United States Floriculture Market Size, Share, and Trends and Forecasts by Product, End-User, and Region, 2025-2033

United States Floriculture Market Size and Share:

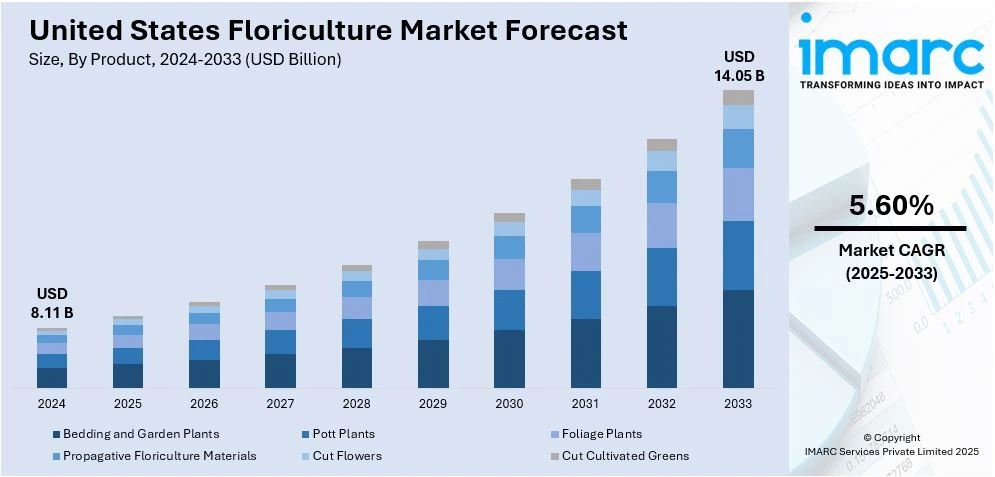

The United States floriculture market size was valued at USD 8.11 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 14.05 Billion by 2033, exhibiting a CAGR of 5.60% from 2025-2033. The increasing consumer demand for ornamental plants and flowers for decorative and gifting purposes, growing popularity of home gardening and DIY floral arrangements, rising disposable incomes and urbanization boosting spending on floriculture products, adoption of sustainable farming practices and eco-friendly cultivation methods, and expansion of e-commerce platforms and subscription-based flower delivery services are some of the factors propelling the United States floriculture market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 8.11 Billion |

| Market Forecast in 2033 | USD 14.05 Billion |

| Market Growth Rate (2025-2033) | 5.60% |

United States Floriculture Market Analysis:

- Key Market Drivers: Spreading popularity of home gardening and houseplants, fueled by urbanization and health trends. Increasing disposable incomes to afford high-end flower purchases for gifting and adornments. Rising usage of sustainable farming methods, such as organic manure and water-saving irrigation systems that improve market attractiveness.

- Important Market Trends: Growth in e-commerce platforms and subscription-based flower delivery services enhancing market accessibility. Convergence of greenhouse technology and controlled environment agriculture ensuring constant supply quality. Social media influence encouraging DIY floral arrangements and home gardening culture among the youth.

- Market Challenges: Some of the key factors impeding the market demand are the steady revenue generation all year round. Increasing input prices such as energy, labor, and transportation that affect profitability. Climate change and weather unpredictability that risks crop production and supply chain reliability across the world.

- Market Opportunities: According to the United States floriculture market forecast, increasing corporate need for flower arrangements in offices and business places for decoration. Growing institutional market such as healthcare facilities, educational institutions, and religious institutions. Developments in biodegradable packaging and organic growing techniques drawing environmentally friendly customers.

The United States floriculture market is driven by growing consumer demand for ornamental plants and flowers for decoration as well as gift purposes. Urbanization and growing per capita incomes prompt consumers to use indoor and outdoor plants for improved living environments. According to industry reports, 82.8% of the total population of the United States lives in urban areas in 2025. In addition, the trend of using flowers as a means to enhance events and celebrations as well as corporate occasions contributes to growth on both the household and commercial front. The popularity of home gardening and DIY floral arrangements, backed by social media trends, is further increasing the customer base. This is propelling innovation in product offerings and marketing strategies that are creating a positive United States floriculture market outlook.

To get more information on this market, Request Sample

Other drivers of the United States floriculture market share include sustainability and technological improvements. Current consumer demands with regard to eco-friendliness have resulted in the embracing of organic farming practices, efficient irrigation techniques, and recyclable packaging by growers. E-commerce websites and subscription-based flower delivery systems are also increasing access to a broader market. As per a report published by the IMARC Group, the United States e-commerce market size is forecasted to reach USD 2,083.97 Billion by 2032, exhibiting a CAGR of 6.80% during 2024-2032. Besides this, improved technology in greenhouses and controlled environment agriculture have increased yields as well as improved quality in blooms, ensuring year-round supplies.

United States Floriculture Market Trends:

Increasing consumer demand for ornamental plants and flowers

Increasing ornamentation interest with plants and flowers for interior decor and gifts is driving the United States floriculture market growth. With urbanization, consumers increasingly bring plants and flowers within their households or offices to improve house aesthetics and air quality. Flower ornamentation for functions, including weddings and corporate events, also stimulates market growth. In addition to this, demand is also being supplemented by the rising popularity of gifting through flowers, along with consumer willingness to spend more on premium-quality flowers. Seasonal flower purchases during holidays and festivals also augment the United States floriculture market demand.

Rising popularity of sustainable and eco-friendly practices

The United States floriculture market trends indicate that sustainability is becoming a highly important focus of both consumers and producers. Consumers now prefer eco-friendly and organic flowers more than ever. This has called for floriculture businesses to follow sustainable farming techniques. Some instances include biodegradable packaging, organic fertilizers, and water-efficient irrigation systems. Other growers are now beginning to apply controlled environment agriculture and greenhouse technologies so that the level of negative environmental effects is minimized with maximum production. This shift toward sustainability aligns with consumer expectations and also enhances the market appeal of floriculture products, thereby supporting overall industry growth.

Advancements in e-commerce and direct-to-consumer sales

The evolution of e-commerce platforms and direct-to-consumer delivery services is revolutionizing the floriculture market. Online flower retailing is convenient and accessible, and one can order flowers and plants from the comfort of his or her home. Subscription-based flower delivery services to one's doorstep are also gaining popularity among urban consumers. These providers often offer options for customizable designs to a digitally driven audience. Marketing and partnering with influencers on social media is also an important aspect of promoting floral products. They are bringing in more visibility and sales to the market. The growth of digital channels also contribute significantly to the overall expansion of the floriculture market.

United States Floriculture Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States floriculture market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on product and end-user.

Analysis by Product:

- Bedding and Garden Plants

- Pott Plants

- Foliage Plants

- Propagative Floriculture Materials

- Cut Flowers

- Tulip

- Lilies

- Gerbera

- Gladioli

- Sunflower

- Rose

- Others

- Cut Cultivated Greens

According to the United States floriculture market analysis, the bedding and garden plants are a leading segment in the United States floriculture market, primarily because of home gardening and landscaping projects. They are used extensively in seasonal gardens, outdoor decoration, and beautification of public areas. The popularity of bedding and garden plants lies in their colorful appearance and easy planting. Thus, both residential and commercial landscapers find these plants highly desirable.

The demand for potted plants is rising, owing to their flexibility and suitability in indoor spaces. They have great prospects in home and office decoration, giving an aesthetic appeal and air-purifying benefits. This segment constitutes flowering plants and greenery sought after by urban consumers in pursuit of low-maintenance options for improving indoor environments, thus significantly contributing to the floriculture market.

The demand for foliage plants is increasing as consumers are opting for more greenery, for beauty and various other purposes. Being aesthetic and functional, as they improve indoor air quality, these plants have achieved a majority presence in houses, offices, and public places. As a result, this segment will see steady growth due to sustainable living, as well as biophilic design trends.

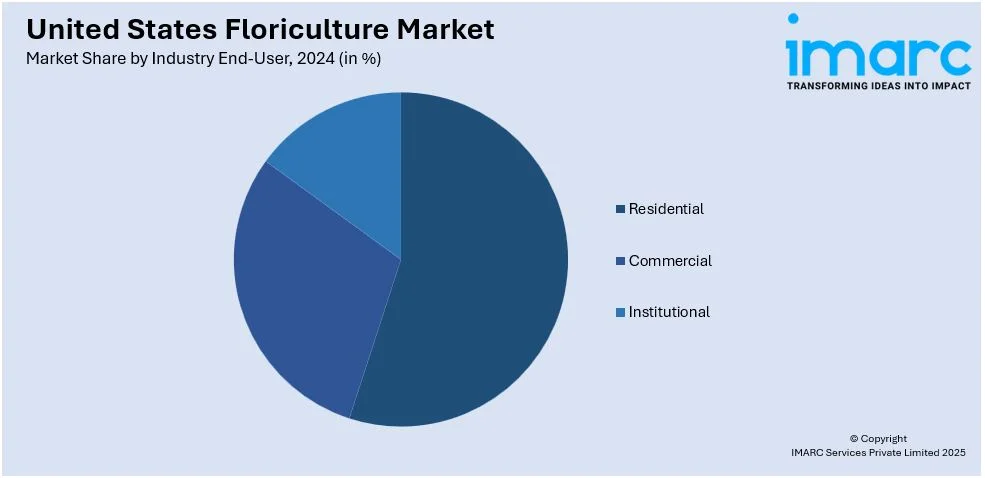

Analysis by End-User:

- Residential

- Commercial

- Institutional

Residential is a dominant segment in the United States floriculture market with growing home gardening and demand for ornamental plants for home decoration. Flowering plants, succulents, and foliage are increasingly becoming part of purchases due to aesthetic values and air-quality improvement. In addition, demand in this segment is boosted further by seasonal flowers purchased during holidays and personal celebrations.

The commercial segment is driven by the use of flowers and plants in weddings, corporate events, and retail spaces. Florists, event planners, and hospitality businesses are key drivers, leveraging floral arrangements for aesthetic and branding purposes. Premium flowers for luxury gifting and decor in high-end establishments also contribute to consistent demand within the commercial sector.

The institutional segment has demand from the educational, health, and religious sectors. Educational institutions require flowers for events and ceremonies. Similarly, hospitals require plants to improve aesthetics and heal patients psychologically. Religious organizations mostly require fresh flowers for ceremonies, which would translate to constant demand. The same segment displays consistency in buying volumes, thereby encouraging market stability and growth.

Regional Analysis:

- Northeast

- Midwest

- South

- West

The floriculture market in the Northeast region of the United States is led by a strong demand for ornamental plants and cut flowers due to urbanization and a high population density in cities. This region is marked by seasonal purchases of flowers, particularly for holidays and certain events. The premium-quality focus of floral products ensures demand consistency from both residents and businesses.

There is a general gardening culture along with vast outdoor open spaces in the Midwest, which increases the demand for bedding and garden plants. This region's agricultural base supports local production, so there are fresh flowers and plants locally available. The event business flourishing in the Midwest, such as weddings and festivals, also adds to the demand for floral products in residential as well as commercial markets.

The South region indicates a healthy demand for floriculture products as its climate favors the cultivation of plants throughout the year. Consumption of flowers for plant landscaping and ornamentation purposes remains high in Atlanta and Miami cities. Demand by the hospitality and tourism industries of this region is also always robust, which supports sustained growth within the market.

Competitive Landscape:

Key market players in the United States floriculture industry continue to drive growth through strategic initiatives such as expanding product lines, embracing sustainability, and revolutionizing themselves through technology. The companies are constantly adding a mix of ornamental plants, cut flowers, and potted plants to meet changing consumer preferences. There have also been investments in organic fertilizers and water-efficient irrigation systems, aligning with sustainability requirements. In addition, using digital platforms for direct-to-consumer sales is enhancing the ease of access for consumers. Collaborations with retail chains and online marketplaces extend the reach of the market, ensure consistent supply and availability, and contribute to the positive growth trajectory of the market.

The report provides a comprehensive analysis of the competitive landscape in the United States floriculture market with detailed profiles of all major companies, including:

- Kurt Weiss Greenhouses, Inc.

- Costa Farms

- The Queen’s Flowers

- Green Circle Growers

- Greenheart Farms

- MONROVIA NURSERY COMPANY

- Larksilk

Recent News and Development:

- In December 2024, The USDA launched the $2 billion Marketing Assistance for Specialty Crops (MASC) program, offering direct payments to specialty crop growers, including floriculture businesses. Eligible applicants can receive up to $125,000 to offset rising costs and expand markets. Applications are open through Jan. 8, 2025. This is only the second time floriculture growers have received direct USDA aid, following SAF’s advocacy during the 2020 CFAP2 program.

- 19 December 2024: The USDA has established a Marketing Assistance for Specialty Crops (MASC) initiative, which will provide USD 2 Billion in funding to growers of specialty crops, including floriculture companies. Qualified growers will receive up to USD 125,000 to increase market prospects and partially cover input costs. Applications for the initiative will be accepted by the USDA till 8 January 2025.

United States Floriculture Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| End-Users Covered | Residential, Commercial, Institutional |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States floriculture market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the United States floriculture market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States floriculture industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The IMARC report for the United States floriculture market covers 2019-2033.

The United States floriculture market was valued at USD 8.11 Billion in 2024.

IMARC estimates the United States floriculture market to exhibit a CAGR of 5.60% during 2025-2033.

The increasing demand for ornamental plants and flowers in landscaping, growth in the number of flower shops and floral arrangements for events, rising consumer interest in gardening and home décor, advancements in greenhouse technology and cultivation methods, and strong export potential and international trade of floriculture products are the primary factors driving the United States floriculture market.

Some of the major players in the United States floriculture market include Kurt Weiss Greenhouses, Inc., Costa Farms, The Queen’s Flowers, Green Circle Growers, Greenheart Farms, MONROVIA NURSERY COMPANY, Larksilk, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)