United States Drug Screening Market Size, Share, Trends and Forecast by Product and Service, Sample Type, End User, and Region, 2025-2033

United States Drug Screening Market Size:

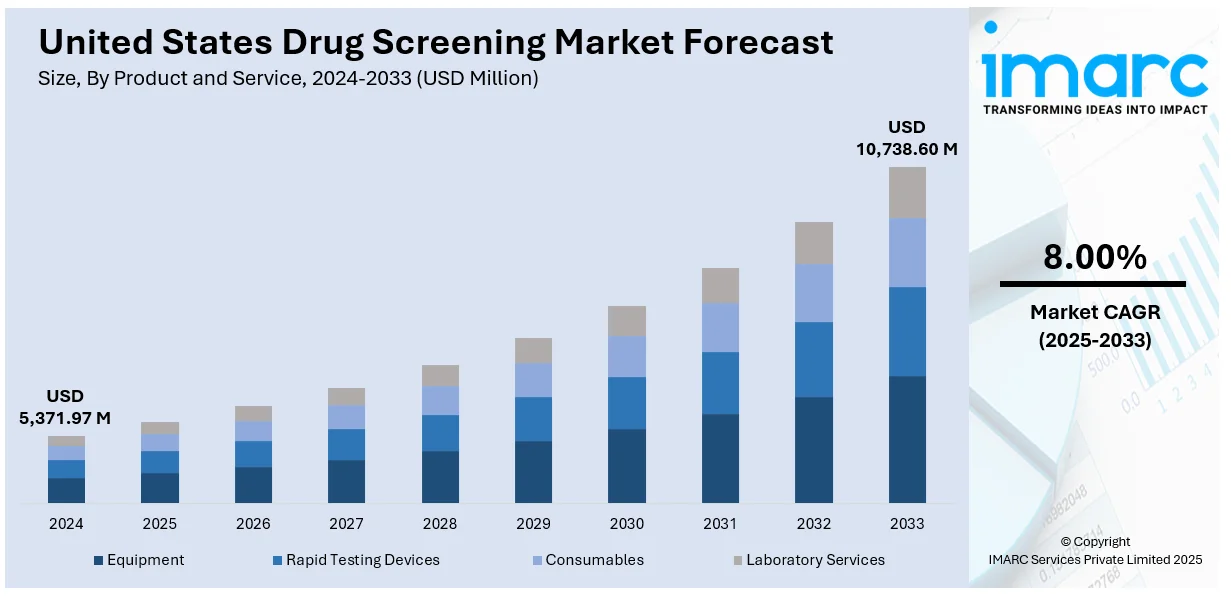

The United States drug screening market size was valued at USD 5,371.97 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 10,738.60 Million by 2033, exhibiting a CAGR of 8.00% from 2025-2033. The market is experiencing steady growth driven by increased workplace testing, rising substance abuse rates, advancements in testing technologies, the legalization of marijuana, heightened public safety concerns, expanding rehabilitation programs, and supportive government regulations.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 5,371.97 Million |

| Market Forecast in 2033 | USD 10,738.60 Million |

| Market Growth Rate 2025-2033 | 8.00% |

Workplace drug testing has become more common as employers prioritize creating safe and productive environments. Businesses recognize that substance use can result in workplace accidents, decreased efficiency, and increased healthcare expenses. In 2023, approximately 56% of U.S. employers conducted drug testing on their employees, encompassing both pre-employment screening and ongoing testing for current staff. This marks a notable increase from earlier years, demonstrating an enhanced focus on workplace safety. Many industries, like transportation, construction, and healthcare, require mandatory drug testing to comply with federal and state regulations. The Department of Transportation (DOT) requires drug and alcohol testing for safety-sensitive positions, encompassing millions of employees. Employers are also investing in random drug tests to discourage substance abuse among employees. As businesses continue expanding these programs, the demand for reliable and accurate drug screening solutions grows, boosting the United States drug screening market size.

The rising rates of substance abuse in the U.S. are a key factor fueling the demand for drug testing. According to the National Institute on Drug Abuse, more than 20 million individuals in the country are affected by substance use disorders. The opioid crisis and the rise in marijuana use due to legalization in many states further highlight the need for testing. Communities, healthcare providers, and legal authorities are using drug testing to address these issues. The ongoing battle against addiction has led to a surge in demand for testing solutions that can detect a variety of substances quickly and accurately.

United States Drug Screening Market Trends:

Legalization of Marijuana in Several States

While the legalization of marijuana has brought economic benefits, it has also raised concerns about its impact on safety, especially in workplaces and public spaces. In 2023, marijuana positivity rates in the general U.S. workforce increased by 10.3% from 2022, with states that have legalized recreational and medical marijuana showing even higher increases of 11.8% and 8.3%, respectively. Employers in these states are working through intricate regulations to maintain a balance between safeguarding employee rights and upholding safety standards. This has increased the demand for drug screening tools that can detect tetrahydrocannabinol (THC) levels accurately. Furthermore, law enforcement agencies are seeking advanced testing methods to address issues like driving under the influence of marijuana. The evolving legal landscape has pushed innovation in drug testing technologies, benefiting the United States drug screening market share.

Advancements in Drug Testing Technologies

Advancements in technology have improved the speed, accuracy, and convenience of drug testing. Innovations such as instant drug test kits and portable devices have made it easier for employers and law enforcement agencies to conduct on-the-spot testing. Laboratories now offer advanced testing methods, including hair follicle analysis and oral fluid testing, which can detect drug use over longer periods or provide immediate results. These innovations improve reliability while cutting down on the time and cost of testing, increasing accessibility across different uses.

Increased Focus on Public Safety

Public safety concerns are a significant driver of the drug screening market. High-profile incidents involving drug-impaired individuals have prompted stricter regulations and increased testing requirements. In the year 2023, post-accident overall positivity rates for the general U.S. workforce continued to rise, reaching 10.4%, with marijuana positivity in post-accident tests hitting a new peak of 7.5%. This has created the need for making drug testing mandatory among drivers involved in accidents or suspected of driving under the influence. Law enforcement agencies are also ramping up drug screening efforts to combat drug-related crimes. With public safety being a top priority, the demand for drug screening products and services continues to rise, encouraging the United States drug screening market growth.

United States Drug Screening Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States drug screening market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on product and service, sample type, and end user.

Analysis by Product and Service:

- Equipment

- Immunoassay Analyzers

- Chromatography Instruments

- Breath Analyzers

- Rapid Testing Devices

- Urine Testing Devices

- Oral Fluid Testing Devices

- Consumables

- Assay Kits

- Sample Collection Cups

- Calibrators and Controls

- Others

- Laboratory Services

As per the United States drug screening market outlook, rapid testing devices, such as portable urine, saliva, and breath analyzers, are gaining popularity, holding a 32.0% market share. This is due to their convenience and immediate results. These devices are commonly utilized for workplace drug testing, roadside checks, and emergency healthcare scenarios. Their portability, cost-effectiveness, and user-friendly design make them ideal for immediate testing needs. With increased emphasis on reducing drug-related workplace incidents and roadside accidents, this segment is witnessing substantial growth.

Analysis by Sample Type:

- Urine Samples

- Breath Samples

- Oral Fluid Samples

- Hair Samples

- Others

Among the various means of drug screening, urine testing remains one of the most important type, holding a market share of 77.8%. This is due it its non-invasive appeal. It is inexpensive and can detect a wide range of substances over a moderate detection period. Workplace drug testing uses it profoundly, along with healthcare settings and government-mandated programs. Thus, advances in technology in immunoassays and portable urine analyzers have further ramped up the segment's importance over the market.

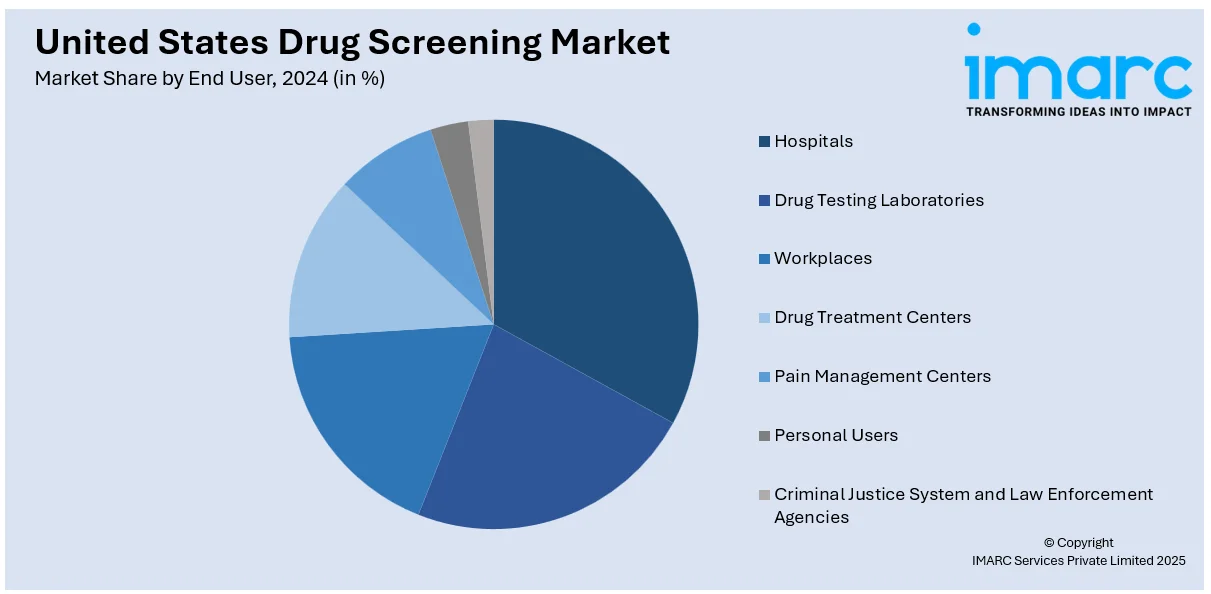

Analysis by End User:

- Hospitals

- Drug Testing Laboratories

- Workplaces

- Drug Treatment Centers

- Pain Management Centers

- Personal Users

- Criminal Justice System and Law Enforcement Agencies

As per the United States drug screening market analysis, workplaces represented the largest segments for drug screening in the United States, holding 33.6% market share. This is due to pre-employment screenings, random drug tests, and post-incident testing to ensure safety and productivity. In the sectors of transportation, construction, and healthcare, it is necessary that regular drug testing should be part of institutional regulations as provided by federal and state regulations. Employers are increasingly introducing various drug screening programs given the awareness that drugs pose workplace safety concerns.

Regional Analysis:

- Northeast

- Midwest

- South

- West

Drug screening in the South holds 32.2% of the total market share. This is primarily due to its huge population density than other territories. The drug screening market is influenced by the size of their workforce and substance use characterized by students. Given the large numbers of workers, work-related and pre-employment drug testing have been the key practice in the region, owing to the presence of booming industries in construction, logistics, and health care. The South also has many drug treatment centers run in response to the increasing rate of addictions.

Competitive Landscape:

Leading companies are continuously innovating and broadening their product lines to meet changing demands. They are developing advanced testing solutions, such as portable devices and rapid diagnostic kits, to enhance accuracy and convenience across various settings. Many are prioritizing the detection of synthetic drugs and substances like cannabinoids to stay relevant in the changing substance use landscape. Investments in research and development (R&D) are driving improvements in non-invasive testing methods, including oral fluid and hair sample analysis, which are gaining popularity due to their accuracy and ease of use. Companies are also expanding laboratory networks and enhancing operational efficiency to meet the increasing demand from workplaces, healthcare providers, and law enforcement. Collaborations with regulatory bodies and organizations to establish compliant testing protocols are another key strategy. By focusing on technological advancements and tailored services, these market leaders are positioning themselves to address the growing challenges of substance abuse and ensure safety and compliance across industries.

The report provides a comprehensive analysis of the competitive landscape in the United States drug screening market with detailed profiles of all major companies:

- Abbott

- Alfa Scientific Designs Inc.

- Bio-Rad Laboratories Inc.

- Drägerwerk AG & Co. KGaA

- Laboratory Corporation of America Holdings

- Lifeloc Technologies Inc.

- Omega Laboratories Inc.

- OraSure Technologies Inc.

- Psychemedics Corporation

- Quest Diagnostics Incorporated

Latest News and Developments:

- In January 2025, Northlane Capital Partners (NCP) declared that the company has made investments in United States Drug Testing Laboratories Inc. (USDTL), a forensic toxicology laboratory specializing in testing for alcohol and substance use.

- In April 2024, Accurate Background introduced a new mobile-first drug and health screening solution aimed at enhancing the candidate experience. This platform includes a mobile-friendly clinic scheduler and fulfillment system, leveraging an expanded network of testing locations. It allows clients and candidates to conveniently schedule drug, alcohol, and occupational health services. Additionally, the platform offers features for clients to generate drug or health service reports, extend test expiration dates, access registration documents, and reschedule tests as needed.

- In May 2024, eMed, which is a leading platform in proctored testing and at-home diagnostics, announced that it has entered into a collaboration with i3screen, an occupational health screening management company, to offer timely oral drug screening options for its employers.

- In January 2024, Sterling announced its acquisition of Vault Workforce Screening, a leading provider of drug testing and occupational health screening services. Vault specializes in serving employers in regulated industries such as healthcare, transportation, and others. The acquisition focuses on advancing drug and health screening solutions that effectively support the evolving business requirements.

United States Drug Screening Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product and Services Covered |

|

| Sample Types Covered | Urine Samples, Breath Samples, Oral Fluid Samples, Hair Samples, Others |

| End Users Covered | Hospitals, Drug Testing Laboratories, Workplaces, Drug Treatment Centers, Pain Management Centers, Personal Users, Criminal Justice System and Law Enforcement Agencies |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States drug screening market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the United States drug screening market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States drug screening industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The United States drug screening market was valued at USD 5,371.97 Million in 2024.

The growth of the U.S. drug screening market is driven by the rising workplace testing requirements, increasing substance abuse rates, advancements in testing technologies, the legalization of marijuana, heightened public safety concerns, expanding healthcare and rehabilitation programs, and supportive government regulations encouraging widespread adoption of screening solutions.

IMARC estimates the United States drug screening market to exhibit a CAGR of 8.00% during 2025-2033, reaching USD 10,738.60 Million by 2033.

Some of the major players in the United States drugs screening market include Abbott, Alfa Scientific Designs Inc., Bio-Rad Laboratories Inc., Drägerwerk AG & Co. KGaA, Laboratory Corporation of America Holdings, Lifeloc Technologies Inc., Omega Laboratories Inc., OraSure Technologies Inc., Psychemedics Corporation, Quest Diagnostics Incorporated, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)