U.S. Endoscopy Devices Market Size, Share, Trends and Forecast by Type, Application, End Use, and Region, 2025-2033

U.S. Endoscopy Devices Market Size and Share:

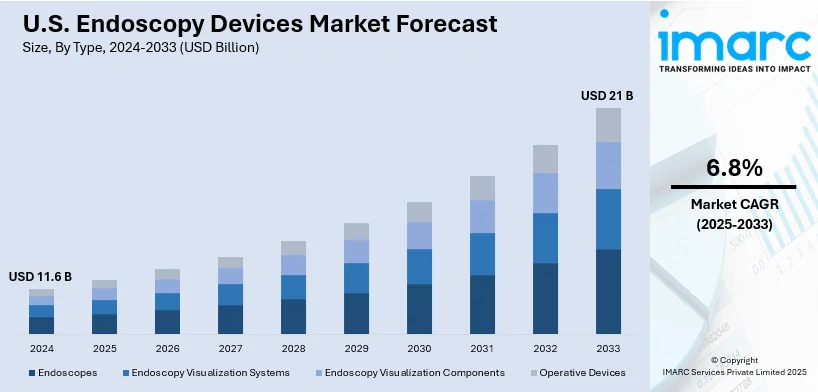

The U.S. endoscopy devices market size was valued at USD 11.6 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 21 Billion by 2033, exhibiting a CAGR of 6.8% from 2025-2033. The market is experiencing robust growth driven by rapid advancements in imaging technologies, increasing prevalence of chronic diseases, rising adoption of minimally invasive procedures, expanding outpatient care settings, and heightened demand for disposable endoscopes to ensure patient safety and infection control.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 11.6 Billion |

|

Market Forecast in 2033

|

USD 21 Billion |

| Market Growth Rate (2025-2033) | 6.8% |

The United States market is significantly expanding due to the increasing prevalence of chronic diseases, such as gastrointestinal disorders, colorectal cancer, and neurological conditions, which necessitate minimally invasive diagnostic and therapeutic procedures. Continual technological advancements in endoscopic equipment, including high-definition imaging, 3D visualization, and AI-assisted diagnostics, are enhancing procedural accuracy, further driving adoption among healthcare providers. For instance, in January 2023, UC Davis Health inaugurated a state-of-the-art endoscopy suite to enhance patient care and expand diagnostic capabilities. Additionally, the growing geriatric population, which is more susceptible to these conditions, is further fueling the demand for advanced endoscopy solutions. The integration of advanced imaging technology in endoscopy facilities is driving improved detection and treatment of gastrointestinal conditions in the United States as enhanced visualization capabilities not only increase diagnostic accuracy but also enables more effective therapeutic interventions, strengthening the market's growth course.

The market is further driven by the increasing shift from inpatient care and hospital outpatient departments to ASCs where endoscopic procedures are frequently conducted. Furthermore, the advancement in healthcare facility is growing demand for invasive surgical operations that have less recovery period and patient discomfort, which in turn is accelerating the market growth. In addition, the strategic partnerships between the leading industry players are another factor contributing to the market development in the endoscopy devices market. KARL STORZ United States and FUJIFILM Healthcare Americas Corporation have announced a strategic collaboration to integrate KARL STORZ's operating room solutions with Fujifilm's gastrointestinal endoscopes. This partnership aims to modernize gastrointestinal suites, improving procedural efficiency and patient care. Improvements in healthcare system infrastructure and efficiency through the adoption of value-based care delivery model is further providing an impetus to the market.

U.S. Endoscopy Devices Market Trends:

Integration of AI in Endoscopy Devices

The adoption of artificial intelligence (AI) in endoscopic technologies is augmenting the market growth in United States. On 3rd January 2024, The FDA approved ANX Robotica’s CapsuleX system, an AI-powered endoscopy tool that is designed to enhance small bowel visualization, the device aims to improve diagnostic accuracy and efficiency in gastrointestinal care. Moreover, AI-powered endoscopy tools improve visualization, enabling early detection of gastrointestinal conditions and reducing diagnostic errors. These innovations align with the increasing demand for minimally invasive procedures, driven by patient preferences and clinical benefits. Furthermore, the integration of AI fosters innovation in device development, attracting investment and expanding product portfolios. As healthcare providers prioritize precision and efficiency, the adoption of AI-enabled endoscopy solutions is accelerating, propelling the growth of the U.S. endoscopy devices market.

Increasing Prevalence of Obesity And Bariatric Endoscopy

The rising obesity rates in the United States are propelling demand for endoscopic devices used in bariatric procedures. Endoscopic bariatric therapies, including intragastric balloon placements and endoscopic sleeve gastroplasty, are gaining traction as minimally invasive options for weight management. These procedures are less risky compared to traditional surgical interventions and align with the growing preference for non-surgical weight loss solutions. Healthcare providers are increasingly incorporating endoscopic bariatric techniques due to their shorter recovery times and favorable outcomes. Additionally, escalating awareness campaigns and rising insurance coverage for obesity-related treatments are further encouraging the adoption of these procedures, thereby driving the endoscopy devices market.

Growing Demand For Disposable Endoscopes

The rising focus on infection prevention in healthcare is accelerating the demand for disposable endoscopes. Regulatory bodies are actively endorsing disposable options, reinforcing their adoption across hospitals and clinics. Advancements in production technologies now enable cost-efficient manufacturing without sacrificing quality, making these devices more accessible. Their convenience, coupled with reduced sterilization needs, aligns with the increasing emphasis on operational efficiency in medical facilities. On 27th March 2024, NTT Corporation and Olympus Corporation have initiated a joint demonstration of a cloud-based endoscopy system. This system leverages NTT's high-speed, low-latency IOWN APN technology and Olympus' advanced endoscopic expertise to enable real-time image processing on the cloud, aiming to enhance endoscopic performance and maintainability. As healthcare providers prioritize infection control and patient safety, disposable endoscopes are emerging as a preferred solution, driving their integration into routine practices, and fueling growth in the U.S. endoscopy devices market.

U.S. Endoscopy Devices Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the U.S. endoscopy devices market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on type, application, and end use.

Analysis by Type:

- Endoscopes

- Endoscopy Visualization Systems

- Endoscopy Visualization Components

- Operative Devices

Endoscopes play a significant role in the United States market as they facilitate minimally invasive diagnosis and therapy. Modern endoscopes used as diagnostic tools help to visualize tangled organs and tissues inside human bodies and perform effective interventions. They vary in size and accuracy and are considered very useful in the contemporary health care delivery systems.

Endoscopy visualization systems play a crucial role of improving the quality of diagnosis and treatment processes. These are fixed surgical table systems that have HD cameras and imaging systems, providing clear and real time images to the clinicians in the operating theatre. By improving visibility and reducing procedural errors, visualization systems are integral to specialties, including oncology and surgery. Their role in ensuring better patient outcomes underscores their growing importance in the market.

Endoscopy visualization components, including light sources, processors, and monitors, form the backbone of effective endoscopic procedures. They provide high quality of the image both during the capturing and processing and at the display level to aid in diagnostics and interventions. Modern developments such as the use of LED lighting system and imaging advancement has enriched the capability of these parts.

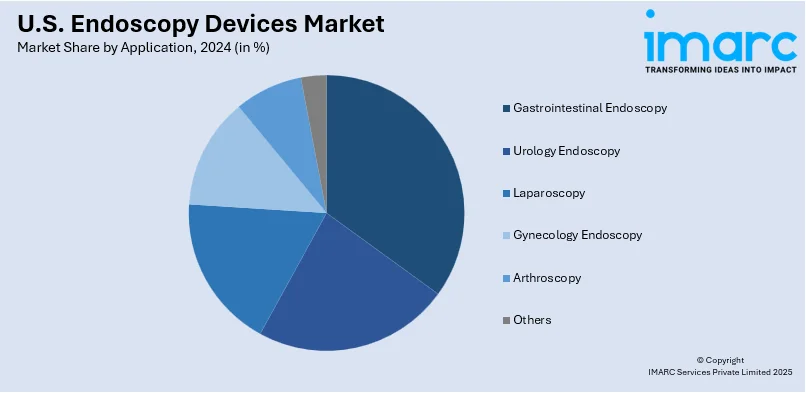

Analysis by Application:

- Gastrointestinal Endoscopy

- Urology Endoscopy

- Laparoscopy

- Gynecology Endoscopy

- Arthroscopy

- Others

Gastrointestinal endoscopy plays a crucial role in the U.S. endoscopy devices market, addressing the growing need for effective diagnosis and treatment of digestive disorders. Procedures such as colonoscopy and upper GI endoscopy are pivotal in detecting conditions like colorectal cancer and ulcers. The increasing prevalence of gastrointestinal diseases and advancements in endoscopic imaging technology highlight the importance of this segment in improving patient outcomes and preventive care.

Urology endoscopy is integral to diagnosing and treating conditions affecting the urinary tract and reproductive organs. Flexible and rigid endoscopes used in procedures like cystoscopy and ureteroscopy facilitate precise examination and intervention for issues such as kidney stones, bladder tumors, and urinary obstructions. The rising incidence of urological disorders and the demand for minimally invasive treatments underscore the significance of this segment in the U.S. endoscopy devices market.

Laparoscopy represents a vital segment of the endoscopy devices market, offering minimally invasive solutions for abdominal and pelvic surgeries. Widely employed in procedures like cholecystectomy and gynecological surgeries, laparoscopes enable reduced recovery times and lower surgical risks. Ongoing innovations, including 3D imaging and robotics, have further enhanced laparoscopic applications, driving its adoption. Its role in surgical precision and patient comfort cements its importance in modern medical practice.

Analysis by End Use:

- Hospitals and Clinics

- Ambulatory Surgical Centers

- Others

Hospitals and clinics play a vital role in endoscopy devices market as they are key facilities where sophisticated diagnostic and treatment processes are performed. Such hospital specializations operate high-tech endoscopic equipment to address any disease, including gastrointestinal diseases and cancer. Due to their function in delivering specialized endoscopy care, along with rising patient traffic, they are classified as a significant force in the overall development of the endoscopy devices market.

ASCs are seen as an increasingly important industry in the U.S. owing to their affordable and patient-friendly operations. They are focused on ambulatory surgery as inpatient and outpatient, which usually include endoscopy diagnostics and interventions, thus they provide a high level of comfort. The increasing adoption of ASCs increases as they afford consumers better care at shorter hospitalization, hence, a major constituent of the market growth.

Regional Analysis:

- Northeast

- Midwest

- South

- West

The Northeast region plays a prominent role in the U.S. endoscopy devices market due to its well-established healthcare infrastructure and concentration of academic medical centers. The presence of top-tier hospitals and research institutions fosters the adoption of advanced endoscopic technologies. Additionally, the region's aging population drives demand for endoscopy devices in managing chronic conditions, solidifying its importance in the national market landscape.

The Midwest region represents a significant share of the U.S. endoscopy devices market, driven by its focus on expanding access to quality healthcare in urban and rural areas. The region benefits from a robust network of teaching hospitals and growing investments in healthcare infrastructure. Rising awareness of preventive care and early diagnosis through endoscopy procedures supports the adoption of advanced devices across the Midwest.

The South is a key contributor to the U.S. endoscopy devices market due to its large and diverse population, coupled with increasing healthcare investments. High rates of obesity and gastrointestinal conditions in the region drive demand for endoscopic procedures. The growing presence of outpatient surgical centers and healthcare providers adopting minimally invasive techniques enhances the importance of the South in advancing the endoscopy market.

The West region leads in innovation and early adoption of advanced endoscopy devices, supported by its strong technology-driven healthcare ecosystem. Home to several medical device manufacturers and research hubs, the region fosters continuous advancements in endoscopic technologies. Rising demand for outpatient procedures and the region’s focus on preventive healthcare contribute to its substantial role in shaping the U.S. endoscopy devices market.

Competitive Landscape:

The market in the United States is highly competitive, with major key players engaging in various research and development (R&D) activities to improve the market presence and foster innovation. These strategies include continual advancements and emerging innovations in high-definition imaging systems and the minimally invasive surgical systems. Also, to meet the increasing endoscopic procedures’ demand and sell different services, companies are increasing their product offerings targeting various specialties. Partnerships with research organizations and healthcare organizations are also currently being developed for clinical study and real-world experience to promote new technologies. In addition, investments in training programs for healthcare professionals are being made to ensure proficient use of advanced endoscopic equipment, thereby enhancing procedural efficiency and safety.

The report provides a comprehensive analysis of the competitive landscape in the U.S. endoscopy devices market with detailed profiles of all major companies.

Latest News and Developments:

-

On 5th December 2024, Odin Medical Ltd., an Olympus corporation company, received U.S. Food and Drug Administration (FDA) 510(k) clearance for the CADDIE computer-aided detection (CADe) device, the first cloud-based Artificial Intelligence (AI) technology designed to assist gastroenterologists in detecting suspected colorectal polyps during colonoscopy procedures.

U.S. Endoscopy Devices Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Endoscopes, Endoscopy Visualization Systems, Endoscopy Visualization Components, Operative Devices |

| Applications Covered | Gastrointestinal Endoscopy, Urology Endoscopy, Laparoscopy, Gynecology Endoscopy, Arthroscopy, Others |

| End Uses Covered | Hospitals and Clinics, Ambulatory Surgical Centers, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the U.S. endoscopy devices market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the U.S. endoscopy devices market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the U.S. endoscopy devices industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Endoscopy devices are medical instruments designed for minimally invasive procedures, allowing physicians to view and operate on internal organs through small incisions or natural body openings. These devices are essential for diagnosing and treating various conditions across specialties such as gastroenterology, pulmonology, and urology.

The U.S. endoscopy devices market was valued at approximately USD 11.6 Billion in 2024.

IMARC Group estimates the U.S. endoscopy devices market to exhibit a CAGR of 6.8% during 2025-2033.

The market is driven by the rising incidence of gastrointestinal diseases, increasing preference for minimally invasive procedures, continual technological advancements in endoscopic equipment, and the growing geriatric population susceptible to chronic conditions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)