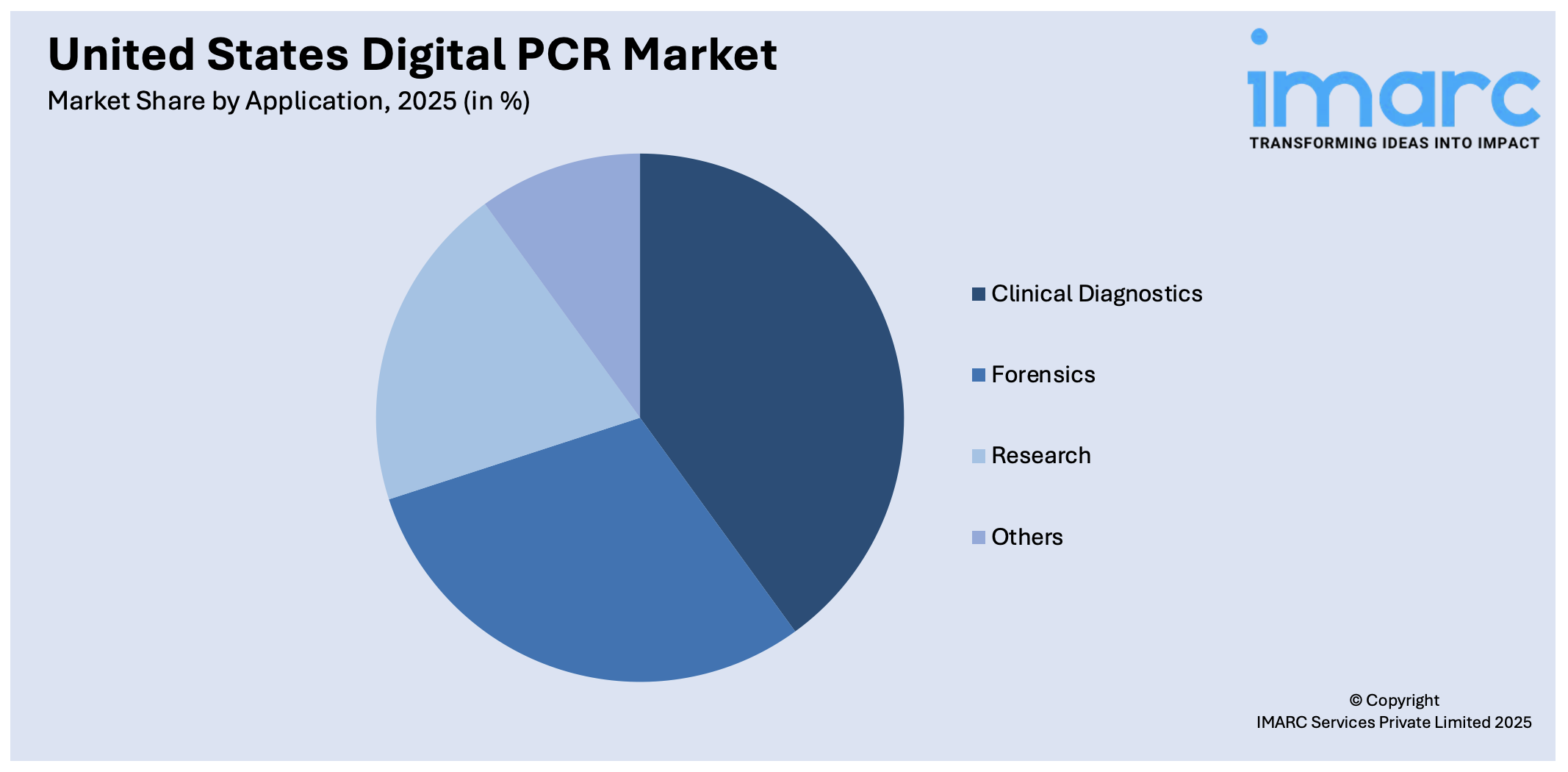

Analysis by Application:

Access the comprehensive market breakdown Request Sample

- Clinical Diagnostics

- Forensics

- Research

- Others

Clinical diagnostics leads the market with 43.2% of market share in 2025. Clinical diagnostics is the primary application segment for the United States digital PCR market outlook as it plays a pivotal role in providing high-specificity and high-sensitivity testing of various health disorders. Digital PCR is increasingly utilized in clinical practice for the identification of cancer-associated mutations, tracking minimal residual disease, detection of infectious pathogens, and non-invasive prenatal screening. US hospitals, reference labs, and academic medical centers are incorporating this technology into everyday workflows due to its ability to measure nucleic acids precisely, even when present in very low concentrations. That is especially helpful in oncology, where liquid biopsies are emerging as a go-to approach for early diagnosis and treatment monitoring. The increasing need for precision medicine, along with the increasing burden of genetic and infectious disease in the US, continues to solidify digital PCR's clinical uptake. With healthcare professionals looking for more accurate diagnostic devices, digital PCR is at the forefront of driving personalization of care and enhanced patient outcomes.

Regional Analysis:

- Northeast

- Midwest

- South

- West

In 2025, Northeast accounted for the largest market share. The United States Northeast has the leading role in the market for digital PCR because it has a high concentration of research hospitals, academic institutions, diagnostic laboratories, and biotechnology companies. Hubs of advanced molecular research and innovation exist in states such as Massachusetts, New York, and Pennsylvania. Boston, for example, has a highly concentrated cluster of universities and world-famous hospitals as well as biotech companies that develop and apply digital PCR technologies on a regular basis. These facilities create demand for next-generation nucleic acid quantification technologies, particularly for use in oncology, infectious disease, and personalized medicine applications. The region also enjoys high investment streams, public-private collaborations, and ease of access to regulatory agencies and funding organizations that facilitate uptake. In addition, the Northeast's established healthcare infrastructure as well as access to skilled personnel facilitate the rapid adoption of new diagnostic platforms such as digital PCR. These regional benefits position the Northeast as a leader in innovation, application, and commercialization in the United States digital PCR market.

Competitive Landscape:

According to the United State digital PCR market analysis, several major companies are proactively driving growth through strategic initiatives aimed at innovation, collaboration, and expansion. Market leaders in research and development spend significantly in the development of more precise, faster, and more user-friendly digital PCR platforms with new features like increased throughput capacity and optimized workflows that match clinical and research requirements. Collaboration with research centers, healthcare organizations, and pharmaceutical firms helps these industry leaders come up with application-specific solutions, particularly for oncology, detection of infectious diseases, and diagnosis of genetic diseases. Apart from this, they aim to increase product portfolios through the introduction of specialized consumables and reagents tailored for specific assays to provide complete offerings catering to different customer requirements. Several of the players are also engaged in enhancing accessibility through the development of small, easy-to-use instruments designed for decentralized testing environments such as point-of-care sites. Moreover, strategic partnerships with regulatory organizations enable smoother approvals and uptake in clinical diagnostics. Market expansion efforts involve targeting emerging markets like agricultural biotechnology and environmental monitoring, expanding the digital PCR application space. By ongoing innovation, collaborations, and diversified utilization, these initiatives collectively support the United States digital PCR market growth trajectory, solidifying their leadership and defining the future of molecular diagnostics.

The report provides a comprehensive analysis of the competitive landscape in the United States digital PCR market with detailed profiles of all major companies.

Latest News and Developments:

- February 2025: Bio‑Rad announced a binding offer to acquire France‑based Stilla Technologies to strengthen Bio‑Rad’s digital PCR portfolio. The acquisition will focus on integrating Stilla’s mid-priced Nio+ system and enhancing its reach in applied research and clinical diagnostics, with deal closure expected by Q3 2025.

- January 2025: In order to commercialize ColoSense, its FDA-approved non-invasive colorectal cancer screening test, Geneoscopy secured USD 105 Million in Series C funding led by Bio-Rad. To improve diagnostic precision, the test makes use of Bio-Rad's Droplet Digital PCR (ddPCR) technology.

- October 2024: Bio-Rad launched the Vericheck ddPCR Empty-Full Capsid Kit to accurately quantify full, partial, and empty AAV capsids in gene therapy development. Using Droplet Digital PCR, the kit ensures high-precision AAV vector characterization, improving safety, efficacy, and regulatory compliance across gene therapy research, manufacturing, and quality control.

United States Digital PCR Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Digital PCR Equipment, Consumables and Reagents, Software and Services |

| Technologies Covered | Droplet Digital PCR, BEAMing Digital PCR |

| Applications Covered | Clinical Diagnostics, Forensics, Research, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States digital PCR market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the United States digital PCR market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States digital PCR industry and its attractiveness.

- A competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The digital PCR market in the United States was valued at USD 1.6 Billion in 2025.

The United States digital PCR market is projected to exhibit a CAGR of 19.23% during 2026-2034, reaching a value of USD 8.2 Billion by 2034.

The United States digital PCR market is driven by demand for precision diagnostics, rising genetic disorders, and personalized medicine initiatives. Increased research funding, technological advancements, and widespread adoption in clinical and public health settings further support growth, making digital PCR essential for accurate nucleic acid quantification and disease monitoring.

Northeast accounts for the largest share in the United States digital PCR market, driven by strong biotech presence, renowned research institutions, and advanced healthcare systems. High demand for precision diagnostics, extensive clinical trials, and regional investment in personalized medicine accelerate adoption. Academic-industry partnerships further enhance innovation and application of digital PCR technologies in this region.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)