United States e-KYC Market Size, Share, Trends and Forecast by Product, Deployment Mode, End User, and Region, 2025-2033

United States e-KYC Market Overview:

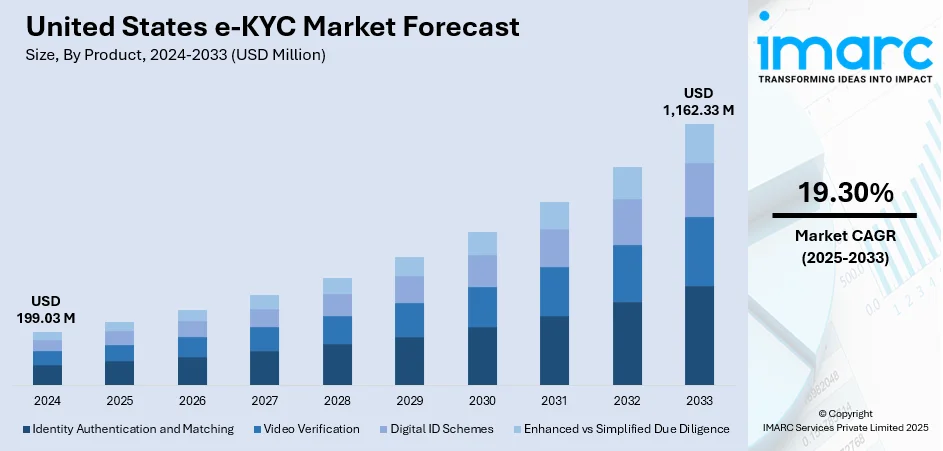

The United States e-KYC market size reached USD 199.03 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,162.33 Million by 2033, exhibiting a growth rate (CAGR) of 19.30% during 2025-2033. At present, institutions are repeatedly reacting to changing regulatory requirements and anti-money laundering (AML) mandates. This, along with the digitalization of banks and financial institutions, is contributing significantly to the market growth. Moreover, the heightened focus on strengthening security due to the increasing risk of identity fraud and cybercrime is expanding the United States e-KYC market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 199.03 Million |

| Market Forecast in 2033 | USD 1,162.33 Million |

| Market Growth Rate 2025-2033 | 19.30% |

United States e-KYC Market Trends:

Meeting Anti-Money Laundering (AML) and Regulatory Compliance Requirements

The United States electronic-know-your-customer (e-KYC) sector is experiencing robust growth as institutions are repeatedly reacting to changing regulatory requirements and AML mandates. Financial institutions are embracing electronic KYC systems in order to comply with legislation like the Bank Secrecy Act and the USA PATRIOT Act. Regulatory authorities are issuing new guidelines on a regular basis that mandate financial institutions to have continuous identity verification, track suspicious activity reporting, and conduct customer due diligence. Since the regulations are getting more advanced, companies are depending on e-KYC technologies to perform identity verification automatically, eliminate human mistake, and produce audit-compliant records. Government authorities are also encouraging openness in beneficial ownership, and this is encouraging firms to focus on safe and digital onboarding processes. With the adoption of e-KYC platforms, firms are becoming compliant and minimizing operational inefficiencies. In 2025, The Office of the Comptroller of the Currency (OCC), the Federal Deposit Insurance Corporation (FDIC), and the National Credit Union Administration (NCUA) (together, the agencies), with the approval of the Financial Crimes Enforcement Network (FinCEN), issued an order providing an exemption from a stipulation of the Customer Identification Program (CIP) rule that enforces section 326 of the USA PATRIOT Act, 31 USC 5318(l). The necessity pertains to a bank acquiring taxpayer identification number (TIN) details from its clients.

To get more information on this market, Request Sample

Driving Digital Transformation Across Financial Services

The digitalization of banks and financial institutions is contributing significantly to the United States e-KYC market growth. Banks, credit unions, and fintech companies are increasingly adopting digital onboarding platforms to address the need for quicker, frictionless customer experiences. Such paper-based KYC processes are facing extinction as businesses are making a transition towards mobile-first and cloud-based technologies. By using e-KYC solutions, businesses are facilitating real-time identity verification, combining biometric authentications, and linking to government databases to achieve instant validation. These improvements are shortening onboarding time, increasing customer satisfaction, and enhancing scalability. At the same time, digital-only banking platforms like neobanks and lending applications are relying solely on e-KYC systems to automate customer acquisition. As companies are streamlining internal processes and minimizing manual interventions, the adoption of electronic verification tools is steadily increasing. In 2025, PEXX launched a cross-border USD neobank in more than 50 countries. The launch introduces four integrated products that allow users to Bank Differently, Pay Differently, Send Differently, and Earn Differently, thereby eliminating traditional banking delays, paperwork, and hidden costs with instant settlement and clear pricing.

Mitigating the Rising Risk of Identity Fraud and Cybercrime

Firms in the United States are promptly deploying e-KYC solutions to counter the increasing risk of identity fraud and cybercrime. As more sophisticated fraudulent attempts emerge, companies are constantly upgrading their identity verification procedures to defend customers and secure transactions. Financial institutions themselves are under mounting pressure to avoid synthetic identities, account takeovers, and document forgeries. Through artificial intelligence (AI)-powered solutions, biometric authentication, and real-time data analysis, companies are identifying suspicious activity and reducing the risk of fraud during onboarding. Cybercrime gangs are continually taking advantage of legacy KYC systems, so organizations are taking more advanced, digital-first approaches. e-KYC platforms are also offering multi-layered security, which is allowing companies to verify users with greater precision and faster speed. This is also increasing user confidence, as clients are demanding more secure online services. The occurrence of cyber threats is also driving the need for strong e-KYC infrastructure, as companies are spending relentlessly on sophisticated solutions to protect operations and maintain regulatory integrity. In 2025, Liquid Inc., part of the ELEMENTS Group, shared that StoneX Group Inc., a NASDAQ-listed company in the United States, has chosen Liquid's online identity verification solution, LIQUID eKYC. The Japanese subsidiary, StoneX Securities Co., Ltd., will implement the solution.

United States e-KYC Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product, deployment mode, and end user.

Product Insights:

- Identity Authentication and Matching

- Video Verification

- Digital ID Schemes

- Enhanced vs Simplified Due Diligence

The report has provided a detailed breakup and analysis of the market based on the product. This includes identity authentication and matching, video verification, digital id schemes, and enhanced vs simplified due diligence.

Deployment Mode Insights:

- Cloud-based

- On-premises

A detailed breakup and analysis of the market based on the deployment mode have also been provided in the report. This includes cloud-based and on-premises.

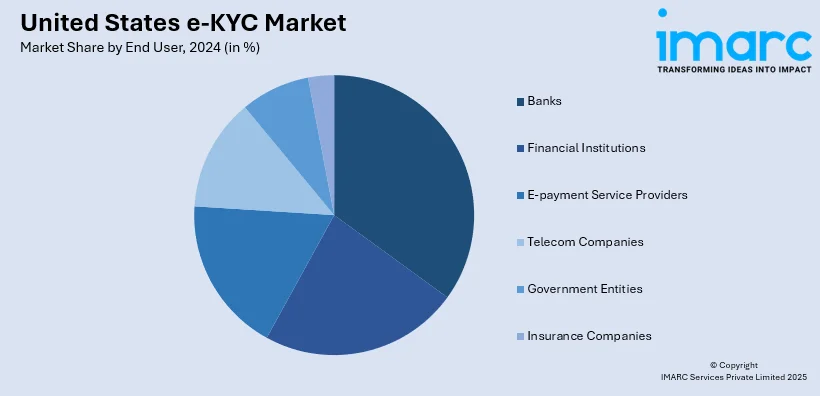

End User Insights:

- Banks

- Financial Institutions

- E-payment Service Providers

- Telecom Companies

- Government Entities

- Insurance Companies

The report has provided a detailed breakup and analysis of the market based on the end user. This includes banks, financial institutions, e-payment service providers, telecom companies, government entities, and insurance companies.

Regional Insights:

- Northeast

- Midwest

- South

- West

The report has also provided a comprehensive analysis of all the major regional markets, which include Northeast, Midwest, South, and West.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

United States e-KYC Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Identity Authentication and Matching, Video Verification, Digital ID Schemes, Enhanced vs Simplified Due Diligence |

| Deployment Modes Covered | Cloud-based, On-Premises |

| End Users Covered | Banks, Financial Institutions, E-Payment Service Providers, Telecom Companies, Government Entities, Insurance Companies |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the United States e-KYC market performed so far and how will it perform in the coming years?

- What is the breakup of the United States e-KYC market on the basis of product?

- What is the breakup of the United States e-KYC market on the basis of deployment mode?

- What is the breakup of the United States e-KYC market on the basis of end user?

- What is the breakup of the United States e-KYC market on the basis of region?

- What are the various stages in the value chain of the United States e-KYC market?

- What are the key driving factors and challenges in the United States e-KYC market?

- What is the structure of the United States e-KYC market and who are the key players?

- What is the degree of competition in the United States e-KYC market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States e-KYC market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the United States e-KYC market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States e-KYC industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)