U.S. Epigenetics Market Size, Share, Trends and Forecast by Product, Technology, Application, and Region, 2025-2033

U.S. Epigenetics Market Size and Share:

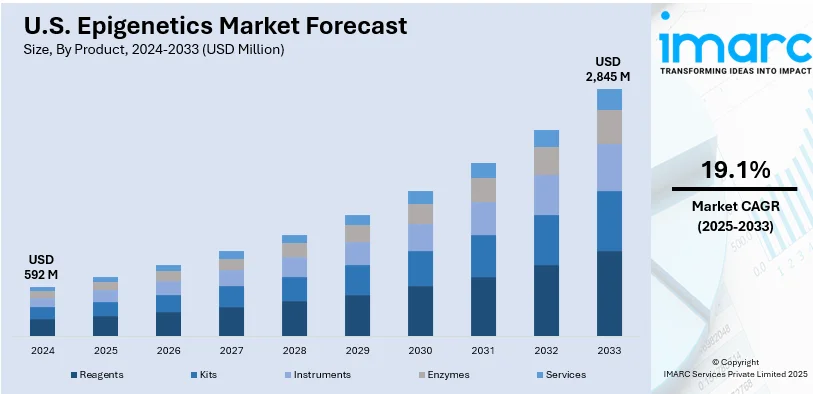

The U.S. epigenetics market size was valued at USD 592 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 2,845 Million by 2033, exhibiting a CAGR of 19.1% from 2025-2033. The market is witnessing constant expansion, chiefly propelled by accelerating incidents of chronic conditions, innovations in precision medicine, and magnified funding for biomedical research. Key applications include oncology and proliferating non-oncology fields, fostered by advanced tools such as epigenetic editing and next-generation sequencing, boosting substantial opportunities across healthcare industries and fueling the market growth in the region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 592 Million |

| Market Forecast in 2033 | USD 2,845 Million |

| Market Growth Rate (2025-2033) | 19.1% |

Increasing innovations in genomic technologies and escalating investment in biomedical research are substantially propelling the growth of the U.S. epigenetics market. The rising prevalence of chronic diseases, especially cancer, has magnified the requirement for epigenetic-based diagnostics and targeted therapies. For instance, according to a research article published in CA: A Cancer Journal for Clinicians in January 2024, 140 new cancer cases, along with 611,720 cancer deaths are estimated to occur in the U.S. during the year 2024. Additionally, the rapid utilization of personalized medicine, which uses epigenetic analysis for customized treatment plans, is gaining significant momentum in the region. Beneficial government initiatives and heavy funding further improve research abilities, facilitating advancements in the development of cutting-edge epigenetic tools and therapeutics.

The expanding applications of epigenetics across oncology, neurology, and metabolic disorders are creating new opportunities in the market. Rising awareness of epigenetic biomarkers for early disease detection and therapeutic monitoring is encouraging their integration into clinical practice. Furthermore, collaborations between research institutions, pharmaceutical companies, and biotech firms are accelerating product development and commercialization. Moreover, advancements in next-generation sequencing and bioinformatics are enhancing the efficiency and accuracy of epigenetic studies, supporting the market's upward trajectory. For instance, in November 2024, Quantum-Si, a U.S.-based company specializing in next generation sequencing, announced the launch of Platinum Pro, set to introduce in 2025, offering enhanced protein sequencing. Additionally, the Proteus platform, debuting in 2026, aims to revolutionize proteomics with rapid sequencing, ultrasensitive proteoform detection, and automated handling, advancing next-generation sequencing applications in protein analysis.

U.S. Epigenetics Market Trends:

Increasing Emphasis on Personalized Medicine

The magnifying focus on personalized medicine is a crucial trend in the U.S. epigenetics market. Epigenetic tools are rapidly being utilized to identify biomarkers and design targeted therapies, especially in oncology. Moreover, innovations in precision medicine facilitate healthcare providers to customize treatments based on individual epigenetic profiles, enhancing efficiency and minimizing side effects. For instance, in February 2024, researchers in the U.S. identified over 275 million previously unreported genetic variants from the precision medicine data provided by nearly 250,000 participants in the NIH’s All of Us Research Program. Among these, nearly 4 million variants are linked to potential disease risk, offering valuable insights into the genetic factors influencing health and disease. This trend is further bolstered by partnerships between pharmaceutical firms and research organizations, prompting the incorporation of epigenetics into standard healthcare practices and proliferating its market prospect.

Rapid Expansion of Non-Oncology Applications

While oncology remains a central focus, the application of epigenetics in non-oncology stream is significantly elevating. Autoimmune diseases, neurological disorders, and metabolic diseases are rising areas where epigenetic research is offering new analysis and therapeutic potential. Moreover, the amplifying incidents of such non-oncological conditions boost requirement for leading-edge epigenetic tools to better comprehend gene regulation and design targeted interventions. For instance, as per industry reports, by 2050, the population of individuals aged 65 and older in the U.S. living with Alzheimer's, a neurological disorder, is projected to reach 12.7 million. Furthermore, elevated funding and rapid innovations in technologies such as CRISPR are fostering more accurate approaches, expanding the scope of the epigenetics market and gaining investment across numerous therapeutic domains.

Technological Advancements in Epigenetic Tools

Technological innovation is fueling the U.S. epigenetics market expansion, especially with notable innovations in bioinformatics and sequencing methodologies. Epigenome editing tools and high-throughput next-generation sequencing, including dCas9 systems, are significantly improving the extensibility and precision of epigenetic research. Moreover, these innovations support the discovery of novel biomarkers and therapeutic targets, accelerating drug development and diagnostics. The integration of artificial intelligence for data analysis is further improving research efficiency, positioning technology as a key driver of market growth. For instance, in September 2024, Johns Hopkins Medicine, a U.S.-based biomedical research facility, introduced the deployment of DELFI-Pro, an AI-based technology designed to enhance ovarian cancer screening by detecting cancer-related genetic changes and protein biomarkers. The DELFI-Pro test, which combines AI-driven cell-free DNA analysis with two protein biomarkers, detected 72%, 69%, 87%, and 100% of ovarian cancer cases in stages 1 to 4, respectively, achieving superior accuracy with minimal false positives.

U.S. Epigenetics Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the U.S. epigenetics market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on product, technology, and application.

Analysis by Product:

- Reagents

- Kits

- Chip Sequencing Kit

- Whole Genomic Amplification Kit

- Bisulfite Conversion Kit

- RNA Sequencing Kit

- Others

- Instruments

- Enzymes

- Services

Reagents form a substantial share of the U.S. epigenetics market, serving as essential components in research and diagnostics. They are widely used in DNA methylation studies, histone modification analysis, and chromatin accessibility assays. The growing demand for high-quality, reliable reagents stems from the increasing adoption of epigenetic techniques in oncology, neuroscience, and precision medicine. Moreover, advancements in reagent formulations continue to enhance experimental accuracy, driving their widespread application across academic, clinical, and pharmaceutical research sectors.

Epigenetic kits cater to a variety of applications, contributing significantly to the market. Chip sequencing kits enable precise chromatin interaction analysis, while whole genome amplification kits facilitate comprehensive genomic studies. Bisulfite conversion kits are critical for DNA methylation profiling, and RNA sequencing kits aid in transcriptomic and epigenomic exploration. Furthermore, these kits streamline complex workflows, ensuring reproducibility and reliability in epigenetic research, making them indispensable tools in laboratories and clinical settings nationwide.

Instruments exhibit a crucial position in the epigenetics market, involving upgraded microarray scanners, sequencing platforms, and real-time PCR systems. Such devices facilitate accurate analysis and high throughput of epigenetic modifications, including histone modifications and methylation patterns. Additionally, the utilization of next-generation sequencing (NGS) technologies and automated platforms has substantially improved the versatility and efficacy of epigenetic studies, prompting their incorporation into both clinical applications and research projects.

Enzymes are critical to epigenetic research, facilitating processes such as DNA methylation, histone acetylation, and chromatin remodeling. Methyltransferases, acetyltransferases, and DNases are commonly used to study regulatory pathways and epigenetic changes. Their specificity and efficiency are integral to achieving accurate experimental outcomes. Moreover, the growing emphasis on understanding gene expression and regulatory mechanisms has fueled the demand for epigenetic enzymes, reinforcing their importance in the market.

Epigenetic services, encompassing histone modification profiling, DNA methylation analysis, and chromatin accessibility studies, represent an emerging segment in the market. Such services offer exclusive expertise and premium results, addressing the demands of clinicians as well as researchers. In addition, subcontracting sophisticated epigenetic assays to service providers enables institutions to emphasize on core research while utilizing leading-edge technologies. The amplifying requirement for personalized medicine and biomarker discovery is further boosting growth in this segment.

Analysis by Technology:

- DNA Methylation

- Histone Methylation

- Histone Acetylation

- Large Non-Coding RNA

- MicroRNA Modification

- Chromatin Structures

DNA methylation holds a significant share in the U.S. epigenetics market due to its pivotal role in gene regulation and disease progression. This technology is widely utilized in cancer research, diagnostics, and drug development for its ability to identify epigenetic markers. Moreover, with advancements in sequencing technologies, DNA methylation profiling has become integral in understanding epigenetic mechanisms, fostering its adoption across academic, clinical, and pharmaceutical research settings.

Histone methylation represents a key segment of the epigenetics market, driven by its importance in chromatin remodeling and gene expression regulation. This technology is extensively applied in studying developmental biology and various disease pathways, particularly in oncology and neurodegenerative disorders. The development of targeted therapies and histone methylation inhibitors further bolsters its market share, supported by growing research investments and technological innovations.

Histone acetylation is gaining prominence in the epigenetics market for its critical role in transcriptional activation and chromatin accessibility. Its applications in drug discovery and disease modeling, especially for inflammatory and neurological conditions, contribute to its market share. Additionally, the development of histone deacetylase (HDAC) inhibitors as potential therapeutics highlights the growing focus on this technology in pharmaceutical research, driving adoption in both academic and clinical settings.

Large non-coding RNAs (lncRNAs) are emerging as a crucial segment in the epigenetics market, with their ability to regulate gene expression and chromatin architecture. Research into lncRNAs is expanding due to their implications in cancer biology, cardiovascular diseases, and developmental disorders. Moreover, advances in RNA sequencing and functional studies have enhanced understanding, positioning lncRNAs as a promising area for diagnostic and therapeutic innovations in the epigenetics field.

MicroRNA (miRNA) modification is a significant technology in the epigenetics market, focusing on its role in post-transcriptional gene regulation. miRNAs are critical in cancer, cardiovascular diseases, and immune response modulation, making them valuable biomarkers and therapeutic targets. Furthermore, innovations in miRNA profiling and silencing technologies have increased their utility in personalized medicine, strengthening their position within the epigenetics research and development landscape.

Chromatin structure analysis is an essential component of the U.S. epigenetics market, providing insights into gene accessibility and transcriptional regulation. Techniques like chromatin immunoprecipitation and ATAC-seq are widely adopted for studying chromatin dynamics in health and disease. Additionally, the importance of chromatin remodeling in cancer and genetic disorders drives the development of advanced tools, ensuring its sustained growth as a vital segment in the epigenetics market.

Analysis by Application:

- Oncology

- Solid Tumors

- Liquid Tumors

- Non-Oncology

- Inflammatory Diseases

- Metabolic Diseases

- Infectious Diseases

- Cardiovascular Diseases

- Others

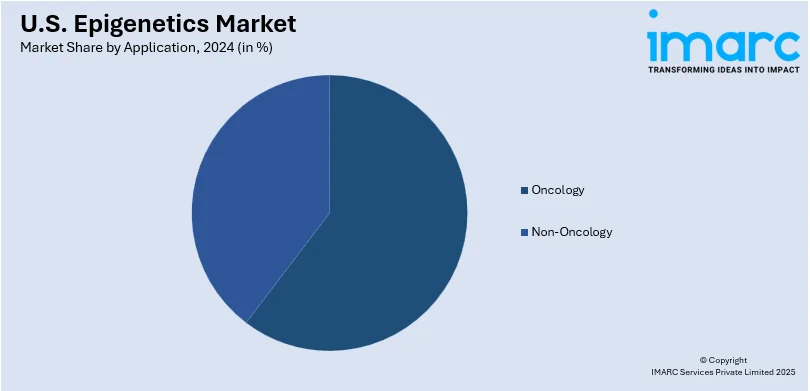

Oncology is one of the major the application segments of the U.S. epigenetics market, driven by advancements in the study of both solid and liquid tumors. Epigenetic technologies are increasingly utilized to understand tumor progression, resistance mechanisms, and genetic alterations in cancers such as breast, lung, leukemia, and lymphoma. Furthermore, this segment benefits from the integration of epigenetic biomarkers in diagnostics and targeted therapies, addressing the demand for precision medicine in combating diverse cancer types effectively.

Non-oncology applications represent a growing segment in the U.S. epigenetics market, fueled by the need to address inflammatory, metabolic, infectious, and cardiovascular diseases. Epigenetic studies aid in identifying disease mechanisms, enabling the development of novel therapeutic approaches. Moreover, this segment is expanding as research advances in autoimmune conditions, diabetes, and chronic infections, highlighting the potential of epigenetic interventions to improve outcomes across various non-cancerous diseases.

Regional Analysis:

- Northeast

- Midwest

- South

- West

The Northeast region is a hub for academic research institutions and biotechnology companies, making it a critical player in the U.S. epigenetics market. The concentration of top-tier universities and research centers fosters advancements in epigenetic studies, particularly in cancer research and personalized medicine. Collaborations between research entities and pharmaceutical companies further accelerate the development and adoption of epigenetic technologies, positioning the Northeast as a leader in cutting-edge healthcare innovations.

The Midwest, known for its strong healthcare infrastructure and pharmaceutical manufacturing, contributes significantly to the epigenetics market in the United States. The region's focus on improving diagnostic capabilities and therapeutic solutions aligns with the growing demand for epigenetic applications in oncology and chronic disease management. Additionally, federal funding for biomedical research and the presence of key pharmaceutical firms strengthen the Midwest's role in advancing epigenetic studies and applications.

The Southern region benefits from its expanding healthcare networks and research initiatives, driving growth in the epigenetics market. Increasing investment in life sciences and biotechnology parks supports the development of epigenetic research, particularly in areas like metabolic disorders and neurodegenerative diseases. Moreover, collaboration between academic institutions and private entities fosters innovation, while the rising prevalence of chronic diseases in the region underscores the demand for epigenetic-based diagnostic and therapeutic solutions.

The Western region, led by California’s biotechnology ecosystem, is a major contributor to the U.S. epigenetics market. Home to numerous biotech startups and research organizations, the region excels in developing cutting-edge epigenetic tools and therapies. Furthermore, investment in precision medicine and advanced diagnostics, coupled with strong venture capital funding, accelerates innovation. Additionally, partnerships between tech companies and healthcare providers in the West enhance the integration of epigenetics into clinical practice.

Competitive Landscape:

The market is characterized by the presence of leading biotechnology firms, pharmaceutical companies, and research organizations. Key players actively focus on innovation in epigenetic tools, such as sequencing technologies, biomarkers, and therapeutics, driven by rising demand for personalized medicine. Furthermore, strategic partnerships, acquisitions, and significant R&D investments are prominent, fostering rapid advancements in the field. For instance, in November 2024, Quantum-Si Incorporated, a next generation sequencing company, announced a strategic partnership with Avantor, a prominent U.S.-based biotechnology and pharmaceutical company, to commercialize its proteomics and genetic sequencing solutions portfolio across the United States. Additionally, the market is witnessing increased competition due to the emergence of startups offering niche solutions, enhancing the overall scope and dynamics of the industry.

The report provides a comprehensive analysis of the competitive landscape in the U.S. epigenetics market with detailed profiles of all major companies.

Latest News and Developments:

- In June 2024, Bio-rad, a U.S.-based technological products company for life sciences, launched the ddSEQ™ Single-Cell 3' RNA Sequencing Kit and Omnition v1.1 analysis software for single-cell transcriptomics. Designed for the ddSEQ Cell Isolator, the kit enables efficient, cost-effective creation of high-quality 3' RNA-Seq libraries, facilitating single-cell gene expression and regulation studies across fields like oncology, immunology, neurology, and stem cell biology.

-

In June 2024, FOXO Technologies, a U.S.-based epigenetic solutions company, announced the strategic acquisition of Rennova Health's healthcare operations, including a behavioral health services subsidiary and a critical access hospital in the U.S. This move aims to integrate cutting-edge epigenetic technology into community health and addiction recovery services.

U.S. Epigenetics Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| Technologies Covered | DNA Methylation, Histone Methylation, Histone Acetylation, Large Non-Coding RNA, MicroRNA Modification, Chromatin Structures |

| Applications Covered |

|

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the U.S. epigenetics market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the U.S. epigenetics market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the U.S. epigenetics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Epigenetics studies heritable changes in gene expression without altering DNA sequences, influenced by mechanisms like DNA methylation and histone modification. Applications include cancer diagnostics, drug development, and personalized medicine, offering insights into disease mechanisms, therapeutic targets, and improved treatment strategies in healthcare and biotechnology.

The U.S. epigenetics market was valued at USD 592 Million in 2024.

IMARC estimates the U.S. epigenetics market to exhibit a CAGR of 19.1% during 2025-2033.

Key drivers of the market include advancements in genomics research, increasing prevalence of chronic diseases like cancer, and growing demand for personalized medicine. Additionally, enhanced funding for biomedical research and the development of innovative epigenetic diagnostics and therapeutics further propel market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)