United States Fitness App Market Size, Share, Trends and Forecast by Type, Platform, Device, and Region, 2025-2033

United States Fitness App Market Size and Share:

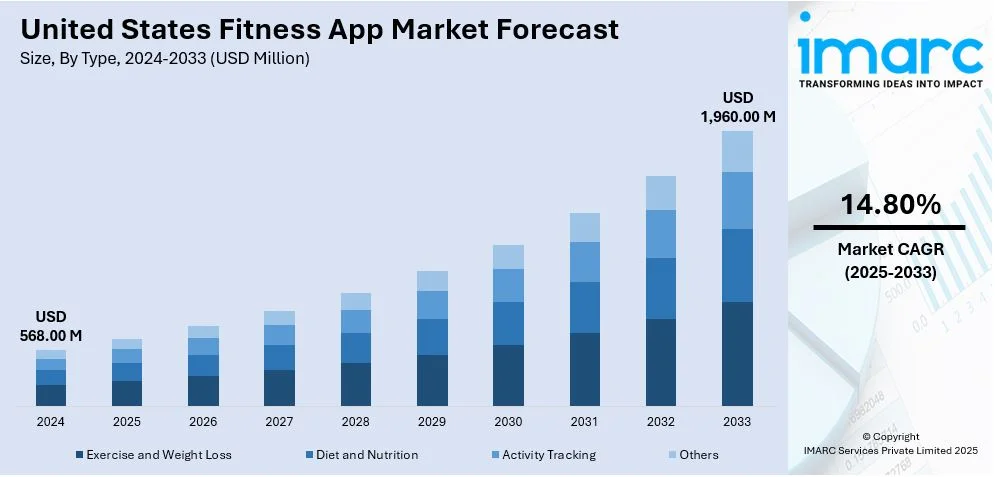

The United States fitness app market size was valued at USD 568.00 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 1,960.00 Million by 2033, exhibiting a CAGR of 14.80% from 2025-2033. The market is experiencing strong growth, led by heightened health awareness, tech innovation, and the development of amplified demand for customized digital health products. Consumers are highly using fitness apps for organized workouts, nutrition support, and immediate feedback on performance. The market is characterized by ongoing innovation, wearable technology integration, and varied user activity across demographics. These together provide a support to the long-term growth and expected increase in the United States fitness app market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 568.00 Million |

|

Market Forecast in 2033

|

USD 1,960.00 Million |

| Market Growth Rate 2025-2033 | 14.80% |

The increased focus on preventive healthcare is an important driver for the United States fitness app market. As a result of heightened awareness of chronic lifestyle conditions like obesity, cardiovascular diseases, and diabetes, individuals are relying more on digital tools to take care of themselves. Fitness apps enable users to track their exercise, sleep, calorie consumption, and general well-being in real time, forming healthier habits. For instance, in August 2024, Reebok released its fitness app in the United States, with on-demand workouts, nutritional advice, social interaction, and workout tracking, both on Android and iOS with a free seven-day trial. Furthermore, the ease of access of these tools has leveled the playing field in health management, enabling users to take proactive action without regular visits to the clinic. Features of education like customized fitness routines, daily advice, and behavior monitoring contribute further to engagement. In addition, the appeal cuts across age groups, with both young and old benefiting from self-monitoring and goal-setting. This rising interest in individual health management, facilitated by easy-to-use digital technologies, is promoting long-term interaction and pushing for a cultural transition toward routine wellness regimens, thus driving United States fitness app market growth.

The widespread adoption of digital technologies into daily life is speeding up the uptake of fitness applications in America. Customers are becoming more attracted to tailored digital services that address their individual health objectives and daily patterns. Fitness apps are now making use of behavior data to deliver tailored workout plans, diet tracking, and wellness tips according to individuals' lifestyles. The user experience and convenience of the apps are boosted by real-time performance feedback, measurement of progress, and encouragement cues that activate users. As mobile use keeps expanding, these applications blend perfectly within the larger digital world, providing integration with wearables, music, calendars, and even virtual coaching interfaces. For example, in December 2024, Peloton formally released Strength Plus, an audio training-based strength app on iOS, with customizable workouts, instructor audio feedback, and Apple Watch support, with a personalized coaching experience. Moreover, this kind of interconnection creates an immediacy and a sense of relevance that makes health monitoring a part of normal daily activity. The trend towards adaptive, user-friendly technology is transforming expectations of personal well-being, creating steady market demand as people pursue more active and responsive fitness options.

United States Fitness App Market Trends:

Emergence of Health-Focused Lifestyles and Fitness Activity

An increasing awareness of the value of health and well-being is transforming consumer trends in the United States. Based on the Health & Fitness Association, approximately 100 million American adults plan to make health and fitness a priority in 2025, demonstrating a major cultural shift toward taking charge of health. Anxiety about how inactive lifestyles impact mental and physical health is motivating more to make active habits a priority. This change is also bolstered by a boom in the participation of sports and fitness activities, creating demand for fitness apps that enable users to track routines and goals. Tracking workouts, calories, and essential health measures through digital platforms is becoming essential. This health-first attitude is reinforced by an expanding market of health-oriented products, services, and community participation that is building momentum toward a positive market direction for the fitness and wellness business in the next few years.

Technology Integration and Wearable Adoption

Innovation in technology is driving the United States fitness app market forecast from the center. With fitness tracker user penetration having been estimated at 21.00% in 2025 and 26.40% in 2029 (Statista), wearables are fast becoming an integral part of personal health management. The wearables, which come with sensors to track steps, heart rate, sleep patterns, and so on, are enabling individuals to make smart health choices in real-time. In combination with increasing smartphone sales, the availability of fitness apps has expanded considerably, re-emphasizing the trend towards mobile health solutions. The growth of virtual training and home workouts also finds support from a thriving digital ecosystem, such as live classes and on-demand training modules. Seamless integration of fitness apps with wearable and mobile devices has resulted in a connected fitness ecosystem, providing customization, ease of access, and engagement like never before. These innovations are not only improving user experience but also speeding up the overall digitalization of the fitness sector.

Social Integration, Corporate Wellness, and Subscription Models

Fitness apps are no longer just personal tools but social and corporate wellness platforms. Social media integration has facilitated easy sharing of progress, milestones, and creating supportive groups. The visibility promotes accountability and sustained use. Meanwhile, companies across the U.S. are embracing corporate wellness programs that often incorporate fitness app subscriptions to foster employee health, lower healthcare expenses, and improve workplace productivity. These initiatives align with broader trends emphasizing work-life balance and holistic well-being. Moreover, the shift toward subscription-based models is proving beneficial for fitness app developers, offering predictable and scalable revenue streams. This model fosters ongoing updates, customized features, and high-end content, thus ensuring long-term retention of users. Coupled with the Health & Fitness Association's findings of U.S. health club and studio memberships totaling 77 million, the expanding universe of digital, social, and corporate wellness aspects is setting the fitness app industry up for ongoing growth.

United States Fitness App Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States fitness app market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on type, platform, and device.

Analysis by Type:

- Exercise and Weight Loss

- Diet and Nutrition

- Activity Tracking

- Others

Exercise and weight loss apps are intended to aid physical training, weight reduction, and strength gain. Customers enjoy personalized workout plans, virtual mentoring, and performance measurement capabilities. Home-based exercise convenience and increasing health consciousness persistently fuel demand and make this a dominating and expanding category in the United States fitness app market.

Diet and nutrition applications help customers keep track of calorie consumption, plan meals, and eat balanced diets. The applications include barcode scanners, food databases, and customized suggestions. The growing emphasis on preventive care and managing eating habits has established this category as an important part of consumers looking for long-term health through digital solutions and more healthy lifestyle habits.

Applications under this category are designed to monitor steps, sleep, heart rate, and daily activity. When integrated into wearable devices, they provide users with real-time feedback regarding physical activity. The popularity of this segment is on the increase owing to consumer demand for meeting daily fitness targets, ensuring steady movement, and receiving statistics-based motivation to remain active during the day.

This category includes meditation, mental health, women's health, and specialty fitness uses. These specialized apps are for particular user groups or purposes and have guided sessions or habit-forming capabilities in many cases. With amplified consumer demand for more holistic wellness, this multifaceted category is growing, providing worthwhile complementary functionalities to physical fitness-oriented apps in the overall market.

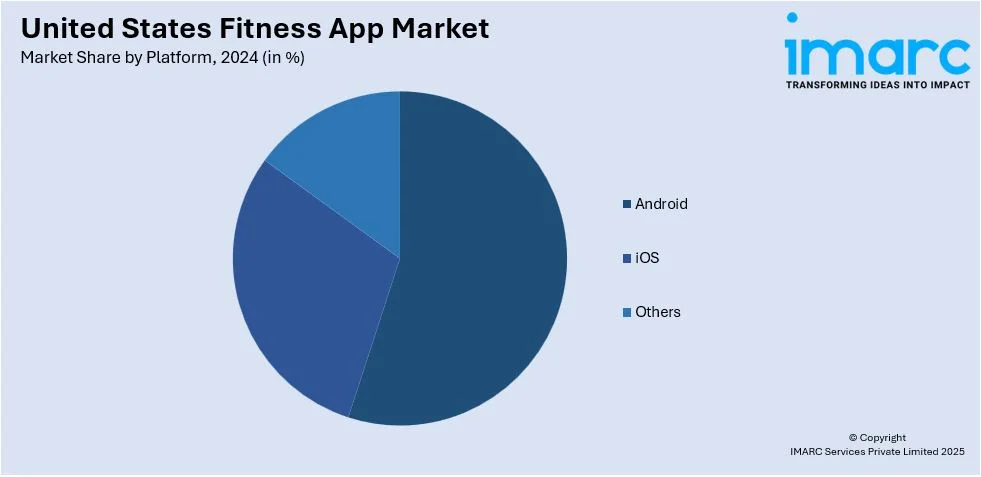

Analysis by Platform:

- Android

- iOS

- Others

Android fitness apps share a significant market percentage because Android smartphones are highly used in various demographics. The offer of free and cheap applications attracts price-sensitive users. The platform supports a range of integrations, which allows for access to personalized health information, hassle-free integration with wearables, and wide application compatibility across devices and fitness types.

iOS exercise apps are for the users who are looking for a high-end digital health experience. Renowned for having elegant user interfaces, data security features, and robust device integration, the apps tend to focus on personalization and high-quality content. The market is driven by the buying power of iOS consumers, and thus, it is a profitable model for those developers providing subscription-based or feature-full wellness solutions.

This category involves cross-platform apps, web-based fitness sites, and programs offered through alternative operating systems. They often center on convenience and compatibility across different devices. Although they have lower market share, they cater to specialized users who want flexible fitness tracking services outside the popular operating systems, making the country's digital health space more inclusive.

Analysis by Device:

- Smartphones

- Tablets

- Wearable Devices

Smartphones are used most extensively for fitness apps because they are portable and have powerful processing. Smartphones enable individuals to track workouts, monitor diet, and access virtual coaching remotely. The spread of smartphones, coupled with fast internet and easy-to-use app interfaces, makes this segment an important driver of digital fitness participation.

Tablets provide bigger screens and better visual experiences for fitness users, especially for individuals performing yoga, guided exercise, or virtual training. Their use is significant in home-based exercise routines and rehabilitation exercises. Although less transportable than smartphones, tablets offer more immersive interfaces, which are best suited for users requiring clearness and comfort during workout sessions.

Wearable technology, including fitness bands and smartwatches, supplements app use through real-time biometric feedback. Wearable technology monitors heart rate, steps taken, sleep, and other health indicators, syncing with health apps in real-time. Their ongoing data gathering complements goal-setting and behavior tracking, propelling their usage among users dedicated to precise and customized fitness analysis.

Regional Analysis:

- Northeast

- Midwest

- South

- West

The Northeast market exhibits a high rate of fitness app adoption, driven by urban life and availability of sophisticated healthcare infrastructure. Improved levels of health awareness and disposable incomes propel usage of high-end fitness apps. The availability of modernized consumers with hectic lifestyles further supports dependence on digital wellness solutions, positioning the region as a prominent driver of market expansion.

The Midwest region captures increased activity among fitness apps, fueled by rising health awareness and smartphone adoption. Suburban and rural regions are experiencing accelerating use of home fitness equipment. Consumers appreciate convenient and affordable wellbeing solutions easily integrated into daily lifestyles, providing a great opportunity for digital fitness growth and recurring user activity.

The South is a fast-emerging fitness app market in the region because of growing health awareness related to lifestyle. An interest in weight management, well-being programs, and mobile health offerings is driving growth. Ease of access to low-cost fitness apps and rising investment in digital healthcare programs are other drivers driving adoption in multiple age groups and segments.

The West is at the forefront of digital fitness adoption with its robust tech infrastructure, health-oriented culture, and early adoption. Consumers here are eager for new wellness tools such as wearable integration and personalized coaching apps. The region's national influence on health trends and role as a center of digital innovation make it a prime mover of market growth.

Competitive Landscape:

The United States fitness app market outlook has a competitive environment where there is fast innovation, varying products, and rising specialization. There are a wide variety of apps that suit different purposes for consumers, such as general fitness, strength training, yoga, meditation, nutrition tracking, and personalized coaching. Most platforms specialize in delivering customized experiences based on artificial intelligence (AI) driven suggestions, interactive content, and progress tracking. The presence of free as well as subscription-based models enables mass consumer adoption across income classes. Alliances with gyms, wellness professionals, and technology companies are making these apps more functional and desirable. Furthermore, compatibility with wearable technology and home automation is becoming mainstream, enabling users to utilize a more integrated and comprehensive fitness ecosystem. The market is very dynamic, with new players continually entering and original platforms updating their services to remain relevant. This competition is driving ongoing product innovation and increased user activity nationwide.

The report provides a comprehensive analysis of the competitive landscape in the United States fitness app market with detailed profiles of all major companies.

Latest News and Developments:

- May 2025: Whoop launched two new wearables, Whoop 5.0 and Whoop MG, featuring 14-day battery life, enhanced health insights, and sleeker designs. It also introduced three membership tiers, added ECG and blood pressure tracking, and unveiled Healthspan metrics. These updates aim to deepen user engagement through personalized and long-term fitness and wellness tracking.

- April 2025: GreenLight Fitness launched the FitnessGram mobile app to simplify physical fitness assessments for educators. The app featured offline capabilities, fast event access, and a mobile-first design. It aims to enhance student health tracking, with future updates planned for collaborative goal setting between students, parents, and teachers to promote life-long wellness habits.

- January 2025: Apple Fitness+ launched new 2025 features, including strength training, yoga peak poses, breath meditation, and a pickleball-focused program. It also introduced a Strava collaboration with exclusive content and integration.

- January 2025: Therabody introduced "Coach", an AI-powered digital recovery platform integrated into its app. Developed in collaboration with Garmin, Coach utilizes data from Garmin smartwatches, Apple Health, Google Fit, Strava, and more to deliver personalized recovery plans. The platform adjusts in real time based on users' goals, activity levels, and health metrics, enhancing athletic performance and overall well-being.

United States Fitness App Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Exercise and Weight Loss, Diet and Nutrition, Activity Tracking, Others |

| Platforms Covered | Android, iOS, Others |

| Devices Covered | Smartphones, Tablets, Wearable Devices |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States fitness app market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the United States fitness app market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States fitness app industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The fitness app market in the United States was valued at USD 568.00 Million in 2024.

The United States fitness app market is projected to exhibit a CAGR of 14.80% during 2025-2033, reaching a value of USD 1,960.00 Million by 2033.

Key drivers, such as heightening health consciousness, rising use of smartphones and wearable devices, and an expanding need for customized wellness programs are influencing the United States fitness app market. Supporting growth further is the adoption of sophisticated app technology and tracking features that improve customer experience, drive long-term engagement, and fuel expansion in various consumer segments.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)