United States Digital X-ray Devices Market Size, Share, Trends and Forecast by Application, Technology, Portability, End User, and Region, 2025-2033

United States Digital X-ray Devices Market Size and Share:

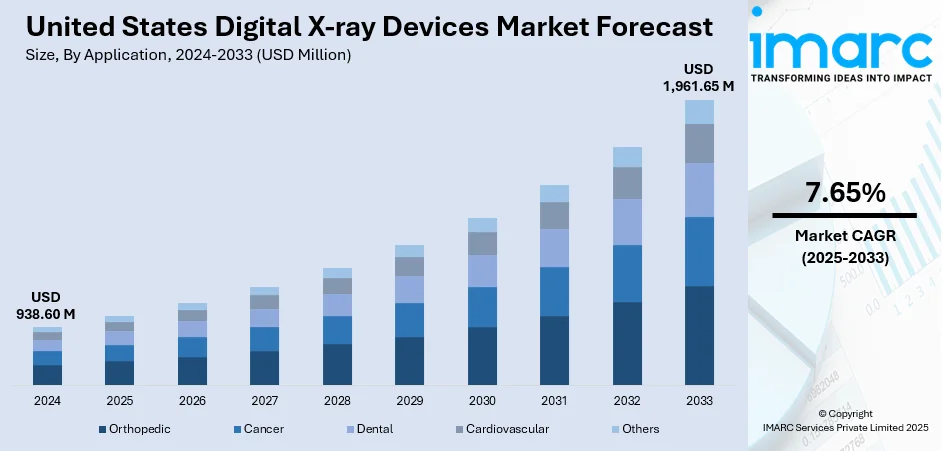

The United States digital x-ray devices market size was valued at USD 938.60 Million in 2024. Looking forward, the market is expected to reach USD 1,961.65 Million by 2033, exhibiting a CAGR of 7.65% during 2025-2033. The market is fueled by sophisticated healthcare infrastructure, enhanced demand for quicker and more precise diagnostic equipment, and rising prevalence of chronic diseases. Shift toward outpatient treatment and enhanced telehealth usage have also fueled the uptake of mobile and portable digital X-ray systems. Interoperability across health systems and integration with electronic health records are additionally driving demand. Technological advancements offering lower radiation exposure and better image quality support widespread use across hospitals, clinics, and urgent care centers, which further expands the United States digital X-ray devices market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 938.60 Million |

| Market Forecast in 2033 | USD 1,961.65 Million |

| Market Growth Rate 2025-2033 | 7.65% |

One of the significant forces driving the United States digital X-ray devices market is the nation's sophisticated healthcare infrastructure and high level of focus on early diagnosis and precision medicine. Medical facilities throughout the US, ranging from major urban hospitals to rural clinics, are increasingly using digital imaging technologies to supplant old-fashioned film-based systems. This change is motivated by the requirements of quicker turnaround in diagnostics, better image quality, and simpler integration with electronic health records (EHRs). Digital X-ray machines provide more efficient workflows, which is essential for high-volume, high-efficiency health care environments such as the US Additionally, government programs urging health IT interoperability have contributed further to the movement toward digital systems. The use of PACS (Picture Archiving and Communication Systems) and telemedicine across the board also helps propel the development of digital radiography since they allow the image to be accessed remotely and consulted with. Consequently, as per the United States digital X-ray devices market analysis, these tools are becoming an integral part of contemporary diagnostic processes throughout the country.

To get more information on this market, Request Sample

Another key factor driving the US digital X-ray equipment market is the growing incidence of chronic conditions like cardiovascular disease, diabetes, and other musculoskeletal conditions that need repeat imaging to diagnose and monitor. In the United States, aging and lack of exercise are fueling higher rates of such diseases, and healthcare providers are being compelled to seek more efficient and accessible diagnostic equipment. Digital X-ray systems are particularly optimal for outpatient and ambulatory care clinics, which are expanding considerably throughout the nation. They are helped by digital radiography's portability, reduced dose of radiation, and economics. Moreover, there is an overwhelming need for mobile X-ray units in nursing facilities, sports clinics, and even in emergency environments, which indicates a trend toward patient-oriented care. This decentralizing of imaging services, from hospitals to more accessible locations, facilitates the speedy rollout of digital X-ray technology in a wide range of healthcare environments. Flexibility and speed are the principal drivers of adoption in the US market.

United States Digital X-ray Devices Market Trends:

Significant Technological Advancements

Innovations in digital technology are driving the United States digital X-ray devices market growth. Compared to conventional techniques, modern digital X-ray systems provide better image quality, quicker processing times, and lower radiation exposure. Features such as high-resolution detectors, wireless connectivity, and integration with electronic health records help improve diagnostic accuracy and operational efficiency. These advancements make digital X-ray systems more attractive to healthcare providers looking to enhance their imaging capabilities and streamline workflows. For example, Carestream Health expanded its market-leading mobile X-ray range in May 2023 with the introduction of the DRX-Rise Mobile X-ray System. Without requiring a substantial capital investment, this feature-rich, fully integrated digital X-ray machine offers clients an economical option for digital imaging and the expansion or replacement of their current DR fleet. Radiographers can drive farther and perform more exams on a single charge because to its cutting-edge lithium battery and in-bin detector charging, which saves time and boosts throughput. Two work zones are provided by the system's twin touchscreen screens to further increase productivity. Furthermore, the radiographer can use the tube head or wireless remote control to precisely move the lightweight system into the ideal position at the bedside thanks to enhanced drive capabilities.

Growing Demand for Diagnostic Capabilities

The United States digital X-ray devices market demand is increased by the rising incidence of chronic illnesses and the requirement for prompt and precise diagnosis. Modern X-ray equipment is sought after by healthcare facilities to facilitate early diagnosis and efficient treatment as the population ages and the prevalence of diseases like cancer and cardiovascular disorders increases. An estimated 129 million Americans suffer from at least one serious chronic illness, including diabetes, heart disease, cancer, obesity, and hypertension, according to the Centers for Disease Control and Prevention (CDC). Furthermore, chronic diseases that may be prevented and treated account for more than five of the top ten causes of death in the United States, or are closely linked to them. The prevalence of chronic diseases has been continuously rising over the last 20 years, and this trend is predicted to continue. In America, a growing percentage of people have more than one chronic illness; 42% have two or more, and 12% have five or more. Chronic illness has a significant impact on the US healthcare system in addition to its personal toll. Approximately 90% of the USD 4.1 Trillion spent on healthcare each year goes toward treating and managing mental health issues and chronic illnesses.

United States Digital X-ray Devices Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States digital x-ray devices market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on application, technology, portability, and end user.

Analysis by Application:

- Orthopedic

- Cancer

- Dental

- Cardiovascular

- Others

Orthopedic uses lead the United States digital X-ray market trends owing to their need in detecting fractures, joint deformities, and bone diseases. The quickness and accuracy of digital imaging assist with surgery planning and post-surgical evaluations, making them a necessity in orthopedic clinics within hospitals, emergency care facilities, and specialty clinics nationwide.

Digital X-ray machines play a critical role in the detection and treatment of cancer, especially in detecting tumors of the lungs, breasts, and other soft tissues. Their high-resolution imaging capability at faster speeds allows early and regular monitoring and assists oncologists in creating early treatment plans and enhancing patient outcomes in cancer clinics.

In dentistry, digital X-ray machines are most utilized for detecting cavities, root problems, bone loss, and other dental problems. The lower radiation dose, rapid image availability, and better diagnostic accuracy aid preventive care as well as complicated procedures. Their small size and portability also make them suitable for small dental clinics.

Cardiovascular imaging is greatly enhanced by digital X-ray technology, particularly in assessing cardiac size, blood vessels, and identification of calcifications. The machines facilitate early diagnosis of diseases such as heart failure or coronary heart disease. Their fast image capture is critical in emergency departments, allowing for quick decision-making and intervention in cardiac care units.

Analysis by Technology:

- Computed Radiography

- Direct Radiography

Computed radiography (CR) is an intermediate technology between old film-based X-rays and complete digital systems. It records images using imaging plates that are processed in a reader to produce digital images. In the US, CR finds application in centers that need cost-effective digital imaging yet are not ready to commit to direct radiography. It provides flexibility and acceptable image quality, which makes it appropriate for small clinics or mobile installations.

Direct radiography (DR) is the most sophisticated technology for digital X-ray, providing instant image acquisition and presentation without intervening processing. It is extensively used in US hospitals and imaging centers and enhances workflow efficiency, lowers radiation exposure, and provides better image quality. DR is especially useful in high-volume diagnostic settings and emergency situations. The integration with PACS and electronic health records further supports clinical decision-making. As healthcare facilities modernize, DR continues to drive innovation and adoption in the digital X-ray space.

Analysis by Portability:

- Fixed Systems

- Portable Systems

Fixed digital X-ray systems are typically installed in hospitals, diagnostic imaging centers, and large outpatient facilities. These systems are ideal for high-volume imaging needs, offering advanced features, high image quality, and seamless integration with electronic health records and PACS. Fixed systems are still critical in the United States for use in emergency departments, orthopedic units, and radiology suites where there needs to be predictable, high-throughput imaging. Their reliability and dual-use capabilities make them a foundation of hospital-based diagnostic workflows.

Portable digital X-ray systems are also becoming increasingly popular as per the United States digital X-ray devices market forecast, especially where bedside imaging or mobile diagnosis is needed. These units are employed widely in nursing homes, intensive care units, sports centers, and in emergency response conditions. Their portability enables faster diagnostics without having to transfer the patient, which is significant for infection control as well as critical care. With healthcare moving in the direction of decentralization and home-based care, portable systems have a central role to play in increasing access to digital imaging in multiple environments.

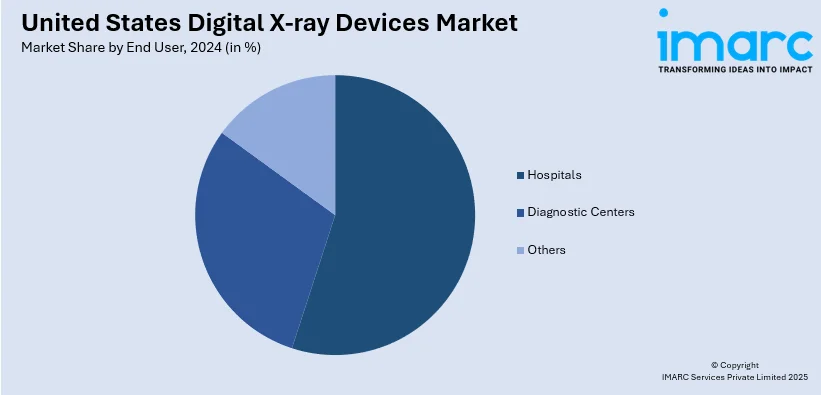

Analysis by End User:

- Hospitals

- Diagnostic Centers

- Others

Hospitals are the greatest end users of digital X-ray equipment in the United States, using them throughout emergency departments, operating rooms, and inpatient settings. Hospitals need high-volume imaging solutions that produce rapid, precise information for many assorted clinical requirements, ranging from trauma to long-term disease tracking. As there is growing demand for integrated care and efficient diagnosis, hospitals will place great importance on systems that are PACS and EHR compatible. Ongoing investment in state-of-the-art radiology facilities makes hospitals the leading market segment.

Diagnostic centers are key clinics for the expanding US outpatient imaging market. Digital X-ray systems are the basis for diagnostic clinics' ability to provide rapid, high-quality diagnostic images for walk-in patients, referrals, and regular screenings. Attention to cost-effectiveness, turnaround, and patient convenience has spurred the use of fixed and portable digital X-ray technologies. As healthcare increasingly shifts toward ambulatory care, diagnostic centers are expanding their capabilities, becoming essential providers of accessible, efficient imaging across diverse patient populations.

Regional Analysis:

- Northeast

- Midwest

- South

- West

The Northeast region is aided by a high density of advanced hospitals, academic medical centers, and research facilities. Robust healthcare infrastructure and early technology uptake drive demand for digital X-ray systems. Urbanized populations and aging populations further fuel increasing diagnostic requirements, making this a primary market for innovation and investment.

The Midwest experiences consistent growth in the adoption of digital X-rays owing to a combination of urban health systems and rural hospitals. Demand is fueled by the necessity of affordable, transportable imaging capabilities in sparsely populated regions. Regional health systems and teaching hospitals also fuel steady investment in advanced diagnostic imaging technology throughout the region.

The South is witnessing increasing demand for digital X-ray equipment, spurred by a large and growing elderly population and a greater incidence of chronic illness. An increase in healthcare infrastructure in the suburbs and rural regions propels adoption. Expansion in outpatient facilities and a greater role by the government in supporting health technology enhancements also encourages regional market growth.

West region, such as states of California and Washington, is the hub of healthcare innovation and integration of digital health. High-technology hospitals and startups fuel robust demand for sophisticated imaging systems. The preventive focus in the region, telemedicine, and mobile health services drive rapid deployment of portable digital X-ray technologies.

Competitive Landscape:

Several major companies in the United States digital X-ray devices market are driving growth actively with strategic innovations, alliances, and expansions to improve imaging quality, accessibility, and clinical efficiency. Market leaders are heavily investing in research and development to launch next-generation systems with AI-assisted image processing, reduced doses of radiation, and accelerated image acquisition times. These technologies are most beneficial in high-demand settings like emergency departments, outpatient clinics, and mobile imaging facilities. The industry leaders are also concentrating on widening their portfolios with wireless and portable digital X-ray units in response to the rising need for point-of-care diagnostics. Digital X-ray equipment may now be easily integrated with PACS platforms and electronic health records (EHRs) thanks to partnerships with software vendors and healthcare organizations. This improves diagnostic workflow and reduces turnaround time. Some of the players are also engaged in training and support programs to facilitate the shift of healthcare providers from analog to digital systems. To meet growing demand from outpatient and ambulatory care facilities, market leaders are also expanding their distribution networks within the US, facilitating faster deployment and support of devices. These aligned initiatives by industry leaders are pushing diagnostic capabilities forward while also enhancing their competitive strengths in the United States digital X-ray devices market outlook.

The report provides a comprehensive analysis of the competitive landscape in the United States digital X-ray devices market with detailed profiles of all major companies.

Latest News and Developments:

- July 2025: The DefiniumTM Pace Select ET, a cutting-edge floor-mounted digital X-ray system, is now commercially available, according to GE HealthCare. The novel device is intended to improve accessibility and affordability while delivering excellent image quality and maximizing efficiency in highly challenging settings.

- May 2025: The Government of the United States donated 48 digital X-ray devices, PPE, and thermal scanners to the Government of Uganda. The cutting-edge digital chest X-ray devices feature computer-aided detection capabilities to improve the accuracy of TB screening throughout Uganda, cut down on screening time and expenses, and serve hard-to-reach populations.

- May 2025: United Imaging declared that the US Food and Drug Administration (USFDA) had approved uAngio AVIVA, the company's first interventional digital X-ray device. The novel system is a bionic ceiling-mounted device that utilizes intelligent robotics, voice control, imaging, and vision to provide clinical professionals in the interventional suite with a vitally necessary helper.

- January 2025: OXOS Medical officially secured FDA 510(k) authorization for its MC2 Portable X-ray System. The MC2 is a digital, cordless, and portable system, allowing healthcare professionals to take X-rays more easily in both conventional and unconventional settings.

- April 2024: California X-ray Imaging Services, Inc. (CIS) was purchased by Shimadzu Medical Systems USA (SMS), a medical division of Shimadzu Precision Instruments, Inc., a subsidiary of Shimadzu Corporation Japan (Shimadzu), in order to increase the scope of its healthcare business in North America.

- March 2024: In order to facilitate access to reasonably priced and superior medical imaging data, the Advanced Research Projects Agency for Health (ARPA-H) and the Food and Drug Administration's (FDA) Center for Devices and Radiological Health (CDRH), both organizations under the US Department of Health and Human Services (HHS), announced a partnership.

United States Digital X-ray Devices Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | Orthopedic, Cancer, Dental, Cardiovascular, Others |

| Crop TypeTechnologies Covered | Computed Radiography, Direct Radiography |

| Portabilities Covered | Fixed Systems, Portable Systems |

| End Users Covered | Hospitals, Diagnostic Centers, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States digital X ray devices market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the United States digital X ray devices market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States digital X ray devices industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The digital x-ray devices market in the United States was valued at USD 938.60 Million in 2024.

The digital x-ray devices market in the United States is projected to exhibit a CAGR of 7.65% during 2025-2033, reaching a value of USD 1,961.65 Million by 2033.

The United States digital X-ray devices market is driven by demand rising for advanced diagnostic imaging along with chronic diseases prevailing increasingly among a population aging then growing. AI integrates, systems are portable, imaging becomes more accurate, and technology advances because of accessibility. The shift in direction toward a digital healthcare infrastructure does provide support for market growth. Governmental initiatives that are favorable additionally support that self-same growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)