U.S. Food Flavors Market Size, Share, Trends and Forecast by Type, Form, End User, and Region, 2025-2033

U.S. Food Flavors Market Size and Share:

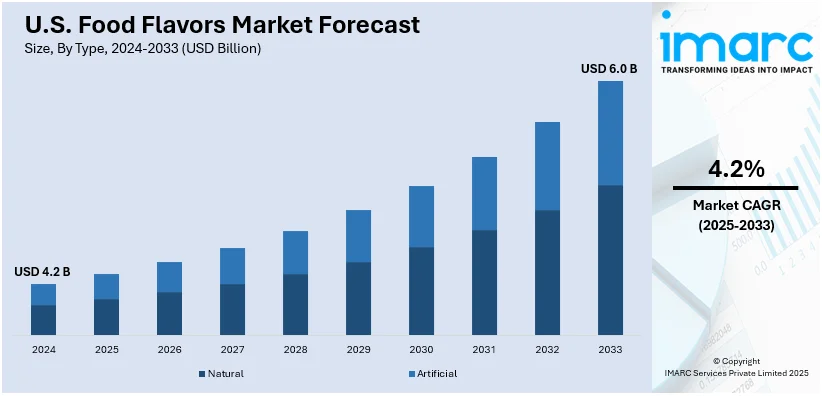

The U.S. food flavors market size was valued at USD 4.2 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 6.0 Billion by 2033, exhibiting a CAGR of 4.2% from 2025-2033. The market is experiencing robust growth, driven by the increasing demand for natural and organic flavors, the expansion of ready-to-eat (RTE) and plant-based food segments, rapid advancements in functional food formulations, and the introduction of innovative flavor delivery technologies thus aiding the U.S. food flavors market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 4.2 Billion |

|

Market Forecast in 2033

|

USD 6.0 Billion |

| Market Growth Rate 2025-2033 | 4.2% |

U.S. Food Flavors Market Analysis:

- Key Drivers: Increasing consumer demand for natural and organic food items is propelling U.S. food flavors market demand. Healthier consumers increasingly demand clean-label options, and FDA guidelines supporting transparency in the labeling of natural flavors also fuel adoption. Convenience food growth and increasing busy lifestyles also drive demand for more-flavorful processed foods.

- Major Market Trends: Plant-based eating habits and non-traditional protein sources are transforming flavor creation priorities. Functional foods and beverages demand advanced flavor masking technologies in order to counterbalance nutritional additives. Innovative flavor creation techniques, such as AI-inspired research and encapsulation technologies, are facilitating more accurate and sustainable flavor delivery systems in various applications.

- Market Challenges: Increased costs of raw materials and supply chain disruptions present major challenges to flavor producers. Compliance with changing FDA standards necessitates great expense in reformulation activities. The demand from consumers for natural ingredients and low-cost products also puts pricing pressures along the value chain.

- Market Opportunities: As per the U.S. food flavors market analysis, the growth in plant-based food segment creates immense opportunities for new-age flavor solutions. Advances in biotechnology and molecular flavor technology provide opportunities to create novel, sustainable products. Ethnic cuisine popularity and regional flavor palates open doors for specialty product creation and segmentation opportunities.

The food flavor industry in the United States is growing with increasing consumer demand for natural and organic food products. This is driven by rising awareness of health and concerns over synthetic chemicals and their long-term health effects. Technical food additives, such as coloring or flavoring chemicals, preservatives, and sweeteners, make up 60% of the food that Americans buy, according to new data published in Elsevier's Journal of the Academy of Nutrition and Dietetics. Consumers' demand for clean-label products has led to manufacturers developing and using more natural flavors, which are nearly exclusively derived from plants, fruits, herbs, and spices. Besides, the FDA regulations concerning the labeling of natural flavors will also increase demand for the types of flavors because the companies are becoming more transparent on the same.

To get more information on this market, Request Sample

The growth of ready-to-eat (RTE) and convenience food industries has caused a great impact on the market of food flavor in the United States. The country's convenience food industry is growing at an explosive rate of 3.50% per year and is expected to reach US$ 165.58 billion by 2032. With busy lifestyles and more homes with dual incomes, there is a growing reliance on quick dinner alternatives that do not sacrifice taste or quality. The improvement in sensory experiences for processed and packaged food, making it maintain the freshness even after shelf life is extensive, due to flavors, while developments in encapsulation and stabilization of flavor offer a chance to give constant sensations by the producer.

U.S. Food Flavors Market Trends:

The Rising Appeal of Plant-Based Diets

The growing popularity of plant-based diets and alternative sources of protein is affecting the flavor food industry in the United States. According to market estimates, 6 out of 10 U.S. families purchased plant-based meals in the year 2023. Additionally, the plant-based food retail sector in the United States was valued $8.1 billion that same year. Consumer demand for healthier and greener options for food will be an impetus in driving requirements for flavors mimicking the taste and texture of traditional animal-based products. Furthermore, plant-based meats, dairy substitutes, and protein-enriched snacks require enhanced formulations to meet consumer preference. According to this, flavor producers are emphasizing on developing masking chemicals to reduce off-notes of plant proteins as well as flavoring similar to the mouth-watering and savory qualities of meat and cheese.

Innovation in Functional Foods and Beverages (F&B)

Another major factor propelling the food flavors market is demand for functional foods and beverages that contain health-enhancing ingredients. Functional poducts such as protein bars, fortified juices, and probiotic drinks often need flavors to balance bitterness or off-tastes created from added nutrients like vitamins, minerals, and botanicals. Functional foods and beverages sales in the U.S. have reached $92.1 billion in 2023, and that category is expected to grow to $106.9 billion by 2026, according to Nutrition Business Journal. The growing interest in wellness and immunity-boosting foods has led to a hike in flavored supplements and nutraceuticals. Companies are developing sophisticated flavor profiles that make these products more palatable while aligning with the health-conscious consumer's preferences.

Rapid Technological Advancements in Flavor Creation and Delivery

New, rapid technology advancements in the flavor development and distribution field have created a tremendous impact on the food flavors industry of the United States. Businesses are now creating sophisticated, multi-dimensional flavor profiles through advancements in cutting-edge technology like bioengineering, AI-driven flavor research, and molecular flavor design. These developments facilitate customization of taste to specific customer demographics and geographical preferences, thus improving market penetration. For instance, methods of encapsulation enhance stability and controlled release of flavors within processed foods, ensuring consistency in flavor throughout the product life cycle. In addition, the growing interest in the sustainability of taste development, such as the use of renewable resources and minimizing waste appeals to an environmentally conscious consumer thereby propelling the U.S. food flavors market growth.

U.S. Food Flavors Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the U.S. food flavors market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on type, form, and end user.

Analysis by Type:

- Natural

- Artificial

Natural flavors are derived from natural sources such as fruits, vegetables, herbs, and spices, and are consistent with health-conscious and environmentally sensitive consumer trends. Furthermore, the Food and Drug Administration's (FDA) regulatory rules stressing clarity in labeling encourage the use of natural flavors. In addition, advances in extraction technologies, such as enzymatic and fermentation processes, are allowing for the production of high-quality natural flavors that maintain authenticity and consistency.

Artificial flavors provide cost-effectiveness, a longer shelf life, and consistent taste characteristics. They are produced by chemical synthesis and are commonly utilized in processed and packaged foods. Their adaptability enables food makers to imitate complex and exotic flavor characteristics at scale. Furthermore, advancements in flavor chemistry are reducing concerns about artificial chemicals, assuring its continued relevance across diverse food and beverage (F&B) applications.

Analysis by Form:

- Dry

- Liquid

Because of its stability, longer shelf life, and ease of handling, the dry flavors segment is a leading segment in the US food flavors industry. These flavors, which are commonly powdered or encapsulated, are frequently utilized in snacks, bakery items, and quick drinks. Their moisture resistance makes them perfect for items that must be stored or distributed under changing circumstances for an extended period of time.

Liquid flavors are a diverse and quickly developing section of the US food flavor industry, owing to their ease of integration and higher solubility in drinks, dairy products, and sauces. These flavors have an instant and powerful taste impression, making them vital for creating beverages such as soft drinks, flavored waters, and cocktails.

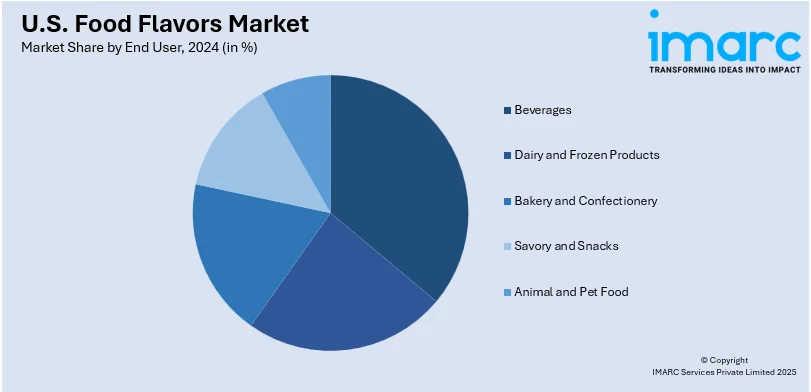

Analysis by End User:

- Beverages

- Dairy and Frozen Products

- Bakery and Confectionery

- Savory and Snacks

- Animal and Pet Food

The beverage industry is being propelled by the rising demand for novel and exotic taste profiles in soft drinks, teas, coffees, and alcoholic beverages. Furthermore, functional beverages such as energy drinks and flavored waters fortified with vitamins and minerals are driving this rise in consumption. Advances in taste technology, such as natural extracts and botanical infusions, also allow beverage makers to appeal to health-conscious customers looking for low-sugar and clean-label choices.

The dairy and frozen goods category is a significant component of the US food tastes industry, because of the popularity of flavored yogurts, ice creams, and frozen desserts. This sector largely relies on natural and artificial flavors to improve the taste and attractiveness of its goods while addressing customer demands for rich and unique offers.

Due to consumers' growing indulgence in baked and sweet products, the bakery and confectionery category is one of the food flavors market's major end users. Popular flavors such as chocolate, vanilla, and fruit are commonly utilized in cakes, cookies, candies, and pastries, and the desire for seasonal and ethnic flavors is increasing. Cakes, cookies, candies, and pastries frequently include popular flavors like chocolate, vanilla, and fruit, along with a growing desire for seasonal and ethnic flavors.

The savory and snacks category is driving its share of the food flavors market, led by the rise in popularity of ready-to-eat and convenience meals. Cheese, barbecue, chili, and herbs are popular flavors for chips, crackers, and ready meals to deliver distinctive taste experiences. Innovation in seasoning mixes and flavor delivery methods allow manufacturers to respond to healthy trends through low-sodium and baked snack options that do not compromise on taste.

The animal and pet food market is considered to be a niche and a very rapidly growing category in the U.S. food flavors market due to the humanization of pets and the growing demand for premium pet food products. Flavors such as chicken, beef, fish, and cheese are widely incorporated in this category to enhance palatability and cater to the preferences of pets and their owners.

Regional Analysis:

- Northeast

- Midwest

- South

- West

The Northeast part of the United States is a vibrant section of the food flavor industry, driven by a diversified population with a wide range of culinary tastes. This region has a significant demand for ethnic and gourmet cuisines that appeal to diverse preferences. The popularity of ready-to-eat meals and functional beverages is especially noticeable, since hectic urban lives drive convenience-based consumption.

The Midwest has a large food processing and agricultural base, which impacts the food taste industry. This area prefers classic and robust flavors, including those found in baked foods, dairy products, and savory snacks. Furthermore, changing consumer tastes are increasing interest in plant-based and clean-label products, driving up demand for natural flavors.

The Southern region makes a significant contribution to the US food flavors industry because of its rich culinary heritage and high consumption of savory and sweet items. The area has a great need for strong, spicy, and barbecue-inspired flavors that represent its traditional cuisine culture. Growth in the beverage and dairy industries, including iced teas, flavored waters, and frozen sweets, also propels the market growth.

The Western market in the US is a critical market for food tastes; health, sustainability, and innovation are all emphasized. Its plant-based and organic food business is booming, and a strong affinity for natural and unique flavors exists. Beverage flavors are quite popular, especially specialty cocktail, kombucha, and alternative dairy products.

Competitive Landscape:

The market leaders are continually exploring tactics to preserve and enhance their market positions. Product innovation, strategic acquisitions, and collaboration are among the strategies employed. For example, they are working to produce natural and sustainable flavor solutions to fulfill the rising customer demand for clean-label products. Aside from that, they are investing in research and development (R&D) to produce distinctive flavor profiles, notably in the plant-based and functional food domains. These companies are also using new technologies, like as artificial intelligence and biotechnology, to innovate and expedite taste development processes.

The report provides a comprehensive analysis of the competitive landscape in the U.S. food flavors market with detailed profiles of all major companies.

Recent News and Developments:

- In August 2025, Lifeway Foods is expanding its ProBugs® kefir line with new conventional whole milk pouches in three kid-friendly flavors, available nationwide. Packaged in no-spill pouches, the products make probiotic-rich kefir more accessible and affordable while maintaining high-quality protein and billions of live probiotics. Building on ProBugs’ success since 2007, this expansion supports Lifeway’s mission to make gut-healthy foods fun, convenient, and widely available for children and families.

- In September 2024, MegaMex Foods expanded its WHOLLY® Guacamole foodservice lineup with three new flavors: Jalapeño Garlic, Serrano Lime, and Cilantro Lime, bringing the total to five varieties. Made with hand-scooped Hass avocados and fresh ingredients, the guacamoles cater to restaurants seeking convenience and bold flavors. All products contain no artificial colors or flavors, are ready to serve, and come in 12/1 lb. tray packs, offering operators versatile options for appetizers, sandwiches, burgers, and Mexican dishes.

U.S. Food Flavors Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Natural, Artificial |

| Forms Covered | Dry, Liquid |

| End Users Covered | Beverages, Dairy and Frozen Products, Bakery and Confectionery, Savory and Snacks, Animal and Pet Food |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the U.S food flavors market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the U.S. food flavors market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the U.S. food flavors industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Food flavors are compounds added to food and beverages to enhance or modify their taste and aroma. They are derived from natural sources or synthesized chemically and are used in applications such as snacks, bakery products, beverages, dairy items, confectionery, and savory foods to create appealing and diverse taste experiences.

The U.S. food flavors market was valued at USD 4.2 Billion in 2024.

IMARC estimates the U.S. food flavors market to exhibit a CAGR of 4.2% during 2025-2033.

The U.S. food flavors market is driven by the increasing demand for natural and organic flavors, the growth of ready-to-eat (RTE) and plant-based food segments, rapid technological innovations in flavor development, and evolving consumer preferences for health-focused and exotic taste experiences.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)