United States Fumaric Acid Market Report by Application (Food Additives, Rosin-Sized Sheathing Paper, Unsaturated Polyester Resins, Alkyd Resins, and Others), End Use Industry (Food and Beverages Industry, Cosmetics Industry, Pharmaceutical Industry, Chemical Industry, and Others), and Region 2026-2034

United States Fumaric Acid Market Size & Outlook:

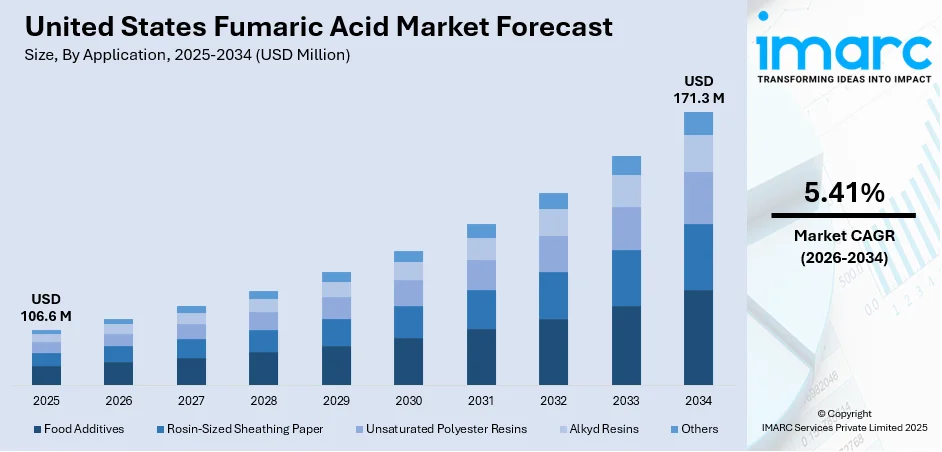

The United States fumaric acid market size reached USD 106.6 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 171.3 Million by 2034, exhibiting a growth rate (CAGR) of 5.41% during 2026-2034. The market is buoyed by growing demand from food processing, unsaturated polyester resin manufacturing, and pharma usage. Growing use of natural acidulants and multifunctional additives is reenforcing its industrial applicability. Further, innovation in green manufacturing processes is facilitating sustainability objectives, bolstering market uptake. With ongoing investment in innovation and diversified end-user uptake, the market is expected to witness steady growth, boosting United States market share of fumaric acid.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 106.6 Million |

|

Market Forecast in 2034

|

USD 171.3 Million |

| Market Growth Rate 2026-2034 | 5.41% |

Access the full market insights report Request Sample

United States Fumaric Acid Market Insights:

- Key Market Drivers: Growing demand for food additives for processing, rising applications in coatings and resins, and higher use in drug formulations are key drivers fueling the United States fumaric acid market growth in industrial, nutritional, and healthcare industries.

- Key Market Trends: The trend is moving towards natural, clean-label food ingredients, growing adoption in unsaturated polyester resins, and growing use in dermatological and controlled-release pharmaceuticals, reflecting more diversification across end-use applications.

- Competitive Landscape: The US market of fumaric acid is fairly concentrated, with companies shifting their focus towards innovation in production effectiveness, quality of the product, and increasing local supply chains to satisfy regulatory requirements and changing demand from food, polymer, and personal care sectors.

- Challenges and Opportunities: While raw material price volatility is a cause for concern, there are opportunities in the production of bio-based fumaric acid, growth in applications in green polymers, and growing consumer demand for additive-free foods to position the market for sustainable long-term growth.

To get more information on this market Request Sample

United States Fumaric Acid Market Trends:

Rising Demand from Food and Beverages

The United States fumaric acid market is gaining strong momentum with increasing application of the compound as a food additive. Fumaric acid is widely employed as a food acidulant in processed foods, bakery foods, and instant drink mixes because of its better acidity and superior flavor stability. With the trend among consumers moving towards shelf-stable and convenient food products, food producers are adding fumaric acid to improve taste and quality as well as preservation. In addition, its natural origin and clean-label-friendly properties render it an attractive option for food-grade applications. The United States fumaric acid market growth is thus directly related to trends in the food processing industry. Approval by regulatory bodies and its General Recognized As Safe (GRAS) status further accelerate its incorporation into formulations. In all, food industry dynamics remain a principal driver of this market's growth in both volume and value.

Increased Usage in Unsaturated Polyester Resins (UPR)

Applications of fumaric acid in unsaturated polyester resins are widening, buoyed by the rising demand for lightweight corrosion-resistant materials in construction, automotive, and marine sectors. In the manufacturing of resins, fumaric acid plays a central intermediate role that improves mechanical properties, resistance to weathering, and longevity. Its capacity to provide composites with structural integrity places it at the center in infrastructural applications, particularly in the wake of heightened investment in construction and transport infrastructure. The United States fumaric acid market share in industrial uses is growing as UPRs highly replace conventional metal and plastic parts. From a sustainability perspective, resins based on fumaric acid result in lower carbon footprints and increased flexibility in design. According to the reports, in September 2023, Bartek Ingredients revealed that its new fumaric acid plant will come on stream by September 2024, doubling the production capacity and cutting per-unit greenhouse gas emissions by more than 80%. Moreover, as the U.S. gears up for modernizing infrastructure and developing material technologies, demand for fumaric acid in the unsaturated polyester resins (UPR) segment is likely to exhibit a consistent upward trend, maintaining market stability in the years to come.

Personal Care and Pharmaceutical Applications Growth

One of the trends in the United States fumaric acid market analysis is increasing usage in personal care and pharmaceutical applications. In the world of skincare, fumaric acid is applied for its pH-controlling abilities, and in pharmaceuticals, it functions as an excipient in controlled-release pharmaceutical delivery. The chemical also holds niche uses in dermatological applications, specifically for psoriasis and other conditions, due to its anti-inflammatory nature. As consumers grow more health-focused and dermatology products are in greater demand, so does interest in multifunctional, well-compliant additives such as fumaric acid. This trend mirrors sweeping changes in consumer habits and healthcare focus, consistent with the quest for specific and tailored treatment options. United States fumaric acid market trends thus point to diversification away from conventional sectors, cementing its position as a high-value chemical substance with increasing applicability across new therapeutic and cosmetic uses.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the United States fumaric acid market report, along with forecasts at the country and regional level from 2026-2034. Our report has categorized the market based on application and end use industry.

Breakup by Application:

- Food Additives

- Rosin-Sized Sheathing Paper

- Unsaturated Polyester Resins

- Alkyd Resins

- Others

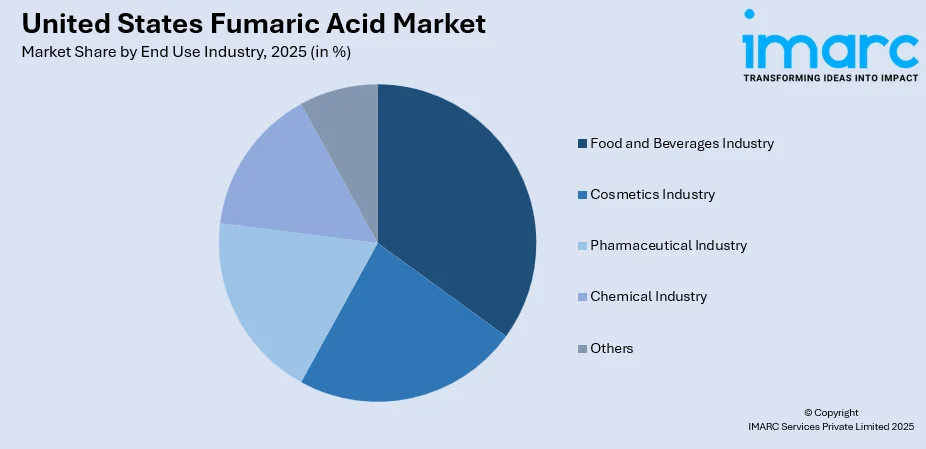

Breakup by End Use Industry:

To get detailed segment analysis of this market Request Sample

- Food and Beverages Industry

- Cosmetics Industry

- Pharmaceutical Industry

- Chemical Industry

- Others

Breakup by Region:

- Northeast

- Midwest

- South

- West

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Latest News and Developments:

- In January 2023, Thirumalai Chemicals Limited started the construction of two greenfield plants in Marshall County, West Virginia. These will manufacture 30,000 tonnes of fumaric and malic acid, and 25,000 tonnes of maleic anhydride a year, with production commencing mid-2024.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Applications Covered | Food Additives, Rosin-Sized Sheathing Paper, Unsaturated Polyester Resins, Alkyd Resins, Others |

| End Use Industries Covered | Food and Beverages Industry, Cosmetics Industry, Pharmaceutical Industry, Chemical Industry, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The fumaric acid market in the United States was valued at USD 106.6 Million in 2025.

The United States fumaric acid market is projected to exhibit a (CAGR) of 5.41% during 2026-2034, reaching a value of USD 171.3 Million by 2034.

Key drivers of the United States fumaric acid market is amplifying demand for food additives with shelf-life extension, increasing application in unsaturated polyester resins in construction and automotive industries, and growing applications in pharmaceuticals and personal care products on account of its multifunctional chemical properties.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)