United States Enteral Feeding Devices Market Size, Share, Trends and Forecast by Product Type, Age Group, Application, End User, and Region, 2026-2034

United States Enteral Feeding Devices Market Summary:

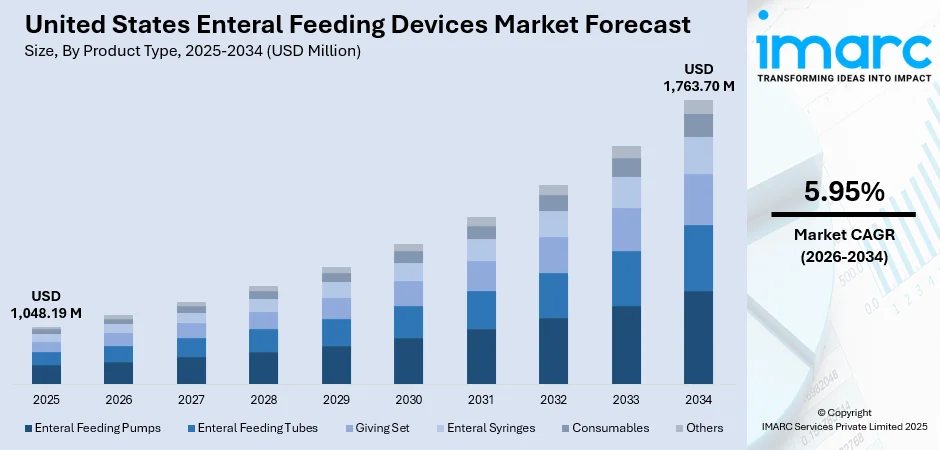

The United States enteral feeding devices market size reached USD 1,048.19 Million in 2025 and is projected to reach USD 1,763.70 Million by 2034, growing at a compound annual growth rate of 5.95% from 2026-2034.

The United States enteral feeding devices market is experiencing robust expansion driven by the country's aging demographic and the corresponding rise in chronic conditions requiring nutritional intervention. The prevalence of neurological disorders, gastrointestinal diseases, and oncological conditions has intensified demand for alternative nutrition delivery methods. Healthcare providers are increasingly adopting advanced enteral feeding solutions that ensure precise nutrient delivery while minimizing patient discomfort. The shift toward value-based care models and home healthcare settings continues to reshape the United States enteral feeding devices market share.

Key Takeaways and Insights:

-

By Product Type: Enteral feeding pumps dominate the market with a share of 28% in 2025, attributed to their superior precision in controlling feeding rates and volumes, advanced programmable features, and alarm systems that enhance patient safety across clinical and home care environments.

-

By Age Group: Adults lead the market with a share of 82% in 2025, driven by the overwhelming burden of age-related neurological, oncologic, and gastrointestinal conditions that impair oral food intake among the aging population.

-

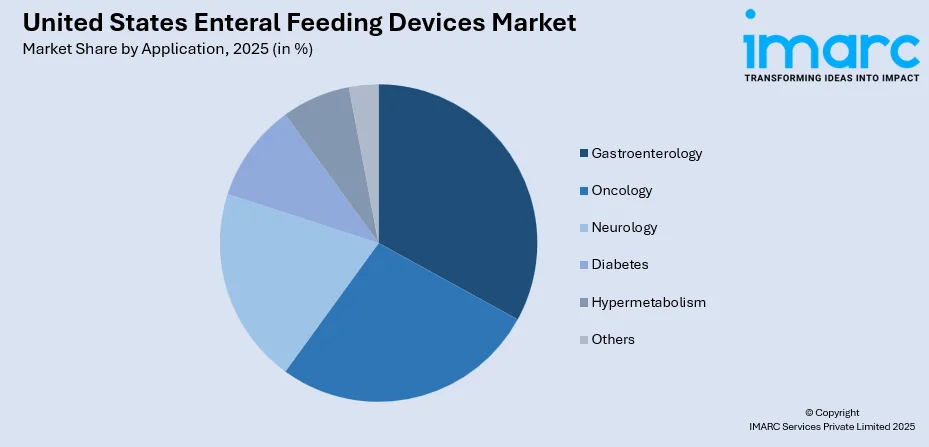

By Application: Gastroenterology represents the largest segment with a market share of 33% in 2025, owing to the high prevalence of gastrointestinal disorders requiring nutritional support and the critical need for effective nutrient delivery in this therapeutic area.

-

By End User: Hospitals account for the largest revenue share of 64% in 2025, supported by growing awareness of hospital-associated malnutrition, increasing ICU admissions, and the necessity for comprehensive nutritional management in acute care settings.

-

Key Players: The United States enteral feeding devices market exhibits moderate to high competitive intensity, with major multinational medical device corporations competing through product innovation, strategic acquisitions, and expanded service offerings. Leading manufacturers focus on developing technologically advanced, user-friendly devices that transition seamlessly from hospital to home care settings.

To get more information on this market Request Sample

The United States represents the largest market for enteral feeding devices globally, benefiting from an advanced healthcare infrastructure and a strong emphasis on clinical nutrition protocols. The country's well-established reimbursement frameworks, including Medicare and Medicaid coverage for enteral nutrition therapy, support widespread adoption of these devices. Healthcare facilities across the nation are implementing standardized nutritional assessment protocols that identify at-risk patients early, facilitating timely intervention with enteral feeding solutions. For instance, in September 2023, Cardinal Health launched the Kangaroo OMNI Enteral Feeding Pump in the United States, representing the first attitude-independent enteral feeding system capable of delivering thick, homogenized, and blended formulas from hospital to home settings. The integration of digital health platforms with enteral feeding systems enables remote patient monitoring and predictive analytics, aligning with the broader transition toward value-based care models. Research institutions and academic medical centers continue to drive innovation in device design and feeding protocols, establishing evidence-based guidelines that influence clinical practice nationwide.

United States Enteral Feeding Devices Market Trends:

Accelerating Adoption of Home-Based Enteral Nutrition

The healthcare landscape is witnessing a pronounced shift toward home-based enteral feeding, driven by cost-efficiency considerations and patient preference for receiving care in familiar environments. This transition is supported by the development of portable, user-friendly devices that caregivers and patients can operate independently. Healthcare providers are implementing comprehensive education programs that train users to manage enteral feeding devices properly, addressing common challenges such as tube clogging and formula administration. In May 2024, Rockfield Medical Devices received FDA over-the-counter clearance for its Mobility+ Enteral Feeding System, a portable elastomeric device designed specifically for home use that eliminates the need for prescription access and enables direct-to-consumer distribution channels.

Integration of Smart Technology and Digital Connectivity

Modern enteral feeding devices are increasingly integrating advanced smart technologies to improve patient monitoring and care management. The United States patient monitoring market size was valued at USD 18.34 Billion in 2024. Looking forward, the market is expected to reach USD 36.96 Billion by 2033, exhibiting a CAGR of 8.10% from 2025-2033. These include built-in sensors that track feeding rates and volumes in real time, programmable settings for personalized nutrition delivery, and alert systems that notify caregivers of potential issues. The use of standardized connectors like ENFit enhances patient safety by preventing tube misconnection, while digital interfaces enable precise, tailored feeding for patients requiring specialized nutritional support.

Growing Preference for Blenderized Tube Feeding Formulations

A notable trend reshaping the enteral nutrition landscape is the increasing preference for blenderized tube feedings, where whole foods are processed to meet patients' nutritional requirements. This approach aligns with broader consumer demand for natural, minimally processed nutritional solutions and is perceived as more closely resembling normal eating patterns. For instance, in November 2023, a US-based plant-based nutrition and healthcare company Kate Farms has introduced a new line of whole food blended meals, set to enter the market in early 2024. The Kate Farms Pediatric Blended Meals are promoted as the “first-of-its-kind” whole food formulas, designed to replicate home-style meals and featuring resealable packaging compatible with standard tube feeding devices. Healthcare providers and caregivers are embracing this methodology as it offers flexibility in customizing nutrient profiles based on individual patient needs. Device manufacturers are responding by developing pumps capable of delivering thicker formulations, expanding the range of nutritional options available to enterally fed patients while maintaining the precision and safety standards required for clinical applications.

Market Outlook 2026-2034:

The United States enteral feeding devices market demonstrates strong growth potential as demographic trends, technological innovations, and evolving care delivery models converge to expand utilization. The continued aging of the population will drive sustained demand for nutritional support solutions, while advancements in device design will improve patient outcomes and caregiver experience. The expansion of ambulatory care services and home healthcare infrastructure presents significant opportunities for market penetration. The market generated a revenue of USD 1,048.19 Million in 2025 and is projected to reach a revenue of USD 1,763.70 Million by 2034, growing at a compound annual growth rate of 5.95% from 2026-2034.

United States Enteral Feeding Devices Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product Type | Enteral Feeding Pumps | 28% |

| Age Group | Adults | 82% |

| Application | Gastroenterology | 33% |

| End User | Hospitals | 64% |

Product Type Insights:

- Enteral Feeding Pumps

- Enteral Feeding Tubes

- Giving Set

- Enteral Syringes

- Consumables

- Others

The enteral feeding pumps segment dominates with a market share of 28% of the total United States enteral feeding devices market in 2025.

Enteral feeding pumps have established market leadership through their superior precision and automation capabilities in nutrient delivery. These devices offer exact control over feeding rates and volumes, which proves critical for managing complex nutritional needs and ensuring accurate dosing across diverse patient populations. Advanced programmable features enable healthcare providers to customize feeding schedules, while integrated alarm systems enhance safety by alerting caregivers to potential issues such as occlusions or empty formula containers. The versatility of modern pumps accommodates various feeding regimens including continuous, intermittent, and bolus delivery modes.

The transition toward home-based care has significantly amplified demand for portable, user-friendly enteral feeding pumps that patients and caregivers can operate independently. Manufacturers have responded by developing compact devices featuring intuitive interfaces, extended battery life, and connectivity options that enable remote monitoring by healthcare professionals. The introduction of attitude-independent pump systems capable of delivering thicker formulations has expanded treatment options for patients requiring specialized nutritional support. These technological advancements distinguish enteral feeding pumps from other product categories that offer more limited functionality or precision in nutrient delivery.

Age Group Insights:

- Adults

- Pediatrics

The adults segment leads the market with a share of 82% of the total United States enteral feeding devices market in 2025.

The overwhelming burden of age-related neurological, oncologic, and gastrointestinal conditions drives the substantial dominance of the adult segment in the enteral feeding devices market. Chronic conditions including stroke, Parkinson's disease, head and neck cancers, and severe dysphagia predominantly affect older adults, frequently impairing their ability to consume adequate nutrition orally. Research indicates that a significant percentage of individuals aged seventy and older experience some form of dysphagia or malnutrition, creating sustained demand for enteral nutrition solutions.

The aging demographic profile of the United States population amplifies this demand trajectory as the country experiences continued growth in its elderly population. Skilled nursing facilities represent a major utilization setting for adult enteral feeding, with a substantial proportion of long-term enteral nutrition patients residing in these care environments. For adults with degenerative conditions or terminal illnesses, enteral feeding devices provide a critical means of maintaining nutrition over extended periods, particularly relevant in palliative care settings where the focus centers on quality of life and preserving patient strength.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Oncology

- Gastroenterology

- Neurology

- Diabetes

- Hypermetabolism

- Others

The gastroenterology segment holds the largest share with 33% of the total United States enteral feeding devices market in 2025.

Gastroenterology applications command the largest market share due to the foundational role of enteral feeding devices in managing conditions that directly impair digestive function. Patients with severe gastrointestinal disorders, inflammatory bowel disease, short bowel syndrome, and other digestive conditions frequently require nutritional support delivered directly to functional portions of their digestive tract. The high prevalence of these conditions across the United States population establishes a consistent demand base for enteral feeding solutions in gastroenterological care.

The versatility of enteral access routes, including nasogastric, gastrostomy, and jejunostomy tubes, allows clinicians to customize nutritional delivery based on individual patient anatomy and disease presentation. Percutaneous endoscopic gastrostomy procedures represent one of the most common enteral access methods, with substantial volumes performed annually across the country. Healthcare providers increasingly recognize the importance of early nutritional intervention in gastroenterological conditions, driving adoption of enteral feeding protocols that preserve gut integrity and support immune function during recovery.

End User Insights:

- Hospitals

- Ambulatory Surgery Centers

- Others

The hospitals segment exhibits clear dominance with a 64% share of the total United States enteral feeding devices market in 2025.

Hospitals maintain their position as the primary utilization setting for enteral feeding devices, driven by the concentration of critically ill patients requiring immediate and sustained nutritional support. Intensive care units, surgical wards, and specialized nutrition support services rely heavily on enteral feeding systems to maintain metabolic stability in patients unable to meet nutritional needs orally. Growing awareness among healthcare professionals regarding hospital-associated malnutrition has prompted the implementation of systematic screening protocols that identify nutritional risk early in the admission process.

The hospital environment provides essential infrastructure, including skilled nursing staff, specialized equipment for tube placement, and comprehensive monitoring capabilities that support safe enteral nutrition delivery. Rising ICU admissions and the increasing complexity of hospitalized patient populations contribute to sustained demand for advanced enteral feeding technologies within acute care settings. Integration with electronic health records enables documentation of nutritional intake and outcomes tracking, while regulatory requirements ensure adherence to safety standards and quality benchmarks in enteral feeding practice.

Regional Insights:

- Northeast

- Midwest

- South

- West

The Northeast’s market is driven by a high concentration of hospitals, specialized clinics, and academic medical centers, which demand advanced enteral feeding devices with smart monitoring features. Aging populations in states like New York and Massachusetts increase long-term care requirements, while robust research activity promotes the adoption of digital interfaces, ENFit connectors, and programmable feeding pumps. Rising awareness of patient safety and precision nutrition further fuels regional demand.

In the Midwest, demand is propelled by a combination of community hospitals, long-term care facilities, and growing home healthcare adoption. The prevalence of chronic illnesses and gastrointestinal disorders drives the need for reliable, easy-to-use enteral feeding devices. Manufacturers focus on portable pumps, blenderized feeding compatibility, and caregiver-friendly designs to serve rural populations while maintaining accuracy, safety, and flexibility in patient nutrition management.

The Southern market benefits from expanding healthcare infrastructure, rising chronic disease incidence, and an increasing geriatric population. Hospitals and home-care providers are adopting programmable feeding pumps, smart sensors, and ENFit-compatible devices to enhance patient safety and streamline care coordination. Regional adoption is further supported by investments in rehabilitation centers, pediatric care units, and community clinics, where demand for customized nutrition delivery and blenderized feeding solutions continues to grow.

In the Western US, the market is driven by innovation hubs, large healthcare systems, and high-tech medical device adoption. States like California and Washington see early uptake of smart enteral feeding devices with integrated monitoring, real-time data tracking, and digital interfaces. Strong focus on home healthcare, outpatient services, and wellness-oriented care models encourages devices that support precision nutrition, safety, and ease of use across hospitals, long-term care, and home settings.

Market Dynamics:

Growth Drivers:

Why is the United States Enteral Feeding Devices Market Growing?

Rising Geriatric Population and Age-Related Chronic Conditions

The aging demographic profile of the United States represents a fundamental driver of enteral feeding devices market expansion, as older adults demonstrate substantially higher rates of conditions requiring nutritional intervention. According to the industry report, the population of Americans aged 65 and above is expected to grow from 58 million in 2022 to 82 million by 2050, representing a 42% increase. During the same period, the proportion of this age group within the total population is projected to rise from 17% to 23%. Age-related diseases including stroke, Parkinson's disease, Alzheimer's disease, and various cancers frequently impair swallowing function or gastrointestinal absorption, necessitating alternative nutrition delivery methods. The prevalence of dysphagia increases significantly among individuals over sixty-five, creating a growing patient population that benefits from enteral feeding solutions. Healthcare systems are implementing comprehensive nutritional screening protocols in geriatric care settings that facilitate early identification of at-risk patients. The expansion of skilled nursing facilities and long-term care communities provides additional settings where enteral feeding devices support sustained nutritional management for elderly patients with chronic conditions.

Increasing Prevalence of Cancer and Neurological Disorders

The rising incidence of cancer cases across the United States significantly contributes to enteral feeding devices market growth, particularly for head and neck cancers, esophageal cancers, and gastrointestinal malignancies that directly affect nutritional intake. In 2025, approximately 2,041,910 individuals in the United States are expected to receive a cancer diagnosis, while around 618,120 people are projected to succumb to the disease. Cancer treatments including surgery, radiation therapy, and chemotherapy frequently cause severe side effects that impair patients' ability to consume adequate nutrition orally. Enteral feeding devices play a pivotal role in oncology care by ensuring uninterrupted delivery of essential nutrients that support healing, maintain immune function, and enhance treatment tolerance. Neurological disorders including traumatic brain injury, stroke, and neurodegenerative diseases create sustained demand for enteral nutrition support as these conditions commonly result in swallowing dysfunction. The American Cancer Society projects substantial annual new cancer diagnoses in the country, indicating continued growth in the patient population requiring nutritional support during and after treatment.

Technological Advancements and Product Innovation

Continuous innovation in enteral feeding device design and functionality drives market expansion by improving patient outcomes, enhancing safety profiles, and expanding treatment options. The introduction of smart pump technology featuring integrated sensors, real-time monitoring capabilities, and wireless connectivity enables healthcare providers to deliver more precise and responsive nutritional care. Advanced safety features, including ENFit connectors, have significantly reduced misconnection risks, while anti-clogging mechanisms improve device reliability. Manufacturers are developing increasingly portable and user-friendly devices that support the transition of enteral nutrition from hospital to home settings. In November 2024, Avanos Medical launched the CORGRIP SR nasogastric tube retention system, designed to reduce accidental tube removal, addressing a significant clinical challenge in enteral feeding management. These technological improvements enhance clinical confidence in enteral feeding protocols and support broader adoption across care settings.

Market Restraints:

What Challenges the United States Enteral Feeding Devices Market is Facing?

Complications Associated with Enteral Feeding Procedures

Enteral feeding devices carry inherent risks including tube dislodgment, aspiration pneumonia, infection at insertion sites, and mechanical complications that can deter adoption in certain patient populations. These adverse events may increase healthcare costs through extended hospitalization and additional interventions required to address complications. Healthcare providers must carefully weigh the benefits of enteral nutrition against potential risks when determining appropriate feeding strategies for individual patients.

Stringent Regulatory Requirements and Approval Processes

The regulatory framework governing medical devices in the United States imposes rigorous and time-consuming approval processes that can delay market entry for innovative products. Food and Drug Administration requirements for enteral feeding devices emphasize safety, efficacy, and manufacturing consistency, necessitating comprehensive clinical data and quality documentation. These regulatory hurdles increase development costs and create barriers for smaller manufacturers seeking to introduce novel solutions to the market.

Shortage of Trained Healthcare Professionals

The growing demand for enteral feeding may outpace the availability of nurses, dietitians, and other healthcare professionals trained in proper device placement, management, and monitoring. Placement of certain enteral feeding tubes requires specialized endoscopic procedures, and a shortage of endoscopy specialists can create bottlenecks in timely device placement. This workforce constraint limits the capacity of healthcare systems to expand enteral nutrition services despite increasing patient demand.

Competitive Landscape:

The United States enteral feeding devices market features a moderately consolidated competitive landscape characterized by the presence of established multinational medical device corporations alongside specialized manufacturers. Industry leaders pursue growth strategies centered on product innovation, strategic acquisitions, and geographic expansion to strengthen market positions. Companies invest substantially in research and development to introduce technologically advanced devices that address evolving clinical needs and patient preferences. Partnerships between device manufacturers and healthcare providers facilitate product development aligned with real-world clinical requirements. The competitive environment encourages continuous improvement in device safety profiles, ease of use, and integration capabilities with broader healthcare information systems.

Recent Developments:

-

July 2024: Amsino Medical Group acquired Alcor Scientific's enteral feeding pump products, including the Sentinel and SentinelPlus systems, enabling the company to broaden its portfolio of enteral feeding devices and strengthen its market presence.

United States Enteral Feeding Devices Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Enteral Feeding Pumps, Enteral Feeding Tubes, Giving Set, Enteral Syringes, Consumables, Others |

| Age Groups Covered | Adults, Pediatrics |

| Applications Covered | Oncology, Gastroenterology, Neurology, Diabetes, Hypermetabolism, Others |

| End Users Covered | Hospitals, Ambulatory Surgery Centers, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The United States enteral feeding devices market size was valued at USD 1,048.19 Million in 2025.

The United States enteral feeding devices market is expected to grow at a compound annual growth rate of 5.95% from 2026-2034 to reach USD 1,763.70 Million by 2034.

Enteral feeding pumps dominated the market with a 28% share in 2025, driven by their superior precision in controlling feeding rates, advanced programmable features, and compatibility with home care settings.

Key factors driving the United States enteral feeding devices market include the rising geriatric population, increasing prevalence of chronic diseases including cancer and neurological disorders, technological advancements in device design, and the expanding adoption of home-based enteral nutrition services.

Major challenges include complications associated with enteral feeding procedures such as tube dislodgment and infection risks, stringent regulatory requirements for device approval, shortage of trained healthcare professionals, and the need for comprehensive caregiver education in home care settings.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)