United States Genetic Testing Market Size, Trends and Forecast by Type, Technology, Application, and Region, 2025-2033

United States Genetic Testing Market Size and Share:

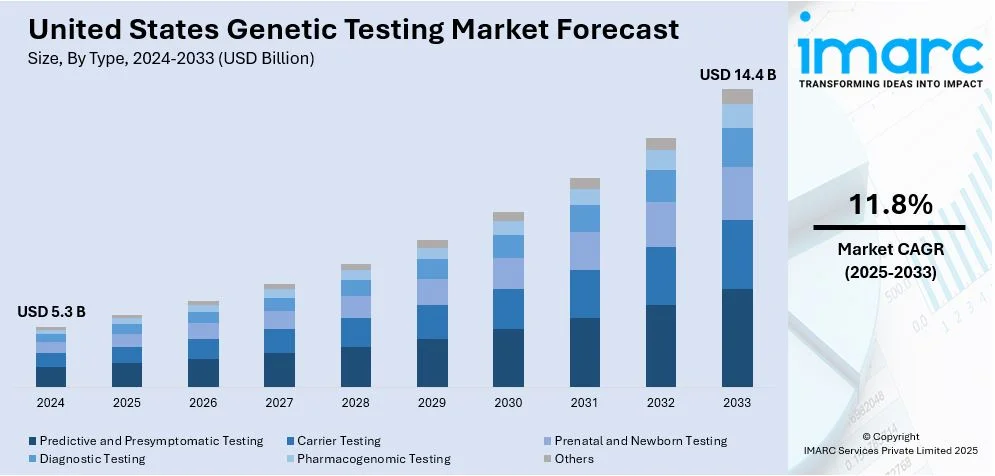

The United States genetic testing market size was valued at USD 5.3 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 14.4 Billion by 2033, exhibiting a CAGR of 11.8% from 2025-2033. Rising rates of chronic and genetic diseases, notable developments in next-generation sequencing (NGS) technology, growing consumer interest in direct-to-consumer (DTC) testing, a growing focus on precision and personalized medicine, and growing oncology diagnostics applications are all driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 5.3 Billion |

|

Market Forecast in 2033

|

USD 14.4 Billion |

| Market Growth Rate 2025-2033 | 11.8% |

Government initiatives and simplified regulatory procedures are key drivers of the US genetic testing market's expansion. For example, federal subsidies and programs have supported genetic diagnostics research and innovation. The Food and Drug Administration (FDA) has recently changed its rules to facilitate the process of approving genetic tests more quickly. This has increased funding for genetic screening, increasing its acceptance and trust, and enabling more medical practitioners to incorporate genetic testing into standard clinical procedures.

The market is driven by the expanding range of genetic testing that is covered by insurance. In the past, people had trouble affording these exams. However, insurance firms are now being urged to implement comprehensive coverage plans as they become more aware of the cost-benefits of early disease identification and preventive therapy. As more businesses include genetic testing benefits in their health plans to assist preventive health activities, employment-based insurance coverage is also becoming increasingly important. The Congressional Budget Office predicts that, due to the aging population, employment-based coverage would continue to be a key source of health insurance, with Medicare subscriptions estimated to increase from 60 million in 2023 to 74 million in 2034.

United States Genetic Testing Market Trends:

Rise in Demand for Personalized Medicine

One of the factors propelling the growth of the genetic testing market in the United States is the growing need for customized medication. Precision medicine, also known as personalized medicine, creates customized prevention and treatment regimens for each patient based on their genetic information. Under normal conditions, patients receive the same general care. Since genetic testing helps detect genetic markers, an individual's sensitivity to medications, and potential side effects, it is essential in enabling tailored therapy. Medical professionals can use it to create customized treatments, especially for complex illnesses like cancer. For instance, genetic profiling of tumors in oncology may reveal mutations that qualify a patient for immunotherapies or other targeted therapies for the high microsatellite instability malignancy.

Advances in Technology and Reduced Costs

Technological advancements also form a significant basis in the genetic testing market in the United States. There have been tremendous breakthroughs in molecular diagnostics and genomic sequencing over the last decade, which greatly increased the accuracy, speed, and affordability of genetics tests. Next-generation sequencing has revolutionized the field and enabled economic sequencing of large DNA segments cheaper than before. In fact, for less than USD 1,000, it is now possible to determine the sequence of an entire human genome, whereas in the early 2000s, it may cost millions of dollars. The cost savings have translated to an increased utilization of genetic testing both in clinical practice and across a greater number of individuals.

Increased Awareness and Education about Genetic Disorders

Increased awareness about genetic diseases and advantages of early diagnosis are the leading forces of the growth of genetic testing market in the United States. Educating efforts through advocacy groups, nonprofit institutions, and medical centers have drastically enlarged public and professional understanding about genetic health. The National Institutes of Health (NIH) recently announced that it had discovered 275 million new genetic variations by February 19, 2024. The advertisements that have come up to promote the early detection of cystic fibrosis, genetic cancers, and other rare genetic disorders have increased the need for genetic testing. However, it belongs to the same class and category of the increasingly popular DTC genetic testing developed in recent years and which continues to grow in popularity in recent years. Firms like 23andMe and AncestryDNA market their products so aggressively today that genetic testing is among the top-of-mind products of the consumer's conscious mind. The plethora of interest in the ancestry and health-related genetic information that is reverberating from these tests is making the general public aware of genetics.

United States Genetic Testing Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States genetic testing market, along with forecasts at the regional levels from 2025-2033. The market has been categorized based on type, technology, and application.

Analysis by Type:

- Predictive and Presymptomatic Testing

- Carrier Testing

- Prenatal and Newborn Testing

- Diagnostic Testing

- Pharmacogenomic Testing

- Others

Predictive and presymptomatic testing looks at a person's DNA to determine the chances that he or she might acquire a genetic condition prior to the appearance of signs and symptoms. People who have a family history of a genetic illness can highly benefit from this testing, which they may use to make the appropriate health decisions. Frequently used predictive tests evaluate the susceptibility for genetic diseases such as BRCA1 and BRCA2, which increase the risk for cancers of the ovaries and the breast.

Carrier testing is utilized to detect individuals with a single copy of a gene mutation that results in a hereditary disorder when present in duplicate copies. This testing is essential for couples planning to have children as it predicts the chances of their future child inheriting certain genetic diseases. Carrier testing is frequently employed for conditions such as Tay-Sachs disease, sickle cell anemia, and cystic fibrosis.

The aim of the genetic test during pregnancy and postnatally is to find genetic anomalies before or at delivery. Non-invasive prenatal testing involves the analysis of DNA from the fetus present in the mother's blood to determine whether there are chromosomal anomalies, such as Patau syndrome, Edwards syndrome, and Down syndrome.

Analysis by Technology

- Cytogenetic Testing and Chromosome Analysis

- Biochemical Testing

- Molecular Testing

- DNA Sequencing

- Others

Cytogenetic testing is the examination of chromosomes to diagnose genetic disorders and abnormalities. Chromosome analysis is essential in cytogenetics as it is usually used to diagnose chromosomal abnormalities leading to genetic disorders. This technology is critical in diagnosing disorders such as Down syndrome, Klinefelter syndrome, and Turner syndrome, which are caused by changes in the number or shape of chromosomes.

Analyzing proteins and enzymes in the body through biochemical testing can help identify genetic conditions by detecting any abnormalities. This kind of testing is commonly employed to detect metabolic disorders, in which enzyme deficiency or malfunction causes disruptions in normal biochemical processes.

Molecular testing is the most advanced and rapidly growing segment in the genetic testing market. It involves analyzing genetic material at the molecular level to identify mutations, gene deletions, duplications, or other genetic variations. DNA sequencing, particularly next-generation sequencing (NGS), has transformed genetic testing by enabling high-throughput analysis of genes, panels, or entire genomes quickly and accurately.

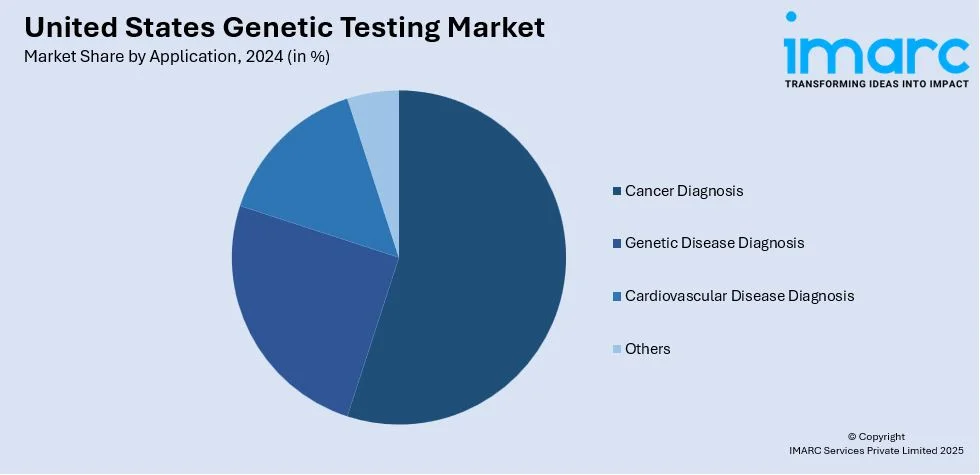

Analysis by Application

- Cancer Diagnosis

- Genetic Disease Diagnosis

- Cardiovascular Disease Diagnosis

- Others

Genetic testing for cancer diagnosis has become a cornerstone in personalized oncology care in the United States. Tests such as BRCA1 and BRCA2 gene mutation screenings have gained prominence for predicting the risk of breast and ovarian cancers, while other tests target mutations related to colorectal, prostate, and lung cancers.

Genetic testing to diagnose hereditary genetic disorders like cystic fibrosis, Huntington's disease, and sickle cell anemia is critical in the U.S. health care landscape. This area has expanded with technological developments including high-throughput genotyping and whole-genome sequencing, which enable faster and more accurate diagnoses. A lot of focus is on prenatal and newborn screening for genetic disorders as they have the potential for early intervention.

Genetic testing for cardiovascular conditions is becoming increasingly prevalent, especially as healthcare providers look to predict and prevent heart disease, which remains a leading cause of mortality in the U.S. Tests for familial hypercholesterolemia, a genetic condition that causes high cholesterol levels, are among the most common. Screening for genetic markers associated with inherited heart diseases, such as hypertrophic cardiomyopathy and long QT syndrome, helps in risk assessment, guiding more personalized treatment plans.

Regional Analysis:

- Northeast

- Midwest

- South

- West

The region is renowned for conducting leading-edge advanced medical research and innovation; in this manner, they highly contribute to the genetic testing market of the United States of America. Prominent educational and research-based institutions have made the States like Massachusetts, New York, and Pennsylvania extremely fertile. Moreover, a lot of excellent quality medical centers as well as superior ranked hospitals found densely throughout this region facilitate extensive consumption of cutting-edge medical genetics services.

The Midwest United States region is a strong contributor to the genetic testing market. The region contains states like Illinois, Minnesota, and Ohio, where healthcare and biotech innovations are on the rise. A good network of hospitals, research institutions, and laboratories dedicated to genetic testing and molecular diagnostics contributes to the region's benefits. Agricultural biotechnology in Midwestern states has been translated into advances in genomics and genetics, spilling over into healthcare.

The Southern United States region is experiencing rapid growth in the genetic testing market, fueled by increasing investments in healthcare infrastructure and rising awareness about genetic diseases. States such as Texas, Florida, and Georgia have become centers for medical research, with a growing number of healthcare facilities offering genetic testing services. The South has seen a significant increase in chronic disease cases, including diabetes, cardiovascular diseases, and cancers, which drives the demand for predictive and diagnostic genetic tests.

The Western United States region, particularly California, is a leader in the genetic testing market due to its strong biotech and life sciences ecosystem. Silicon Valley, as a global technology and innovation center, drives research and development in genomics, precision medicine, and genetic diagnostics. The region has a high density of startups and established companies pioneering new genetic testing methods, including direct-to-consumer (DTC) testing, which has gained popularity.

Competitive Landscape:

By means of strategic alliances, acquisitions, and technological innovation, major players in the US genetic testing industry are propelling developments. Prominent businesses such as 23andMe, Invitae, Myriad Genetics, and Quest Diagnostics are diversifying their offerings to address a wider spectrum of ailments, ranging from prenatal and cancer diagnostics to predictive testing for genetic diseases. With an emphasis on next-generation sequencing (NGS) and CRISPR technologies to produce quicker and more accurate answers, these businesses are making significant investments in research and development (R&D) to increase the precision and accessibility of genetic tests. In order to increase research efforts and investigate the possibilities of customized medicine, numerous players are also forming partnerships with academic institutions, pharmaceutical corporations, and healthcare providers.

The report provides a comprehensive analysis of the competitive landscape in the United States genetic testing market with detailed profiles of all major companies.

Latest News and Developments:

- 2 November 2023: A non-invasive genetic test have been developed by a team of investigators from Massachusetts General Hospital (MGH), Brigham and Women’s Hospital (BWH), and the Broad Institute of MIT and Harvard that can screen the blood of pregnant individuals to survey all genes for fetal DNA sequence variants. The method was effective at discovering new mutations that only occurred in the fetal genome.

United States Genetic Testing Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Predictive and Presymptomatic Testing, Carrier Testing, Prenatal and Newborn Testing, Diagnostic Testing, Pharmacogenomic Testing, Others |

| Technologies Covered |

|

| Applications Covered | Cancer Diagnosis, Genetic Disease Diagnosis, Cardiovascular Disease Diagnosis, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States genetic testing market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the United States genetic testing market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States genetic testing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Genetic testing is the analysis of DNA to identify changes, mutations, or variations in genes that may indicate a risk for certain diseases or conditions. It helps diagnose genetic disorders, guide treatment decisions, and assess the likelihood of passing genetic traits to offspring. It's used in healthcare and ancestry research.

The United States genetic testing market was valued at USD 5.3 Billion in 2024.

IMARC estimates the United States genetic testing market to exhibit a CAGR of 11.8% during 2025-2033.

Key factors driving the United States genetic testing market include advancements in genomics technology, rising prevalence of genetic disorders, increasing demand for personalized medicine, growing awareness of early disease detection, and expanding applications in ancestry and consumer genomics.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)