United States Green Ammonia Market Size, Share, Trends and Forecast by Technology, End User, and Region, 2025-2033

United States Green Ammonia Market Size and Share:

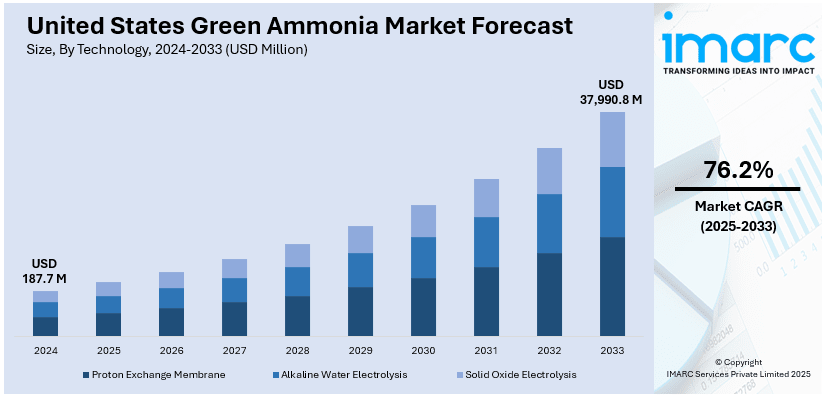

The United States green ammonia market size was valued at USD 187.7 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 37,990.8 Million by 2033, exhibiting a CAGR of 76.2% from 2025-2033. The market is expanding exponentially, propelled by its role in sustainable agriculture, clean energy solutions, and increasing export demand. Driven by government incentives and technological innovations, the market is becoming increasingly cost-competitive, positioning the U.S. as a global pioneer in the shift toward low-carbon industrial and energy solutions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 187.7 Million |

| Market Forecast in 2033 | USD 37,990.8 Million |

| Market Growth Rate (2025-2033) | 76.2% |

The United States green ammonia market is witnessing significant momentum, propelled by the nation's push towards decarbonization and sustainable industrial practices. The product’s growing adoption in agriculture as a substitute for conventional ammonia is a key driver, as farmers increasingly seek eco-friendly fertilizers to reduce carbon footprints. For instance, in July 2024, CF Industries, a U.S. based ammonia producer, partnered with POET to pilot the adoption of green ammonia fertilizer for sustainable corn cultivation and ethanol production. The initiative aims to reduce ethanol’s carbon intensity by up to 10%. It offers farmers low-carbon fertilizer options, certified supply chains, and carbon scoring education, promoting sustainable agriculture and boosting grain value while advancing a decarbonized bioethanol sector. Moreover, the energy sector is contributing to market growth by leveraging green ammonia as a hydrogen carrier and a potential fuel for power generation, especially in sectors aiming to transition away from fossil fuels.

Other market trends highlight increasing investments in green ammonia production technologies, particularly those utilizing renewable energy sources like wind and solar for hydrogen electrolysis. Companies are prioritizing advancements to lower production costs and achieve greater commercial viability. Additionally, strategic partnerships and acquisitions are becoming common, further accelerating the demand of green ammonia into the market. For instance, in September 2024, Ohmium International joined forces with Ten08 Energy to provide PEM electrolyzers for a 500MW clean ammonia project in Texas. This Gulf Coast project aims to produce 1.4 million metric tons of clean ammonia annually, incorporating both blue and green ammonia. The project supports decarbonization and will export ammonia to Europe and Asia, meeting global demand for cleaner energy solutions. Furthermore, combined with the growing emphasis on carbon neutrality across industries, these developments underscore the robust trajectory of the U.S. green ammonia market.

United States Green Ammonia Market Trends:

Growing Adoption in Sustainable Agriculture

The use of green ammonia in agriculture is gaining momentum as farmers transition to low-carbon fertilizers to align with sustainability goals. Traditional ammonia, a significant source of greenhouse gas emissions, is being replaced by its green counterpart produced using renewable energy. This shift is supported by growing consumer demand for sustainable food production practices and government incentives aimed at reducing emissions in the agricultural sector. For instance, in September 2024, the U.S. Department of Energy's (DOE) Loan Programs Office announced a USD 1.559 billion conditional loan guarantee to Wabash Valley Resources for a waste-to-ammonia facility in Indiana. Using CCS technology, the project will produce 500,000 metric tons of low-carbon ammonia annually, support domestic fertilizer supply in the Corn Belt, and strengthen U.S. food security and clean energy manufacturing. Green ammonia not only helps improve soil health but also aligns with broader environmental compliance efforts. The rising interest in sustainable farming methods is expected to solidify green ammonia's role as a key input for the agricultural industry in the United States.

Expanding Applications in Clean Energy

Green ammonia is emerging as a versatile solution in the clean energy space, acting as both a hydrogen carrier and a power generation fuel. Its efficient hydrogen storage and transportation capabilities position it as a vital element in the hydrogen economy. Industries such as shipping and energy-intensive manufacturing are exploring its use as a direct fuel to reduce dependency on fossil fuels. Additionally, technological advancements, such as ammonia-based fuel cells, are unlocking opportunities for integration into grid-scale energy systems and renewable power storage. For instance, in September 2024, Amogy, a New York-based startup, unveiled the NH3 Kraken, an ammonia-powered tugboat, on a Hudson River tributary, marking a step toward zero-emission maritime transport. The 67-year-old diesel vessel was converted to run on ammonia, a carbon-free fuel, using a system that produces hydrogen for a fuel cell. This innovation addresses shipping’s 3% global emissions contribution, supporting the 2050 net-zero target. Furthermore, such innovations and developments are positioning green ammonia as a cornerstone in the transition toward carbon-neutral energy infrastructure.

Advancements in Production Technologies

Green ammonia is becoming increasingly cost-competitive with traditional ammonia, driven by innovations in production technologies. Electrolysis powered by renewable energy sources, such as wind and solar, has become a cornerstone of production, with strategic collaborations between energy firms and technology providers fostering a robust ecosystem for large-scale green ammonia projects and ensuring minimal carbon emissions. For instance, in April 2024, Nova Clean Energy acquired HyFuels, an assortment of over 1 GW of wind, solar, and green ammonia projects in Texas. The project, spanning approximately 25,000 acres, will provide a steady supply of clean energy with a balanced mix of wind and solar power. These advancements are not only reducing barriers to adoption but are also paving the way for the United States to become a global leader in green ammonia production.

United States Green Ammonia Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States green ammonia market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on technology and end user.

Analysis by Technology:

- Proton Exchange Membrane

- Alkaline Water Electrolysis

- Solid Oxide Electrolysis

Proton Exchange Membrane (PEM) electrolysis is gaining traction in the green ammonia market due to its high efficiency and compatibility with renewable energy sources. This technology uses a solid polymer electrolyte to produce hydrogen, a key input for ammonia synthesis, with minimal energy loss. Its rapid start-up times and ability to operate at varying power levels make PEM ideal for integrating with intermittent renewables like wind and solar. While costs are currently higher than other methods, ongoing innovations and scaling efforts are expected to enhance its competitiveness in the U.S. market.

Alkaline Water Electrolysis is the most established technology in the green ammonia market, offering reliability and cost-effectiveness. This method uses a liquid alkaline electrolyte to produce hydrogen, benefiting from decades of industrial application. Its ability to handle large-scale hydrogen production makes it particularly suitable for meeting industrial demand. The simplicity of its design and relatively lower capital costs positions it as a preferred choice for early-stage green ammonia projects in the U.S. Continuous improvements in efficiency and durability further solidify its role in driving market growth.

Solid oxide electrolysis (SEO) is a prominent technology in the U.S. green ammonia market, contributing to high efficiency since it works at high temperatures. Unlike other methods, SOE can employ heat from industrial processes or renewable sources to effect overall energy conservation. Its potential for co-electrolyzing water and CO₂ makes it an attractive option for producing green ammonia with minimal environmental impact. While still in the developmental phase, advancements in materials and scalability are positioning SOE as a promising solution for future ammonia production, particularly in energy-intensive sectors.

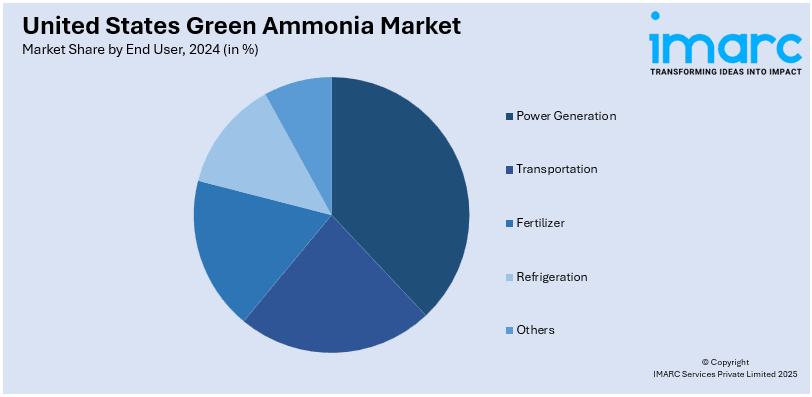

Analysis by End User:

- Power Generation

- Transportation

- Fertilizer

- Refrigeration

- Others

Green ammonia is emerging as another source of energy, including in the power generation industry. Additionally, it can provide a stable form of hydrogen that is suitable for carbon-free electricity generation, particularly in regions with excess renewable power. Power plants are increasingly blending green ammonia with conventional fuels to reduce emissions, while long-term projects aim for 100% ammonia utilization. Its potential to enable energy storage for intermittent renewables further positions green ammonia as a cornerstone of the U.S. transition to a low-carbon energy grid.

Transportation is benefiting from green ammonia due to cleaner alternatives to fossil fuels, notably in shipping and heavy-duty vehicles. Its high energy density, coupled with zero carbon emissions during combustion, makes it ideal for decarbonization of marine industries. Experiments with ammonia-based fuel cells for trains, trucks, and even aviation are being conducted. Despite the progress, it is vital to recognize that there are essential barriers that have not been solved, including infrastructure development and safety on transportation; nevertheless, federal incentives and innovations in ammonia-to-hydrogen technologies are increasing the adoption, making transportation a crucial end user segment for green ammonia in the United States.

Fertilizer production is one of the key end user segments for green ammonia, known for its nitrogen-rich formulation to support agriculture and help lower the level of greenhouse gas emissions. The stakeholders in the U.S. agricultural industry are now turning green as they look to adopt green ammonia that will help in the reduction of emissions of greenhouse gases. Firms in areas such as the Midwest are applying green ammonia to fulfill these requirements while leveraging on renewable resources. Moreover, its dual property in enhancing soil fertility and cutting emissions makes green ammonia an essential element for sustainable farming, establishing the sector as a critical driver of market expansion.

Refrigeration serves as a crucial end user in the U.S. green ammonia market due to its crucial role in reducing greenhouse gas emissions and supporting sustainable agricultural practices. As ammonia is a key component in fertilizers, its production typically involves energy-intensive processes with high carbon footprints. However, green ammonia, produced using renewable energy sources, offers a more eco-friendly alternative. The refrigeration industry is adopting green ammonia for its natural refrigerant properties, low global warming potential, and effectiveness in reducing energy consumption. This shift supports both environmental goals and the demand for more sustainable, efficient cooling systems in various sectors.

Regional Analysis:

- Northeast

- Midwest

- South

- West

The Northeast region, characterized by dense urban centers and a strong focus on renewable energy policies, is a growing market for green ammonia. States like New York and Massachusetts are leading in adopting clean energy initiatives, which directly influence the demand for sustainable ammonia in industries such as power generation and agriculture. Limited space for large-scale renewable energy projects poses challenges, but advancements in hydrogen and ammonia storage technologies are expected to drive further adoption. The region's progressive environmental regulations make it a critical market for pilot and demonstration projects.

The Midwest is a prominent region for the green ammonia market, which can be attributed to its influence in agriculture and existing ammonia infrastructure. Being one of the largest producers of fertilizers, the region is adopting green ammonia to lower the level of CO2 emissions in the agriculture sector. States like Iowa and Illinois, with significant wind energy resources, are poised to integrate renewable electricity into ammonia production. The Midwest's industrial base and supportive policies for clean energy transitions enhance its potential as a leader in green ammonia adoption for both agricultural and industrial applications.

The South is evolving as a major contributor in the green ammonia market, primarily due to its ample solar energy resources and strong industrial base. States like Texas and Louisiana, known for key ammonia producers, are making a shift towards low-carbon methods in order to remain competitive in global markets. The region’s port infrastructure supports ammonia export opportunities, positioning it as a hub for international trade. While challenges include regulatory inconsistencies across states, growing investments in renewable energy and federal incentives are accelerating the South's transformation into a green ammonia powerhouse.

The West, especially California with its high objective of non-emitting energy states, is actively implementing green ammonia in the process of decarbonization. This region is endowed with various renewable electricity sources, such as solar, wind, and hydropower, which are suitable for ammonia production. Integrated production and application have embraced technological innovations, financial support for green technologies, and a skilled workforce in states such as California and Nevada. Furthermore, the growing sustainability focus in the West makes it a leader in the green ammonia market in the United States.

Competitive Landscape:

The United States green ammonia market is characterized by the efforts of established energy companies, emerging startups, and technology providers committed to sustainable innovation. Companies are heavily investing in renewable energy integration and scaling production capacities to meet growing demand. Advancements in electrolyze technology are a focal point, aimed at reducing costs and enhancing efficiency. For instance, in October 2024, First Ammonia, headquartered in New York, signed agreements with Danish company Topsoe to produce solid oxide electrolyzers for a green ammonia project in Victoria, Texas. The first 100 MW modules will be produced at Topsoe’s new factory in Herning, which will begin operations by the end of 2024. These innovations are supported by strategic partnerships that enhance supply chains and address the growing need for sustainable solutions across agriculture, energy, and industrial applications. This collaborative approach is accelerating the transition to low-carbon ammonia production, positioning the U.S. as a global leader in green ammonia innovation, with a clear focus on reducing emissions, ensuring energy security, and enhancing food security through sustainable fertilizer production.

The report provides a comprehensive analysis of the competitive landscape in the United States green ammonia market with detailed profiles of all major companies.

Latest News and Developments:

- In September 2024, Mitsubishi Corporation and Exxon Mobil Corporation signed a Project Framework Agreement to collaborate on a facility in Baytown, Texas, producing low-carbon hydrogen and ammonia. This project will benefit the United States and Japan, as it supplies clean ammonia for industrial applications in Japan, while supporting the U.S. in advancing its clean energy initiatives.

United States Green Ammonia Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Proton Exchange Membrane, Alkaline Water Electrolysis, Solid Oxide Electrolysis |

| End Users Covered | Power Generation, Transportation, Fertilizer, Refrigeration, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States green ammonia market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the United States green ammonia market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States green ammonia industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Green ammonia is ammonia produced using renewable energy sources, such as wind or solar, through an electrolysis process that generates hydrogen without emitting carbon. It serves as an eco-friendly alternative in agriculture for fertilizers, in energy sectors as a hydrogen carrier, and as a potential fuel for decarbonizing industrial processes.

The United States green ammonia market was valued at USD 187.7 Million in 2024.

IMARC estimates the United States green ammonia market to exhibit a CAGR of 76.2% during 2025-2033.

The United States green ammonia market is driven by rising demand for sustainable agricultural practices, government incentives for renewable energy adoption, and the increasing focus on reducing carbon emissions. Technological advancements in ammonia production and the growing shift towards eco-friendly fertilizers further contribute to the market's expansion.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)